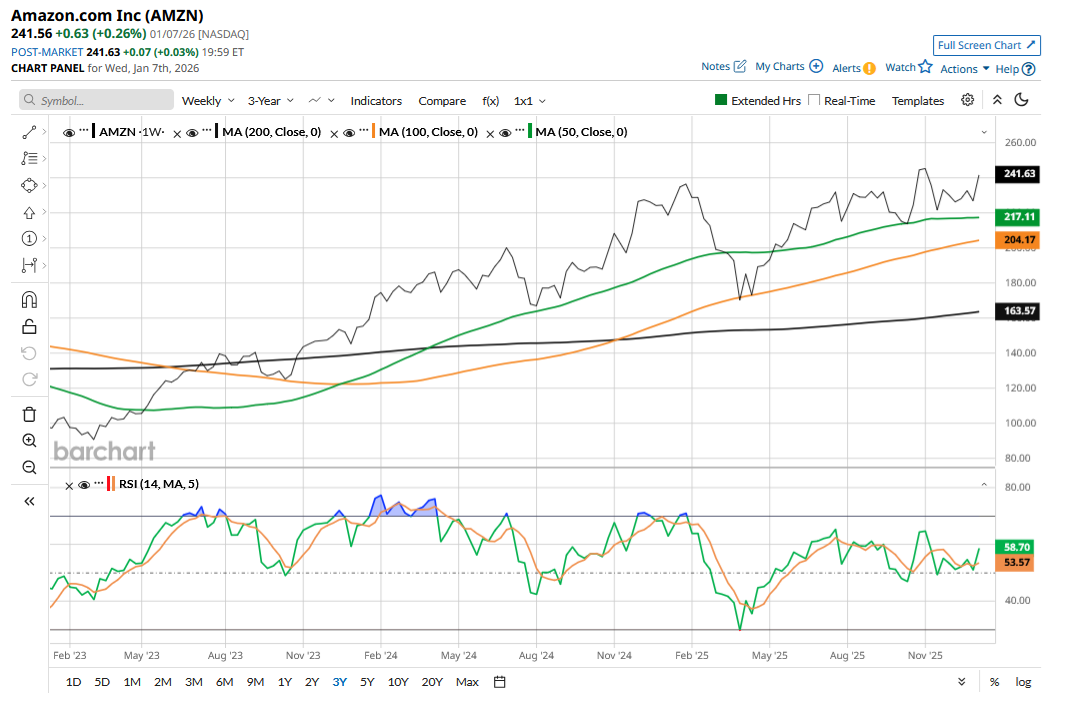

Amazon (AMZN) stock, which gained a mere 5% last year and was the worst-performing “Magnificent 7” stock, has had a strong start to 2026, already up over 5% for the year. In a reversal of fortunes of sorts, it is the best-performing Mag 7 so far. While it's too early to extrapolate whether AMZN can continue its good run, it looks like a name to hold this year, as we’ll explore in this article.

To begin with, let’s examine the various factors behind Amazon’s underperformance last year. Firstly, there is growing concern over Amazon's burgeoning capex towards artificial intelligence (AI). This is taking a toll on the company’s free cash flows for now and would be an overhang on earnings in the coming years in the form of higher depreciation.

There is also rising competition in both e-commerce and cloud businesses. While legacy brick-and-mortar chains like Walmart (WMT) have upped their game in e-commerce, Microsoft (MSFT) and Alphabet (GOOG) (GOOGL) have eaten into Amazon’s market share in the cloud market.

Then there are concerns over third-party AI agents being a headwind for Amazon’s high-margin digital advertisement business. Amazon went after Perplexity and sent it a “cease and desist” letter for a reason, as shopping agents of the kind that the AI upstart offers are a threat to the ad revenues that Amazon garners from merchants on its platform.

Meanwhile, Amazon is now accused of the same behavior that it accused Perplexity of, and many merchants are up in arms over its platform listing their products without consent. The moral discussion about Amazon’s approaches to AI shopping assistants, besides, AI is both an opportunity and a threat for the company.

Why Amazon Looks Like a Good Buy for 2026?

