Tech giant Microsoft (NASDAQ: MSFT) announced better-than-expected revenue in Q2 CY2025, with sales up 18.1% year on year to $76.44 billion. Its GAAP profit of $3.65 per share was 8% above analysts’ consensus estimates.

Is now the time to buy Microsoft? Find out by accessing our full research report, it’s free.

Microsoft (MSFT) Q2 CY2025 Highlights:

- Revenue: $76.44 billion vs analyst estimates of $73.86 billion (3.5% beat)

- Operating Profit (GAAP): $34.32 billion vs analyst estimates of $32.25 billion (6.4% beat)

- EPS (GAAP): $3.65 vs analyst estimates of $3.38 (8% beat)

- Intelligent Cloud Revenue: $0.03 vs analyst estimates of $28.96 billion (3.2% beat)

- Business Software Revenue: $33.11 billion vs analyst estimates of $32.21 billion (2.8% beat)

- Personal Computing Revenue: $13.45 billion vs analyst estimates of $12.68 billion (6.1% beat)

- Gross Margin: 68.6%, down from 69.6% in the same quarter last year

- Operating Margin: 44.9%, up from 43.1% in the same quarter last year

- Free Cash Flow Margin: 33.4%, down from 36% in the same quarter last year

- Market Capitalization: $3.81 trillion

Revenue Growth

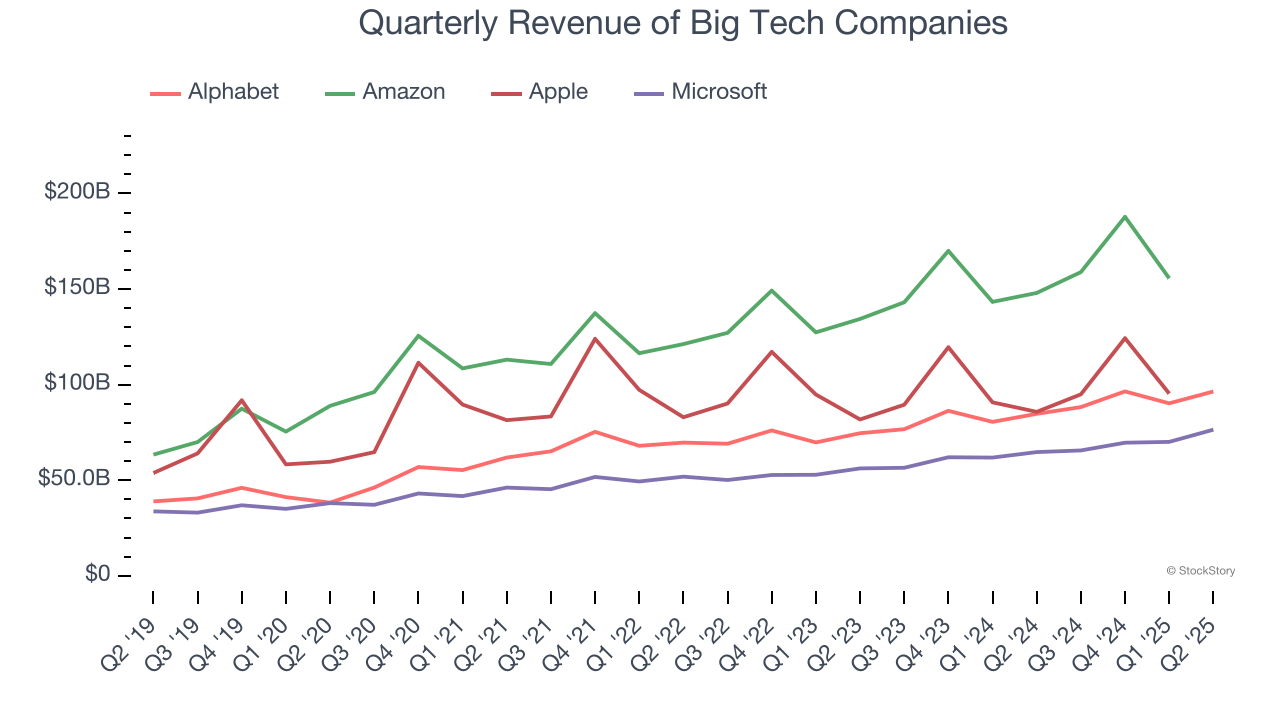

