Beta Technologies (BETA) shares have rallied more than 20% this week after Amazon (AMZN) announced a sizable 5.3% stake in the electric aviation company.

AMZN investment signals confidence in BETA’s tech and market potential, potentially improving its access to capital and boosting its credibility with customers.

Despite this surge, BETA stock remains down more than 30% versus its year-to-date high.

Does Amazon News Warrant Buying BETA Stock?

AMZN stake could prove transformative for BETA stock as it provides both institutional validation and a clear path to commercial scalability.

For the NYSE-listed firm, this deal means much more than capital only; it secures a high-profile anchor customer with a vast delivery network BETA can use as a primary deployment ground for its eVTOL aircraft.

Amazon’s investment mitigates the high risks inherent in the aerospace sector, reinforcing that BETA’s technology (scheduled for certification in 2026) is viable for large-scale industrial use.

All in all, lowering the cost of capital and bridging the gap toward long-term profitability, it makes BETA Technologies a promising pick for risk-tolerant investors.

Jefferies Sees Significant Upside in BETA Shares

BETA shares are worth owning also because the company has transitioned from speculative startup to a critical hardware supplier with tangible revenue streams, Jefferies analysts wrote in their recent report.

The cornerstone of their bullish stance is a $1 billion contract Beta Technologies signed with Eve Air Mobility in December.

By securing high-margin hardware deals alongside its aircraft development, the eVTOL specialist has diversified its risk profile, they told clients.

Jefferies sees BETA as oversold, given the upcoming FAA/DOT pilot program awards in March, and expects it to hit $30 this year, which signals potential upside of roughly 50% from here.

Note that the company’s relative strength index (14-day) also sits at about 36 currently.

What’s the Consensus Rating on Beta Technologies?

Other Wall Street analysts are even more bullish on Beta Technologies following Amazon’s recent announcement.

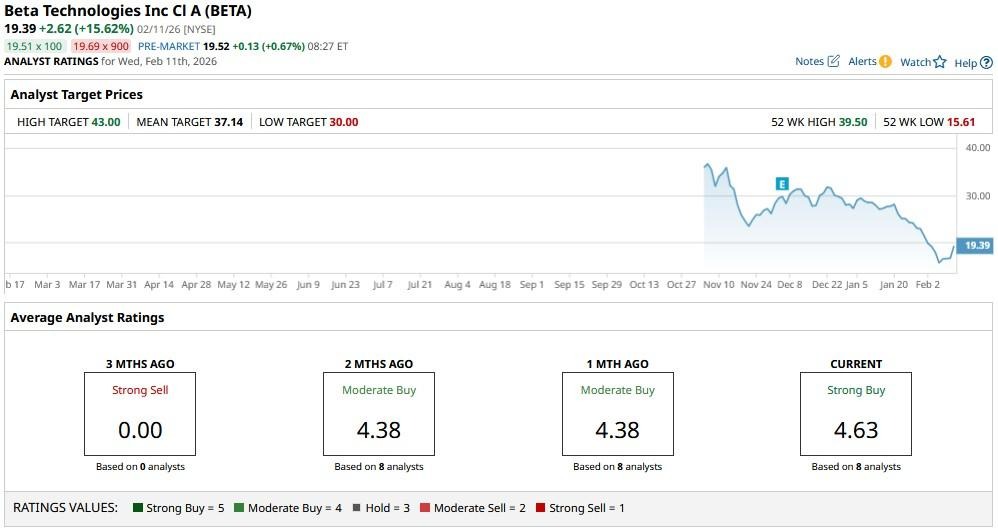

According to Barchart, the consensus rating on BETA stock remains at a “Strong Buy,” with the mean target of an even higher $37 indicating potential upside of a whopping 100% from current levels.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart