The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how electronic components & manufacturing stocks fared in Q3, starting with TTM Technologies (NASDAQ: TTMI).

The sector could see higher demand as the prevalence of advanced electronics increases in industries such as automotive, healthcare, aerospace, and computing. The high-performance components and contract manufacturing expertise required for autonomous vehicles and cloud computing datacenters, for instance, will benefit companies in the space. However, headwinds include geopolitical risks, particularly U.S.-China trade tensions that could disrupt component sourcing and production as the Trump administration takes an increasingly antagonizing stance on foreign relations. Additionally, stringent environmental regulations on e-waste and emissions could force the industry to pivot in potentially costly ways.

The 10 electronic components & manufacturing stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 4.1% while next quarter’s revenue guidance was in line.

Luckily, electronic components & manufacturing stocks have performed well with share prices up 10.1% on average since the latest earnings results.

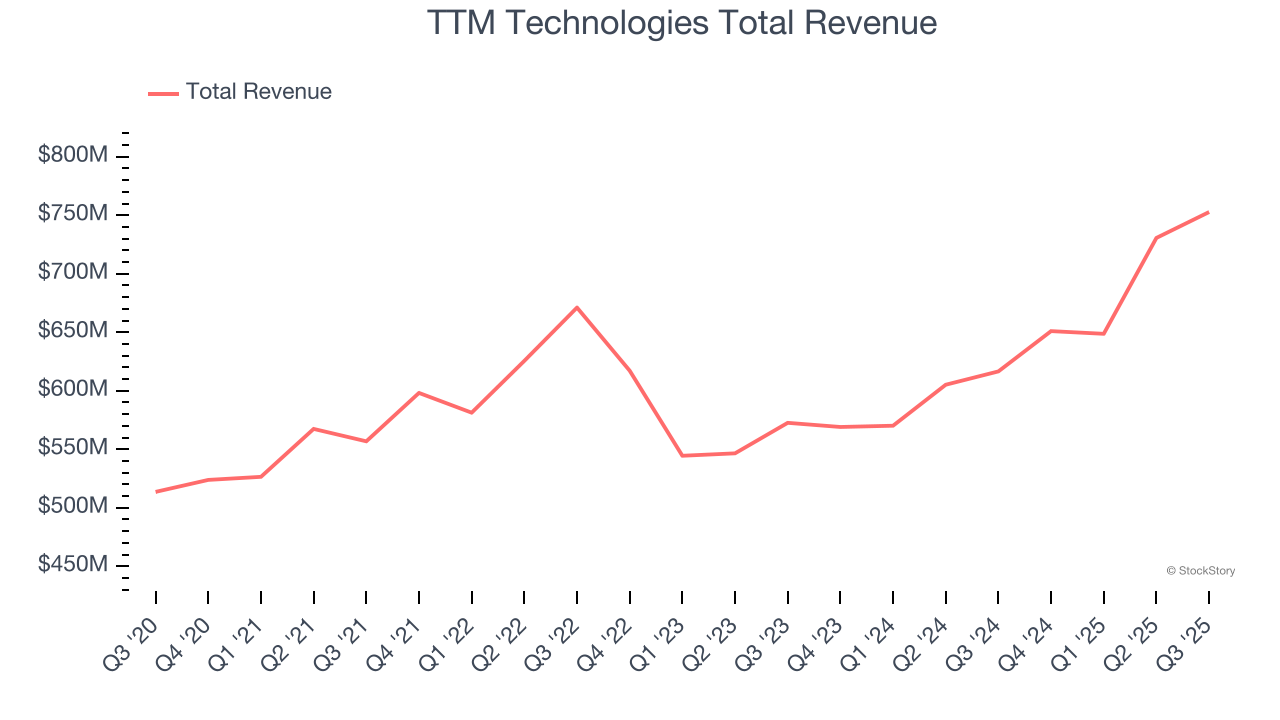

TTM Technologies (NASDAQ: TTMI)

As one of the world's largest printed circuit board manufacturers with facilities spanning North America and Asia, TTM Technologies (NASDAQ: TTMI) manufactures printed circuit boards (PCBs) and radio frequency (RF) components for aerospace, defense, automotive, and telecommunications industries.

TTM Technologies reported revenues of $752.7 million, up 22.1% year on year. This print exceeded analysts’ expectations by 6%. Overall, it was a stunning quarter for the company with an impressive beat of analysts’ EPS guidance for next quarter estimates and a solid beat of analysts’ revenue estimates.

Interestingly, the stock is up 11.2% since reporting and currently trades at $70.35.

Is now the time to buy TTM Technologies? Access our full analysis of the earnings results here, it’s free for active Edge members.

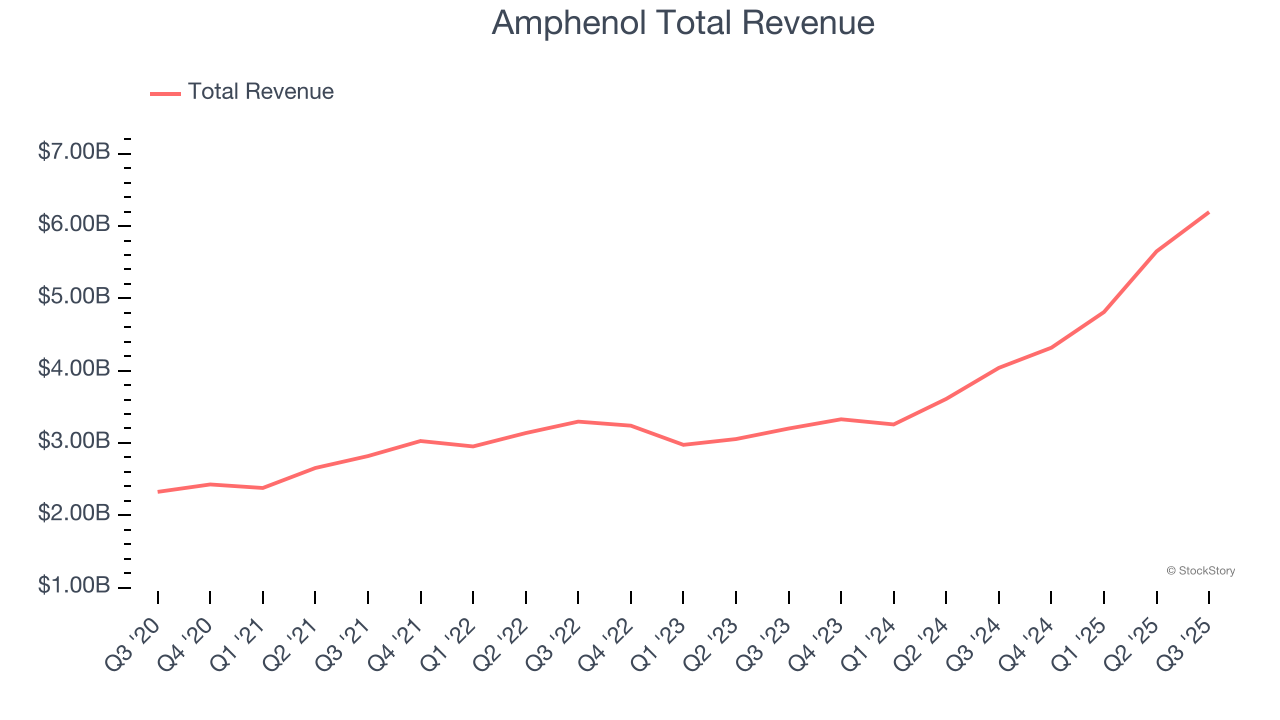

Best Q3: Amphenol (NYSE: APH)

With over 90 years of connecting the world's technologies, Amphenol (NYSE: APH) designs and manufactures connectors, cables, sensors, and interconnect systems that enable electrical and electronic connections across virtually every industry.

Amphenol reported revenues of $6.19 billion, up 53.4% year on year, outperforming analysts’ expectations by 10.9%. The business had an incredible quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ EPS guidance for next quarter estimates.

Amphenol delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 13.7% since reporting. It currently trades at $141.54.

Is now the time to buy Amphenol? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: CTS (NYSE: CTS)

With roots dating back to 1896 and a global manufacturing footprint, CTS (NYSE: CTS) designs and manufactures sensors, connectivity components, and actuators for aerospace, defense, industrial, medical, and transportation markets.

CTS reported revenues of $143 million, up 8% year on year, exceeding analysts’ expectations by 4.8%. It was a satisfactory quarter as it also posted an impressive beat of analysts’ revenue estimates but a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 7.3% since the results and currently trades at $45.53.

Read our full analysis of CTS’s results here.

Plexus (NASDAQ: PLXS)

With over 20,000 team members across 26 global facilities, Plexus (NASDAQ: PLXS) designs, manufactures, and services complex electronic products for companies in aerospace/defense, healthcare, and industrial sectors.

Plexus reported revenues of $1.06 billion, flat year on year. This result beat analysts’ expectations by 1.1%. It was a strong quarter as it also logged a beat of analysts’ EPS estimates and revenue guidance for next quarter beating analysts’ expectations.

Plexus had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is up 7.2% since reporting and currently trades at $156.66.

Read our full, actionable report on Plexus here, it’s free for active Edge members.

Jabil (NYSE: JBL)

With manufacturing facilities spanning the globe from China to Mexico to the United States, Jabil (NYSE: JBL) provides electronics design, manufacturing, and supply chain solutions to companies across various industries, from healthcare to automotive to cloud computing.

Jabil reported revenues of $8.31 billion, up 18.7% year on year. This number topped analysts’ expectations by 3.8%. Overall, it was an exceptional quarter as it also produced revenue guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EPS guidance for next quarter estimates.

Jabil had the weakest full-year guidance update among its peers. The stock is up 5.5% since reporting and currently trades at $224.33.

Read our full, actionable report on Jabil here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.