Internet, cable TV, and phone provider Cable One (NYSE: CABO) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 4.5% year on year to $376 million. Its GAAP profit of $14.52 per share was 94.5% above analysts’ consensus estimates.

Is now the time to buy Cable One? Find out by accessing our full research report, it’s free for active Edge members.

Cable One (CABO) Q3 CY2025 Highlights:

- Revenue: $376 million vs analyst estimates of $378.9 million (4.5% year-on-year decline, 0.8% miss)

- EPS (GAAP): $14.52 vs analyst estimates of $7.46 (94.5% beat)

- Adjusted EBITDA: $201.9 million vs analyst estimates of $203 million (53.7% margin, 0.6% miss)

- Operating Margin: 25.2%, down from 28% in the same quarter last year

- Free Cash Flow Margin: 22.5%, down from 25.2% in the same quarter last year

- Residential Data Subscribers: 910,400, down 149,100 year on year

- Market Capitalization: $807.3 million

Company Overview

Founded in 1986, Cable One (NYSE: CABO) provides high-speed internet, cable television, and telephone services, primarily in smaller markets across the United States.

Revenue Growth

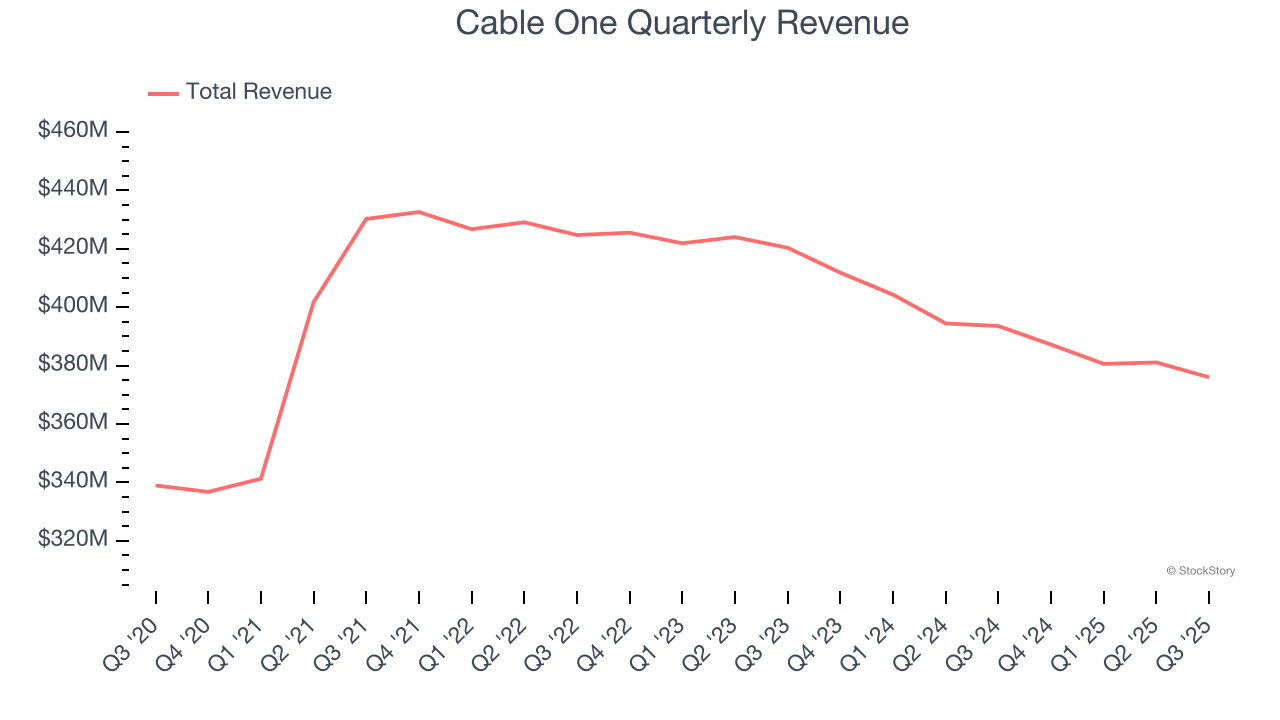

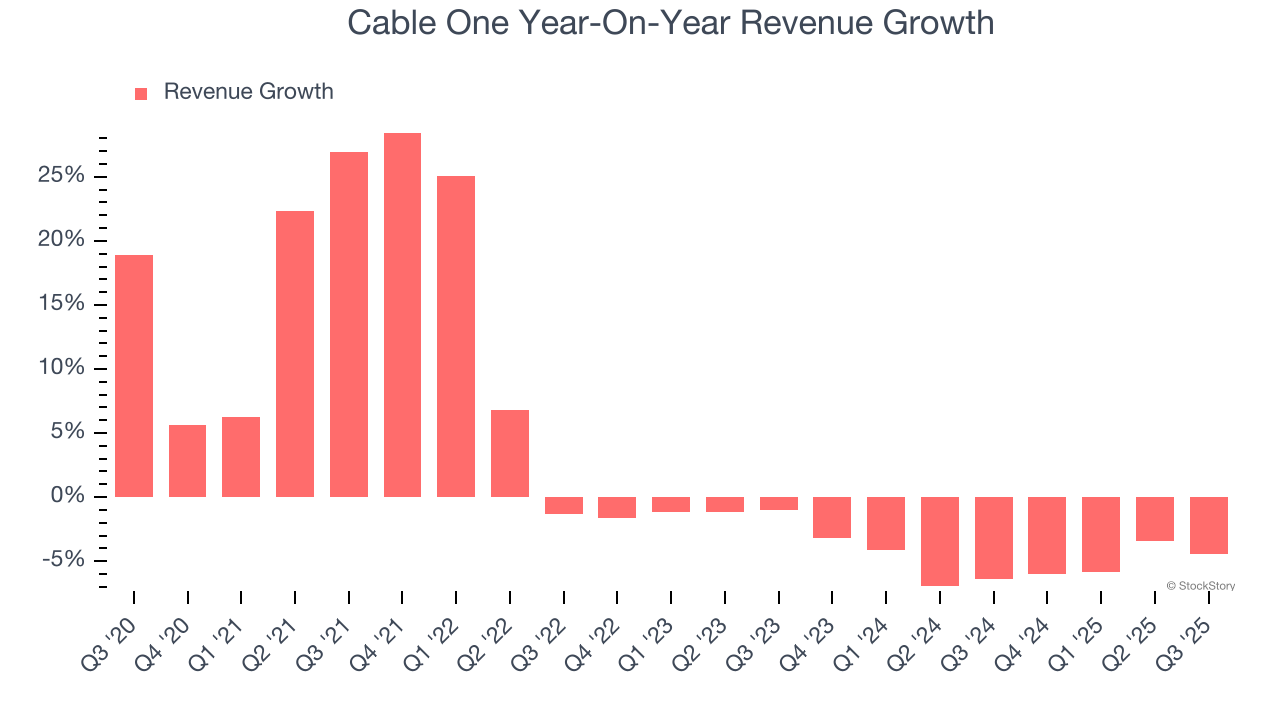

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Cable One’s 3.1% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the consumer discretionary sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Cable One’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 5.1% annually.

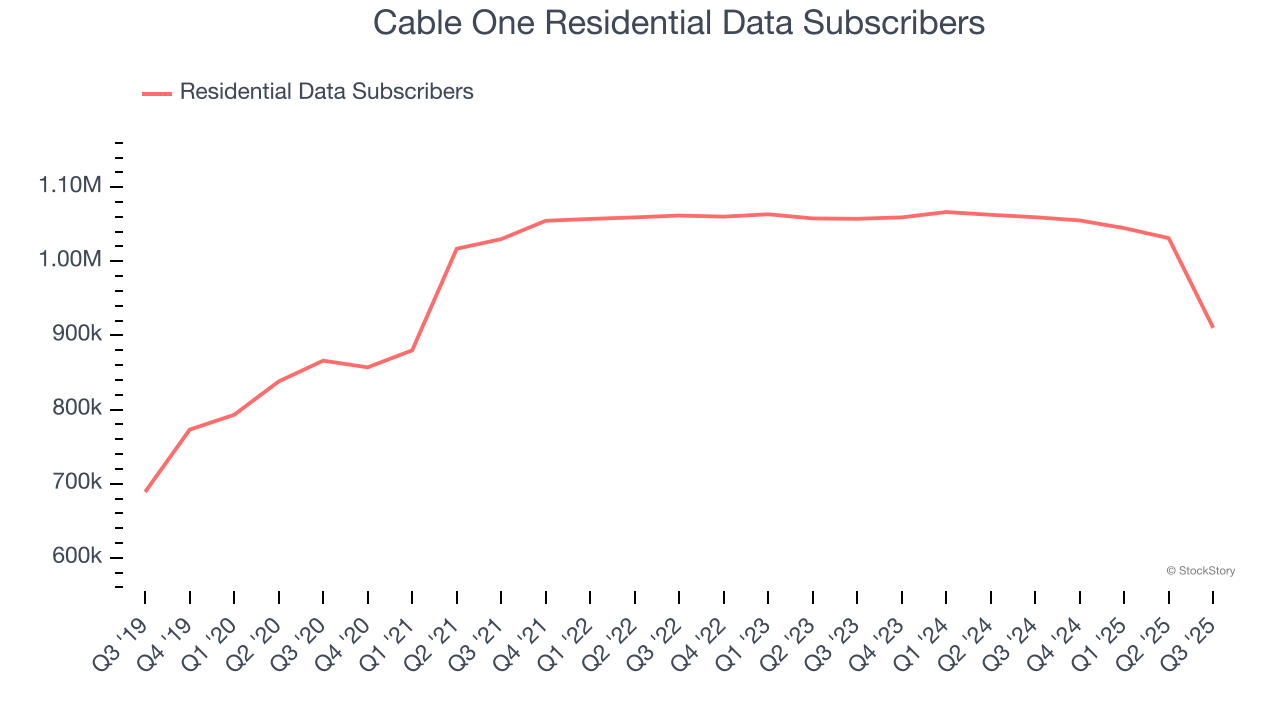

Cable One also discloses its number of residential data subscribers and residential video subscribers, which clocked in at 910,400 and 58,400 in the latest quarter. Over the last two years, Cable One’s residential data subscribers averaged 2.3% year-on-year declines while its residential video subscribers averaged 23.9% year-on-year declines.

This quarter, Cable One missed Wall Street’s estimates and reported a rather uninspiring 4.5% year-on-year revenue decline, generating $376 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 2.8% over the next 12 months. Although this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

