Seattle, Washington-based Starbucks Corporation (SBUX) is a roaster, marketer, and retailer of coffee. Valued at a market cap of $109.5 billion, the company specializes in premium coffee, handcrafted beverages, and a range of food offerings, operating thousands of company-owned and licensed stores across international markets.

This coffee company has lagged behind the broader market over the past 52 weeks. Shares of SBUX have declined 2.5% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.9%. However, on a YTD basis, the stock is up 14.4%, considerably outperforming SPX’s 1.5% return.

Narrowing the focus, SBUX has also underperformed the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 6.4% uptick over the past 52 weeks. Nonetheless, it has outpaced XLY’s 2.4% YTD rise.

On Oct. 29, SBUX delivered mixed Q4 results, and its shares plunged 1.2% in the following trading session. The company’s revenue increased 5.5% year-over-year to $9.6 billion, beating consensus expectations by 2.6%. However, due to restructuring costs associated with the closure of coffeehouses and a decline in its North American Coffee Partnership joint venture, its margins got squeezed. Its adjusted EPS for the quarter fell 35% from the year-ago quarter to $0.52, missing analyst estimates by 5.5%.

For fiscal 2026, ending in September, analysts expect SBUX’s EPS to rise 9.9% year over year to $2.34. The company’s earnings surprise history is disappointing. It missed the consensus estimates in three of the last four quarters, while surpassing on another occasion.

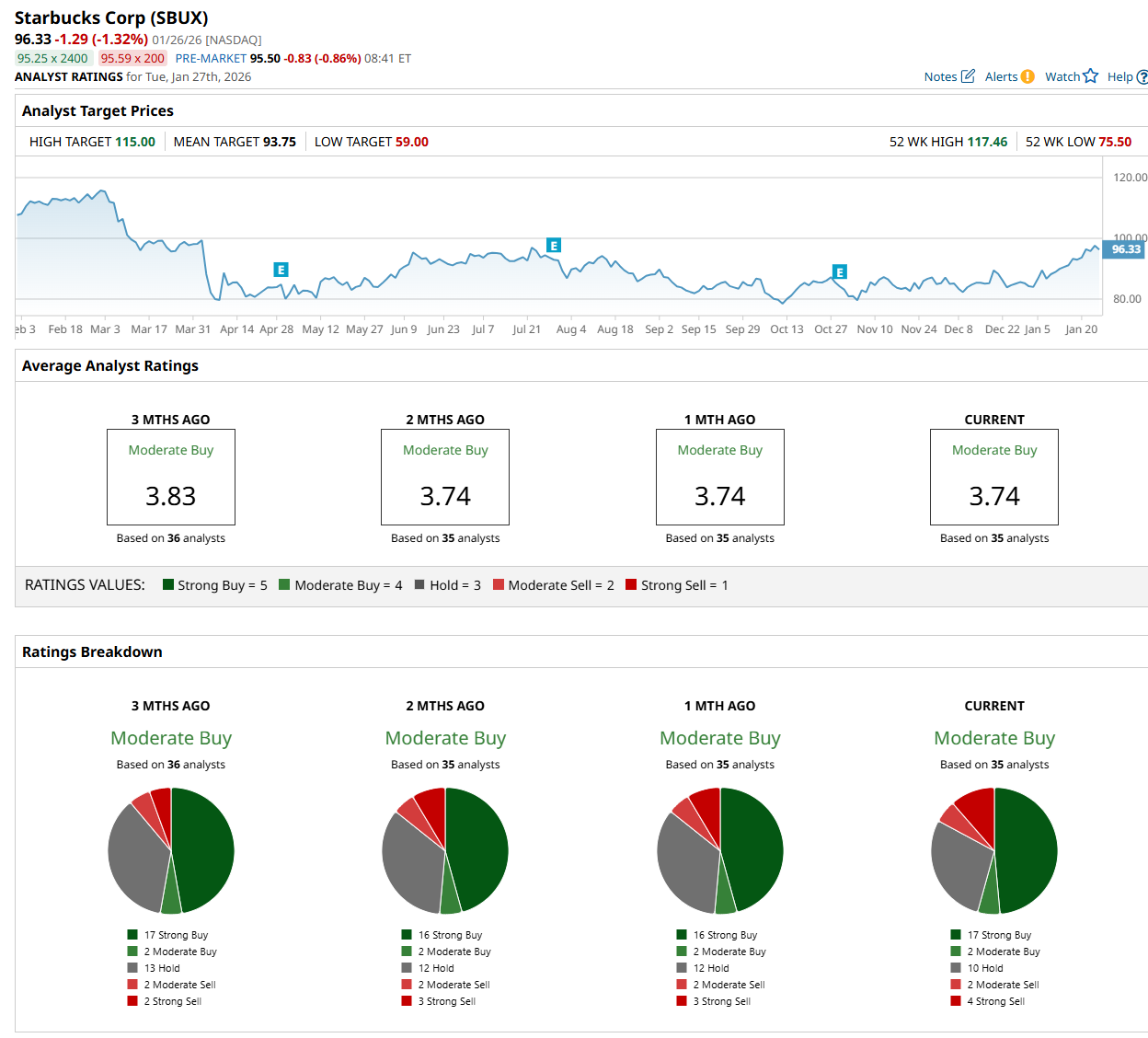

Among the 35 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 17 “Strong Buy,” two "Moderate Buy,” 10 "Hold,” two "Moderate Sell,” and four “Strong Sell” ratings.

The configuration has changed since last month, when 16 analysts suggested a “Strong Buy” rating, and three recommended a “Strong Sell.”

On Jan. 26, Jefferies Financial Group Inc. (JEF) analyst Andy Barish maintained a "Sell" rating on SBUX and set a price target of $76.

While the company is trading above its mean price target of $93.75, its Street-high price target of $115 suggests a 19.4% potential upside from the current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart