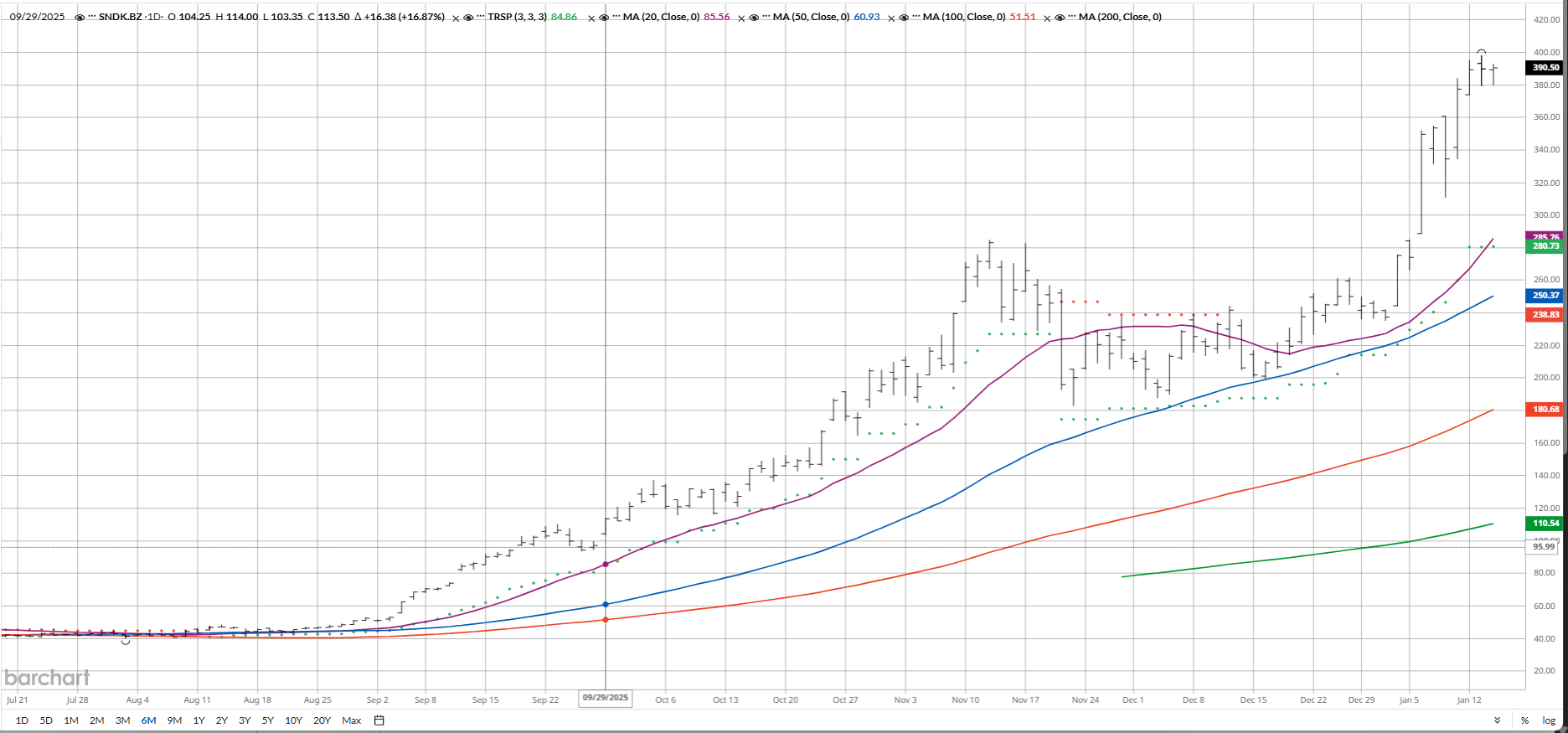

- Sandisk (SNDK) is trading at new all-time highs.

- Shares are up more than 745% over the past six months.

- SNDK maintains a 100% “Buy” technical opinion from Barchart.

- The stock is benefitting from what some analysts have called a “supply crunch” in memory products driven by artificial intelligence demand.

Today’s Featured Stock

Valued at $57 billion, Sandisk (SNDK) is a maker of flash storage products like memory cards, USB flash drives, and solid state drives. Sandisk is a spinoff of Western Digital (WDC), which first acquired the memory business in 2016.

What I’m Watching

I found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. SNDK checks those boxes. Since the Trend Seeker signaled a new “Buy” on Dec. 11, the stock has gained 61.34%.

Barchart Technical Indicators for Sandisk

Editor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock.

Sandisk scored a new all-time high of $398 on Jan. 13.

- SNDKhas a Weighted Alpha of +866.32.

- Sandisk has a 100% “Buy” opinion from Barchart.

- The stock gained 745.76% over the past six months.

- SNDK has its Trend Seeker “Buy” signal intact.

- The stock recently traded at $389.81 with a 50-day moving average of $250.37.

- Sandisk made 15 new highs and gained 89.06% in the last month.

- Relative Strength Index (RSI) is at 77.64.

- There’s a technical support level around $380.15.

Don’t Forget the Fundamentals

- $57 billion market capitalization.

- 32.52x forward price-earnings ratio.

- Analysts project earnings to increase by 550% in fiscal 2026 and 110% in fiscal 2027.

Analyst and Investor Sentiment on Sandisk

- The analysts tracked by Barchart rate Sandisk a “Moderate Buy” with price targets ranging between $220 and $410.

- Short interest is relatively low at 6.03% of the float.

The Bottom Line on Sandisk

Sandisk, along with memory business peers Micron (MU) and Western Digital, has been one of the market’s top performers in 2025. That trend seems likely to only strengthen in 2026, with KeyBanc writing recently that “insatiable data center demand” was creating a “supply crunch” for NAND and DRAM supply products.

Sandisk specializes in the former, and since its spinoff, its shares have soared higher. However, investors can find reason for caution in the magnitude of its run-up, its relatively short life span as an independently trading stock, and its current valuation .

Additional disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy, Sell, or Hold Visa Stock for January 2026?

- Trump Just Juiced the Bull Case for Lockheed Martin to $1.5 Trillion. Does That Make LMT Stock a Buy Here?

- A $2.65 Billion Reason to Buy Bloom Energy Stock in January 2026

- This 1 Greenland Stock Has Surged in the Past Month. Should You Chase the Rally Here?