Oracle Corporation (ORCL), once known mainly for its dominance in enterprise databases, has reshaped itself for the cloud era, and then artificial intelligence (AI) poured fuel on that transition. As demand for AI compute surged, Oracle’s cloud infrastructure became a key piece of the ecosystem, drawing renewed investor attention.

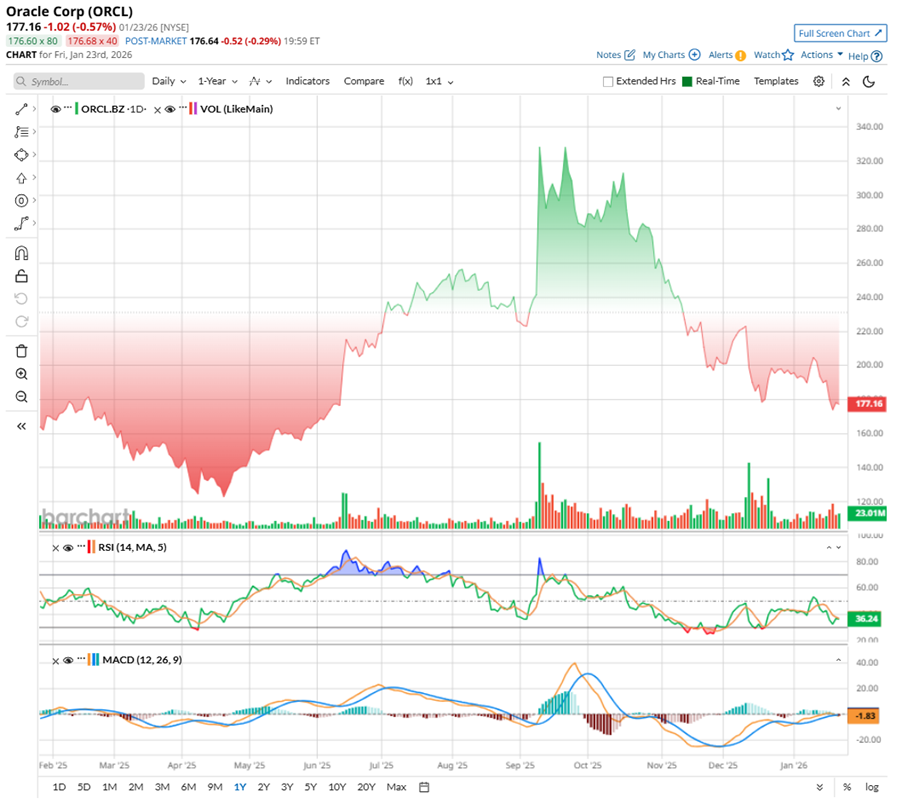

Oracle’s shares climbed relentlessly through the first nine months of 2025, topping by mid-September as optimism around AI-driven growth took hold. But after that powerful run, the tone shifted. ORCL stock has given back a meaningful portion of those gains, signaling that the market is beginning to reassess how much growth is already priced in, and what it might cost to sustain it.

That’s exactly where Morgan Stanley (MS) is planting its flag. Oracle’s backlog looks undeniably enormous, offering rare long-term visibility that few companies can match. But that visibility comes with heavy investment requirements.

Morgan Stanley’s Keith Weiss argues that the scale of infrastructure expansion required to support these long-term contracts will weigh on the company’s bottom line and drive capital expenditures well above expectations. As a result, the bank’s analyst sees limited upside from current levels, rising balance-sheet risk, and a tougher path to management’s long-term EPS targets – prompting a 33% cut to its price target.

Let’s dive in deeper on ORCL stock.

About Oracle Stock

Founded in 1977 and headquartered in Austin, Texas, Oracle is a global leader in enterprise information technology, with a market capitalization of approximately $509 billion. The company is best known for its Oracle Database and autonomous systems, which serve as critical infrastructure for businesses worldwide. Oracle offers a broad portfolio of cloud-based applications, including ERP, HCM, and NetSuite, supporting organizations across industries.

With expanding capabilities in cloud infrastructure, hardware, and consulting services, Oracle plays a central role in modern enterprise computing. The company continues to focus on scalable, secure solutions that support data-driven operations and long-term digital transformation.

Riding a powerful mix of cloud infrastructure momentum and AI enthusiasm, ORCL stock went on a blistering rally that had investors fully locked in. After delivering strong earnings last year, the stock rose – most notably in September, when shares jumped nearly 36% in a single session following a blockbuster Q1 report. That surge pushed Oracle to a high of $345.72 on Sept. 10, cementing its status as a top AI infrastructure beneficiary.

