Applied Materials (AMAT) stock climbed 1.13% on Jan. 23 after Deutsche Bank was the latest Wall Street firm to upgrade the semiconductor equipment maker. The investment firm joined a growing chorus of analysts who turned bullish on the company’s near-term prospects.

Analyst Melissa Weathers raised her rating to “Buy” from “Hold” and set a $390 price target, citing an increasingly favorable environment for wafer fabrication equipment spending. She noted her estimates for Applied Materials are roughly 10% above Wall Street consensus, with potential for further upside. The upgrade follows similar moves earlier this month from Susquehanna and Barclays, while KeyBanc raised its price target to $380.

Key factors driving the optimism include major capital expenditure increases from both Taiwan Semiconductor (TSM) and Intel (INTC). Several chip manufacturers are accelerating the construction of new DRAM fabrication facilities. AMAT also stands to benefit from the rising complexity of chip architectures, which require sophisticated deposition and etching processes.

Valued at a market cap of $255 billion, AMAT stock has almost tripled investor returns in the past three years. At the time of writing, it trades at $319 per share.

Is AMAT Stock Still a Good Buy?

Despite trade-war-related headwinds, Applied Materials delivered its sixth consecutive year of revenue growth in fiscal 2025 (ended in October). It reported record revenue of $28.4 billion in fiscal 2025 with gross margins of almost 49%, the highest level in 25 years.

However, growth rates lagged expectations, as China declined to 28% of total systems and service revenues, down from peaks above 40% in prior quarters.

Trade restrictions significantly impacted the company's addressable market in China. The portion of the China market that Applied Materials cannot serve has more than doubled from roughly 10% in fiscal 2024 to over 20% in fiscal 2025. These restrictions primarily affected DRAM customers and certain mature node segments. Management emphasized AMAT maintains market share in areas where it can compete, with strong performance in leading-edge DRAM outside China, where revenues grew more than 50% over the past four fiscal quarters.

The company positioned itself strategically for the artificial intelligence infrastructure buildout. Management estimates that approximately 15% of leading-edge logic capacity and 15% of DRAM wafer starts currently support AI data center products, including GPUs and accelerators.

This segment is growing at a mid-30 percent compound annual growth rate, which should create tailwinds for semiconductor equipment spending in the coming years. Applied Materials holds the number one position in process equipment for leading-edge foundry logic, DRAM, and high-bandwidth memory packaging.

The company expects to capture more than 50% of its served market as gate-all-around transistors and backside power-delivery technologies ramp into volume production. These advanced manufacturing processes increase the company's serviceable addressable market by roughly $1 billion per technology node transition.

Customer visibility improved dramatically in recent months as hyperscalers plan large-scale advanced factory ramps. Applied Materials now has demand visibility extending one to two years, rather than the typical single-quarter outlook. This allows the company to better prepare its supply chain for anticipated production increases beginning in the second half of calendar 2026.

Management expects revenue to remain relatively flat in the first half before accelerating meaningfully as new capacity comes online and customers take delivery of equipment for next-generation chip production.

Is AMAT Stock Still Undervalued Right Now?

Analysts tracking AMAT stock forecast revenue to grow from $28.4 billion in fiscal 2025 to almost $39 billion in 2030. In this period, adjusted earnings per share are forecast to expand from $9.42 to $15.60.

AMAT stock is trading at 33.4x forward earnings, which is expensive given decelerating growth rates. If the tech stock is priced at 20x earnings, it should trade around $312 in late 2029, which is below the current trading price.

