After a week like the one we just have had, I can’t help but start an article with “I’m old enough to remember when...”

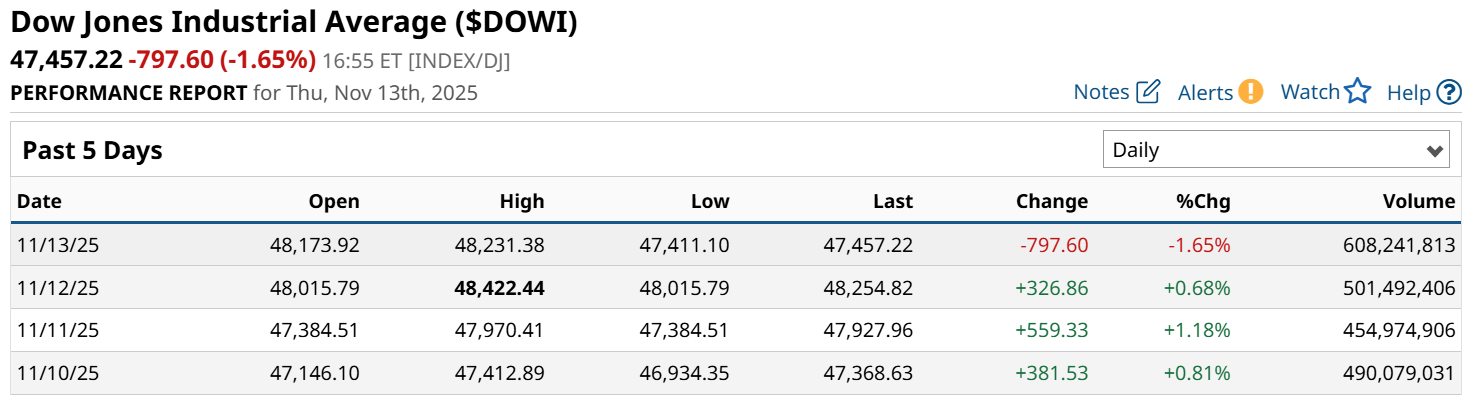

Check out the Dow’s first four trading days of this past week.

Changes of 300-800 points a day. Now, in the market of 2025, with the Dow Jones Industrial Average ($DOWI) having just crossed 48,000 for the first time ever, a move of that magnitude is in the 1% volatility range. But the Dow was around $1,800 when I started my career (1986), and it was only at $2,746 at its 1987 peak, just before it crashed in October.

So when we see a 500-point down move, or 797 like we had on Thursday, some of us think of how far we’ve come. The 1987 crash took 508 points off the Dow in a single, wild day. But that was good for a 22.6% drop that Monday.

Back to the present, the Dow has a pressing issue. The headlines flashed 48K earlier this week, and likely have some looking skyward, to 50K and beyond. That might indeed occur. However, there’s an issue, and it has to do with how the Dow’s quirky weighting system makes it vulnerable today.

Which Stocks Are in the Dow Jones Industrial Average?