Since October, though, the mood has shifted. The stock steadily rolled over as concerns around spending and balance-sheet risk moved front and center. From its peak, ORCL has slid roughly 47.2%, nearly cutting the rally in half. Over the past 52 weeks, shares declined 0.63%, while the last three months alone have delivered a sharp 35.6% drop. Investors are clearly reassessing the amount they’re willing to pay for growth that comes with heavy capital demands.

Those concerns are not abstract. Oracle raised $18 billion in debt to fund new data center construction, pushing total debt north of $100 billion. The company has also committed to the Stargate project alongside OpenAI and SoftBank (SFTBY), a massive $500 billion effort to build AI infrastructure across the U.S. The question now is whether returns can keep pace with the scale of investment.

Technically, Oracle’s momentum remains cautious but is showing early signs of stabilization. The 14-day RSI stands near 41.5, indicating the stock is no longer oversold and is gradually recovering from December’s lows, though it remains well below September’s overbought levels. The RSI’s upward slope suggests improving momentum.

Meanwhile, the MACD oscillator continues to reflect bearish momentum. The MACD line remains below the signal line and in negative territory, while the histogram has slipped slightly below zero, indicating that downside pressure is still present, though selling momentum appears to be moderating.

Oracle’s valuation is mixed. Priced at about 24.1 times forward non-GAAP earnings, the stock is not cheap compared to its historical average, even if it looks slightly more reasonable against today’s sector average. Investors are clearly paying up for visibility and scale. That optimism shows up even more clearly in Oracle’s price-to-sales forward ratio of roughly 7.6x, a level well above traditional enterprise software peers and its own long-term median. The multiple reflects expectations that cloud and AI-driven revenues will grow far faster than the legacy software business ever did.

Meanwhile, leverage adds another layer to the equation. With a debt-to-equity ratio above three and interest coverage just under five, Oracle’s balance sheet leaves less cushion if growth stumbles.

Meanwhile, Oracle still knows how to reward patience. It has been paying dividends for 16 years and raising them for 11 consecutive years. The latest $0.50 quarterly payout translates to $2 per share dividend annually, delivering a modest 1.13% forward yield.

Oracle’s Q2 Earnings Beat Estimates

On Dec. 10, Oracle released its fiscal second-quarter 2026 numbers, which showed just how far the company has come in reshaping its business and how expensive that transformation is becoming. The company generated total revenue of $16.1 billion, up 14% year-over-year (YOY). The cloud business continued to do the heavy lifting, with revenue jumping 34% annually to $8 billion. Infrastructure demand was particularly strong, with cloud infrastructure revenue surging 68%, more than offsetting a 3% decline in legacy software sales.

Meanwhile, non-GAAP EPS rose 54% YOY to $2.26 and was comfortably ahead of expectations. Oracle’s backlog ballooned as well, with remaining performance obligations (RPO) climbing to $523 billion, up an eye-catching 438% YOY, giving the company a long runway of contracted revenue.

Still, not everything landed perfectly. The top line fell slightly short of consensus estimates, and the market zeroed in on that detail. The day after the release, Oracle shares slid nearly 11%, signaling investor unease around near-term margins and the pace at which all that backlog can be translated into earnings.

But digging a little deeper, that reaction starts to make sense. Oracle is in the middle of a big infrastructure push, pouring capital into new data centers to support its expanding cloud footprint. In Q2, CapEx jumped to roughly $12 billion. That spending came with a cost. Its free cash flow swung to a negative $10 billion for the quarter, a stark shift that underscored how capital-intensive Oracle’s strategy has become.

Management did not downplay the scale of what’s coming next. The company now expects CapEx to reach about $50 billion in fiscal 2026, a $15 billion increase from its previous outlook. Unlike some of its larger peers, Oracle is leaning heavily on borrowing to fund this expansion. Including operating lease liabilities, total debt climbed by double digits and that growing leverage has not gone unnoticed. Credit default swap prices on Oracle’s debt spiked to levels last seen during the 2008 financial crisis, highlighting rising concern around balance-sheet risk.

Plus, management estimates cloud revenue jumping 37% to 41% in Q3, lifting total revenue growth between 16% and 18%, with non-GAAP EPS up between 12% and 14%. They are even penciling in an extra $4 billion of revenue in fiscal 2027.

Analysts tracking Oracle expect the tech stock’s fiscal 2026 EPS to grow 35.7% YOY to $5.97, followed by a 6% annual surge to $6.33 in fiscal 2027.

What Do Analysts Expect for Oracle Stock?

Morgan Stanley slashed Oracle’s price target to $213 from $320 – a sharp 33% trim – while sticking with an “Equal-weight” rating. The target cut was not about dismissing Oracle’s scale or ambition, but was about questioning the math.