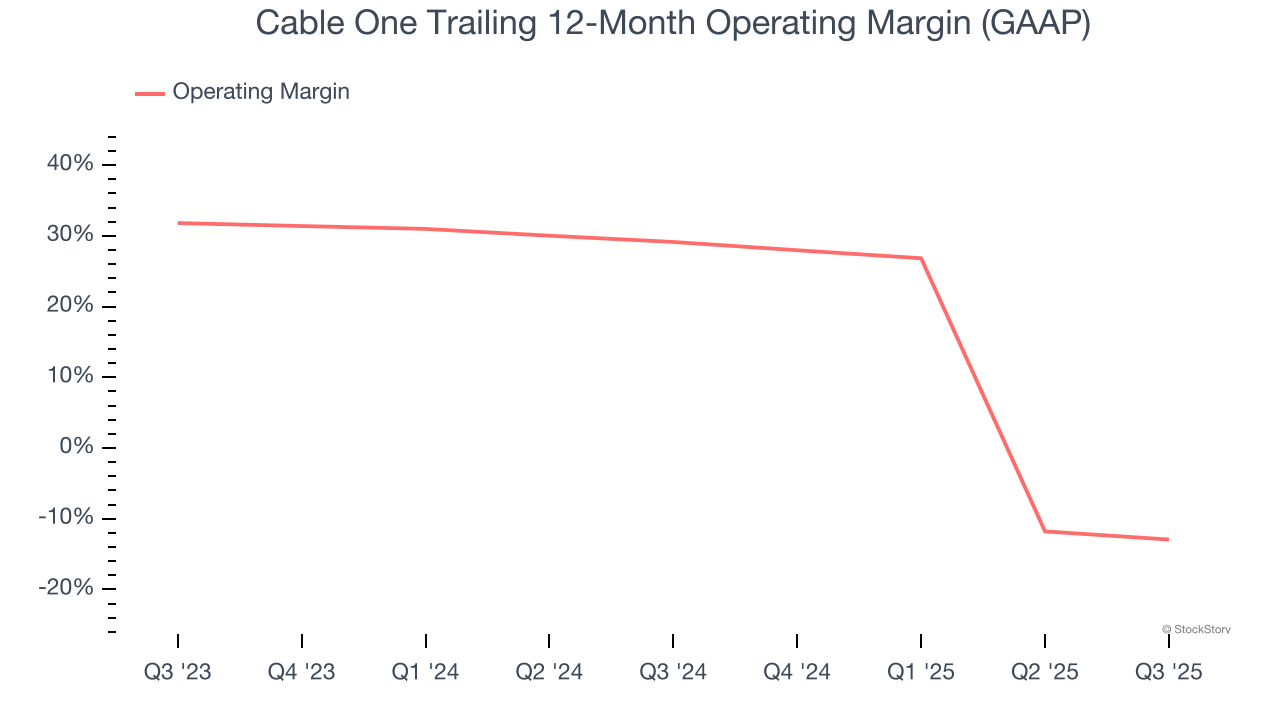

Cable One’s operating margin has been trending down over the last 12 months and averaged 8.6% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Cable One generated an operating margin profit margin of 25.2%, down 2.8 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

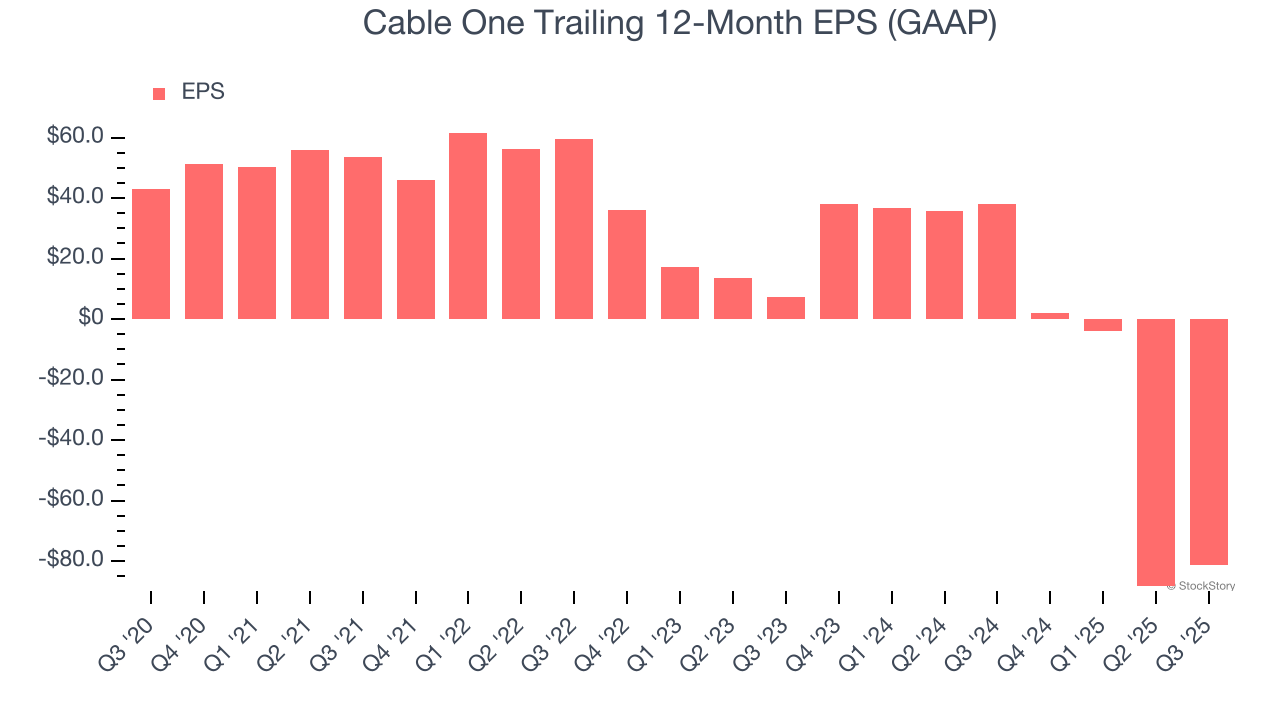

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Cable One, its EPS declined by 31.3% annually over the last five years while its revenue grew by 3.1%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q3, Cable One reported EPS of $14.52, up from $7.58 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast Cable One’s full-year EPS of negative $81.43 will flip to positive $32.31.

Key Takeaways from Cable One’s Q3 Results

It was good to see Cable One beat analysts’ EPS expectations this quarter. On the other hand, both its residential video and data subscriber counts missed, resulting in revenue that fell short of Wall Street’s estimates. Overall, this print was mixed. The stock remained flat at $134.68 immediately after reporting.

Sure, Cable One had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.