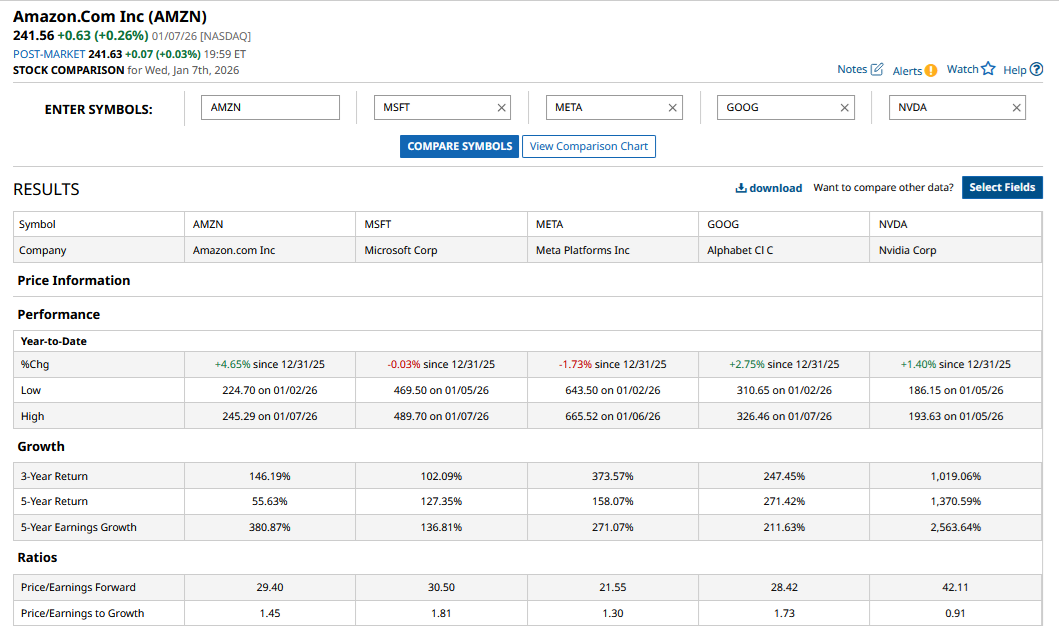

I, however, believe Amazon is among the best Mag 7 stocks to hold at these levels and has quite an attractive risk-reward. The stock trades at a forward price-to-earnings (P/E) multiple of 29.4x, while the P/E-to-growth (PEG) multiple is 1.45x. If we leave aside Tesla (TSLA), which is the most expensive Mag 7 stock based on traditional earnings-based metrics, Amazon’s valuations are not very different from the mean valuations of other constituents.

Amazon’s valuations are, however, much cheaper than they were a couple of years back, and not without reason. The company’s e-commerce business is nearing maturity in developed markets. There is also a denominator side of the equation, as Amazon’s aggressive cost cuts have helped it improve margins and, by extension, earnings. A sharp rise in profits over the previous few years has pulled down AMZN’s P/E multiples.

That said, Amazon looks like a much better structural growth story than some of its Mag 7 peers. The company’s business is quite diversified, and while cloud accounts for the lion’s share of its operating profits, it is a play on several other themes, including streaming. The company has still just about scratched the surface in initiatives like grocery, pharmacy, and business-to-business (B2B), as well as the recently added low-cost platform Haul, which would help it take on the likes of Temu and Shein.

To sum it up, while Amazon is no longer the kind of growth engine it was a few years back, the valuations also look commensurate with the current realities. However, at a forward P/E of under 30x, I find Amazon a no-brainer for someone looking to hold the shares for a couple of years. Despite all the headwinds, Amazon should be able to grow its topline by double digits for the near foreseeable future, with earnings growth outstripping that number.

AI could be a new growth driver for Amazon and turbocharge its cloud business. AI incidentally has the potential to not only propel revenues of Amazon’s cloud and e-commerce business but also help it lower costs and increase margins.

For now, AI has been a drain on Amazon’s cash flows and earnings, but it should become a net positive over the next couple of years. At current levels, markets don’t seem to be giving Amazon much of a premium for the expected AI-led growth.

AMZN Stock Forecast

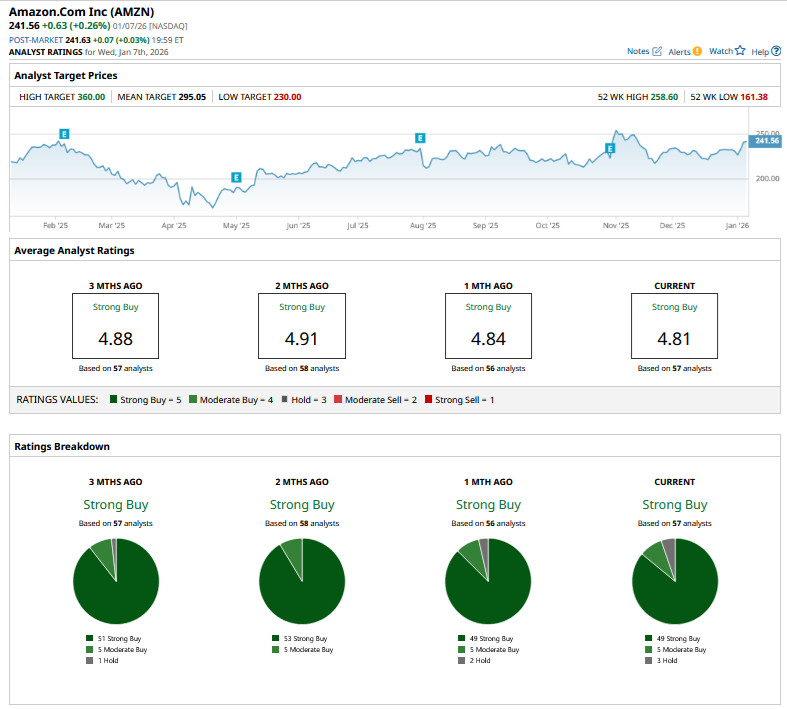

Sell-side analysts are also upbeat on AMZN stock, and its mean target price of $295.05 is 22% higher than current levels, while the Street-high target price of $360 is almost 50% higher. While analysts’ optimism should be read with a grain of salt, as AMZN was the “top pick” for many brokerages last year, I believe the stock is a good buy after last year’s underperformance.

On the date of publication, Mohit Oberoi had a position in: AMZN , TSLA , GOOG , MSFT . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Follow the Smart Money: 2 Undervalued Stocks With Aggressive Share Buybacks and Unusual Options Activity

- Warren Buffett Loved American Express Stock. With the Oracle of Omaha Now in Retirement, How Should You Play AXP in 2026?

- The 3 Best Warren Buffett Stocks to Buy for 2026

- These Are the 3 Best Data Center Stocks to Buy for 2026