When Nvidia (NVDA) backs a company, investors pay attention. It is not just because of its market leadership in artificial intelligence (AI) chips but because Nvidia sits at the center of the entire AI ecosystem. Its capital tends to flow toward infrastructure that can support the next wave of large-scale AI deployment. One lesser-known AI infrastructure company has quietly earned the backing of Nvidia, reflecting its long-term potential in a rapidly expanding AI market.

Nvidia’s recent 13F filing revealed that it had invested $177 million (at the time of disclosure) in Applied Digital (APLD). Valued at $10.6 billion, Applied Digital stock soared 309% last year and is up 43% so far this year. Wall Street views this AI stock as a “Strong Buy” with meaningful upside ahead.

Let’s see if this Nvidia-backed stock is worth buying now.

A Data Center Growth Story Enters Its Revenue Phase

Applied Digital builds and operates high-performance, purpose-built data center infrastructure for AI, cloud, and advanced computing workloads. As AI models become larger and more resource-intensive, demand shifts to specialized data centers that can handle dense GPU installations, improved cooling, and tremendous power demands. This puts Applied Digital directly in the path of the AI boom that is propelling Nvidia's core business. Nvidia's equity position indicates a belief in the long-term value of scalable AI infrastructure.

Applied Digital reported its second quarter of fiscal 2026 last week, revealing a firm shifting from a multi-year building period to active lease revenue generation. Total revenue increased by a staggering 250% year-on-year (YoY) to $126.6 million. The growth was mainly driven by $73 million in turnkey fit-out services for the HPC hosting business, as well as $12 million in recognized lease revenue from Polaris Forge One's first CoreWeave (CRWV) lease. Polaris Forge One, located in North Dakota, is Applied Digital's first big AI-focused hyperscale data center campus. It is designed as an “AI factory,” which means it provides purpose-built infrastructure suited for continuous, high-density AI workloads.

In the quarter, Polaris Forge One reached ready-for-service status, with 100 megawatts energized on schedule and the first three contracted buildings completed. This site will eventually house 400 megawatts for CoreWeave, which represents around $11 billion in potential leasing revenue over a 15-year period. The final construction of the AI manufacturing campus is scheduled to be completed by the end of 2027.

During the quarter, the company also announced a roughly $5 billion, 15-year lease with a U.S.-based investment-grade hyperscaler for 200 megawatts at Polaris Forge Two. This $3 billion project near Harwood, North Dakota, is on track, with initial capacity projected in 2026 and full build-out planned for 2027. Together, Polaris Forge One and Two represent 600 megawatts of contractual capacity and nearly $16 billion in potential leasing revenue throughout Applied Digital's North Dakota facilities.

AI Data Center Strategy Takes Shape

The company’s data center hosting segment, which operates 286 megawatts of customer ASICs across two North Dakota facilities, generated $41.6 million in revenue, up 15% YoY. This segment delivered approximately $16 million in operating profit in a single quarter on a $131 million asset base, driven by increased capacity coming online.

During the quarter, Applied Digital invested $15 million in a $25 million funding round for Correntis, focused on advanced liquid cooling solutions for high-density AI workloads. The company announced plans to spin out Applied Digital Cloud through a non-binding letter of intent to combine it with Exo to form Chronoscale, a dedicated GPU-accelerated compute platform. Management believes that separating the cloud platform from the data center company will allow them to grow independently while increasing long-term shareholder value.

Despite worldwide power limitations, hyperscalers are fiercely racing to secure sites capable of sustaining enormous AI workloads. Many are being asked to commit funds to long-term power generation projects, which increases both timing and cost uncertainties. Management stated that winning two hyperscale leases in the region has resulted in significantly increased inbound demand. The company is currently in advanced talks with another investment-grade hyperscaler across numerous areas, including more locations in the Dakotas and select southern U.S. markets.

Applied Digital ended the quarter with $2.3 billion in cash, cash equivalents, and restricted cash against $2.6 billion in debt, most of which matures in 2030. Along with rapid expansion, expenses continued to rise, resulting in a net loss of $31.2 million, or $0.11 per share, while adjusted net income was around breakeven. Adjusted EBITDA reached $20.2 million. While analysts predict revenue to climb by 60.9% in fiscal 2026, followed by a 57% increase in fiscal 2027, the company remains unprofitable.

Applied Digital stands out as an AI infrastructure play with solid Nvidia backing, positioning it as a potential high-upside stock as the AI build-out continues. However, as it is a growth stock still in development, the company is unprofitable and has substantial debt levels. Hence, the stock is more suitable for investors with a high-risk appetite.

What Is The Target Price for APLD Stock?

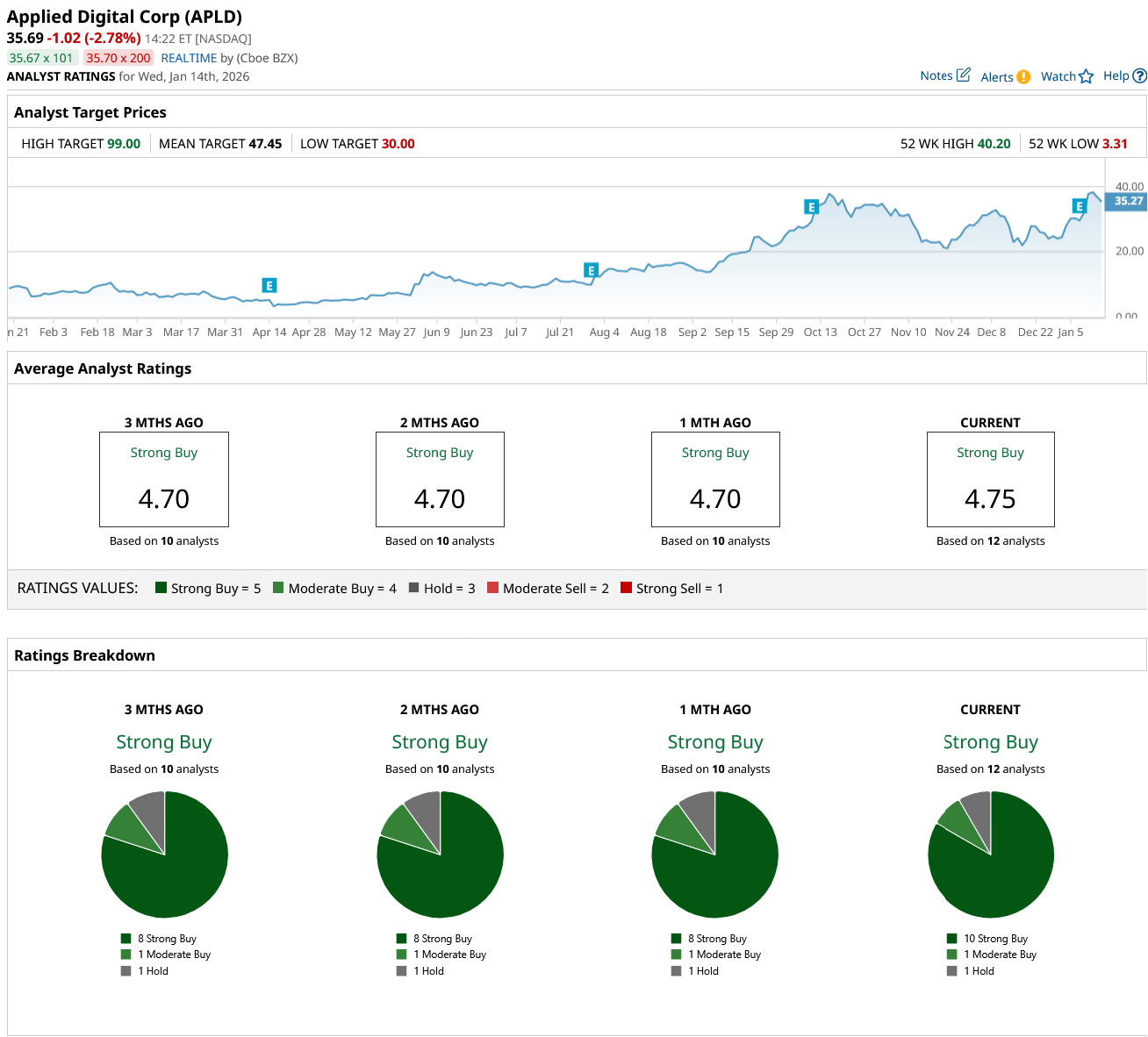

Overall, Wall Street remains optimistic about APLD stock with a “Strong Buy” rating. Of the 12 analysts covering the stock, 10 rate it a “Strong Buy,” one rates it a “Moderate Buy,” and one rates it a “Hold.”

Despite its rapid surge of 43% this year, analysts still see meaningful upside in 2026. The average target price of $47.45 suggests the stock can rally over 33% over the next 12 months. Additionally, the high target price of $99 implies upside potential of 177% from current levels.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart