GE HealthCare Technologies Inc. (GEHC) is a Chicago-based global healthcare technology company that designs, manufactures, and markets advanced medical technologies, diagnostic imaging systems, patient care solutions, and pharmaceutical diagnostics used by hospitals and health networks worldwide. Valued at $38.6 billion by market cap, the company operates through key segments including medical imaging, advanced visualization, patient care solutions, and diagnostics, while also delivering digital infrastructure, analytics, and decision-support tools that help clinicians diagnose, monitor, and treat patients more effectively.

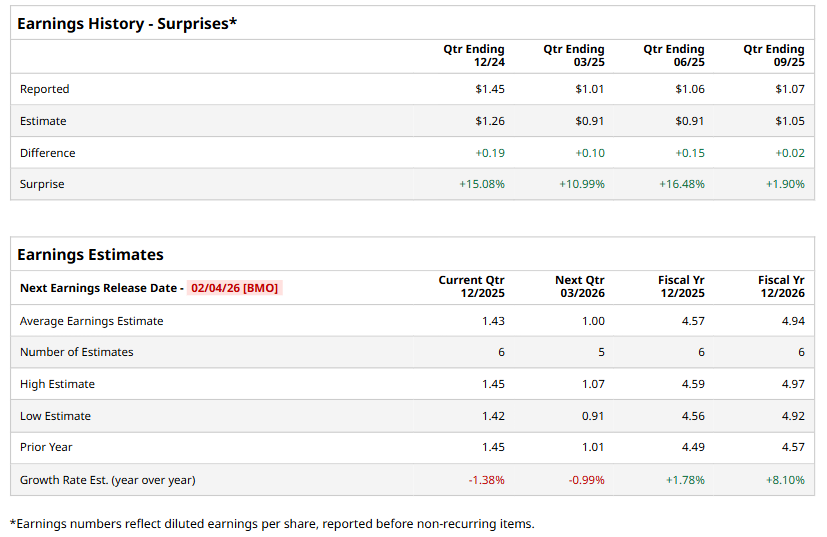

The health-tech titan is set to announce its fourth-quarter results before the market opens on Wednesday, Feb. 4. Ahead of the event, analysts expect the company to deliver a profit of $1.43 per share, down 1.4% from $1.45 per share reported in the year-ago quarter. However, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For fiscal 2025, GEHC is expected to report an EPS of $4.57, up 1.8% from $4.49 reported in fiscal 2024. In fiscal 2026, its earnings are expected to soar 8.1% annually to $4.94 per share.

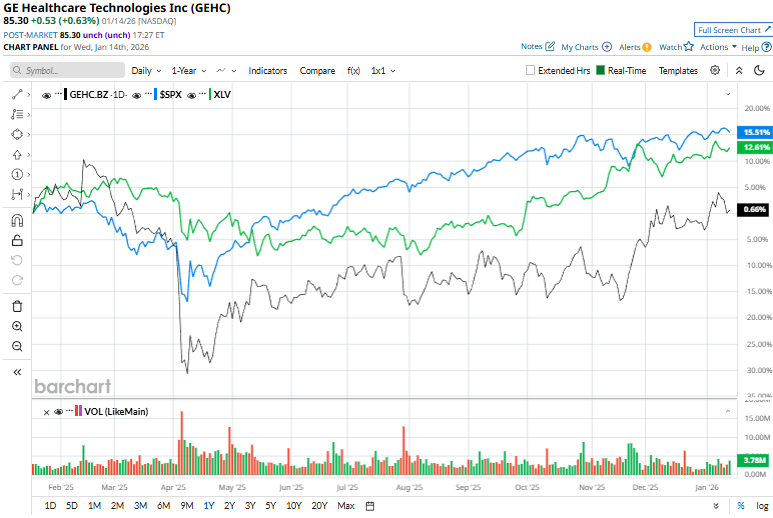

GEHC stock prices have surged 1.4% over the past 52 weeks,underperforming the Health Care Select Sector SPDR Fund’s (XLV) 12.8% dip and the S&P 500 Index’s ($SPX) 18.6% gains during the same time frame.

On Jan. 7, shares of GE HealthCare climbed 2% after the company announced a strategic collaboration with NXP Semiconductors N.V. (NXPI) to advance edge AI innovation in acute care settings. Investor sentiment was buoyed by the unveiling of new anesthesia and neonatal care concepts at CES 2026, highlighting how low-latency, secure, on-device AI can enhance clinical workflows, reduce cognitive burden for clinicians, and improve patient safety while maintaining strict data privacy standards.

GEHC currently holds a “Moderate Buy” rating. Among the 20 analysts covering the stock, opinions include 12 “Strong Buys,” one “Moderate Buy,” and seven “Holds.” Its mean price target of $91.45 suggests a 7.2% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart