Gene therapy differs from NYSE: NVS">gene editing, which is getting the lion's share of headlines. While gene editing is a form of gene therapy, there are basic differences. Gene-editing involves using techniques like CRISPR/Cas9 to precisely target and cut or modify the sequence of human genomes to manage hereditary diseases.

Gene therapy adds or replaces genes with a functional copy into a patient’s cells utilizing various viruses or AAV capsids. A Global Data study expects cell and gene therapy (CGT) to be a top industry trend in 2024 and expects the market to grow to over $80 billion by 2029. Here are two low-priced gene therapy stocks in the medical sector that speculators may watch to keep an eye on.

bluebird bio Inc. (NASDAQ: BLUE)

This clinical-stage biotech specializes in developing gene therapies for severe genetic and rare diseases. The company is focused specifically on sickle cell disease (SCD) and beta-thalassemia (BT). bluebird is also exploring gene therapies for rare diseases like transfusion-dependent thalassemia (TDT) and cerebral adrenoleukodystrophy (CALD).

FDA-approved gene therapies

bluebird bio has three FDA approved gene therapies:

ZYNTEGLO (betibeglogene autotemcel) is a gene therapy treatment for beta-thalassemia characterized by the inefficient production of healthy red blood cells. Patients receive functional copies of the beta-globin gene. Studies have shown that 89% of patients achieved transfusion independence.

SKYSONA (elivaldogene autotemcel) is a gene therapy treatment for early active cerebral adrenoleukodystrophy (CALD). It’s the first and only gene therapy proven to slow the progression of neurologic dysfunction in boys with early and active CALD.

LYFGENIA (lovotibeglogene autotemcel) was FDA-approved on Dec. 8, 2023, at the same time as Casgevy for the treatment of sickle cell disease (SCD). LYFGENIA is the longest-studied approved gene therapy for SCD. It's designed to allow the production of anti-sickling hemoglobin to decrease vaso-occlusive events.

Competing Sickle Cell Disease (SCD) treatments

Incidentally, Vertex Pharmaceuticals Inc. (NASDAQ: VRTX) and CRISPR Therapeutics AG (NASDAQ: CRSP) received FDA approval for Casgevy, a CRISPR/Cas9 therapy for SCD for patients with recurrent vaso-occlusive crises (VOCs) on Dec. 8, 2023. Vertex announced its treatment would be priced at $2.2 million per patient, coming in cheaper than the $3.1 million per patient that bluebird bio is charging for its SCD therapy. Check out the sector heatmap on MarketBeat.

Raising more funds for commercialization

On Dec. 20, 2023, bluebird bio announced a $150 million secondary stock offering of 83.34 million shares priced at $1.50. This caused shares to gap down 41% from its previous trading day closing price of $2.43 on Dec. 19, 2023, to $1.45. Investors were taken by surprise as shares fell as low as $1.26 before staging a slow rally back towards $1.45. The company said the offering, combined with existing funds, should help the company fund operations through the first quarter of 2025. Net proceeds will be used to support the commercialization of its three approved gene therapies and to fund working capital and general corporate purposes.

bluebird bio analyst ratings and price targets are at MarketBeat. bluebird bio peers and competitor stocks can be found with the MarketBeat stock screener.

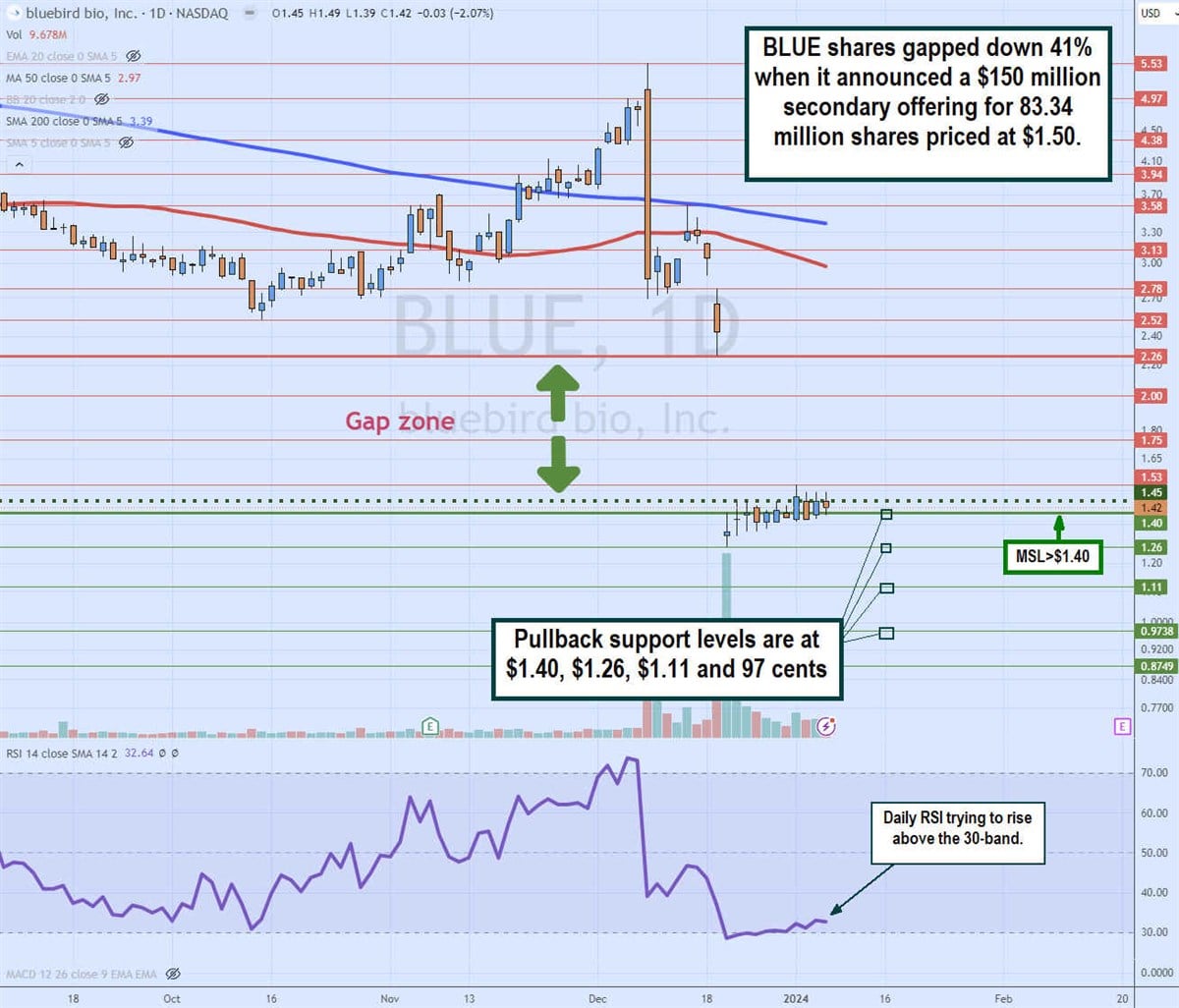

Daily gap fill

The daily candlestick chart for BLUE illustrates a gap channel between $2.26 and $1.40 that formed on the announcement of its $150 million secondary common stock offering, where shares were priced at $1.50. The daily 50-period moving average falls to $2.97, followed by the daily 200-period moving average (MA) at $3.39.

The daily market structure low (MSL) buy triggers the $1.45 breakout. The daily relative strength index (RSI) slowly rose through the 30-band but is having a hard time bouncing higher. Pullback support levels are at $1.40, $1.26, $1.11, and 97 cents.

Sangamo Therapeutics Inc. (NASDAQ: SGMO)

This is a clinical-stage genomic medicine company. The company develops gene therapy treatments for severe diseases. The company is transforming into a neurology-focused genomic medicine company. Sangamo is the riskier speculation since it’s gone into cost-savings mode with enough funds to operate through Q3 2024. It has put two programs on hold until further funding or a collaboration partner is found for its Fabry gene therapy and Car-Treg cell therapy program. In June 2023, collaboration agreements with Novartis AG (NYSE: NVS) and Biogen Inc. (NASDAQ: BIIB) were terminated.

Pfizer Phase 3 AFFINE trial

It has a partnership with Pfizer Inc. (NYSE: PFE) for giroctogene fitelparvovec, an investigational gene therapy treatment for moderately severe to severe hemophilia A. Dosing is complete for its Phase 3 AFFINE trial with pivotal data expected in mid-2024. A BLA and MAA submission is anticipated in the second-half of 2024.

Desperate for a lifeline

The company is actively seeking collaboration partners for CAR-Treg cell therapy programs and deferring new investments until one is found. The company announced plans to shut down its Brisbane headquarters in early 2024 to restructure the company for a workforce reduction of around 40%. Cost savings from restructuring are anticipated to reduce annual operating expenses by 50%. The company will need to raise more funds to operate beyond Q3 2024.

Fabry disease FDA Fast Track Designation

While Sangamo doesn't have any current FDA approvals, they did receive FDA Fast Track Designation status for ST-920 (isaralgagene civaparvovec), a gene therapy product for the treatment of Fabry disease, on May 22, 2023. Fabry disease is a rare genetic disorder that impacts the body's ability to break down certain types of fat due to mutations in the GLA gene. Phase 3 trial planning is deferred until a collaboration partner or funding is secured. Get AI-powered insights on MarketBeat.

Gloomy Q3 2023 results

On Nov. 1, 2023, Sangamo reported an EPS loss of 59 cents, missing analyst estimates by 26 cents. Revenues fell 64.5% YoY to $9.4 million due to the termination of collaboration deals with Novartis and NASDAQ: BIIB">Biogen.

Sangamo CEO Sandy Macrae commented about the cost cuts and streamlining Sangamo’s pipeline, "At the same time, we will continue to progress our promising epigenetic regulation programs for neurological diseases and hope to share soon a breakthrough in our capsid delivery capabilities, which we believe could open the door for many other high-value and unmet diseases to be addressed with our editing capabilities. We continue to seek ways to raise additional capital to strengthen our financial foundation."

Sangamo Therapeutics analyst ratings and price targets are at MarketBeat. Sangamo Therapeutics peers and competitor stocks can be found with the MarketBeat stock screener. Editas has an 18.33% short interest.

Daily ascending triangle

The daily candlestick chart on SGMO illustrates an ascending triangle pattern. The flat-top upper horizontal trendline resistance is at 65 cents. The lower ascending trendline commenced after bottoming at 29 cents on Nov. 13, 2023.

The MSL triggered the breakout through 34 cents and eventually peaked at the 65-cent upper trendline on Dec. 28, 2023. SGMO fell back down to the daily 50-period MA at 43 cents and climbed to the trendline at 42 cents. Daily RSI is falling under the 50-band. Pullback support levels are at 34 cents, 29 cents, 24 cents and 18 cents.