Toy manufacturing and entertainment company (NASDAQ: MAT) announced better-than-expected revenue in Q1 CY2025, with sales up 2.1% year on year to $826.6 million. Its non-GAAP loss of $0.03 per share was 70.4% above analysts’ consensus estimates.

Is now the time to buy Mattel? Find out by accessing our full research report, it’s free.

Mattel (MAT) Q1 CY2025 Highlights:

- Revenue: $826.6 million vs analyst estimates of $791.5 million (2.1% year-on-year growth, 4.4% beat)

- Adjusted EPS: -$0.03 vs analyst estimates of -$0.10 (70.4% beat)

- Adjusted EBITDA: $57.2 million vs analyst estimates of $48.57 million (6.9% margin, 17.8% beat)

- Operating Margin: -6.4%, down from -3.2% in the same quarter last year

- Free Cash Flow was -$11.4 million, down from $5 million in the same quarter last year

- Market Capitalization: $5.29 billion

Ynon Kreiz, Chairman and CEO of Mattel, said: “This was a strong quarter for Mattel, with positive performance and continued operational excellence. Our brands are thriving, our products and experiences stand out in the marketplace, and our balance sheet gives us resilience and flexibility to execute our strategy. As we navigate the current period of macro-economic volatility, we are adapting with speed, agility, and discipline. We expect not only to manage through this period but strengthen our competitive position.”

Company Overview

Known for the creation of iconic toys such as Barbie and Hotwheels, Mattel (NASDAQ: MAT) is a global children's entertainment company specializing in the design and production of consumer products.

Sales Growth

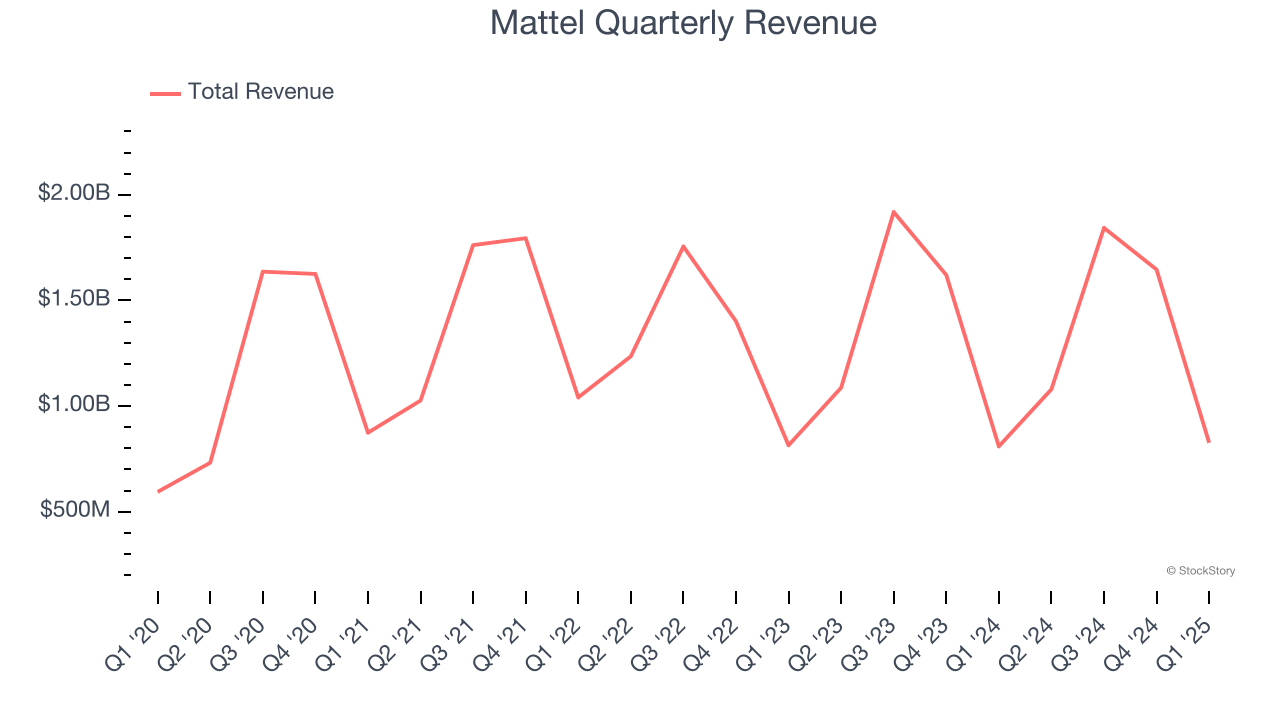

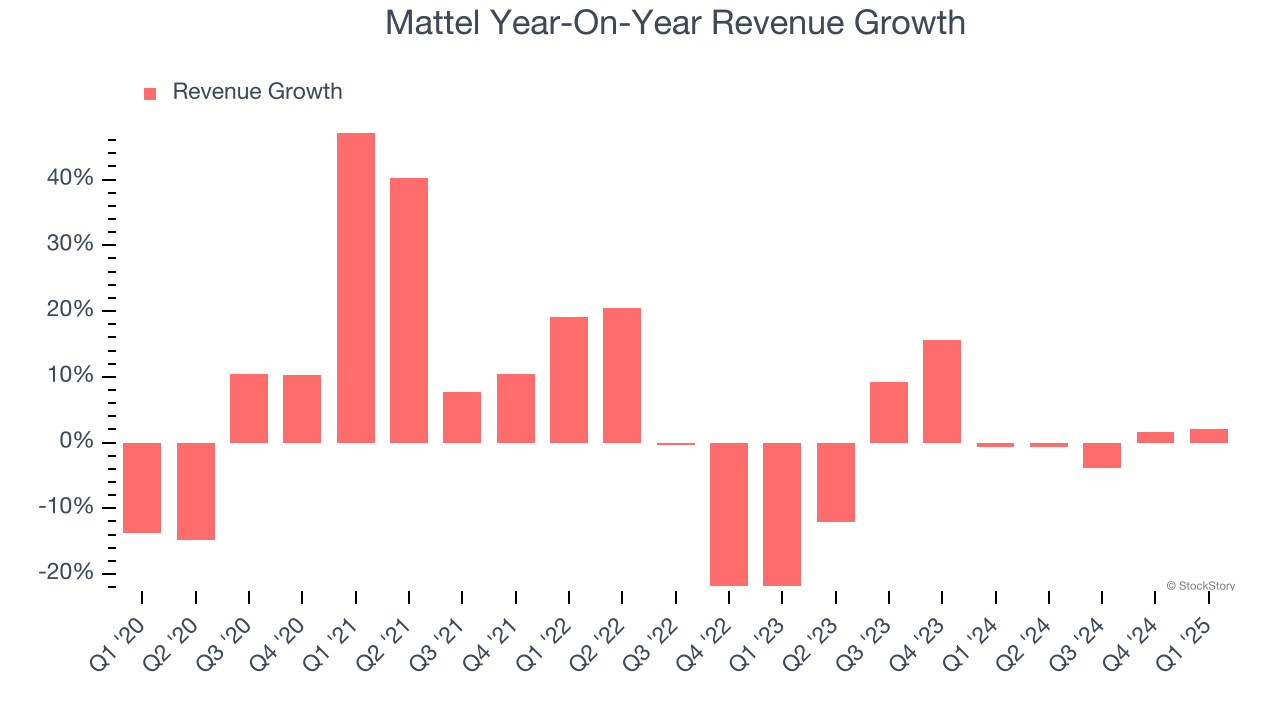

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Mattel’s 4.1% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Mattel’s recent performance shows its demand has slowed as its annualized revenue growth of 1.8% over the last two years was below its five-year trend.

This quarter, Mattel reported modest year-on-year revenue growth of 2.1% but beat Wall Street’s estimates by 4.4%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection is underwhelming and suggests its newer products and services will not accelerate its top-line performance yet.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

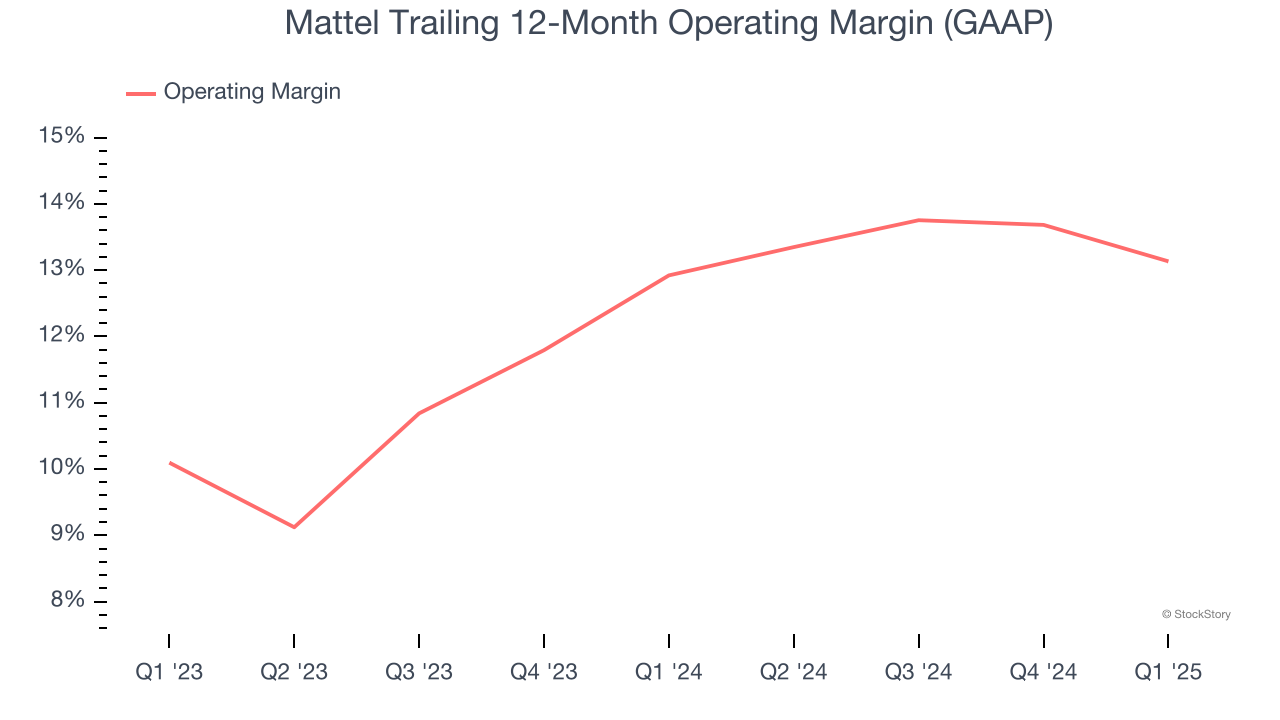

Mattel’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 13% over the last two years. This profitability was solid for a consumer discretionary business and shows it’s an efficient company that manages its expenses well.

In Q1, Mattel generated an operating profit margin of negative 6.4%, down 3.2 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

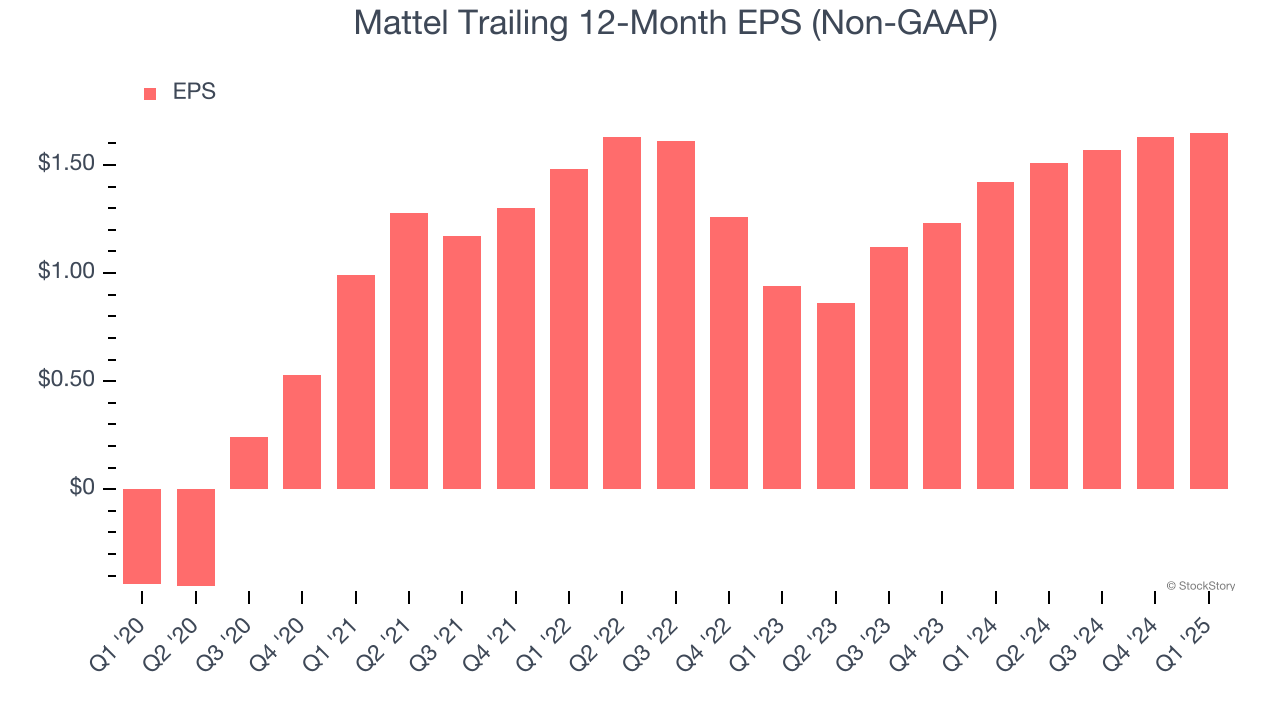

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Mattel’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q1, Mattel reported EPS at negative $0.03, up from negative $0.05 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Mattel’s full-year EPS of $1.65 to stay about the same.

Key Takeaways from Mattel’s Q1 Results

We were impressed by how Mattel blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. On the other hand, it pulled its guidance due to macro uncertainty. Zooming out, we think this was a mixed quarter. The market seemed to be hoping for more, and the stock traded down 2.3% to $15.80 immediately after reporting.

Big picture, is Mattel a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.