Valued at a market cap of $16.5 billion, CDW Corporation (CDW) is a leading North American IT solutions provider that helps organizations design, procure, implement, and manage technology infrastructure. Headquartered in Vernon Hills, Illinois, the company serves enterprise, small-business, and public-sector customers (government, education, healthcare) across the U.S., U.K., and Canada.

Shares of the tech company have lagged behind the broader market over the past 52 weeks. CDW stock has slumped 33.9% over this time frame, while the broader S&P 500 Index ($SPX) has risen 11.9%. Moreover, shares of CDW have dropped 8.1% on a YTD basis, compared to SPX's marginal fall.

Looking more closely, CDW stock has underperformed the State Street Technology Select Sector SPDR Fund's (XLK) 16.3% increase over the past 52 weeks and a 3.1% drop on a YTD basis.

On Feb. 4, CDW shares surged 9.5% after the company reported stronger-than-expected Q4 2025 results that underscored resilient enterprise IT spending. Its revenue rose 6% year over year to $5.5 billion, while non-GAAP EPS of $2.57 topped consensus forecasts, supported by robust demand for cloud, software, and services solutions across corporate and public-sector customers. Gross profit grew faster than sales, with margin expanding to 22.8% as the mix continued shifting toward higher-value offerings. Although operating margins were slightly pressured by higher SG&A investment, the overall earnings beat and healthy solution-led growth trajectory drove a sharp positive market reaction.

For the fiscal year ending in December 2026, analysts expect CDW's EPS to rise 4.3% year-over-year to $9.94. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

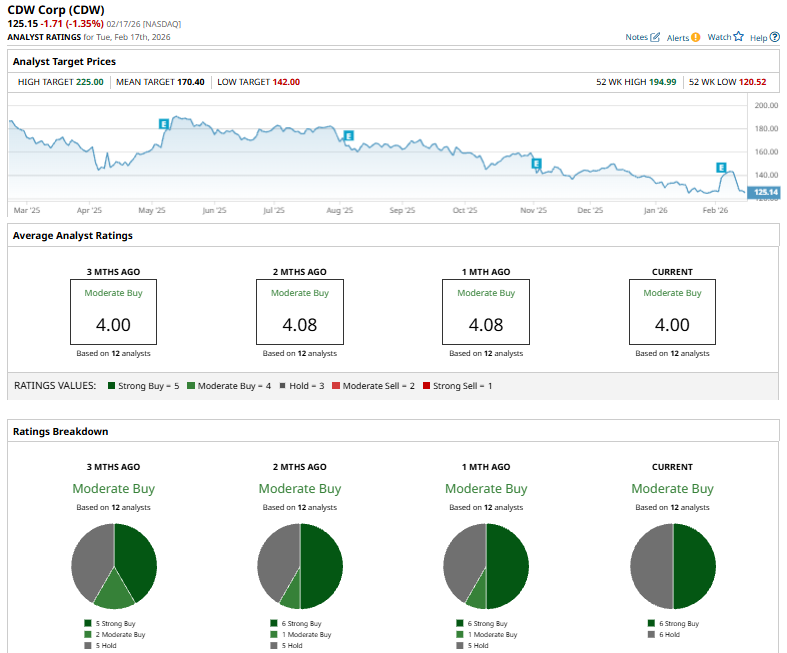

Among the 12 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on six “Strong Buy” and six “Holds.”

The current consensus is bullish than three months ago when the stock had five “Strong Buy” suggestions.

On Feb. 5, Citigroup analyst Asiya Merchant maintained a “Neutral” rating on CDW and modestly raised the price target to $150 from $148.

The mean price target of $170.40 represents a 30.2% premium to CDW’s current price levels. The Street-high price target of $225 suggests a 60.9% potential upside.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Goldman Sachs Is Pounding the Table on This 1 Rare Earths Stock: New Price Target Implies 50% Upside

- 3 Option Ideas to Consider this Wednesday for Income and Growth

- Stock Index Futures Climb as AI Jitters Ease, FOMC Minutes and U.S. Economic Data in Focus

- Earn While You Sleep: 3 High-Yield Dividend Stocks to Buy and Hold Forever