Financial technology provider Euronet Worldwide (NASDAQ: EEFT) fell short of the market’s revenue expectations in Q3 CY2025 as sales rose 4.2% year on year to $1.15 billion. Its non-GAAP profit of $3.62 per share was in line with analysts’ consensus estimates.

Is now the time to buy Euronet Worldwide? Find out by accessing our full research report, it’s free for active Edge members.

Euronet Worldwide (EEFT) Q3 CY2025 Highlights:

- Revenue: $1.15 billion vs analyst estimates of $1.2 billion (4.2% year-on-year growth, 4.5% miss)

- Pre-tax Profit: $180.2 million (15.7% margin, 13.5% year-on-year decline)

- Adjusted EPS: $3.62 vs analyst estimates of $3.61 (in line)

- Market Capitalization: $3.52 billion

“Euronet’s commitment to innovation and global expansion continues to drive our success with recent Ren deployments, Dandelion sales momentum and the pending acquisition of CoreCard – all accelerating our digital transformation. Through Dandelion, we’re enhancing Euronet’s global money network with stablecoin innovation — which will enable businesses and consumers to move value seamlessly between digital assets and local fiat currencies. Our on- and off-ramp capabilities will make stablecoins practical, connecting blockchain digital assets to real-world payments liquidity in over 200 countries.” said Michael J. Brown Euronet’s Chairman and Chief Executive Officer.

Company Overview

Operating a global network of over 47,000 ATMs and 821,000 point-of-sale terminals across more than 60 countries, Euronet Worldwide (NASDAQ: EEFT) provides electronic payment solutions including ATM services, prepaid product processing, and international money transfer services.

