Tesla’s (TSLA) bold claims about driverless robotaxis in Austin have come under scrutiny. Reports suggest the vehicles still rely on support crews, raising doubts about Tesla’s autonomy claims and keeping the stock down.

Meanwhile, Alphabet’s (GOOG) (GOOGL) Waymo and Amazon’s (AMZN) Zoox are widely seen as front-runners in the self-driving taxi race. Waymo, backed by Google, has launched a paid robotaxi service in Miami, its sixth U.S. market, extending its lead over rivals.

Analysts project the global robotaxi market will explode in the next decade. Meanwhile, Zoox is deploying purpose-built electric robotaxis in Las Vegas, leveraging Amazon’s vast resources and integration advantages. For those seeking a pure-play on this autonomous mobility trend, GOOG and AMZN present compelling long-term opportunities.

Robotaxi Stock #1. Alphabet (GOOG)

Alphabet, the parent of Google, Waymo and other ventures, is one of the world’s largest companies, with a market cap of nearly $3.96 trillion. It dominates online search and advertising, is a leading cloud provider, and has built Waymo into a top player in self-driving technology. GOOGL’s scale is reflected in a premium growth valuation.

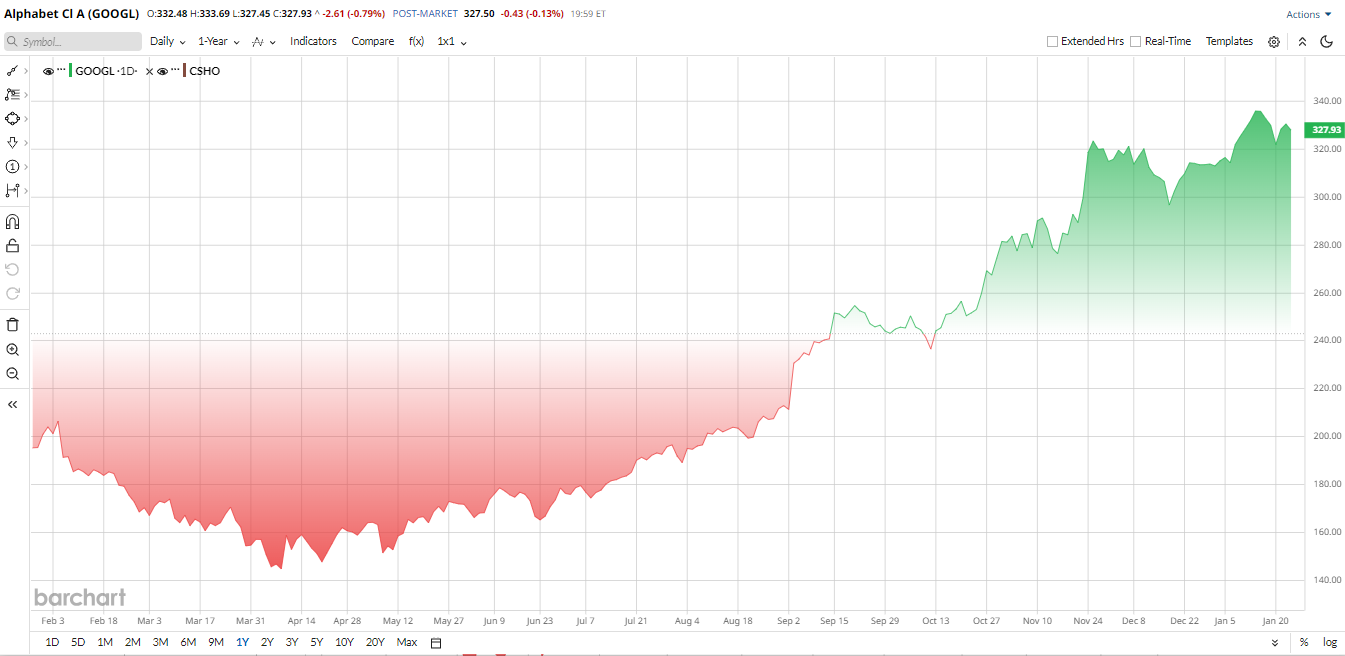

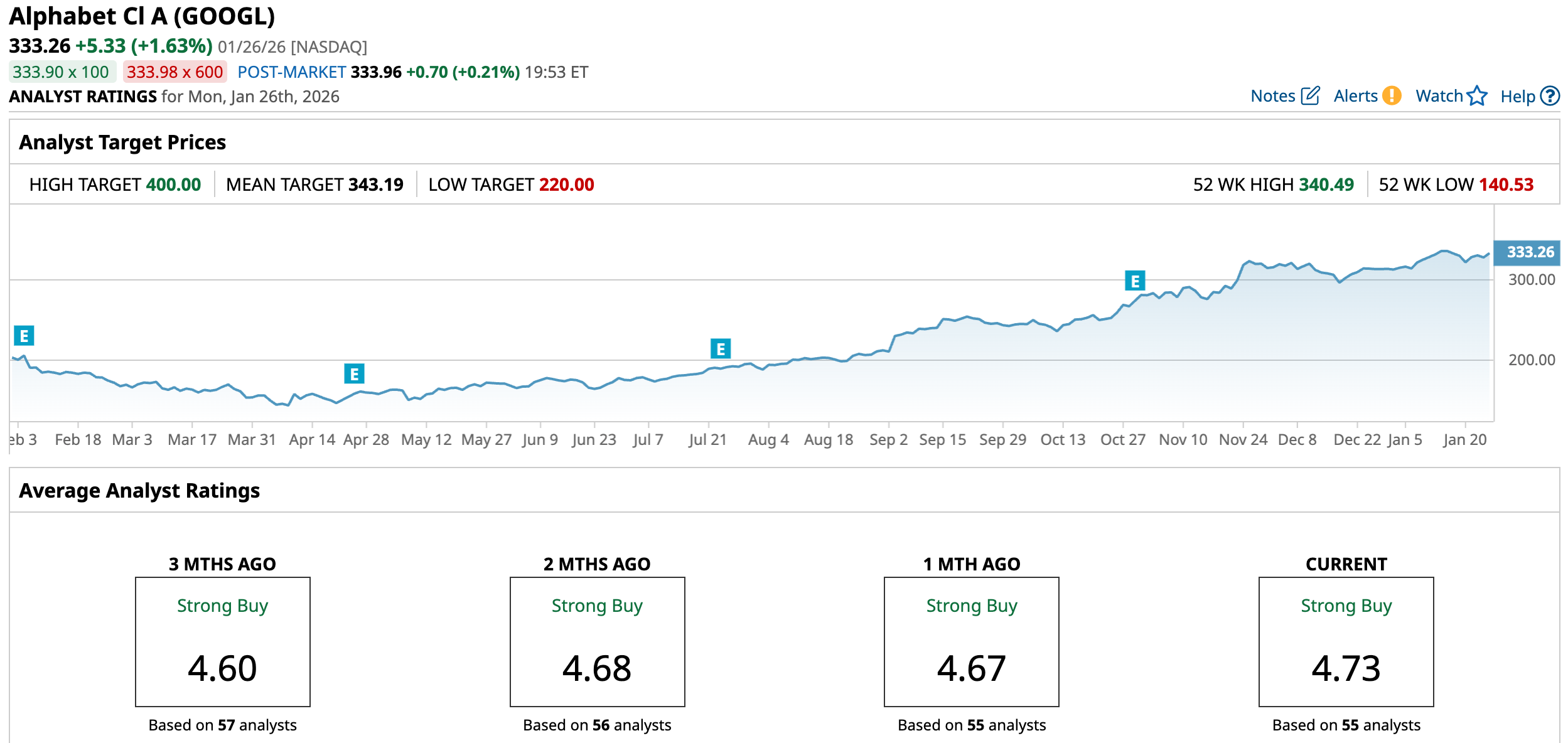

Over the past year, GOOGL has climbed roughly 65%, comfortably outperforming the S&P 500 Index’s ($SPX) 13.9% gain. That performance sits alongside a challenging valuation picture: a price-to-sales ratio of 10.34x versus a sector median of 1.28x, and a price/book (TTM) of 10.24x compared with the sector median of 1.80x, metrics that suggest the shares are expensive on traditional measures.

Alphabet's Waymo is accelerating its commercial rollout. The unit plans fully driverless rides in London in 2026 after logging more than 100 million autonomous miles and over 10 million paid rides in the U.S., and it intends to expand to Tokyo and additional U.S. cities Dallas, San Antonio, Houston, Miami, and Orlando. Alphabet’s AI efforts are also gaining traction, the new Gemini AI app now attracts about 650 million monthly users, signaling rapid adoption of its AI services.

Financially, Alphabet is doing great and has delivered a very strong last quarter. Revenue rose 16% year-over-year (YOY), topped $102 billion for the first time ever, led by double-digit growth in Google Search and YouTube services revenue, 14% and a 34% jump in Google Cloud to $15.2 billion.

Operating income was roughly $31.2 billion, about a 30.5% margin, and net income increased 33% to $34.98 billion, with EPS of $2.87, despite a €3.5 billion EU fine. Management called this Google’s first $100+ billion quarter and guided aggressive capex, roughly $91 to 93 billion for 2025, to expand AI and data-center capacity.

Looking ahead, Alphabet is set to report Q4 results on Feb. 4, 2026, after the market close. Analysts expect revenue of roughly $111.3 billion and EPS of about the consensus $2.58.

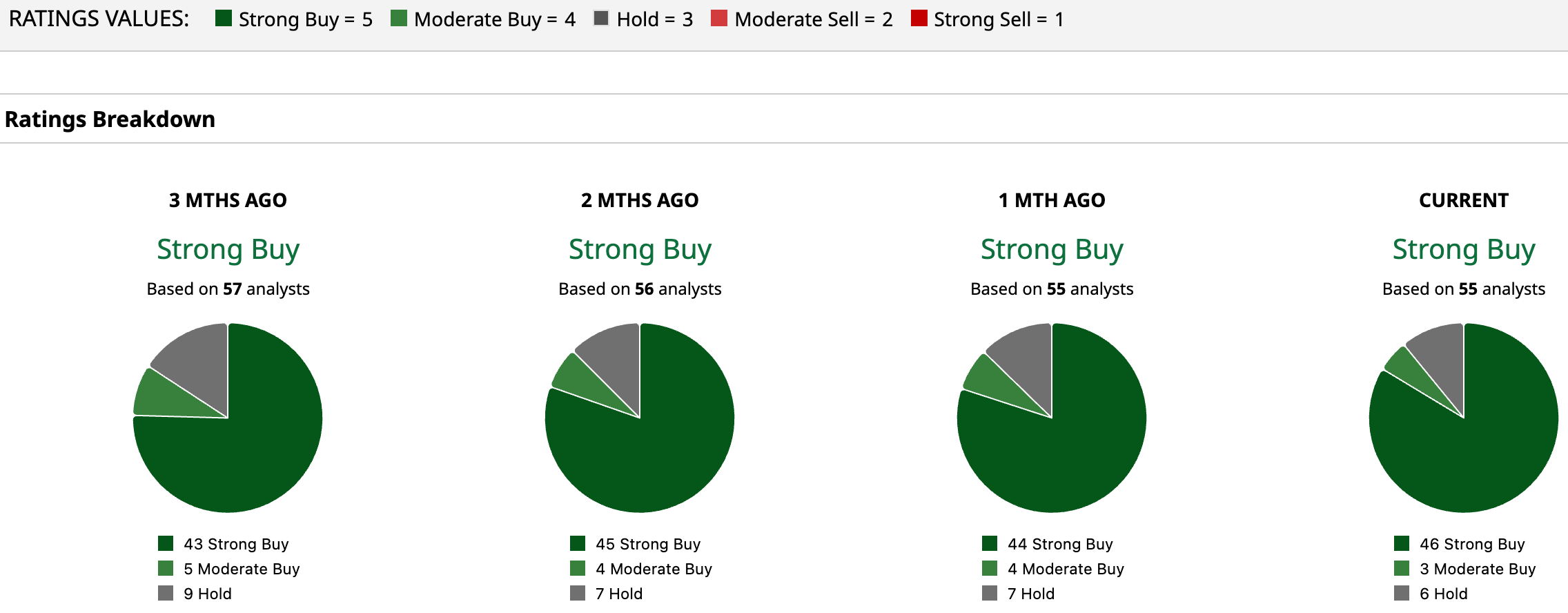

Wall Street is broadly bullish. Analysts maintain a “Strong Buy” consensus with a mean price target near $343, implying modest upside of around 3%.

