Toy and entertainment company Hasbro (NASDAQ: HAS) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 8.3% year on year to $1.39 billion. Its non-GAAP profit of $1.68 per share was 2.9% above analysts’ consensus estimates.

Is now the time to buy Hasbro? Find out by accessing our full research report, it’s free for active Edge members.

Hasbro (HAS) Q3 CY2025 Highlights:

- Revenue: $1.39 billion vs analyst estimates of $1.34 billion (8.3% year-on-year growth, 3.2% beat)

- Adjusted EPS: $1.68 vs analyst estimates of $1.63 (2.9% beat)

- Adjusted EBITDA: $412.9 million vs analyst estimates of $383.3 million (29.8% margin, 7.7% beat)

- EBITDA guidance for the full year is $1.25 billion at the midpoint, above analyst estimates of $1.21 billion

- Operating Margin: 24.6%, up from 23.6% in the same quarter last year

- Free Cash Flow Margin: 16.2%, up from 13.6% in the same quarter last year

- Market Capitalization: $10.54 billion

“Hasbro delivered another quarter of growth, highlighting the strength of our brands and Playing to Win strategy,” said Chris Cocks, Chief Executive Officer,

Company Overview

Credited with the creation of toys such as Mr. Potato Head and the Rubik’s Cube, Hasbro (NASDAQ: HAS) is a global entertainment company offering a diverse range of toys, games, and multimedia experiences for children and families.

