The AI “hype train” has been accelerating for far longer than even most bulls would have expected, and it is no longer far-fetched to assume that 2026 could be just a repeat of what happened in the past two years. This means more money pouring into everything AI, with all these investments translating into a higher share price for the companies that are most directly involved.

It doesn't get more “direct” than power and electricity, which are essential for AI and are expected to face a crunch. AI data centers demand large amounts of energy, something that has been increasing continuously, independent of AI. However, the immense computational needs of these data centers are further amplifying demand.

Barchart has identified three stocks that are receiving the most ambitious price targets from analysts so far. Let's take a look at why they may be the best names to bet on if you think AI will spearhead the market this year.

Ideal Power (IPWR)

Ideal Power (IPWR) is a tiny company, with a market capitalization of just $31 million. What brought IPWR to this list is that it has a “Buy” rating with a price target of $10.75. That's over 200% north of the current $3.48 price.

This price target came in the form of an upgrade from WestPark Capital due to the company's B-TRAN tech and its growth in EV/data center markets. B-TRAN is a next-generation semiconductor switch that can boost energy efficiency by reducing power loss and heat in electrical systems.

There is plenty of demand as electricity prices increase and companies are pressured to be more conservative with their energy usage. It is making more sense to invest in more power-saving technology, and IPWR stock seems to be a potential key beneficiary.

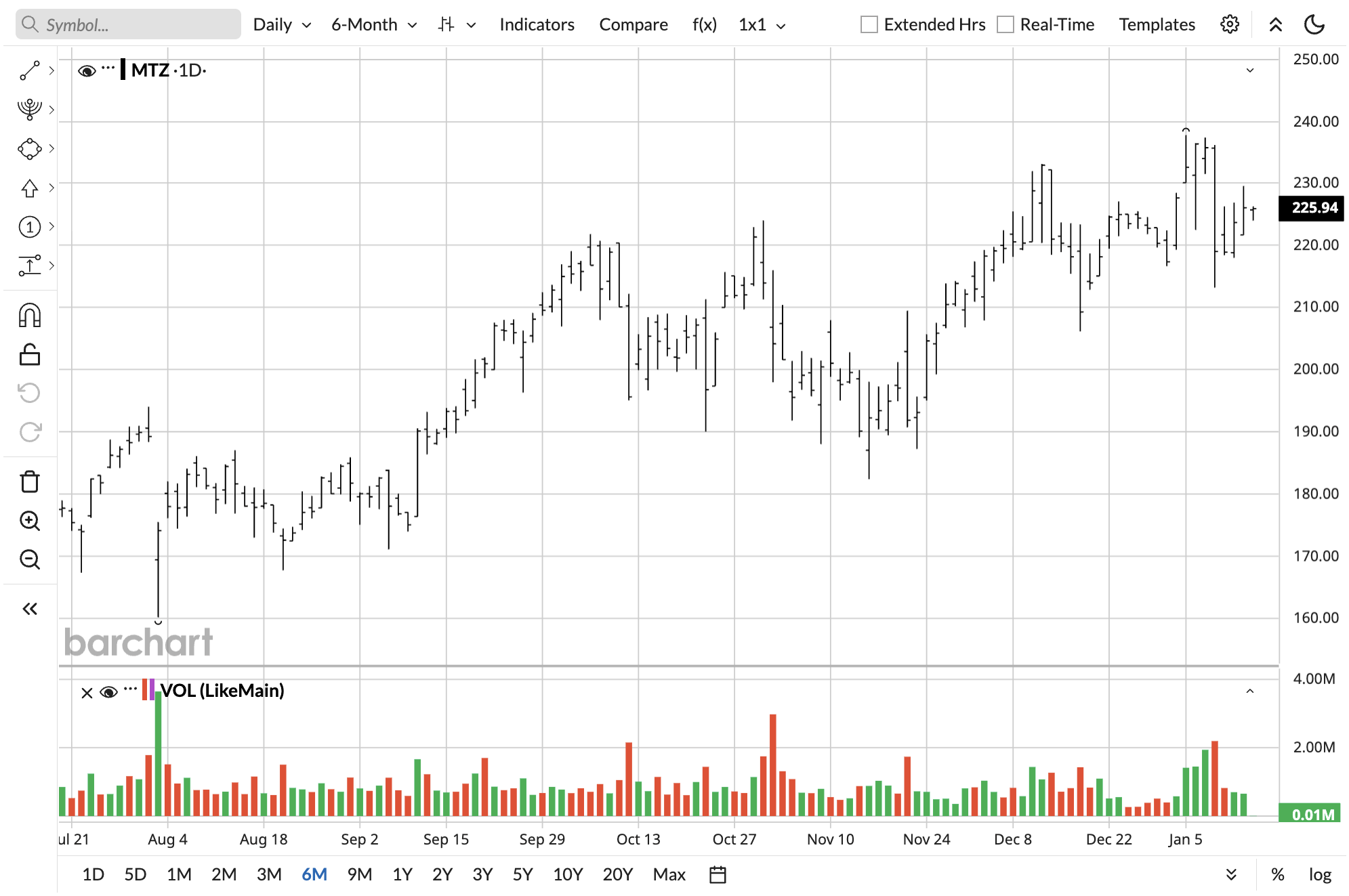

MasTec (MTZ)

MasTec (MTZ) is an infrastructure engineering and construction company. It deals with the maintenance of energy, utility, and communications infrastructure.

Companies and government entities are investing heavily in energy and communications infrastructure. Both are vital for AI, especially as data centers become more demanding and they need top-notch reliability to service users.

MTZ stock has seen explosive growth due to this influx of new business. It is up over 50% in the past year alone, but analysts believe much more growth is ahead.

Out of 21 analysts, 20 tag it as a “Strong Buy,” with the average price target at $252.42 and a high target of $290.

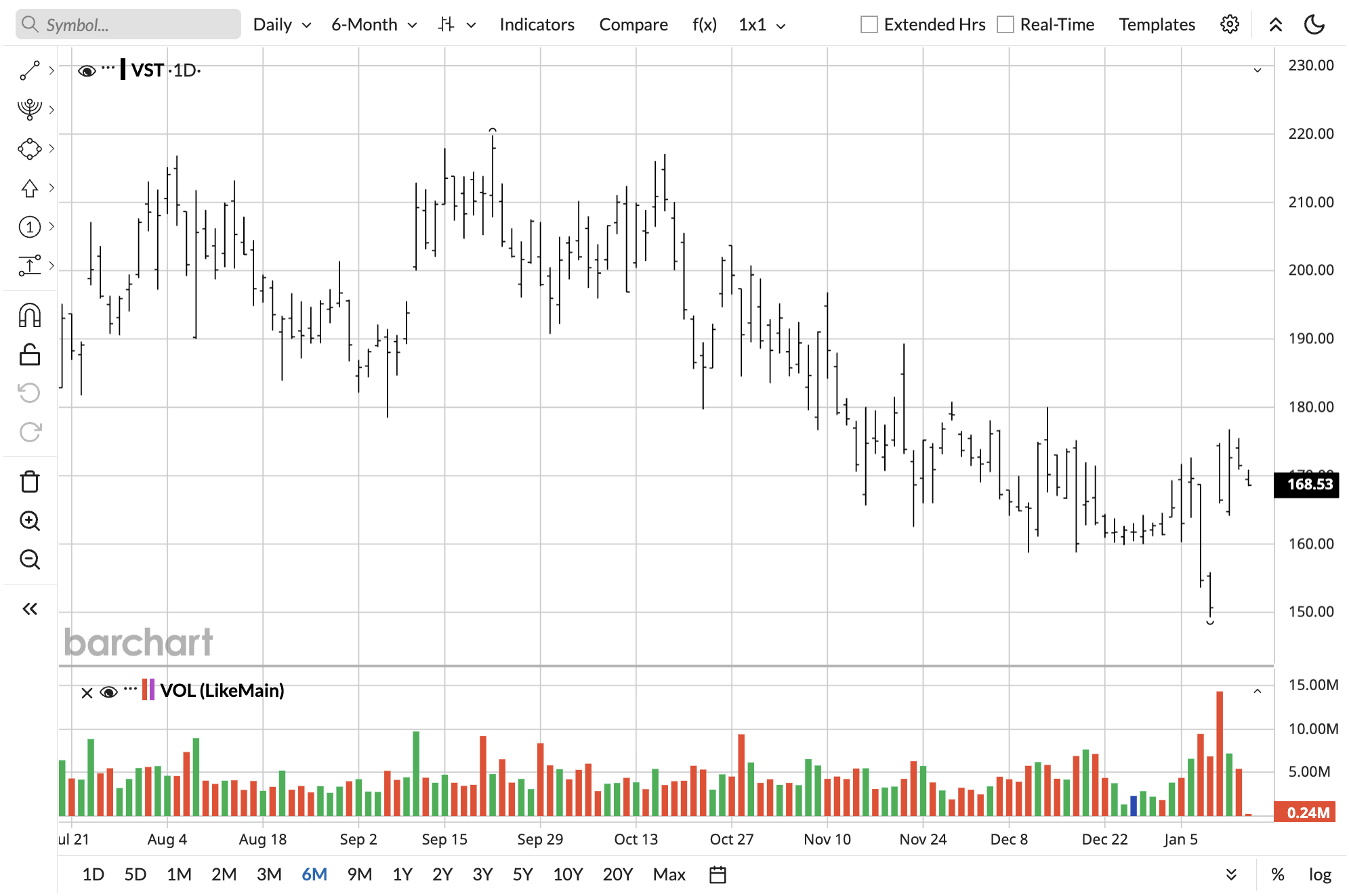

Vistra Energy (VST)

Vistra Energy (VST) is one of the biggest winners of the AI rally. It has surged from less than $30 in August 2023 to over $211 in September 2025. The stock has taken a breather and is down to about $180 as of this writing.

Vistra has a massive generation fleet with a capacity of 41,000 to 44,000 megawatts. The company's generation capacity contains coal, nuclear, and solar sources and is expected to become more profitable with time as electricity demand surges and supply gets more constrained. Lower mark-to-market gains on derivatives and a plant outage led to a 21% revenue decline in Q3, but analysts are confident the long-term outlook is rosy.

Out of 19 analysts, 16 tag it as a “Strong Buy,” with the average price target at nearly $242 and a high target of $295.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart