-Drilling set to resume at Company’s centerpiece exploration project-

-Campaign to target high-value resource growth opportunities-

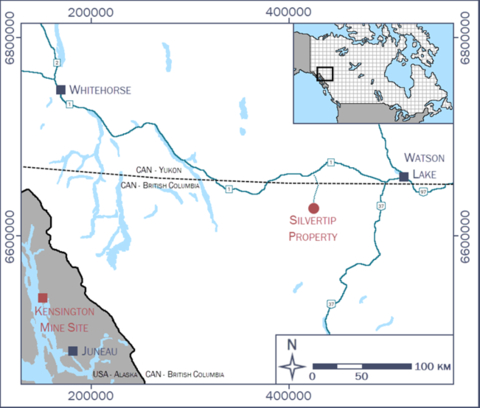

Coeur Mining, Inc. (“Coeur” or the “Company”) (NYSE: CDE) today provided plans for a sustained 24-month exploration program beginning July 1, 2023 at its expanding high-grade Silvertip polymetallic exploration project in northern British Columbia. The program is designed to (i) enable better understanding of the overall mineralizing system, (ii) discover all mineralization styles (i.e., skarn and/or porphyry) on the property, (iii) expand the resource base, and (iv) assess the potential footprint and upside of the larger land package, 95% of which remains to be explored.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230621310812/en/

Figure 1: Location of Silvertip Project (Graphic: Business Wire)

Key Highlights

- Grades continue to be among the world’s highest compared to similar carbonate replacement deposits

- Recent deep drilling has indicated proximity to an intrusive heat source, opening up potential for skarn and porphyry styles of mineralization in addition to carbonate replacement style mineralization

- Limestone-rich stratigraphy at district scale over 2,500 vertical meters in thickness presents significant potential for stacked carbonate replacement style deposits (“CRD”)

- Multiple look-alike targets identified within large 37,650 hectares land package

- Exploration priorities during the 24-month program include (i) working to expand the resource base by drilling known extensions to mineralization directly north and south of Silvertip, (ii) testing additional horizons to ascertain the full vertical extent of mineralization through the stratigraphic column, (iii) further exploring the immediately adjacent heat source to test for skarn and/or porphyry styles of mineralization, and (iv) test high-priority regional look-alike targets

“The Silvertip team has made impressive progress on advancing the geologic understanding of this emerging world-class ore body, and the commencement of this focused drilling campaign over the next 18 months positions us to pursue our primary goal of growing overall resource tonnage,” said Mitchell J. Krebs, Coeur President and Chief Executive Officer. “Silvertip is one of the highest-grade undeveloped carbonate replacement deposits in the world, hosting large and growing resources of silver, zinc and lead—three minerals already playing key roles in the accelerating transition to a net-zero emissions global economy. Located in British Columbia, recent drilling at Silvertip has also identified a suite of other key critical minerals that may further support the growing strategic value of this deposit for Canada and for Coeur as a key driver of future growth.”

Since acquisition in late 2017, the Company’s exploration investment has nearly tripled the measured and indicated resource base, including a year-over-year increase of silver, zinc and lead of approximately 128%1, 132%1 and 131%1, respectively. Historically, mineralization at Silvertip was hosted in a single sub-horizontal manto horizon located at the top of the McDame Limestone package in contact with the Earn sediments above (see Figure 3 below). Since late 2017, Coeur has discovered several new, stacked manto horizons hosted at different elevations throughout the McDame Limestone. In addition, numerous sub-vertical mineralized chimneys have also been discovered with Southern Silver Zone being the largest to date. This zone accounts for approximately 50% of the current inferred resource and 9% of the current measured and indicated resources. Multiple other chimney targets have been identified and are ready for drill-testing during this new program.

In addition to mineralization in the McDame Limestone unit, favorable indications for mineralization have also been identified lower in the stratigraphic sequence, in the underlying dolostone, sandstone and Atan Group limestones (see Figure 3 below). This opens up over 2,500 vertical meters of stratigraphy that is prospective for stacked, carbonate replacement deposits. Testing this large vertical extent of stratigraphy is a key focus of the upcoming drill program.

Another key aim will be to continue building the resource base immediately adjacent to Silvertip located near existing underground development. This will be undertaken mainly over the two kilometer corridor immediately south of the main Silvertip deposit. During 2020 – 2022, 15 of 16 scout holes from Saddle Zone south to Tour Ridge intersected mineralization. This program also outlined mineralization one kilometer north through the Keda zone, thereby doubling the known mineralized strike length to more than four kilometers (see Figure 4).

Alongside the known silver, lead, zinc carbonate replacement style mineralization, the Silvertip District is prospective for porphyry and / or skarn mineralization. A recently completed deep drillhole tested a circular, geophysical anomaly located to the southeast of Silvertip. This anomaly is interpreted to be a potential heat and fluid source for the Silvertip deposit. Geology intersected in this drilling includes higher temperature mineralogical assemblages and increased quantities of alteration and veining that are indicative of an intrusive porphyry or skarn source at depth. The hole therefore provided proof of concept and additional exploration drilling is being designed to further test this target during the next 18-24 months.

Multiple other, similar circular geophysical anomalies are seen on the Silvertip land package. These are associated with similar structural features and/or geochemical signatures and are therefore look-alike targets to Silvertip.

“We believe the resource base currently outlined at Silvertip represents a distal portion of a large mineralizing system and the detailed geological analysis and modelling completed during the first half of 2023 supports that thinking,” said Aoife McGrath Senior, Coeur Vice President of Exploration. “The understanding gained through this process is allowing us to target exploration more concisely and continue to work to build value at this world class project.”

This news release is neither an offer to sell nor a solicitation of an offer to buy any securities and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale is unlawful.

About Coeur

Coeur Mining, Inc. is a U.S.-based, well-diversified, growing precious metals producer with four wholly-owned operations: the Palmarejo gold-silver complex in Mexico, the Rochester silver-gold mine in Nevada, the Kensington gold mine in Alaska and the Wharf gold mine in South Dakota. In addition, the Company wholly-owns the Silvertip silver-zinc-lead exploration project in British Columbia.

Cautionary Statements

This news release contains forward-looking statements within the meaning of securities legislation in the United States and Canada, including statements regarding the Company’s Silvertip exploration project. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Coeur’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risk that exploration efforts will not occur on a timely basis or at all, the risks and hazards inherent in the mining business (including risks inherent in exploration and development activities, environmental hazards, industrial accidents, weather or geologically-related conditions), changes in the market prices of gold, silver, zinc and lead and a sustained lower price or higher treatment and refining charge environment, the uncertainties inherent in Coeur’s production, exploratory and developmental activities, including risks relating to permitting and regulatory delays, changes in mining laws, ground conditions and, grade and recovery variability, any future labor disputes or work stoppages (involving the Company and its subsidiaries or third parties), the uncertainties inherent in the estimation of mineral reserves, changes that could result from Coeur’s future acquisition of new mining properties or businesses, the loss of access or insolvency of any third-party refiner or smelter to which Coeur markets its production, the potential effects of the COVID-19 pandemic, including impacts to the availability of our workforce, continued access to financing sources, government orders that may require temporary suspension of operations at one or more of our sites and effects on our suppliers or the refiners and smelters to whom the Company markets its production and on the communities where we operate, the effects of environmental and other governmental regulations and government shut-downs, the risks inherent in the ownership or operation of or investment in mining properties or businesses in foreign countries, Coeur’s ability to raise additional financing necessary to conduct its business, make payments or refinance its debt, as well as other uncertainties and risk factors set out in filings made from time to time with the United States Securities and Exchange Commission, and the Canadian securities regulators, including, without limitation, Coeur’s most recent reports on Form 10-K and Form 10-Q. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. Coeur disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, Coeur undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Coeur, its financial or operating results or its securities.

Notes

- In 2022, the Company reclassified Silvertip‘s reserves to measured and indicated resources. Excluding the reclassification, silver, zinc and lead measured and indicated resources increased 73%, 69% and 81%, respectively, year-over-year.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230621310812/en/

Contacts

Coeur Mining, Inc.

200 S. Wacker Drive, Suite 2100

Chicago, Illinois 60606

Attention: Jeff Wilhoit, Director, Investor Relations

Phone: (312) 489-5800

www.coeur.com