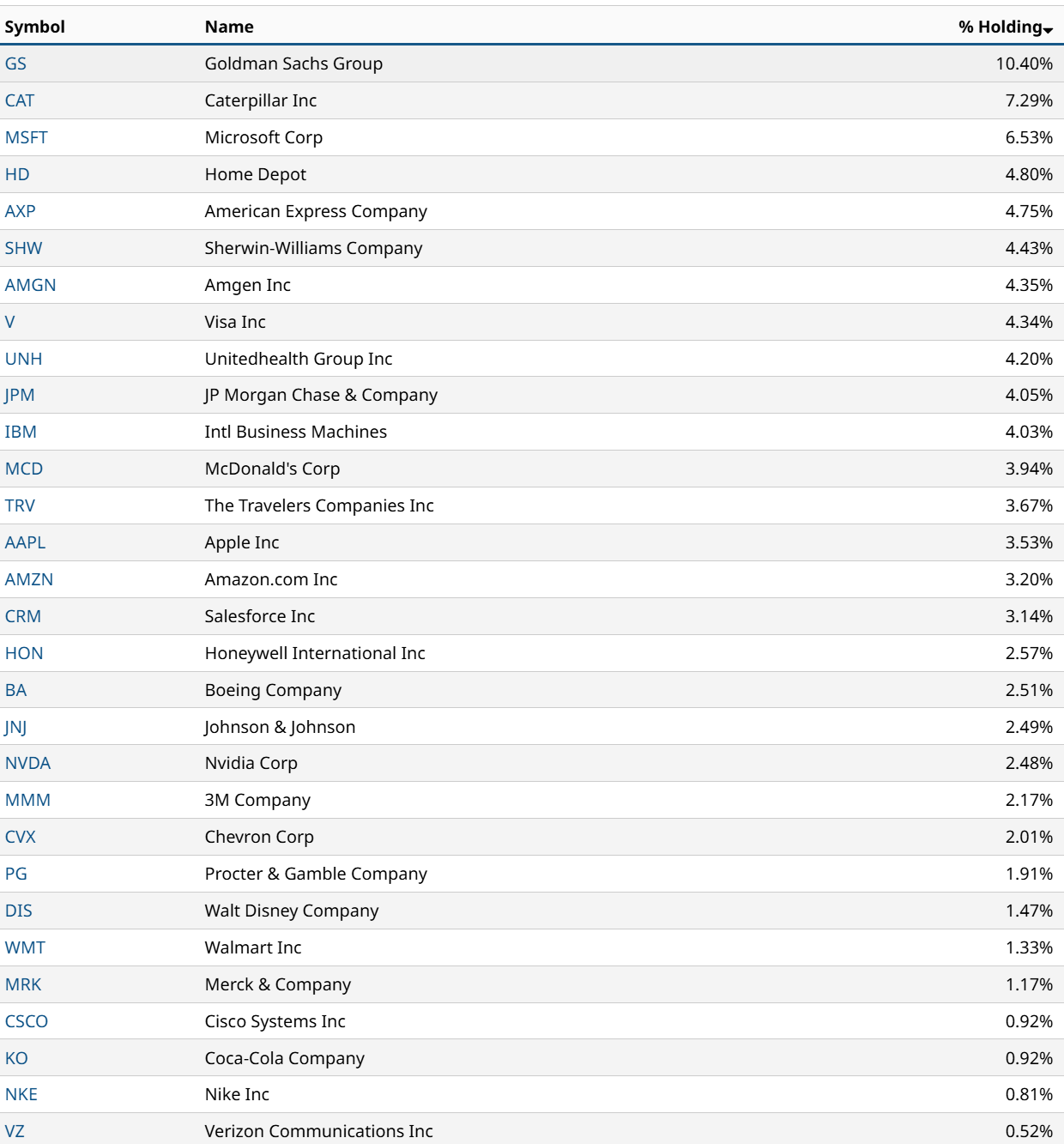

Unlike most major indexes, the Dow Jones Industrial Average is weighted according to the price of a stock, not its market capitalization. That leads to some differences between the Dow and the S&P 500 Index ($SPX). Sometimes that helps. These days, it could hinder.Here’s nearly all of the Dow’s holdings.

The Dow is a large-cap index, and contains several of the biggest stocks in the world. But due to the price weighting system, stocks in the trillion-dollar market cap club do not dominate here. That held the Dow back during the market rally after “Liberation Day” in April.

And at times, for brief periods, the Dow took over market leadership from the Nasdaq-100 Index ($IUXX). But the habit the past few years is that these have tended to be akin to a “flight to quality,” or at least an anti-tech bounce. And not much more.

However when we look forward, there are issues, and they appear at the top of that list above. Because while the Dow is not loaded up size wise the way the S&P 500 and Nasdaq-100 are, it still has a problem with a concentration of holdings.

How Concentrated Are the Dow Industrials?

The venerable Dow, which dates back to the 1800s when railroads were the dominant growth stocks, has nearly 40% of its current allocation in just six stocks. And though only one of them, Microsoft (MSFT), is a Magnificent 7 member, all half dozen big Dow holdings have something in common with those market darlings atop the Nasdaq: They have all appreciated in price, by very large margins. And now appear richly valued.

This is a market finally getting keen to the idea that just as trees don’t grow to the sky, neither do stock prices.