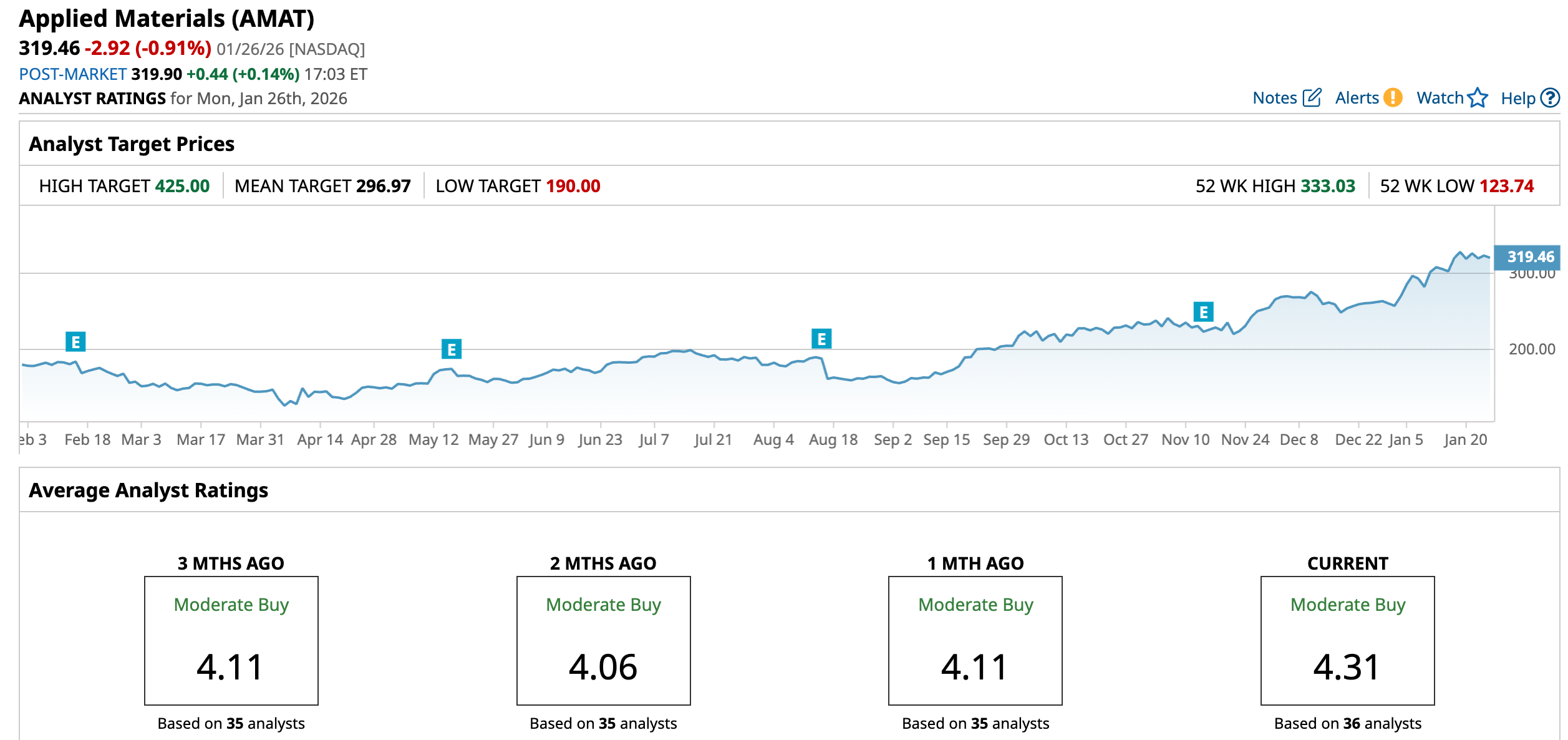

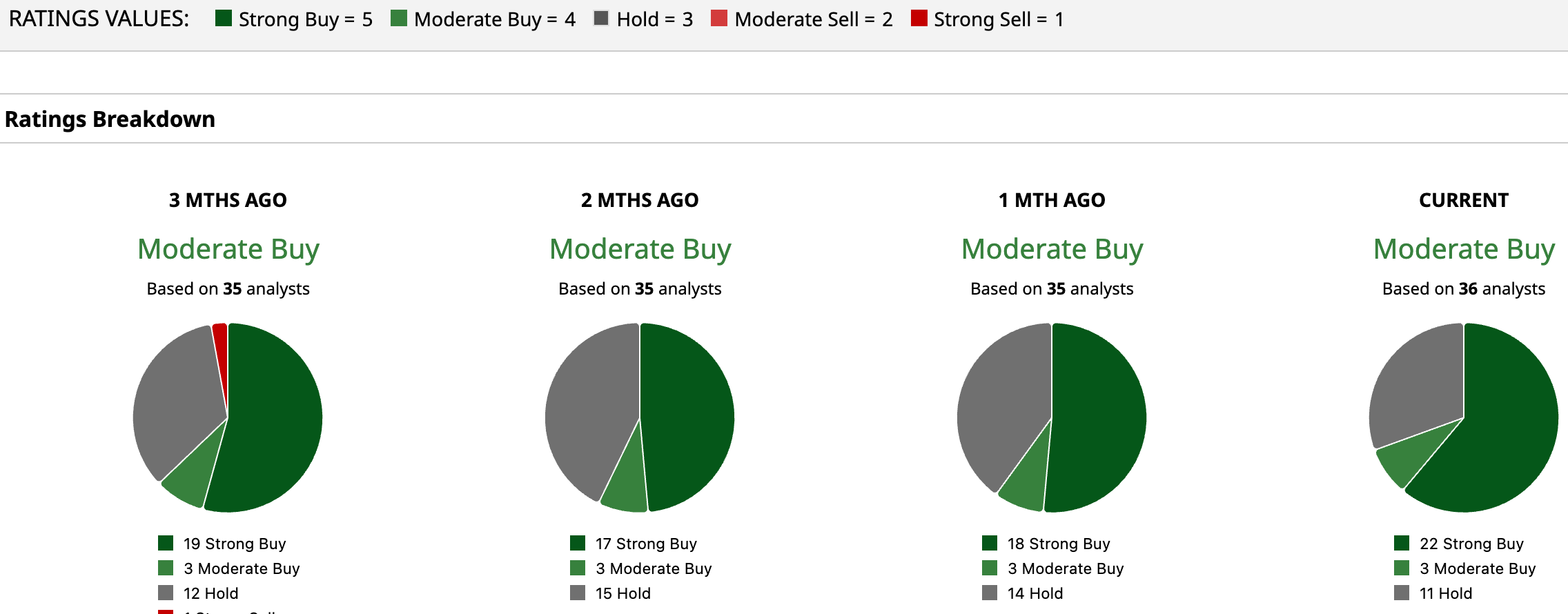

Out of the 36 analysts covering AMAT stock, 22 recommend “Strong Buy”, three recommend “Moderate Buy,” and 11 recommend “Hold”. The average AMAT stock price target is $296.97.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart