After the initial blockchain gaming storm spurred Facebook’s Meta transformation, the play-to-earn (P2E) market is entering calmer waters. Before the next bull cycle starts and major games are released, it is important to consider the major changes coming our way.

Here are some of the key ways in which P2E shifts the business model for developers, but also turns gamers from passive consumers into stakeholders.

Why Is P2E Gaming Important?

As of 2020, the video gaming industry has become the most profitable industry of entertainment. According to NPD Group, it grew to $57 billion in revenue, overshadowing both the music and movie industries combined. And that’s just the U.S. Consumer spending on games globally reached $116 billion in 2021, according to data.ai.

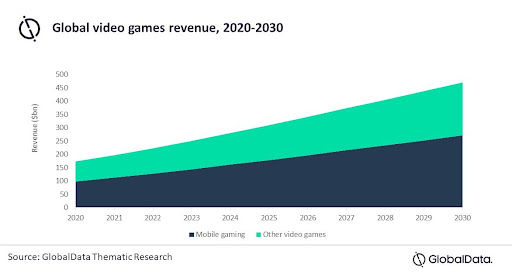

One of the key reasons why gaming surpassed all other forms of entertainment is due to its flexibility and smartphone penetration. Because of Moore’s Law, even entry-level smartphones now provide computing power that was only found in boxy consoles just a decade ago. The mobile gaming market is becoming more dominant, with projections indicating a 12.3% compound annual growth rate (CAGR) between 2021–2026.

In other words, tablets, in-car computers, and smartphones are creating a low-entry mobile gaming infrastructure that is likely to create a market size of over $400 billion by 2026. For comparison, according to Research And Markets, the global film and video market for 2020 reached $235 billion, with projections reaching $410 billion by 2030.

However, these projections were made before the onset of blockchain gaming. For the first time, tokenized games allow for a game’s internal resources to be exported out of the game into NFT marketplaces and cryptocurrency exchanges, giving real world value to items in-game like never before.

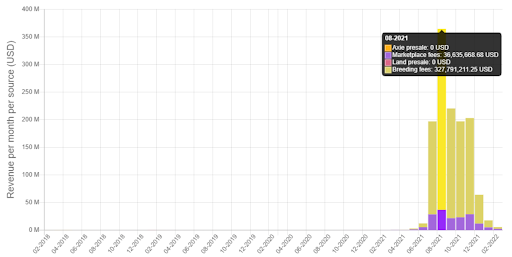

The trendsetter was Axie Infinity, employing NFTs as playable creatures that players evolve like Pokémon, alongside dual tokens called Axie Infinity Shards (AXS) and Smooth Love Potions (SLP). When synchronized, these three digital assets created a money-making machine both for players and developers in the span of a year.

Image credit: AxieWorld.com

What was previously reserved for occasional esports competitions and streamers can now be the default experience; the fusion of earning and entertainment. It doesn’t take too long to realize that if gamers have a choice in playing non-tokenized and tokenized games, more likely than not, they would spend their time on a hobby that has an earning potential.

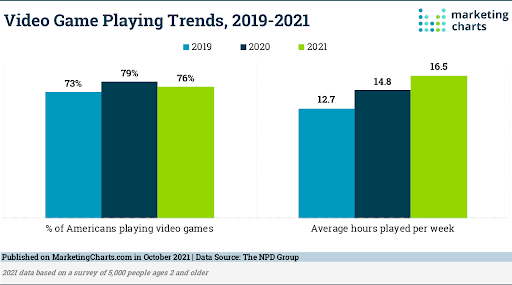

Furthermore, the average gamer spends more hours playing year over year. The pandemic scare is the obvious trigger, but the habits formed are likely to remain cemented. From 2019 to 2021, weekly gaming hours increased by 30%, from 12.7 to 16.5.

Overall, these trends paint a picture that makes it clear why Microsoft bought Activision Blizzard for a record $68 billion, why Facebook rebranded to Meta, and why Ubisoft launched its own Quartz NFT marketplace for in-game items.

However, we are still in the anticipatory stage before blockchain gaming becomes mainstream. It takes time to successfully build such complex projects that combine both blockchain technology and traditional video gaming development. Nonetheless, the upcoming P2E trends are already visible.

Beyond Gamified Finance: Hedge Funds and Derivatives

As more blockchain games are released, there will be more digital assets across NFT marketplaces and crypto exchanges. In turn, just as it happened with the stock market, avenues to asset systems are developing specifically to create indices and investment funds by applying DeFi protocols to NFTs and P2E games.

At the lower level, fractional NFT ownership is already outlining this trend. With expensive NFTs broken into smart contract pieces, they would not only be reserved for millionaires but also retailers.

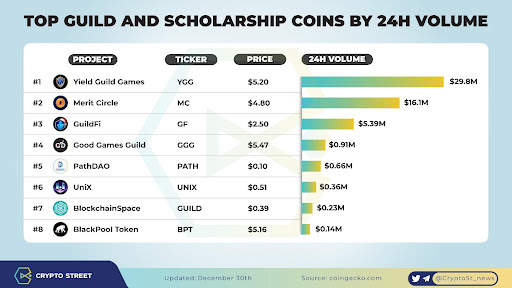

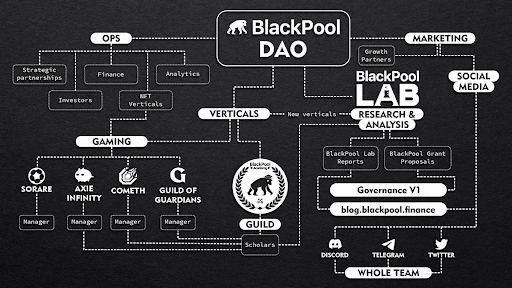

At the higher level, we see DAOs (decentralized autonomous organizations) emerging as effective hedge funds for NFTs. BlackPool DAO is a quantitative, smart-contract-powered hedge that takes in ETH funds in order to acquire NFTs for its investors; holders of BlackPool Token (BPT).

This is quite similar to how BlockBuster DAO intends to collect funds to buy the BlockBuster IP from the current owner, Dish Network, and set up a decentralized movie production and distribution platform. Not only do both rely on their native DAO tokens for voting rights and treasury management, but also on social media and brand recognition to gain traction.

P2E Guilds

Video gaming guilds have been around since the first MMORPG was released, but popularized with Blizzard’s World of Warcraft. Up until now, guilds were simply formed as in game communities and to form competitive groups.

Blockchain gaming now allows for an economic component to be added. For example, it costs about $360 to begin playing Axie Infinity because the player has to buy at least three Axie NFTs for tactical battles. For most players, this is too steep of an entry, which is where guilds come in.

In exchange for upfronting gamers with necessary NFTs, P2E gaming guilds rent the assets. Meaning, this profit-sharing “scholarship” model allows them to get a cut when the player earns rewards through gameplay, which could be either NFTs or the game’s native tokens.

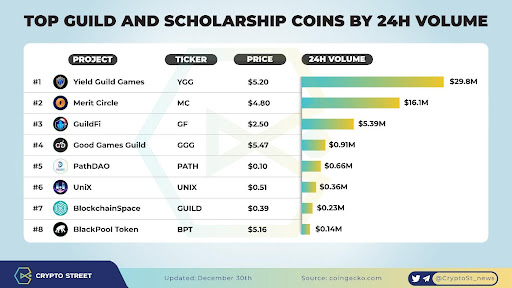

Of course, the entire process is governed by DAOs, with token holders deciding how much of the DAO’s treasury should be allocated. Thus far, the most popular P2E guild is Yield Guild Games. Overall, this market has grown to $610.8 million capitalization across 12.6k tokens, according to CoinGecko.

Decentralized Game Development

So far, we’ve talked a lot about DAOs as decentralized governance that uses smart contracts to create guilds and hedge funds. Yet, there is another cutting-edge application of blockchain in P2E gaming: the decentralizing game service itself.

Traditionally, there is a wall between gamers and developers. Blockchain gaming is no exception, even if they provide players with the means to have stakes via tokens. An upcoming P2E strategy rpg titled Covenant Child from developer Game Changer Limited aims to alter this dynamic by involving players in how the game is actually developed.

Chan Han, the CEO of Game Changer Limited describes it as a staggered launch. The decentralization part will come after the game has launched.

“Covenant Child will separate from the centralized game service environment that has been unilaterally operated by game companies…we will be able to become a new pioneer of the Play-to-Earn (P2E) market through the systematic decentralization service that will be provided after the launch of Covenant Child.”

He further notes that P2E should grow organically to attract players, based on utility (COVN) and governance tokens (CHLD).

“Players will also be able to receive fair value for their in-game play. We believe that this direction will create an environment where game companies can develop by focusing on the essence of the game.”

For gamers looking for a more serious and realistic tone to their P2E blockchain game, SIDUS HEROES offers a space-faring RPG similar to Mass Effect. The CEO of the project, Dan Khomenko, looks to employ utility (SIDUS) and governance (SENATE) tokens to give players some say in how the game is developed post-launch.

“Because they rely on always-online blockchain networks, P2E games inherently lend themselves to forming communities. In SIDUS HEROES, players will use SENATE tokens to constitute their factions. More so, they provide us with inputs on where the game should go.“

P2E: Monetization on Steroids?

Judging by negative gamer reaction to Ubisoft’s launch of Digits NFTs for their Quartz marketplace, the concern is that gaming will become more about grinding instead of entertainment. However, there are plenty of projects on the field to take up the place of P2E games that fall into that trap.

What is important to keep in mind is that tokenized games open a door to new avenues of income, both for gamers and developers. We have already seen how the first wave was successful as exemplified by Axie Infinite with its over $1 billion revenue in less than a year.

In no uncertain terms, these trends show that converting in-game assets into tradable goods has as much value as trading on the stock market. Axie also showed that gamer-powered economies take on a life of their own. The tag-along that follow, such as DAO guilds and hedge funds, only serve as a cherry on top to mature the market and make it more accessible.

Media Contact

Company Name: Micky Pty Ltd

Contact Person: Michael Manlapig

Email: Send Email

Country: Australia

Website: https://micky.com.au/play-to-earn-gaming-is-about-to-take-over-the-video-gaming-industry/