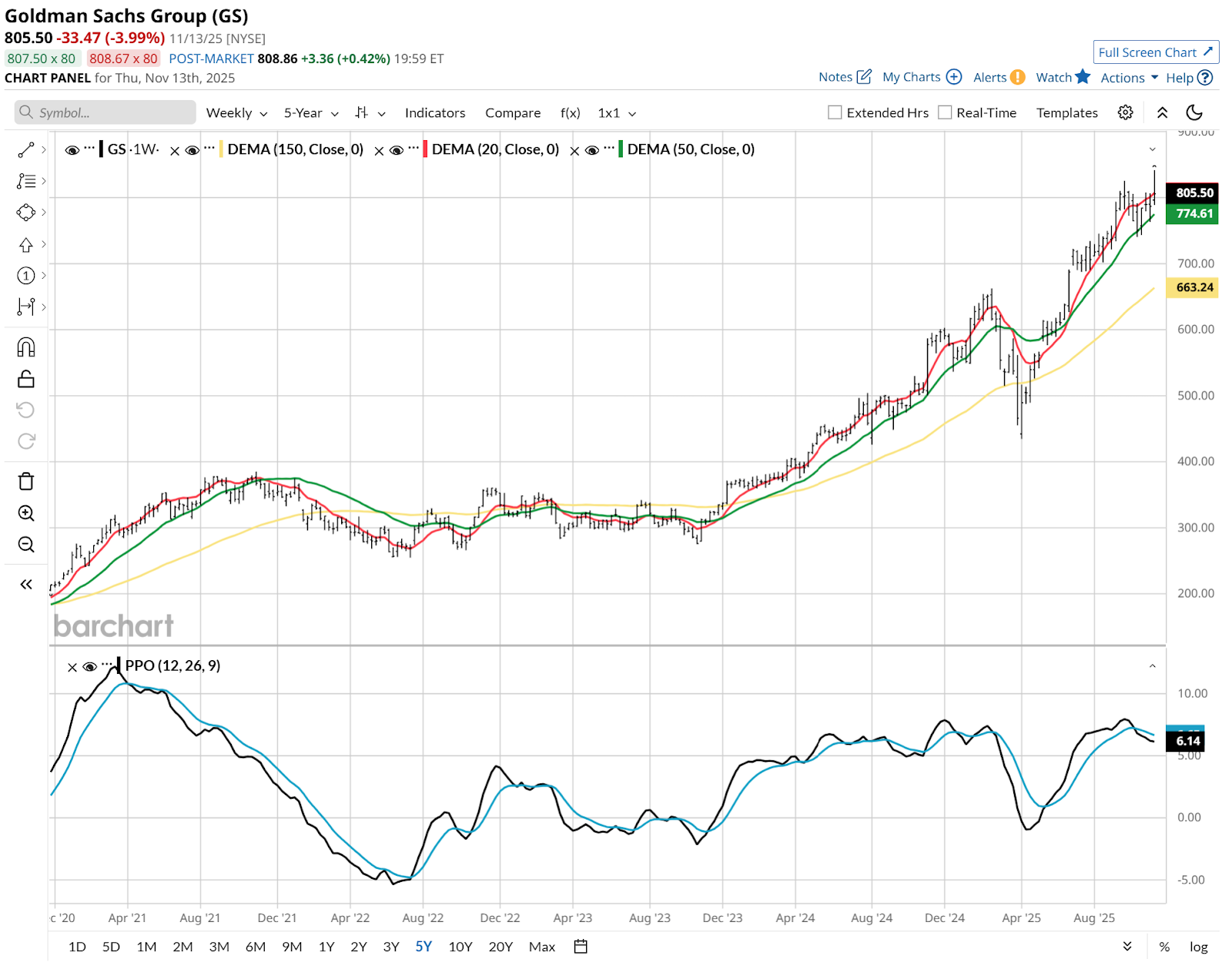

For instance, here’s Goldman Sachs (GS). It is now the Dow’s biggest holding at more than 10%. And while its stock price has not caved in, and potential for lower short-term interest rates could be a boost to financial stocks, this tree has grown quite high.

