Microsoft (MSFT) will release its second-quarter fiscal 2026 financial results on Jan. 28. While the technology giant has been delivering strong financial results with expanding margins, MSFT stock has struggled to gain traction and has recently pulled back.

A major factor weighing on the stock is investor unease around Microsoft’s rising capital expenditures (capex). As the company scales up its artificial intelligence (AI) and cloud infrastructure, concerns have emerged that spending is expanding too aggressively amid broader market fears of an AI investment bubble.

Investors’ worries intensified after Microsoft disclosed Q1 capital expenditures of $34.9 billion, significantly exceeding its prior guidance of $30 billion. Management attributed the increase to surging demand for AI workloads and cloud capacity, especially within the Azure platform.

While elevated capex has made investors cautious, technical indicators suggest MSFT stock has room to run. Microsoft’s 14-day Relative Strength Index (RSI) currently sits at about 50, well below the 70 threshold typically associated with overbought conditions. This level implies that shares could rebound if the upcoming earnings report and management’s outlook help reassure the market that higher capital spending will translate into durable growth and improving returns over time.

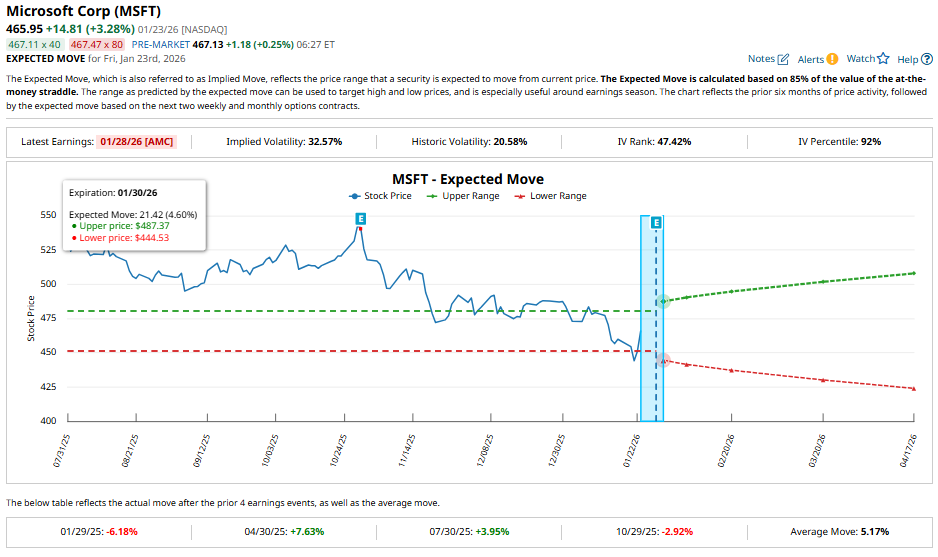

Derivatives markets are projecting a moderate reaction to MSFT’s earnings release. Options pricing implies a post-earnings move of about 4.3% in either direction for contracts expiring Jan. 30, which is lower than Microsoft’s average earnings-related move of 5.2% over the past four quarters. Investors should note that Microsoft stock declined 2.9% following its previous earnings announcement.

Microsoft's Q2 Earnings: Here’s What to Expect

The momentum in Microsoft’s business will likely sustain in Q2, driven by cloud and AI strengths. Management has guided for Q2 revenue in the range of $79.5 billion to $80.6 billion, representing year-over-year (YOY) growth of 14% to 16%.

The company’s cloud business remains the key growth driver. In the prior quarter, Microsoft Cloud revenue reached $49.1 billion, up 26% from the same period last year. Within the segment, the Intelligent Cloud business delivered $30.9 billion in revenue, up 28% YOY. Azure and related cloud services continue to see strong demand for core infrastructure offerings, with revenue climbing 40% YOY.

Looking ahead to Q2, management expects Intelligent Cloud revenue to be between $32.25 billion and $32.55 billion, translating into YOY growth of 26% to 27%. Azure’s growth trajectory remains healthy, with revenue projected to rise by approximately 37% on a constant-currency basis. This guidance points to resilient demand trends across Microsoft's cloud and AI platforms.

While revenue growth remains strong, management has signaled near-term margin pressure. Operating margins are expected to be flat YOY and lower sequentially, consistent with historical seasonal patterns. At the same time, Microsoft plans to step up investment in GPUs and CPUs to support accelerating demand and a growing remaining performance obligation balance. As a result, total spending is expected to increase sequentially, putting pressure on margins.

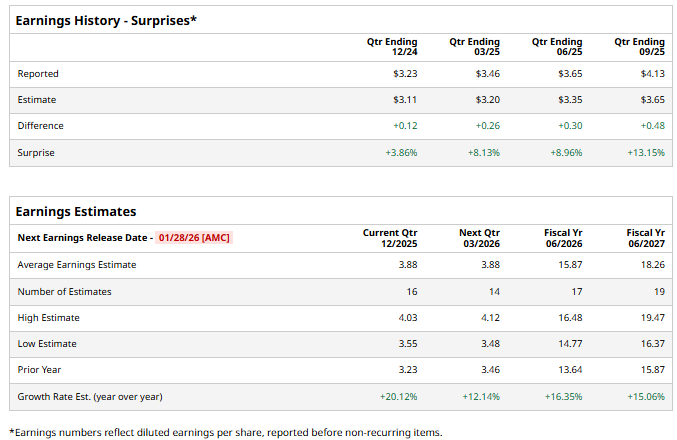

While investments in GPUs and CPUs will pressure margins, strong top-line growth and sustained momentum in high-margin businesses could drive the company's bottom line. Analysts are forecasting earnings of $3.88 per share, representing more than 20% YOY growth.

Microsoft has a track record of outperforming expectations, having delivered sizable earnings beats in each of the past four quarters, including a notable 13.2% positive surprise in Q1.

Is MSFT Stock a Buy?

With demand for cloud computing and AI services continuing to grow at a solid pace, Microsoft appears well-positioned to sustain robust growth. The company is expanding its capacity that could help alleviate current supply constraints and enable it to capture additional demand, supporting further revenue growth over time.

That said, the scale of Microsoft’s investment may weigh on margins in the near term as spending remains elevated. However, the momentum in margin businesses will enable it to deliver profitable growth.

Analysts remain bullish heading into the upcoming earnings release, with MSFT stock carrying a “Strong Buy” consensus rating.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Microsoft Reports Q2 Earnings Jan. 28. Is MSFT Stock a Buy Before Then?

- As IonQ Snaps Up SkyWater Technology for $1.8B, Should You Buy the Quantum Computing Stock Here?

- What's Next for Sandisk Stock After a 1,000% Rally?

- USAR Stock Is Solidly in Overbought Territory as Trump Invests in USA Rare Earth. Can You Still Chase the Rally Here?