Wrapping up Q1 earnings, we look at the numbers and key takeaways for the healthcare technology stocks, including Tandem Diabetes (NASDAQ: TNDM) and its peers.

Healthcare Technology

The 8 healthcare technology stocks we track reported a mixed Q1. As a group, revenues beat analysts’ consensus estimates by 4.4% while next quarter’s revenue guidance was 0.9% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Tandem Diabetes (NASDAQ: TNDM)

With technology that automatically adjusts insulin delivery based on continuous glucose monitoring data, Tandem Diabetes Care (NASDAQ: TNDM) develops and manufactures automated insulin delivery systems that help people with diabetes manage their blood glucose levels.

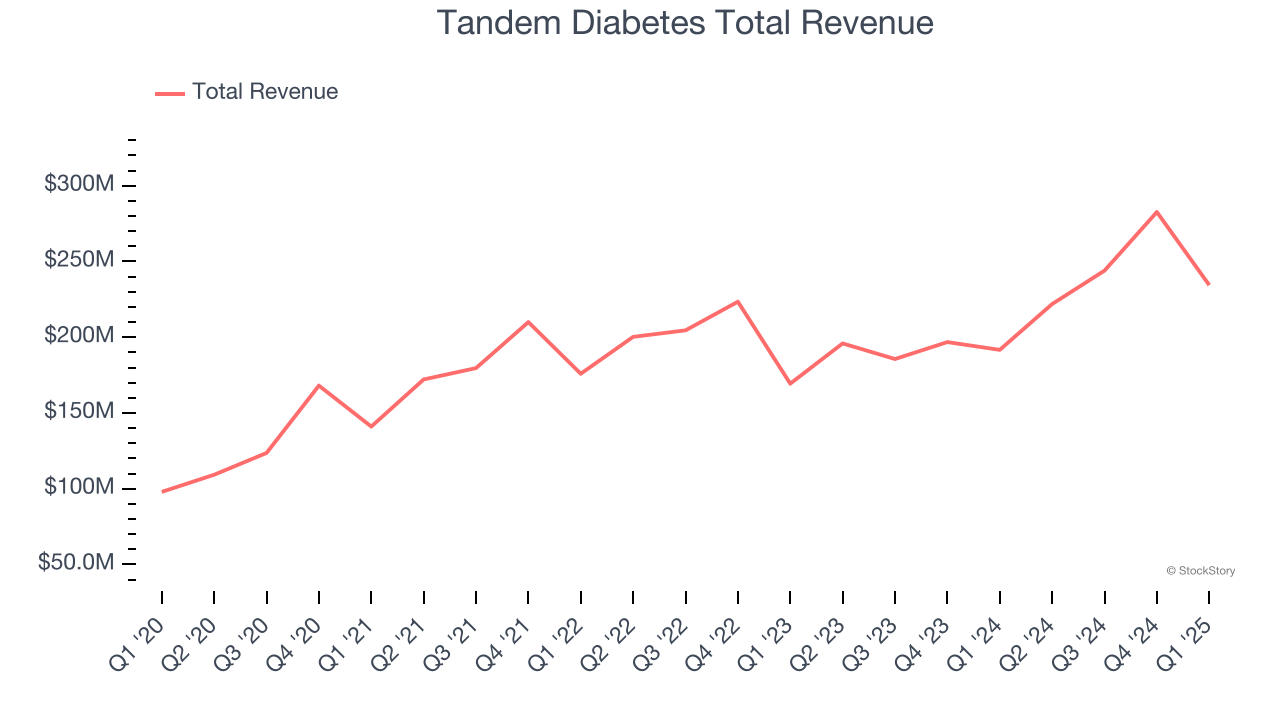

Tandem Diabetes reported revenues of $234.4 million, up 22.3% year on year. This print exceeded analysts’ expectations by 6.8%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ sales volume estimates.

The stock is up 24.1% since reporting and currently trades at $20.88.

Is now the time to buy Tandem Diabetes? Access our full analysis of the earnings results here, it’s free.

