With a market cap of $33.3 billion, Carnival Corporation & plc (CCL) is a global cruise company providing leisure travel services across North America, Australia, Europe, and other international markets. It operates multiple cruise brands and travel-related assets, offering cruises and vacation experiences through various sales channels worldwide.

Shares of the Miami, Florida-based company have lagged behind the broader market over the past 52 weeks. CCL stock has gained 12.8% over this time frame, while the broader S&P 500 Index ($SPX) has increased 13.9%. In addition, shares of the company are down 6.1% on a YTD basis, compared to SPX’s 1.5% rise.

However, shares of the cruise operator have outpaced the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 6.4% return over the past 52 weeks.

Despite Q3 2025 revenue of $6.33 billion missing expectations, CCL shares jumped 9.8% on Dec. 19 as adjusted EPS of $0.34 beat forecasts by a wide margin and adjusted net income of $454 million exceeded guidance by more than $150 million, driven by strong close-in demand and tight cost control. Investors also reacted positively to full-year 2025 record results, including $3.1 billion in adjusted net income and $7.2 billion in adjusted EBITDA. Optimism was reinforced by robust 2026 guidance projecting $3.5 billion in adjusted net income, higher net yields, record bookings at historically high prices,

For the fiscal year ending in November 2026, analysts expect CCL’s adjusted EPS to increase 12.9% year-over-year to $2.54. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

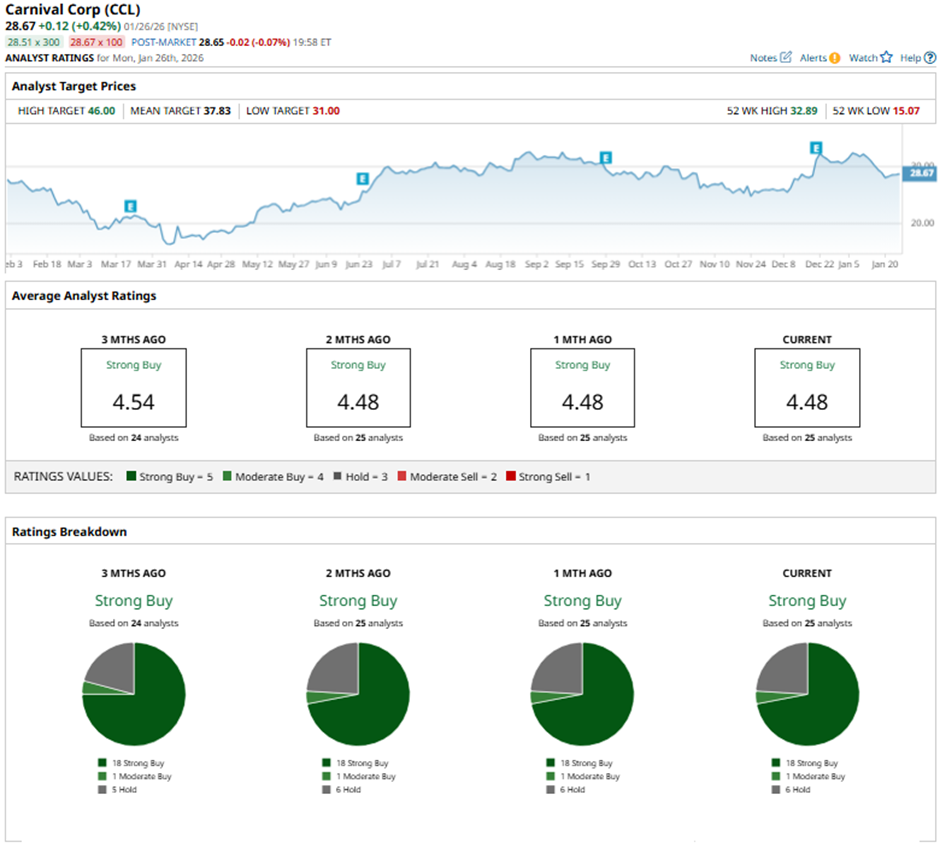

Among the 25 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 18 “Strong Buy” ratings, one “Moderate Buy,” and six “Holds.”

On Jan. 6, Bernstein raised its price target on Carnival to $33, maintaining a “Market Perform” rating.

The mean price target of $37.83 represents a premium of 31.9% to CCL's current price. The Street-high price target of $46 suggests a 60.4% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Microsoft Reports Q2 Earnings Jan. 28. Is MSFT Stock a Buy Before Then?

- As IonQ Snaps Up SkyWater Technology for $1.8B, Should You Buy the Quantum Computing Stock Here?

- What's Next for Sandisk Stock After a 1,000% Rally?

- USAR Stock Is Solidly in Overbought Territory as Trump Invests in USA Rare Earth. Can You Still Chase the Rally Here?