SmartRent’s stock price has taken a beating over the past six months, shedding 26.7% of its value and falling to $1.10 per share. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in SmartRent, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is SmartRent Not Exciting?

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why we avoid SMRT and a stock we'd rather own.

1. Revenue Tumbling Downwards

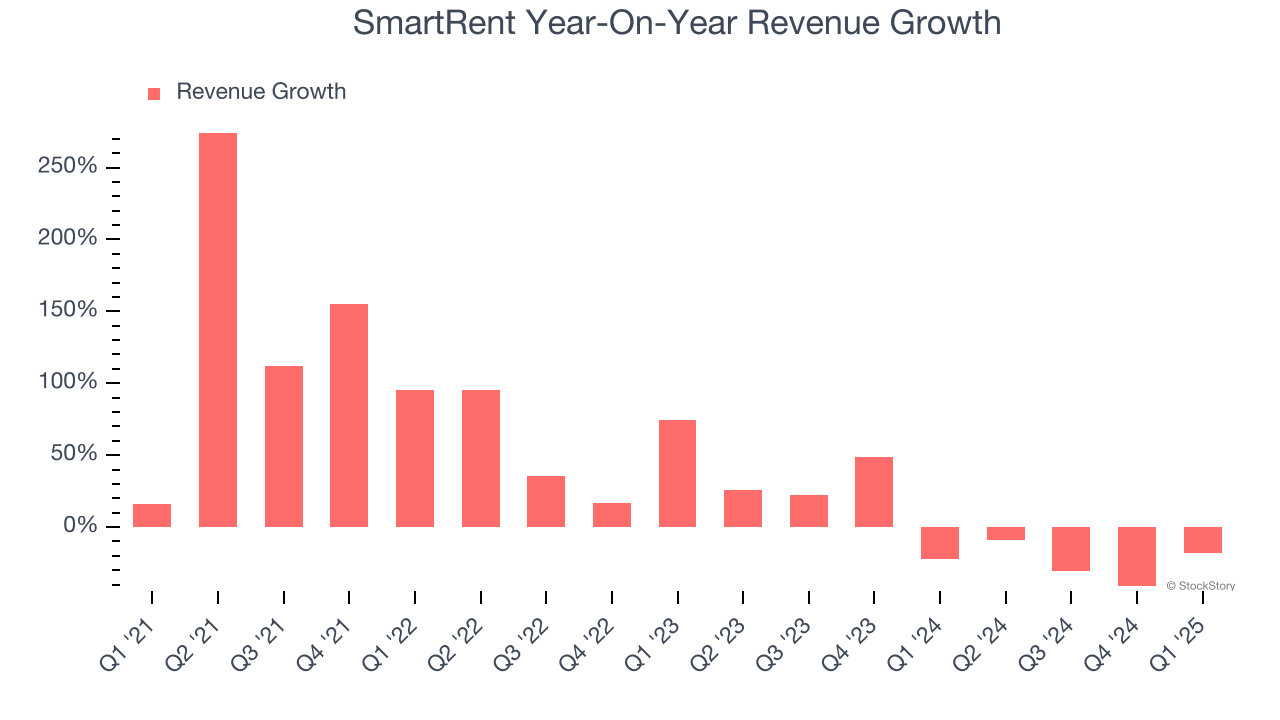

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. SmartRent’s recent performance marks a sharp pivot from its four-year trend as its revenue has shown annualized declines of 7.9% over the last two years. SmartRent isn’t alone in its struggles as the Internet of Things industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

2. Low Gross Margin Reveals Weak Structural Profitability

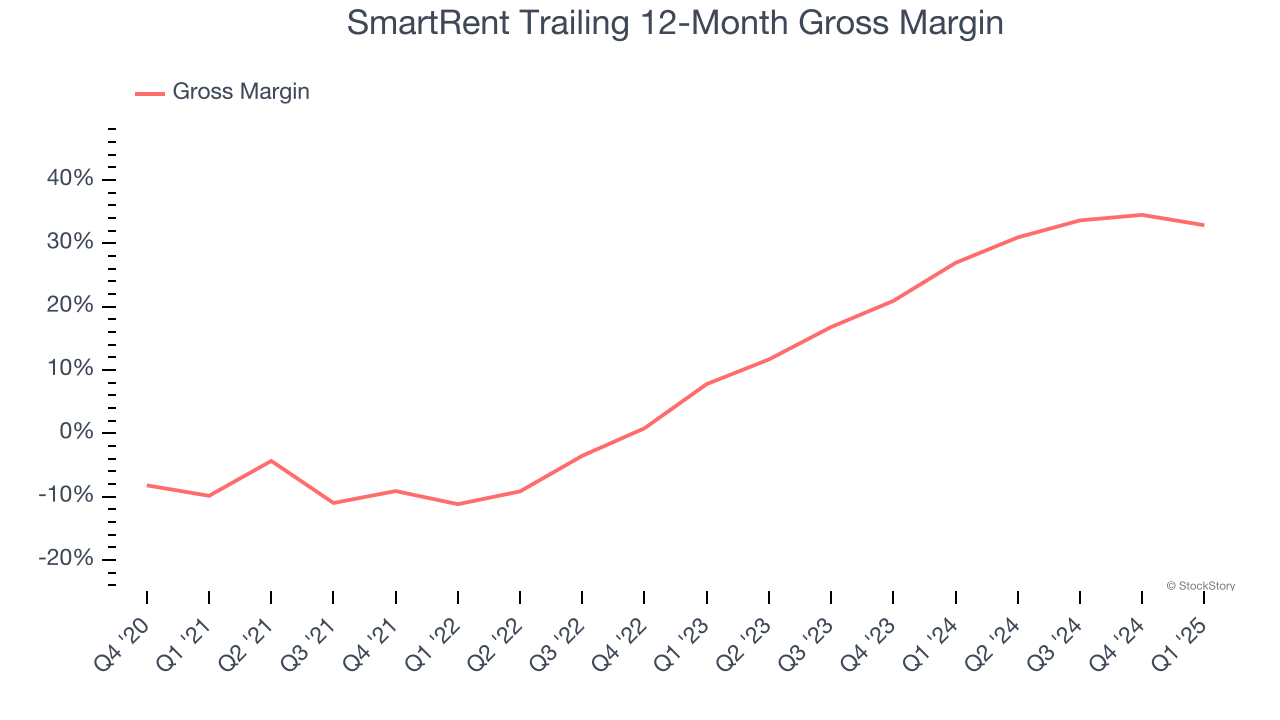

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

SmartRent has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 14.3% gross margin over the last five years. That means SmartRent paid its suppliers a lot of money ($85.71 for every $100 in revenue) to run its business.

3. Cash Burn Ignites Concerns

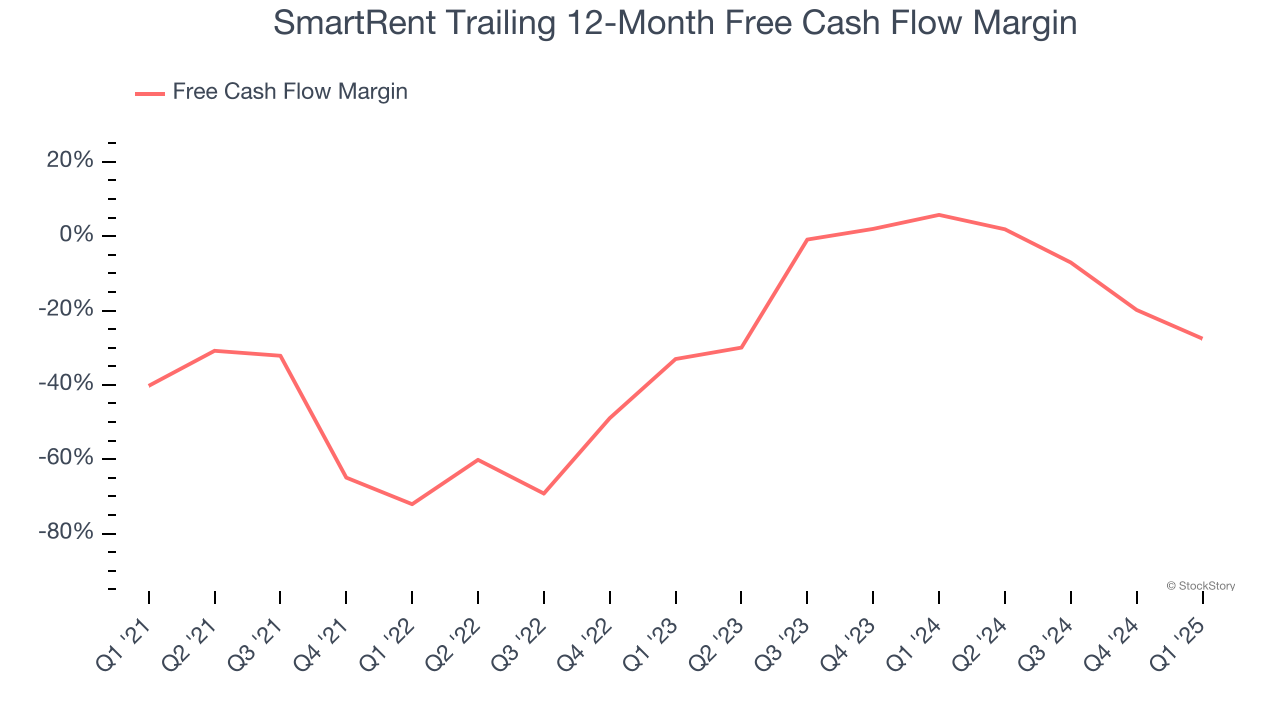

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

SmartRent’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 27.7%, meaning it lit $27.69 of cash on fire for every $100 in revenue.

Final Judgment

SmartRent isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at $1.10 per share (or a forward price-to-sales ratio of 1.3×). The market typically values companies like SmartRent based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy. Let us point you toward the most dominant software business in the world.

Stocks We Would Buy Instead of SmartRent

Trump’s April 2024 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.