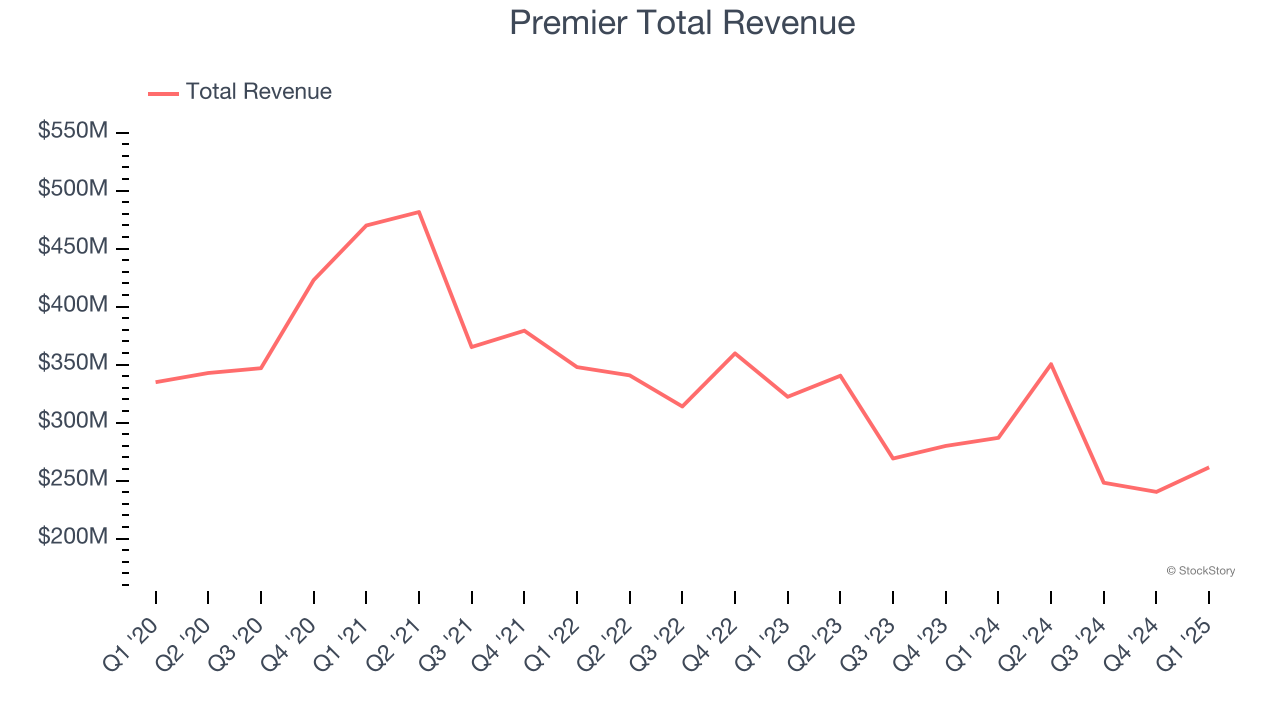

Best Q1: Premier (NASDAQ: PINC)

Operating one of the largest healthcare group purchasing organizations in the United States with over 4,350 hospital members, Premier (NASDAQ: PINC) is a technology-driven healthcare improvement company that helps hospitals, health systems, and other providers reduce costs and improve clinical outcomes.

Premier reported revenues of $261.4 million, down 8.9% year on year, outperforming analysts’ expectations by 7.4%. The business had a very strong quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ full-year EPS guidance estimates.

The market seems happy with the results as the stock is up 13.1% since reporting. It currently trades at $23.23.

Is now the time to buy Premier? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Astrana Health (NASDAQ: ASTH)

Formerly known as Apollo Medical Holdings until early 2024, Astrana Health (NASDAQ: ASTH) operates a technology-powered healthcare platform that enables physicians to deliver coordinated care while successfully participating in value-based payment models.

Astrana Health reported revenues of $620.4 million, up 53.4% year on year, falling short of analysts’ expectations by 2.5%. It was a slower quarter as it posted revenue guidance for next quarter meeting analysts’ expectations and full-year EBITDA guidance slightly missing analysts’ expectations.

Astrana Health delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 29.6% since the results and currently trades at $23.50.

Read our full analysis of Astrana Health’s results here.

Hims & Hers Health (NYSE: HIMS)

Originally launched with a focus on stigmatized conditions like hair loss and sexual health, Hims & Hers Health (NYSE: HIMS) operates a consumer-focused telehealth platform that connects patients with healthcare providers for prescriptions and wellness products.

Hims & Hers Health reported revenues of $586 million, up 111% year on year. This result topped analysts’ expectations by 8.3%. Overall, it was a strong quarter as it also recorded a solid beat of analysts’ EPS estimates and full-year EBITDA guidance beating analysts’ expectations.

Hims & Hers Health delivered the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The company added 137,000 customers to reach a total of 2.37 million. The stock is up 30% since reporting and currently trades at $54.55.

Read our full, actionable report on Hims & Hers Health here, it’s free.

GoodRx (NASDAQ: GDRX)

Started in 2011 to tackle the problem of high prescription drug costs in America, GoodRx (NASDAQ: GDRX) operates a digital platform that helps consumers find lower prices on prescription medications through price comparison tools and discount codes.

GoodRx reported revenues of $203 million, up 2.6% year on year. This print was in line with analysts’ expectations. However, it was a slower quarter as it produced a significant miss of analysts’ EPS estimates.

The company lost 200,000 customers and ended up with a total of 6.4 million. The stock is down 1.1% since reporting and currently trades at $3.74.

Read our full, actionable report on GoodRx here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.