Valued at a market cap of $81.2 billion, United Parcel Service, Inc. (UPS) is a package delivery and logistics provider based in Atlanta, Georgia. It offers domestic and international shipping, freight forwarding, contract logistics, last-mile delivery, and e-commerce fulfilment solutions.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and UPS fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the integrated freight & logistics industry. The company continues to strengthen its competitive position through advanced technology, data-driven route optimization, and automation across hubs and delivery operations.

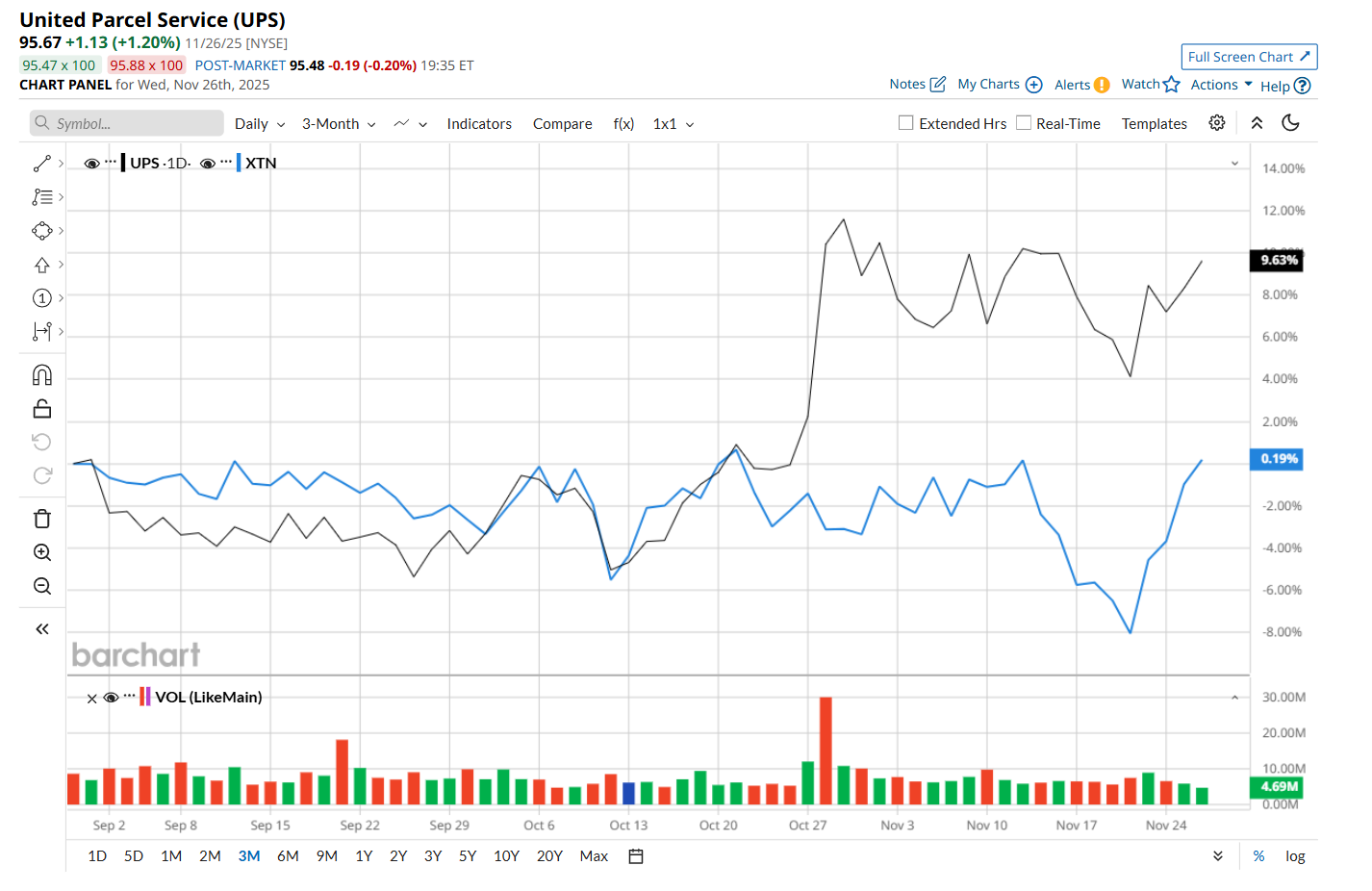

This freight and logistics company is currently trading 30.2% below its 52-week high of $137.10, reached on Nov. 27, 2024. Shares of UPS have gained 9.4% over the past three months, outpacing the SPDR S&P Transportation ETF’s (XTN) marginal drop during the same time frame.

However, in the longer term, UPS has declined 29.1% over the past 52 weeks, considerably underperforming XTN's 8.8% loss over the same time period. Moreover, on a YTD basis, shares of UPS are down 24.1%, compared to XTN’s slight decline.

To confirm its recent bullish trend, UPS has been trading above its 50-day moving average since mid-October. However, it has remained below its 200-day moving average over the past year, with slight fluctuations.

On Oct. 28, shares of UPS surged 8% after reporting better-than-expected Q3 results. The company’s consolidated revenue came in at $21.4 billion, 2.9% ahead of analyst estimates. Moreover, its adjusted EPS of $1.74 declined 1.1% from the year-ago quarter, but handily topped Wall Street estimates of $1.31.

UPS has lagged behind its rival, FedEx Corporation (FDX), which declined 9% over the past 52 weeks and 2% on a YTD basis.

Given UPS’ recent outperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 30 analysts covering it, and the mean price target of $104.17 suggests an 8.9% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Buy-Rated Dividend Aristocrats Easily Beating Inflation

- ‘Insatiable’ Demand Is Powering This ‘Picks and Shovels’ AI Stock up 245%. Should You Buy It Here?

- Using Probability Density to Extract a Huge Payout from Microchip’s Potential Breakout

- Dear UnitedHealth Stock Fans, Mark Your Calendars for January 30