Providence, Rhode Island-based Citizens Financial Group, Inc. (CFG) provides retail and commercial banking products and services. Valued at $25.2 billion by market cap, CFG offers consumer and commercial loans, mortgage finance, deposit products, retail and commercial banking, asset management, and trust services. The bank holding company is expected to announce its fiscal fourth-quarter earnings for 2025 in the near future.

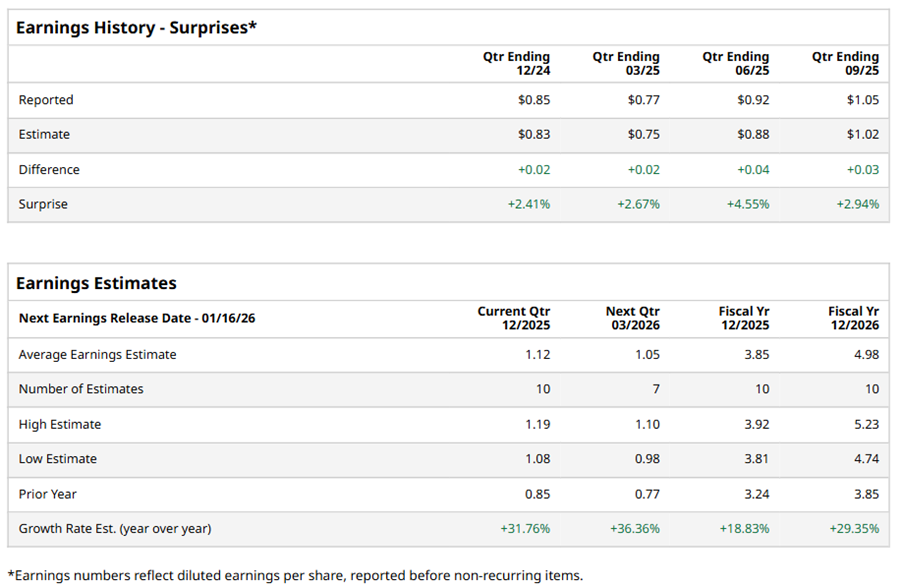

Ahead of the event, analysts expect CFG to report a profit of $1.12 per share on a diluted basis, up 31.8% from $0.85 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect CFG to report EPS of $3.85, up 18.8% from $3.24 in fiscal 2024. Its EPS is expected to rise 29.4% year over year to $4.98 in fiscal 2026.

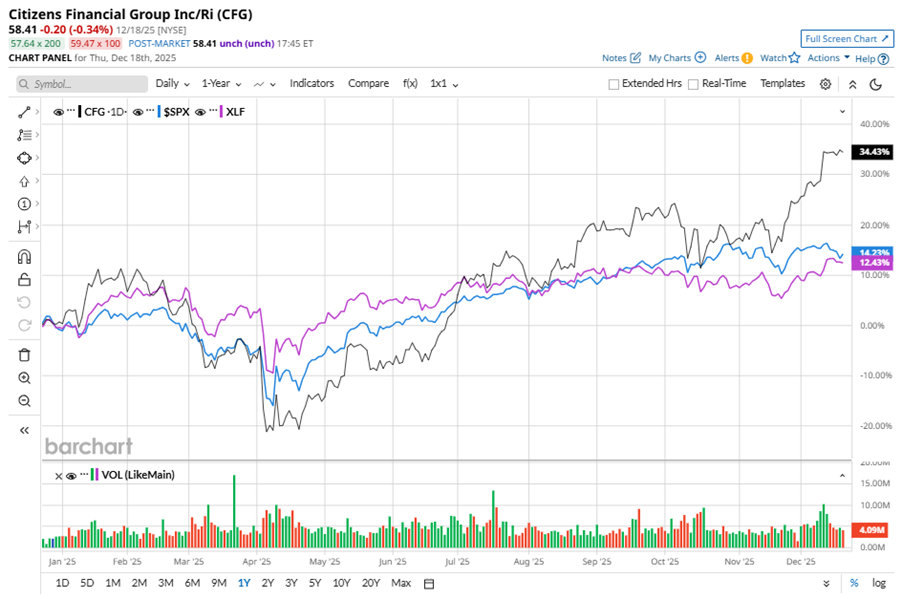

CFG stock has outperformed the S&P 500 Index’s ($SPX) 15.4% gains over the past 52 weeks, with shares up 36.9% during this period. Similarly, it outperformed the Financial Select Sector SPDR Fund’s (XLF) 14.5% returns over the same time frame.

CFG is outperforming due to strong growth in its private bank and wealth franchise, driven by 3.5% NII growth, record capital markets performance, and disciplined expense management. The private bank surpassed $12.5 billion in deposits, and capital markets delivered the second-highest quarterly results. Moreover, strategic investments in technology and private banking are boosting efficiency and profitability.

On Oct. 15, CFG reported its Q3 results, and its shares closed down more than 6% in the following trading session. Its adjusted EPS of $1.05 beat Wall Street expectations of $1.02. The company’s revenue was $2.12 billion, topping Wall Street forecasts of $2.10 billion.

Analysts’ consensus opinion on CFG stock is bullish, with a “Strong Buy” rating overall. Out of 23 analysts covering the stock, 17 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and four give a “Hold.” CFG’s average analyst price target is $62.16, indicating a potential upside of 6.4% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Dividend Kings Delivering Generational Income & Market-Beating Returns

- Mizuho Says This 1 Agentic AI Company Is the Top Software Stock to Buy in 2026

- Broadcom Stock Just Raised Its Dividend by 10%. Should You Buy AVGO Stock Now?

- Weight Watchers Is Going All In on GLP-1 Drugs. Should You Buy WW Stock Here?