The world’s largest freelance marketplace platform Upwork. Inc. (NASDAQ: UPWK) shares can’t seem to catch a break as they trade down (-52.6%) on the year. Despite strong industry tailwinds projecting nearly 500 million worldwide freelancers by 2030, the sentiment on the stock continues to be negative. The pandemic-triggered lockdowns were a boon to the Company as remote work became a mainstream phenomenon that has been sticky even through the reopening. Inflation and macroeconomic uncertainty is having an impact on growth in Europe. Enterprise Clients are the growth driver. The Company added 36 new enterprise clients including ServiceNow (NYSE: NOW), Asurion, Newsweek, Fanatics, and Pearson. Enterprise revenue is growing at a 45% clip with $1 million clients growing significantly. The pandemic has spawned a new normal for the workplace, which is now elastic and commonly includes remote work. The apathetic reaction in the stock price might be more of an industry sentiment struggle as competitor Fiverr International (NYSE: FVRR) shares are down (-70%) on the year. However, this could be a buying opportunity for investors who believe in the continued adoption and growth of freelancers and remote work moving forward as the tailwind gains more momentum.

The world’s largest freelance marketplace platform Upwork. Inc. (NASDAQ: UPWK) shares can’t seem to catch a break as they trade down (-52.6%) on the year. Despite strong industry tailwinds projecting nearly 500 million worldwide freelancers by 2030, the sentiment on the stock continues to be negative. The pandemic-triggered lockdowns were a boon to the Company as remote work became a mainstream phenomenon that has been sticky even through the reopening. Inflation and macroeconomic uncertainty is having an impact on growth in Europe. Enterprise Clients are the growth driver. The Company added 36 new enterprise clients including ServiceNow (NYSE: NOW), Asurion, Newsweek, Fanatics, and Pearson. Enterprise revenue is growing at a 45% clip with $1 million clients growing significantly. The pandemic has spawned a new normal for the workplace, which is now elastic and commonly includes remote work. The apathetic reaction in the stock price might be more of an industry sentiment struggle as competitor Fiverr International (NYSE: FVRR) shares are down (-70%) on the year. However, this could be a buying opportunity for investors who believe in the continued adoption and growth of freelancers and remote work moving forward as the tailwind gains more momentum.Upwork Recently Added Features

The Company added new features like Consultations to help with the onboarding of new clients by enabling paid booking sessions for expert advice from talent before engaging larger projects. Client using this new feature are averaging 1.5 days for a time-to-hire, which is half the time compared to using the Talent Marketplace. Nearly 50% of Consultation clients return for another job within 30 days, also a 50% higher rate than the Talent Marketplace. The Company will extend Consolations across all 90-plus categories in the following quarter. Virtual Talent Bench (VTB) enables clients to share their roster of talent with both registered and unregistered users. Pricing changes were made to enable Clients to access premium talent, talent searches and reporting tools from the start with visibility into Top Rate, Rising Talent, and Top Rated Plus talent pools.

Upwork Improving Fundamentals

On July 27, 2022, Upwork released Q2 2022 results for the quarter ending June 2022. The Company reported a non-GAPP loss of (-$0.04) per share versus consensus analyst estimates for a loss of (-$0.08) per share, a $0.04 beat. Revenues rose 26.3% year-over-year (YoY) to $156.9 million beating consensus analyst estimates for $147.78 million.

Upwork Mixed Guidance

Upwork issued mixed guidance for Q3 2022 for EPS to come in between (-$0.15) to (-$0.17) versus (-$0.16) consensus analyst estimates on revenues between $156 million to $158 million versus $150.84 million.