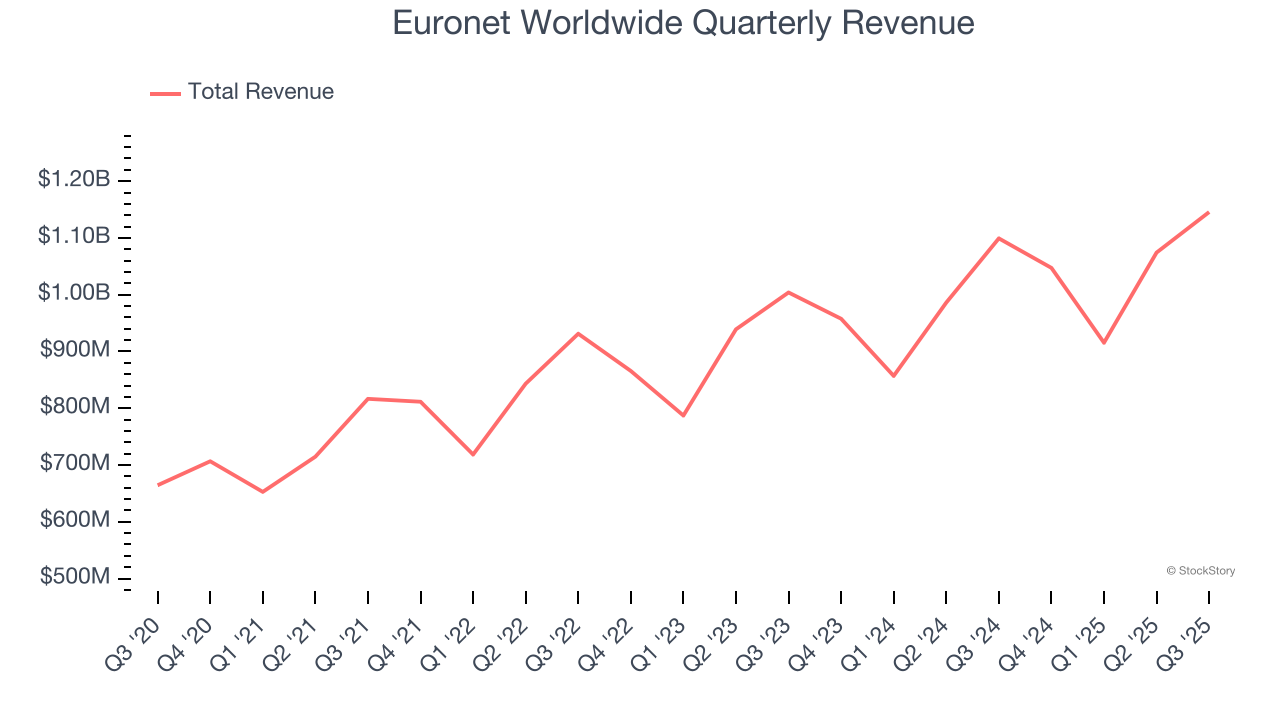

Revenue Growth

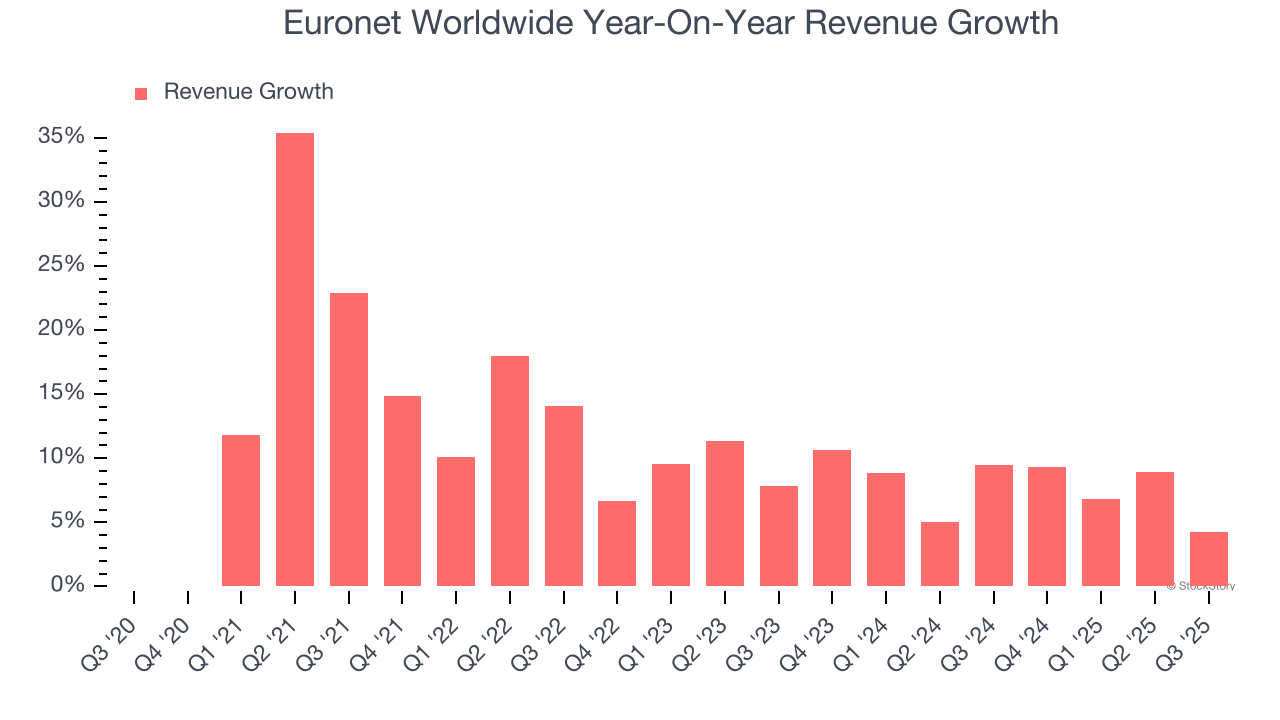

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Euronet Worldwide’s revenue grew at a solid 11.1% compounded annual growth rate over the last five years. Its growth beat the average financials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Euronet Worldwide’s annualized revenue growth of 7.9% over the last two years is below its five-year trend, but we still think the results were respectable.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Euronet Worldwide’s revenue grew by 4.2% year on year to $1.15 billion, falling short of Wall Street’s estimates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Key Takeaways from Euronet Worldwide’s Q3 Results

We struggled to find many positives in these results. Overall, this quarter could have been better. The stock traded down 2.5% to $86.52 immediately following the results.

The latest quarter from Euronet Worldwide’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.