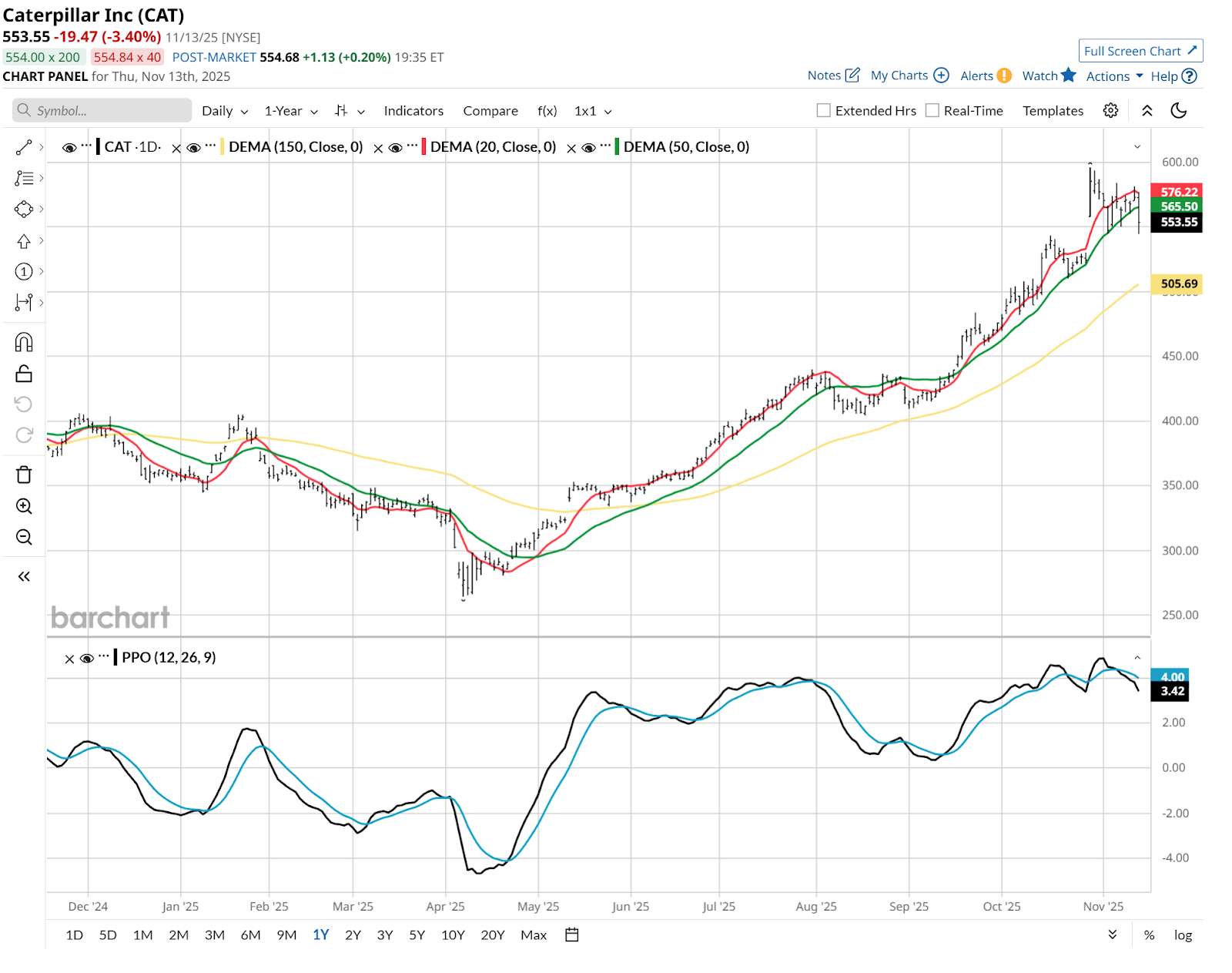

Add Caterpillar (CAT) to GS, and you have more than one-sixth of the full Dow index. And its stock already appears to be topping out. There are more charts like this as I went down the list of 30 stocks than there are stocks that look like their best days are ahead.

Is the Dow 30 a Good Buy Now?

So, like many stock market maladies today, there are signs of bending, but no breaking just yet. The Dow has a tenuous hold on its rally, but 800-point down days like Thursday remind us that this rally is long in tenure. Any analysis of the Dow has to incorporate this.

The valuations themselves are merely what I’d call high, not outrageous. But with liquidity and geopolitical news headlines more impactful than ever, this set of 30 stock market blue-chips is walking a tightrope.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- I’m Old Enough to Remember When a 500-Point-Drop in the Dow Jones Was a Crisis. Now It’s Just a Warning.

- Stock Index Futures Plunge on Fed Rate-Cut Doubts and Valuation Concerns

- Ray Dalio Warns the Next Big Debt Crisis Won’t Come From Banks. It’ll Come From Governments.

- Who Is Phil Clifton? Michael Burry Names Successor as Famed Investor Deregisters Hedge Fund.