Microsoft proves that huge, scaled companies can still grow quickly. The company’s revenue base of $143 billion five years ago has nearly doubled to $281.7 billion in the last year, translating into an exceptional 14.5% annualized growth rate.

Over the same period, Microsoft’s big tech peers Amazon, Alphabet, and Apple put up annualized growth rates of 16.6%, 17.5%, and 8%, respectively. This is an important consideration because investors often use the comparisons as a starting point for their valuations. With these benchmarks in mind, we think Microsoft is a bit expensive (but still worth owning).

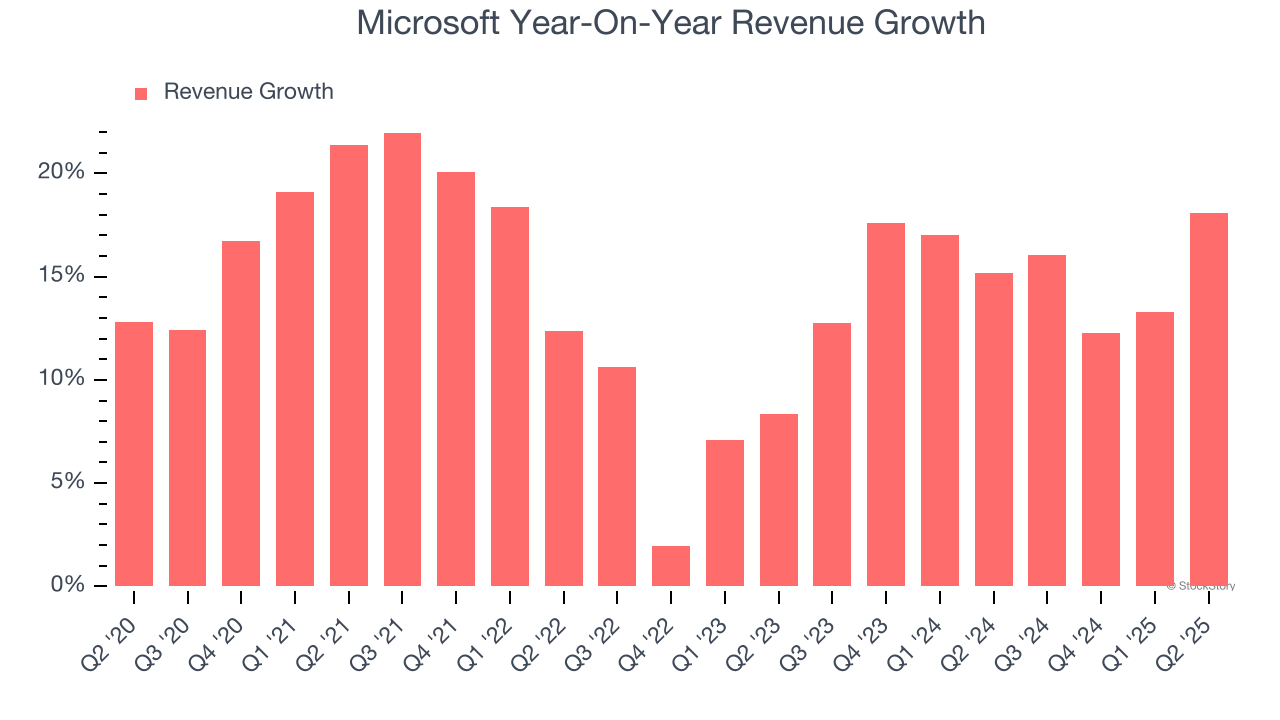

Long-term growth reigns supreme in fundamentals, but for big tech companies, a half-decade historical view may miss emerging trends in AI. Microsoft’s annualized revenue growth of 15.3% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, Microsoft reported year-on-year revenue growth of 18.1%, and its $76.44 billion of revenue exceeded Wall Street’s estimates by 3.5%. Looking ahead, sell-side This projection is still healthy and illustrates the market sees some success for its newer products.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Intelligent Cloud: Azure & Cloud Computing