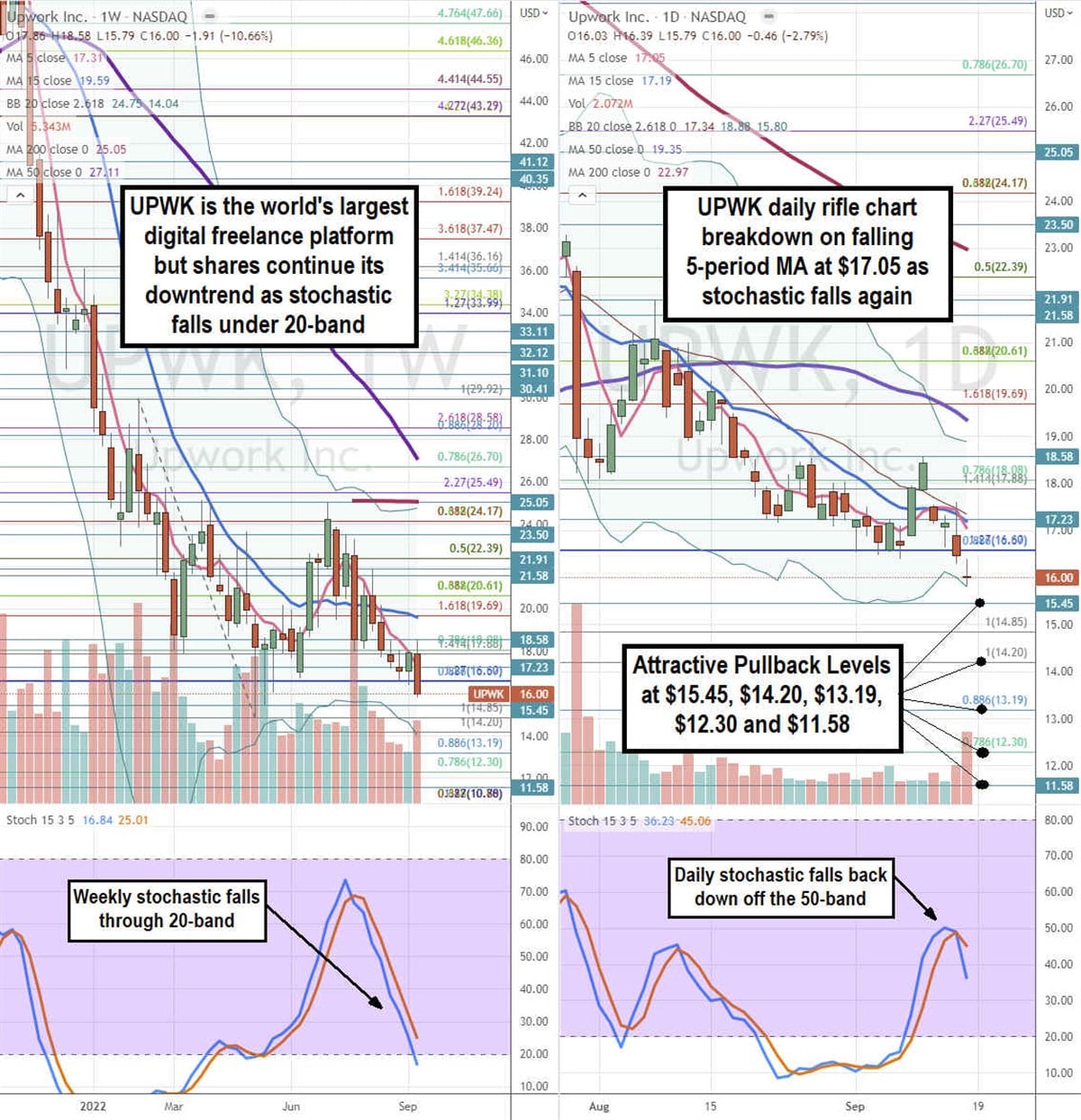

Upwork Attractive Price Levels

Using the rifle charts on weekly and daily time frames provides a precision view of the price action for UPWK stock. The weekly rifle chart broke down again on the breakdown of the $19.69 Fibonacci (fib) level. The weekly downtrend has a falling 5-period moving average (MA) resistance at $17.31 followed by the 15-period MA at the $19.69 fib level. The weekly lower Bollinger Bands (BBs) sit at $14.04. The weekly stochastic has made a full oscillation collapsing through the oversold 20-band. The daily rifle chart broke down as well on an inverse pup breakdown as the 5-period MA resistance slopes back down at $17.05 followed closely behind by the 15-period MA resistance at $17.19. The daily stochastic triggered the inverse pup breakdown on the crossover down off the 50-band. The daily lower BBs are falling at $15.80. Attractive pullback levels sit at the $15.45 fib, $14.20 fib, $13.19 fib, $12.30 fib, and the $11.58 level.

The Appeal and Problem with Using Upwork

Upwork clients have actually moved their non-Upwork contractors to the platform to take advantage of the global payroll and work protection products which ensure compliance in 160 countries. The Upwork platform accommodates the needs for unified billing with enhanced visibility, reporting, and worker classification peace of mind. Upwork takes a lofty 20% fee for jobs to new talent. That fee eventually drops after certain income milestones are achieved. For the client, the hiring process for talent on a per project or hourly basis is simple. The client pays Upwork upfront which gets stored in an escrow account until the job is completed and then Upwork pays the talent. Upwork handles the currency adjustments and ensures payout to the talent if they meet the expectations. For international business, either for the client or the talent, this can be a very valuable resource that justifies the lofty 20% commission. However, it may be a turn off for workers who believe the commissions are just too high and seek to negotiate an off-platform agreement. This is ultimately the catch-22 that Upwork or any freelancer platform has yet to solve. Take less fees to ensure talent retention or raise prices but risk losing clients.