Robotaxi Stock #2. Amazon (AMZN)

Amazon is the e-commerce and cloud powerhouse that also owns Zoox, and its reach stretches from online retail to AWS cloud services and digital ads. The company is famous for reinvesting aggressively, plowing profits back into its ecosystem to capture long-term growth rather than maximize short-term margins.

On the mobility and AI front, Zoox is moving fast. The unit began offering free robotaxi rides in Las Vegas and San Francisco in late 2025 as part of an operational ramp, with paid services penciled in for 2026 pending regulatory sign-off. To scale, Amazon repurposed a former bus plant in Hayward, Calif., and is aiming for as many as 10,000 vehicles a year.

At the same time, Amazon is doubling down on AI infrastructure, Trainium2 chips and expanded Bedrock and SageMaker capabilities, which management says are already helping reaccelerate AWS growth by about 0.2% YOY in recent periods and lift enterprise adoption.

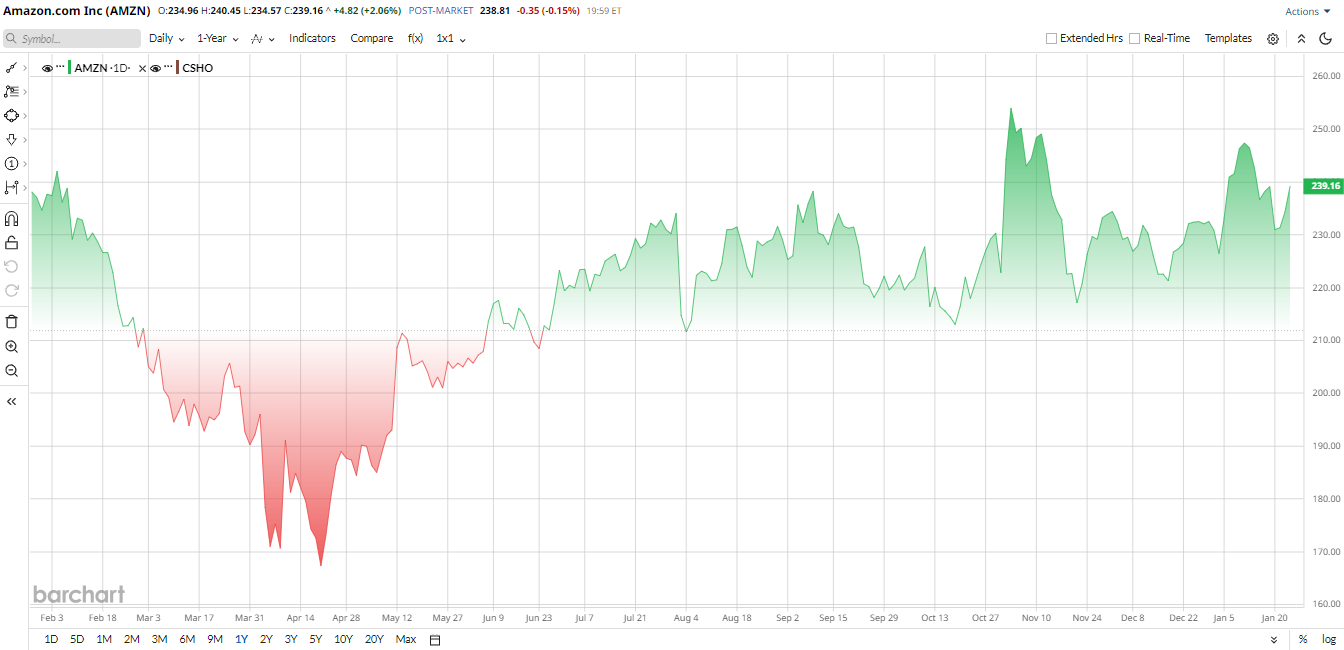

Despite the progress, the stock’s performance has been muted so far. Market cap is roughly $2.56 trillion, and shares have traded nearly flat over the past 52 weeks. That underperformance reflects a few headwinds, tariff worries that could nudge up product costs, stiffer competition in e-commerce, softer consumer discretionary demand, and the drag from very heavy capex on near-term free cash flow.

Still, AMZN presents a challenging valuation landscape. Its price-to-sales (FWD) ratio of 3.58X is significantly higher than the sector median of 0.98x, reflecting an expensive stock. Similarly, the EV/EBIT ratio of 32.83x is also higher than the sector's 16.44x, indicating a premium valuation.