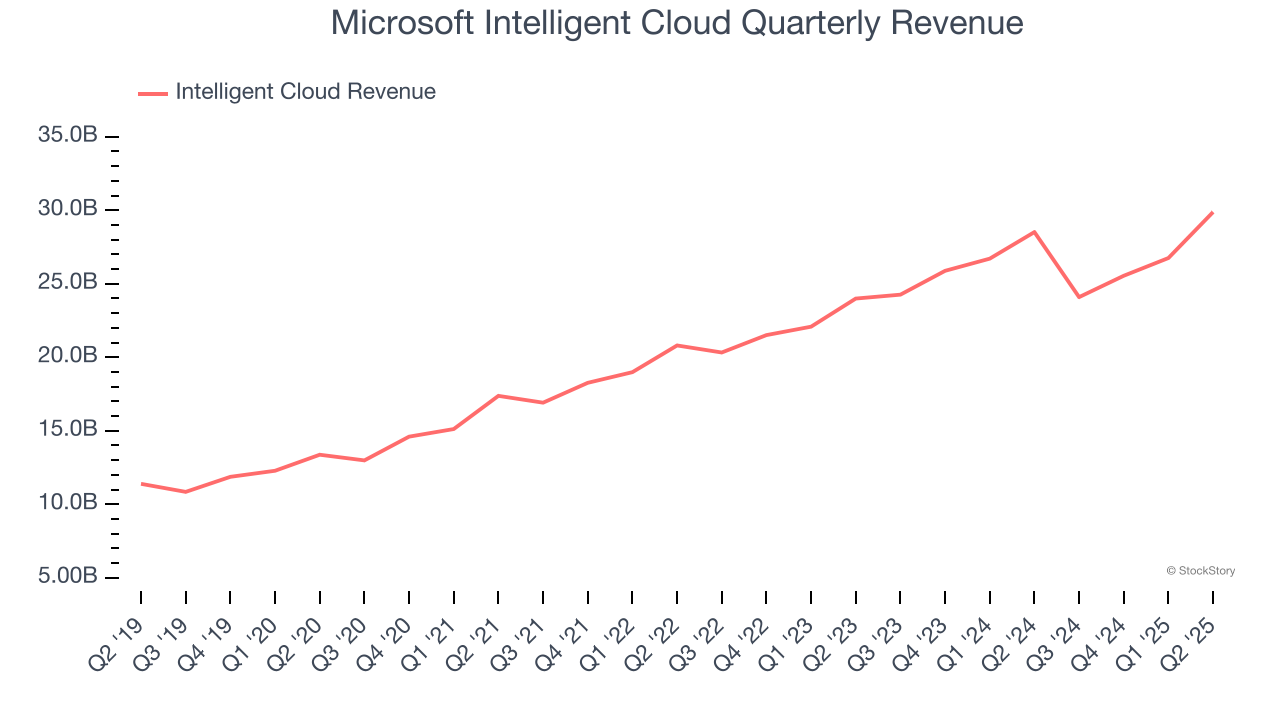

The most pressing question about Microsoft’s business is how much AI can boost its revenues. The company's cloud computing division, Intelligent Cloud, is one we watch carefully because its Azure platform and server/database offerings could be the biggest beneficiaries of the AI megatrend.

Intelligent Cloud is 37.7% of Microsoft’s total sales and grew at a 17% annualized rate over the last five years, faster than its consolidated revenues. The previous two years saw deceleration as it grew by 9.9% annually.