Revenue Growth

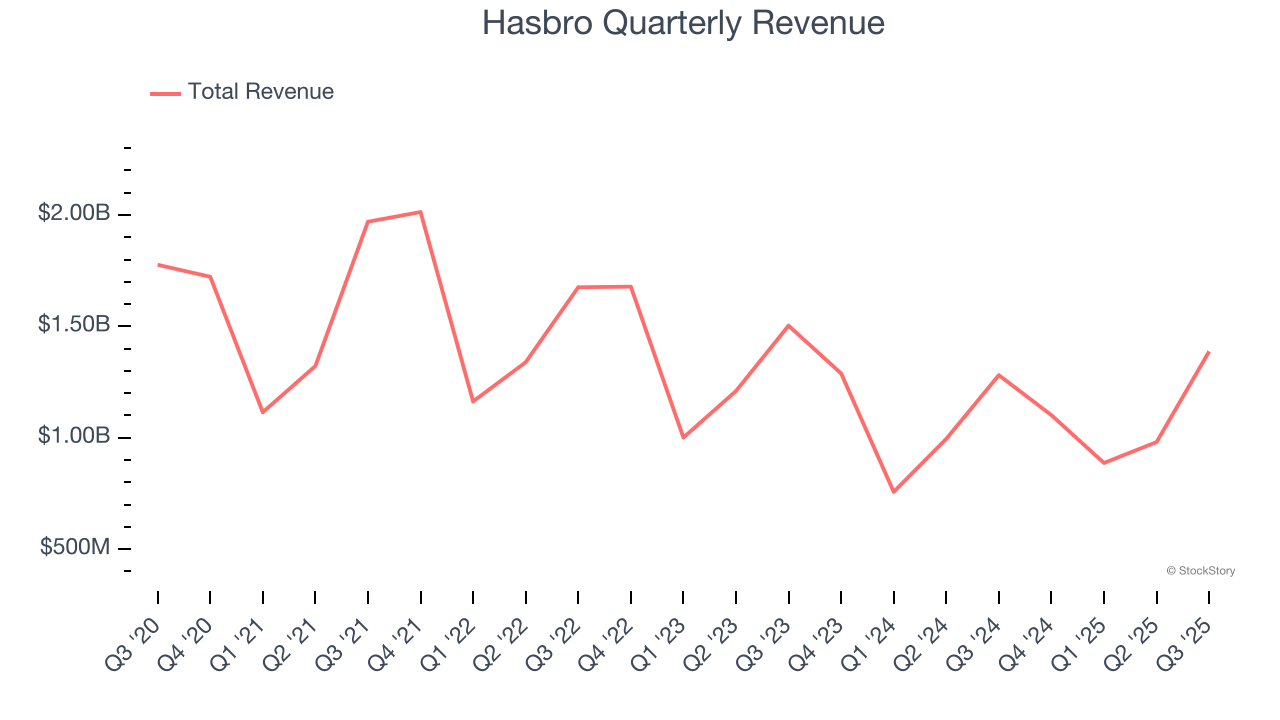

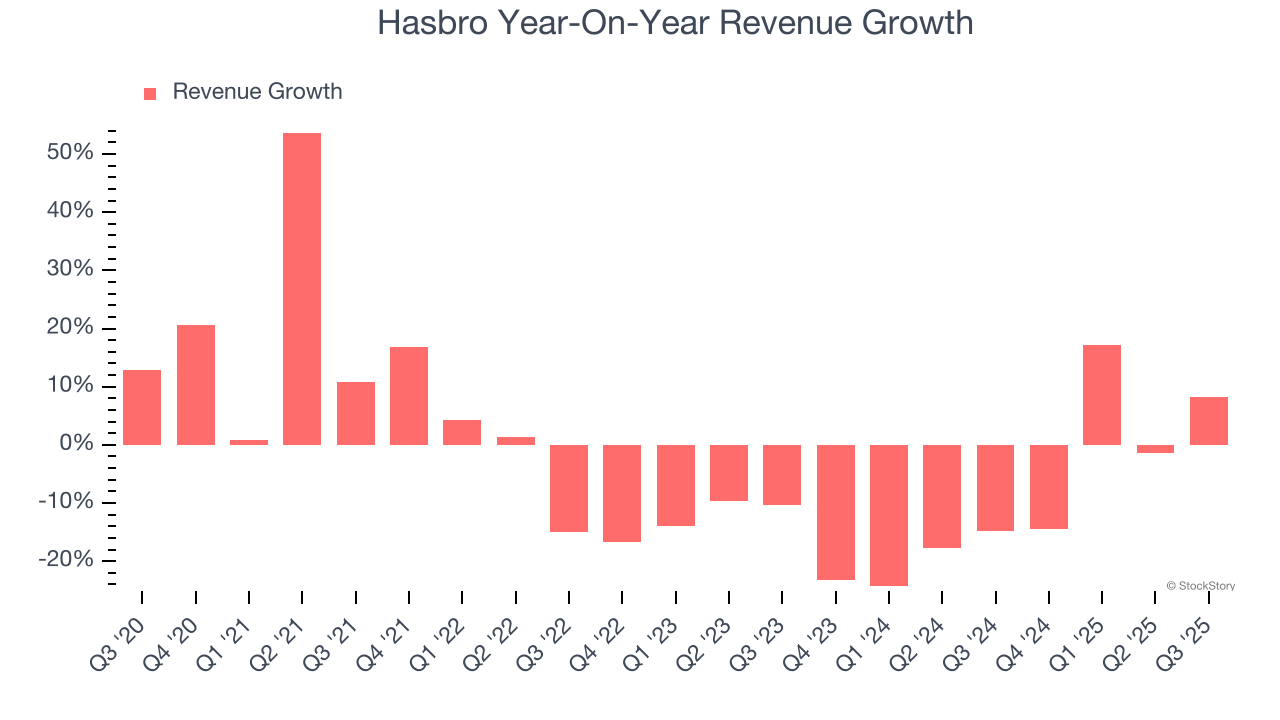

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Hasbro struggled to consistently generate demand over the last five years as its sales dropped at a 3.4% annual rate. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Hasbro’s recent performance shows its demand remained suppressed as its revenue has declined by 10.1% annually over the last two years.