Analysts led by Keith Weiss cautioned that the company’s rapid infrastructure expansion could be a heavier drag on EPS and push capital spending well beyond what the market is currently discounting. From an equity perspective, the analyst sees limited room for upside, arguing the stock already reflects much of the good news.

The concern deepens while looking at funding. Analyst Weiss expects Oracle’s cash capital expenditures to be roughly $275 billion between fiscal 2026 and 2028, far above consensus. That level of investment could drive adjusted debt, including leases, past $400 billion and lift leverage above 5x, increasing balance-sheet and ratings risk. Consequently, the bank cut its fiscal 2028 EPS forecast to $8.51 versus Oracle’s $10.65 target, and slashed its 2030 estimate to $10.02, less than half of management’s $21 goal.

To be fair, Oracle’s backlog is massive, with $426 billion in contracted commitments and $523 billion in RPO, which offers solid visibility. But much of it – roughly 60% – is tied to large infrastructure contracts, particularly with OpenAI, which adds concentration risk alongside the opportunity.

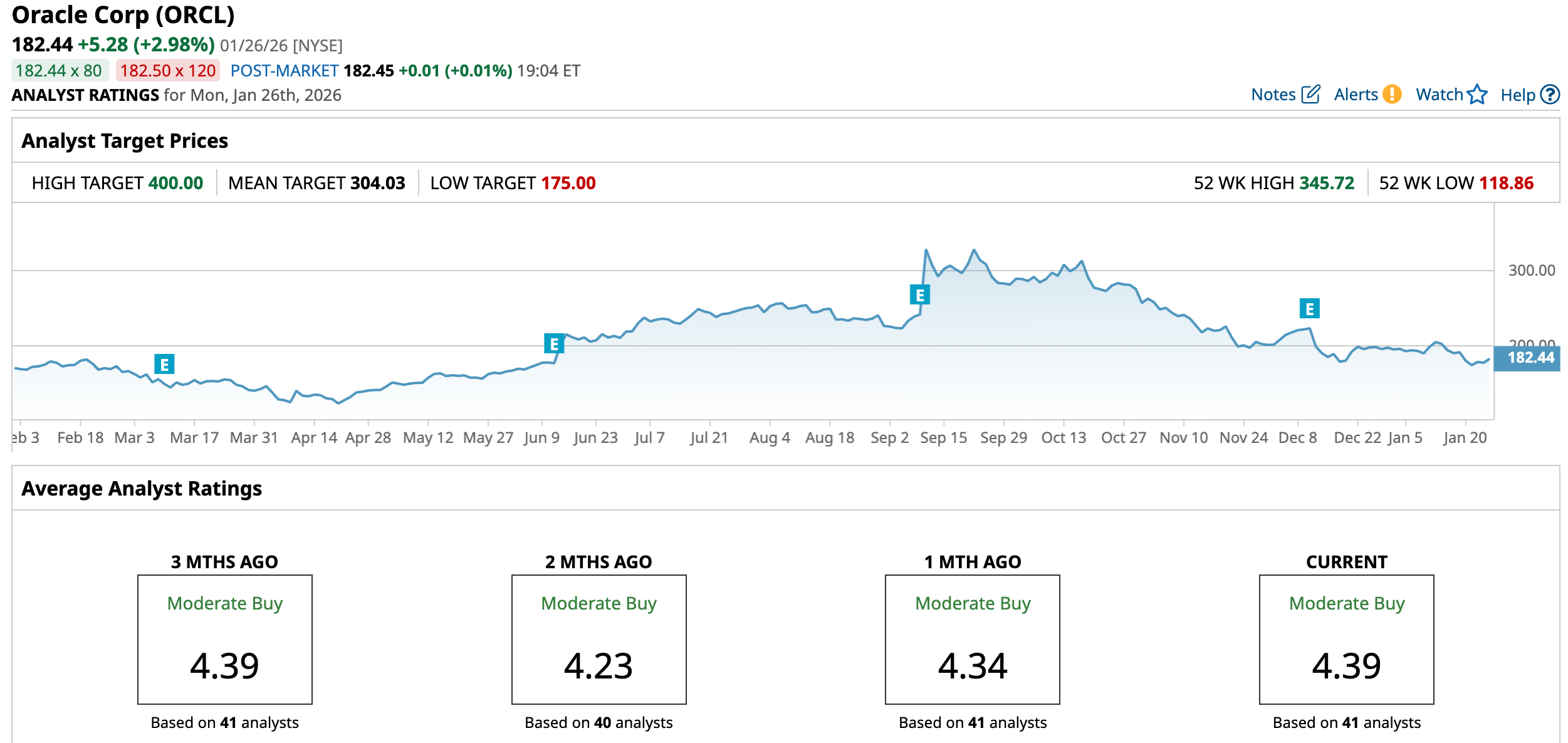

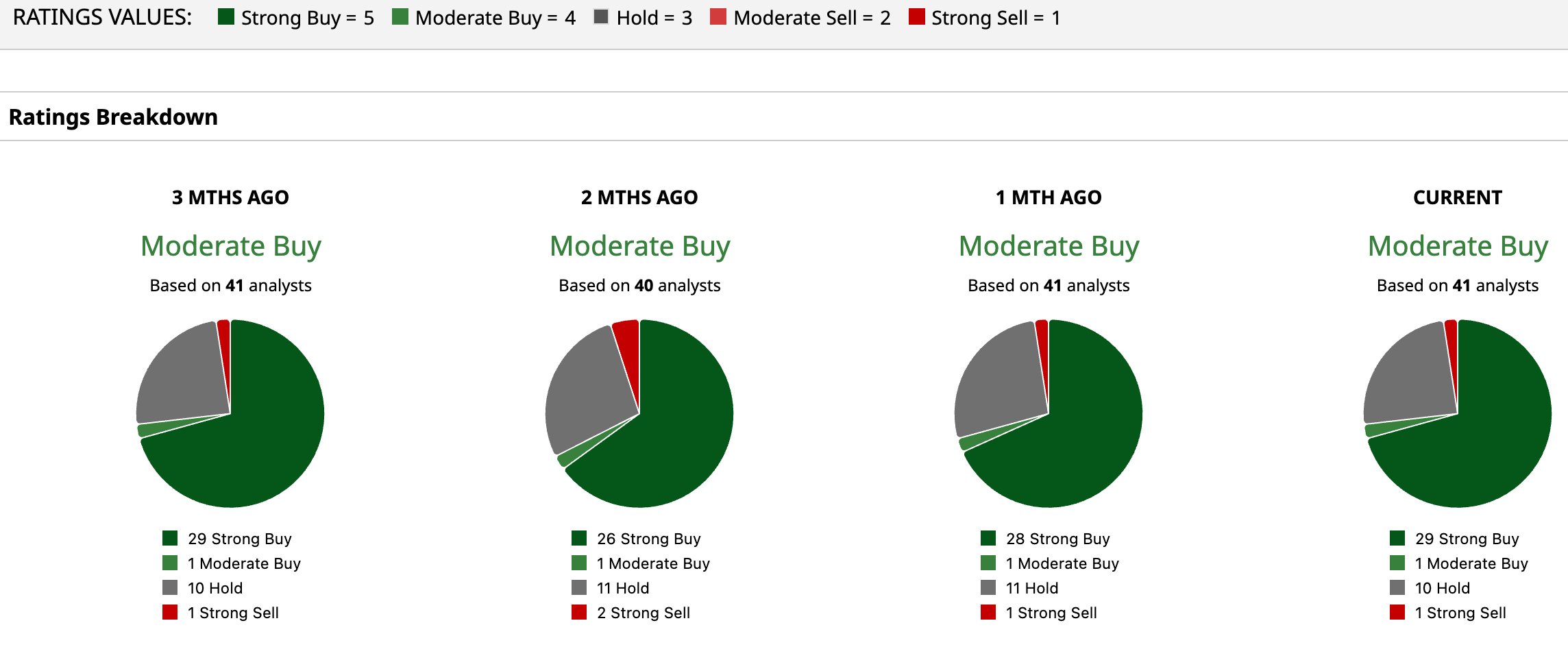

Overall, analysts have a positive outlook on ORCL, giving a consensus “Moderate Buy” rating. Of the 41 analysts rating the stock, a majority of 29 analysts rate it a “Strong Buy,” one suggests a “Moderate Buy,” 10 analysts are playing it safe with a “Hold” rating, and the remaining one is outright skeptical, having a “Strong Sell” rating.

The tech stock’s consensus price target of $304.03 implies 66.6% upside potential. Meanwhile, the Street-high target of $400 suggests the stock could rally as much as 119%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Tesla Q4 2025 Earnings Preview: Should You Buy or Dump TSLA Stock?

- They’re ‘an Expensive Distraction for Many Investors’: Berkshire’s Warren Buffett Says ‘Ignore Political and Economic Forecasts’ When Investing

- Analysts Expect Applied Materials Stock to Dominate in 2026. Should You Buy Shares Now?

- Why the Charts Say It’s Still Too Soon to Buy This Beaten-Down Mega-Cap Stock