The fundamentals of Amazon are mixed but compelling. For example, Q3 2025 showed healthy top line momentum, in which net sales grew 13% to $180.2 billion. AWS segment jumped 20% to $33.0 billion, while operating income held at $17.4 billion, including $4.3 billion of special charges.

On the profitability front, net income jumped to $21.2 billion, helped by a $9.5 billion Anthropic gain, and AWS operating profit rose to $11.4 billion. Trailing-12-month operating cash flow was robust at $130.7 billion, up 16% YOY, though free cash flow slipped to $14.8 billion amid record investment.

Looking ahead, Amazon is scheduled to report its Q4 earnings on Jan. 28 and management has guided for net sales of $206 billion to $213 billion, broadly in line with the roughly $208 billion Wall Street consensus.

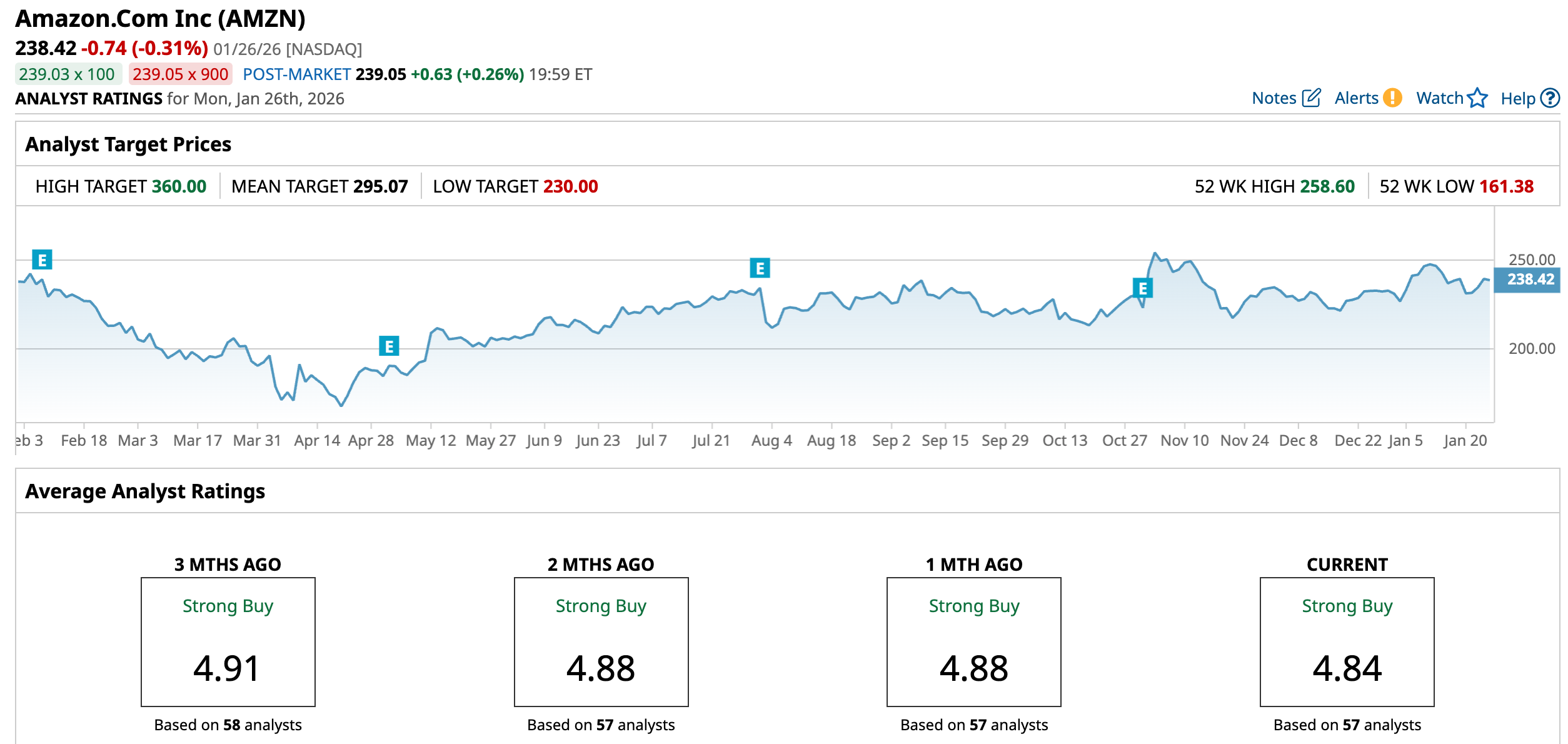

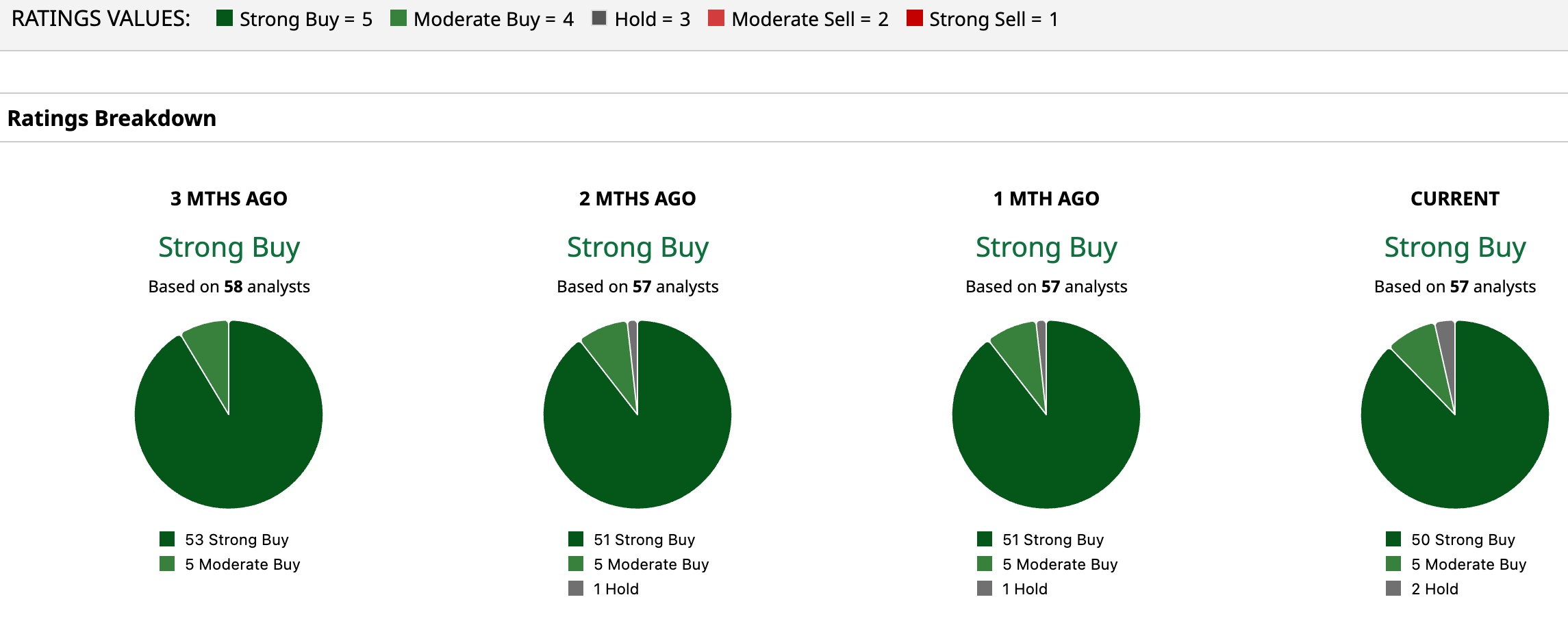

Analysts continue to remain optimistic with a consensus of a “Strong Buy”, rating and the average 12-month target of $295.07 implies meaningful upside of 23.76% from current levels.

So considering all into account, it looks like Amazon is executing on multiple long-term growth themes, cloud, AI infrastructure and autonomous mobility. However, investors must balance that upside against near-term cash-flow pressure from heavy capex and the usual execution risks.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why 1 Analyst Thinks Meta Platforms Stock Can Gain Another 40% from Here

- An Extreme Short Squeeze Is Underway in Sandisk Stock. How Much Higher Can Shares Go?

- Tesla Q4 2025 Earnings Preview: Should You Buy or Dump TSLA Stock?

- They’re ‘an Expensive Distraction for Many Investors’: Berkshire’s Warren Buffett Says ‘Ignore Political and Economic Forecasts’ When Investing