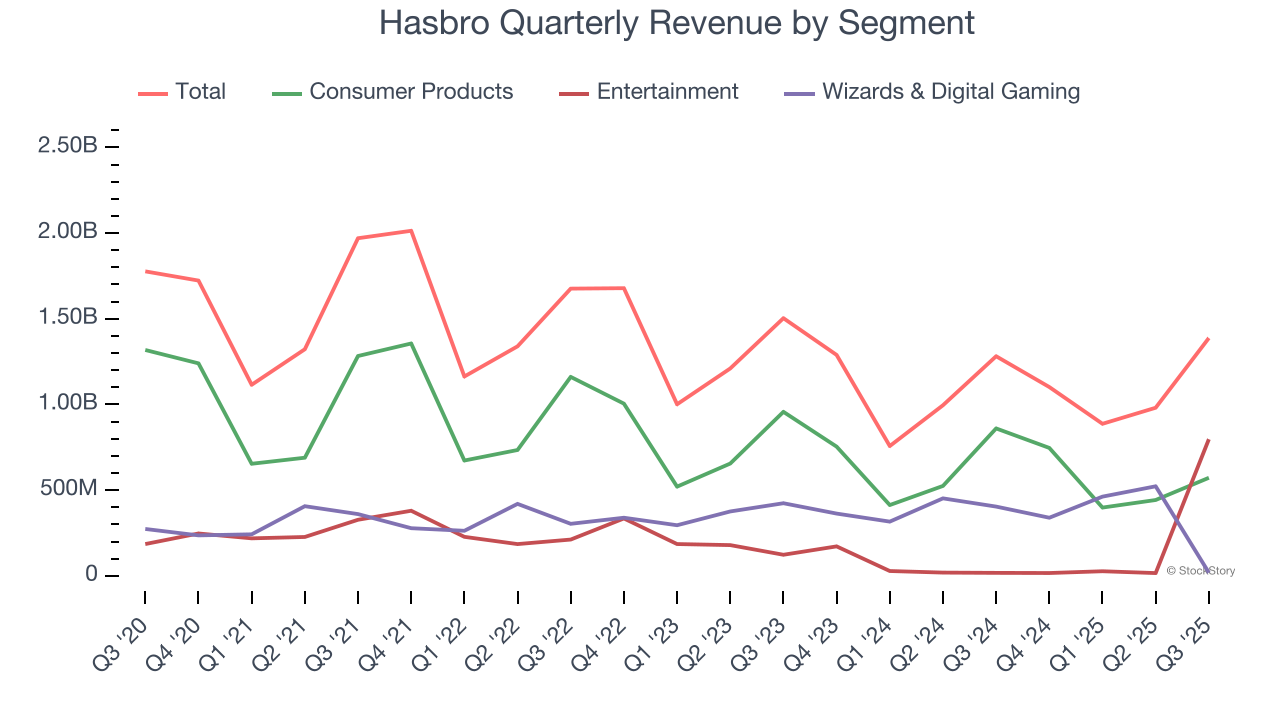

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Consumer Products, Entertainment, and Wizards & Digital Gaming, which are 41.2%, 57.4%, and 1.3% of revenue. Over the last two years, Hasbro’s Entertainment revenue (content) averaged 514% year-on-year growth while its Consumer Products (toys, games, apparel) and Wizards & Digital Gaming (Wizards of the Coast) revenues averaged 16.2% and 1.3% declines.

This quarter, Hasbro reported year-on-year revenue growth of 8.3%, and its $1.39 billion of revenue exceeded Wall Street’s estimates by 3.2%.

Looking ahead, sell-side analysts expect revenue to grow 4% over the next 12 months. While this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

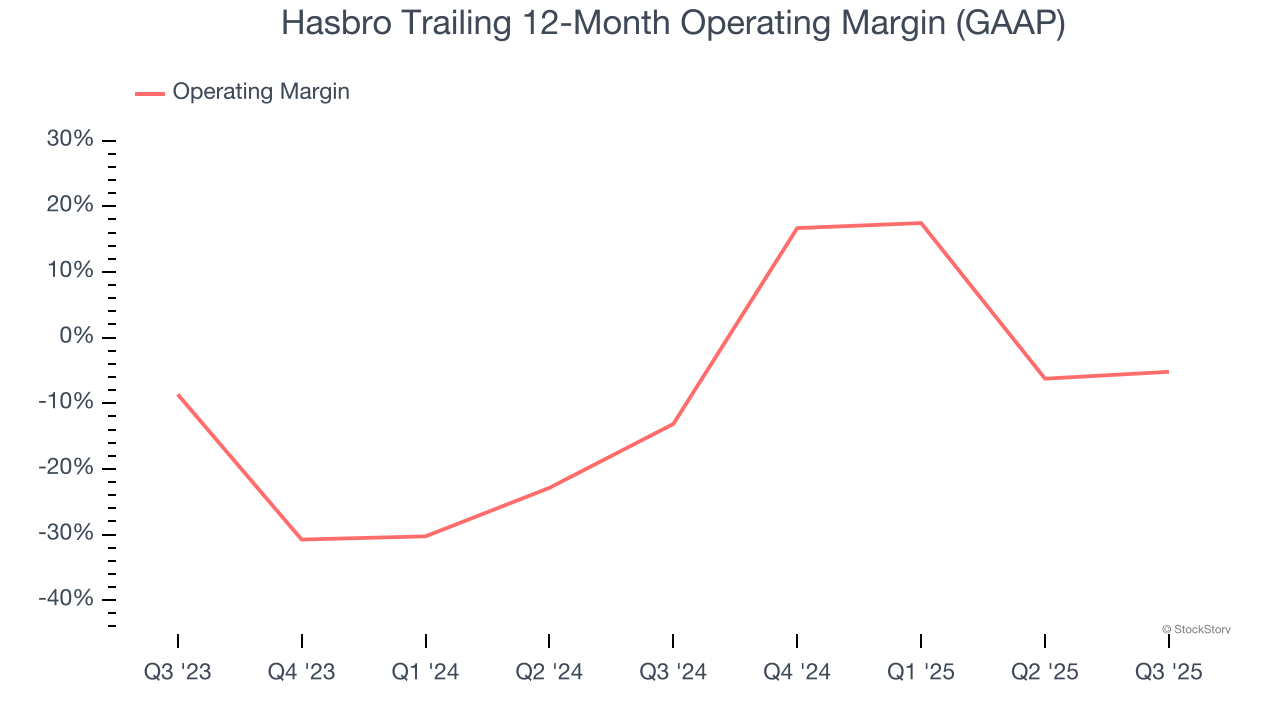

Hasbro’s operating margin has risen over the last 12 months, but it still averaged negative 9.2% over the last two years. This is due to its large expense base and inefficient cost structure.

In Q3, Hasbro generated an operating margin profit margin of 24.6%, up 1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

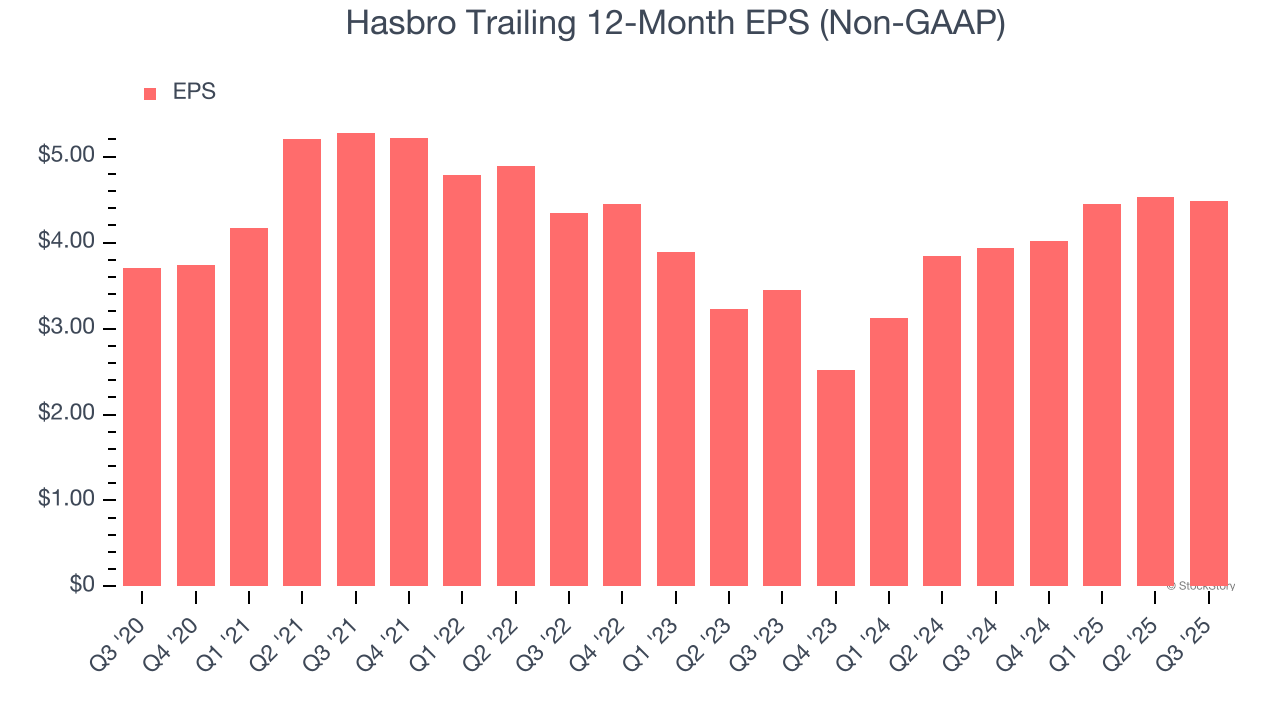

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Hasbro’s EPS grew at an unimpressive 3.8% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 3.4% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

In Q3, Hasbro reported adjusted EPS of $1.68, down from $1.73 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 2.9%. Over the next 12 months, Wall Street expects Hasbro’s full-year EPS of $4.48 to grow 13.8%.

Key Takeaways from Hasbro’s Q3 Results

We were happy that Hasbro's revenue and EBITDA outperformed Wall Street’s estimates. Full-year EBITDA guidance also exceeded expectations. However, "tariff volatility" looms over the toy market, and the stock traded down 2.5% to $73.26 immediately following the results.

So should you invest in Hasbro right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.