McLean, Virginia-based Capital One Financial Corporation (COF) operates as a bank holding company focusing on consumer and commercial lending as well as deposit origination. With a market cap of $140.3 billion, Capital One operates through Credit Card, Consumer Banking, and Commercial Banking segments.

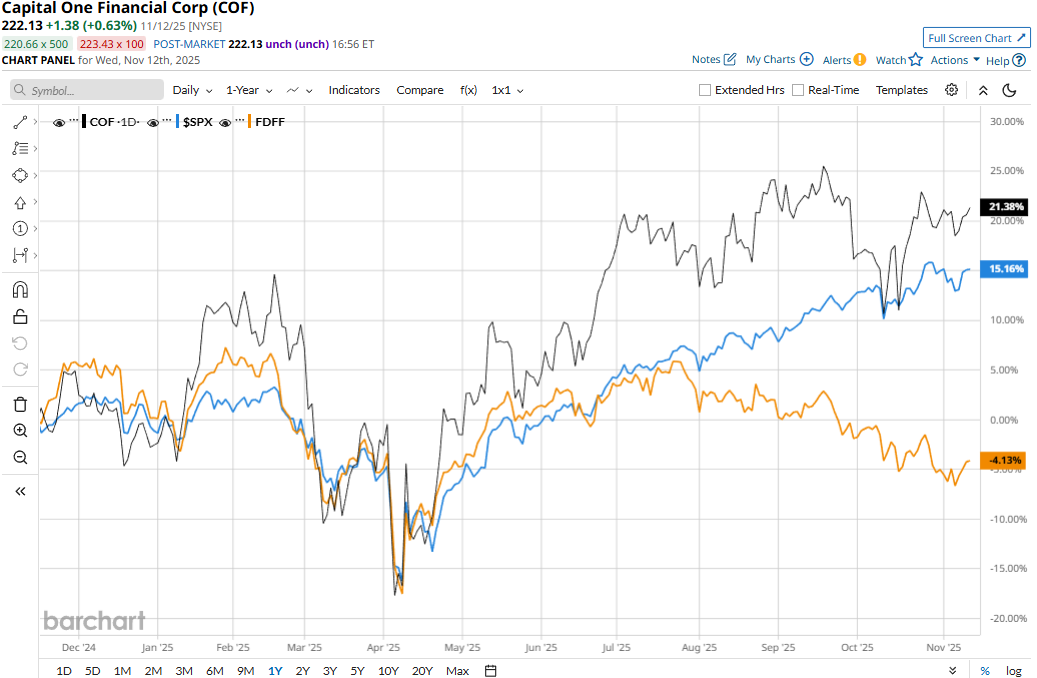

Capital One has significantly outperformed the broader market over the past year. COF stock prices have soared 24.6% on a YTD basis and 18.9% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 16.5% gains in 2025 and 14.5% returns over the past year.

Narrowing the focus, Capital One has also outpaced the industry-focused Fidelity Disruptive Finance ETF’s (FDFF) 4.3% decline on a YTD basis and 5.5% drop over the past 52 weeks.

Capital One Financial’s stock prices gained 1.5% in the trading session following the release of its impressive Q3 results on Oct. 21. The company’s interest income from loans has continued to soar, increasing 44.4% year-over-year to $15.2 billion. After considering other interest income, non-interest income, and interest expenses, the company’s overall topline increased by a solid 23% year-over-year to $15.4 billion, beating the Street’s expectations by 3.1%. Meanwhile, its adjusted EPS came in at $5.95, exceeding the consensus estimates by a staggering 41.7%.

For the full fiscal 2025, ending in December, analysts expect COF to deliver an adjusted EPS of $18.58, up 33.1% year-over-year. Further, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

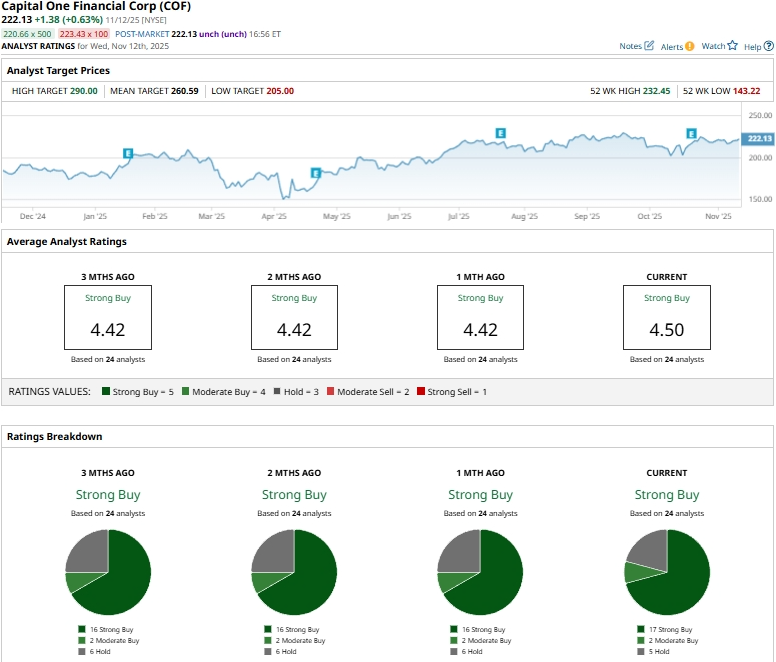

Among the 24 analysts covering the COF stock, the consensus rating is a “Strong Buy.” That’s based on 17 “Strong Buys,” two “Moderate Buys,” and five “Holds.”

This configuration is slightly more optimistic than a month ago, when 16 analysts gave “Strong Buy” recommendations.

On Oct. 22, Morgan Stanley (MS) analyst Betsy Graseck maintained an “Overweight” rating on COF and raised the price target from $267 to $272.

COF’s mean price target of $260.59 represents a 17.3% premium to current price levels. Meanwhile, the street-high target of $290 suggests a 30.6% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is This Dividend Stock a Buy for 2026 After More Than Doubling This Year?

- 4 Reasons to Roll Your Covered Call Option and Keep Your Income Strategy Alive

- AMD Says Data Center Revenue Could Jump 60% Annually from Here. Should You Buy AMD Stock Now?

- Circle Stock Enters Oversold Territory on Earnings Plunge. Should You Buy the Dip?