Intelligent Cloud’s 4.8% year-on-year revenue growth exceeded expectations in Q2, beating Wall Street’s estimates by 3.2%.

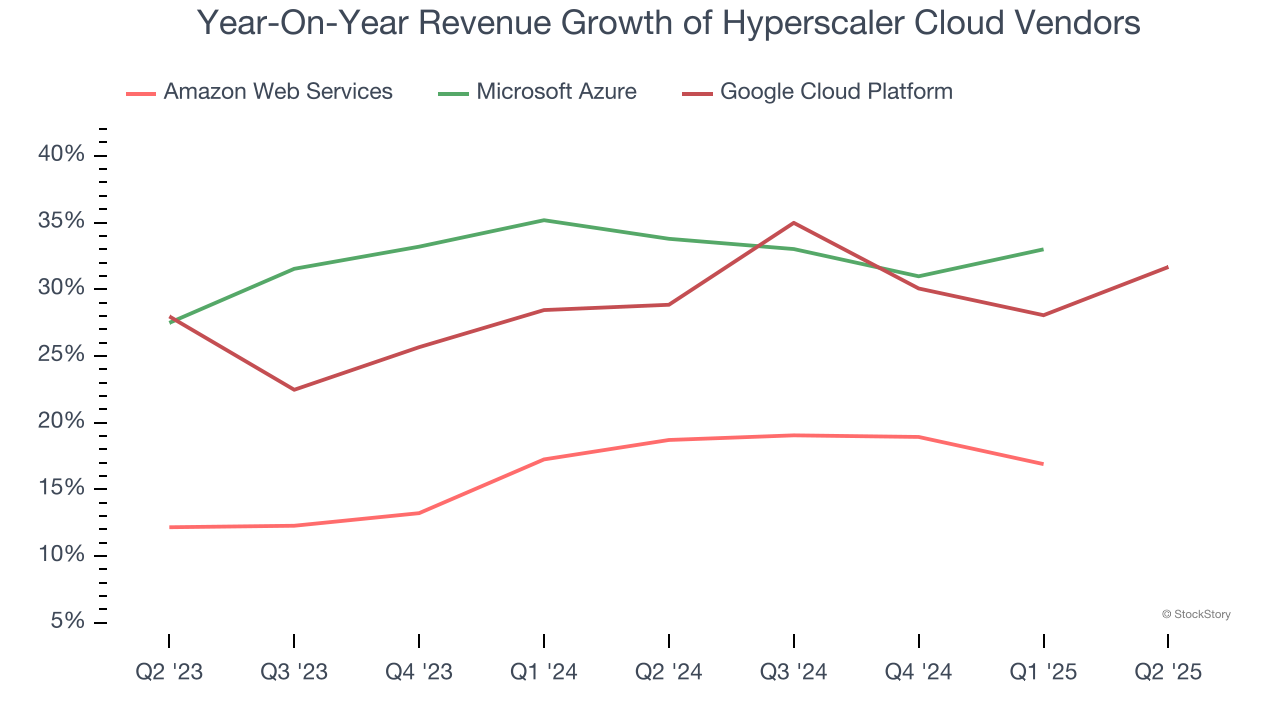

In terms of market share, Azure is a close second as its run-rate revenue (current quarter’s sales times four) is around $NaN billion versus roughly $100 billion and $55 billion for AWS and Google Cloud. If Azure wants to catch up to AWS in the coming years, growth will have to accelerate beyond its current levels.

Key Takeaways from Microsoft’s Q2 Results

We enjoyed seeing Microsoft beat analysts’ revenue expectations this quarter, as Personal Computing, Intelligent Cloud, and Business Services segment revenues all beat. Operating profit also exceeded expectations, showing that strong topline growth was also more efficient than Wall Street's projections. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 7% to $550.05 immediately following the results.

Indeed, Microsoft had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.