With a market cap of $29.4 billion, Fox Corporation (FOXA) is a leading U.S.-based media company that delivers news, sports, and entertainment content through its well-known brands, including FOX News, FOX Sports, the FOX Network, and Tubi. Operating across four main segments - Cable Network Programming; Television; Credible; and The FOX Studio Lot, it serves audiences via traditional and digital platforms.

Shares of the New York-based company have significantly outperformed the broader market over the past 52 weeks. FOXA stock has surged 47.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12.7%. Moreover, shares of the company are up 35.8% on a YTD basis, compared to SPX’s 14.4% gain.

Focusing more closely, shares of the TV broadcasting company have also outpaced the Communication Services Select Sector SPDR ETF Fund’s (XLC) 16% return over the past 52 weeks.

Shares of Fox Corporation climbed 7.7% on Oct. 30 after the company reported Q1 2026 adjusted EPS of $1.51 and revenue of $3.74 billion, topping expectations. The strong results were driven by Tubi’s first profitable quarter, where ad revenue jumped 27% and viewing time rose 18%, alongside robust NFL ratings up 12% year-over-year. Additionally, Fox announced a $1.5 billion share buyback, boosting investor confidence in its digital growth and live programming strategy despite broader cable market softness.

For the fiscal year ending in June 2026, analysts expect FOXA’s adjusted EPS to decline 7.7% year-over-year to $4.41. However, the company's earnings surprise history is strong. It beat the consensus estimates in the last four quarters.

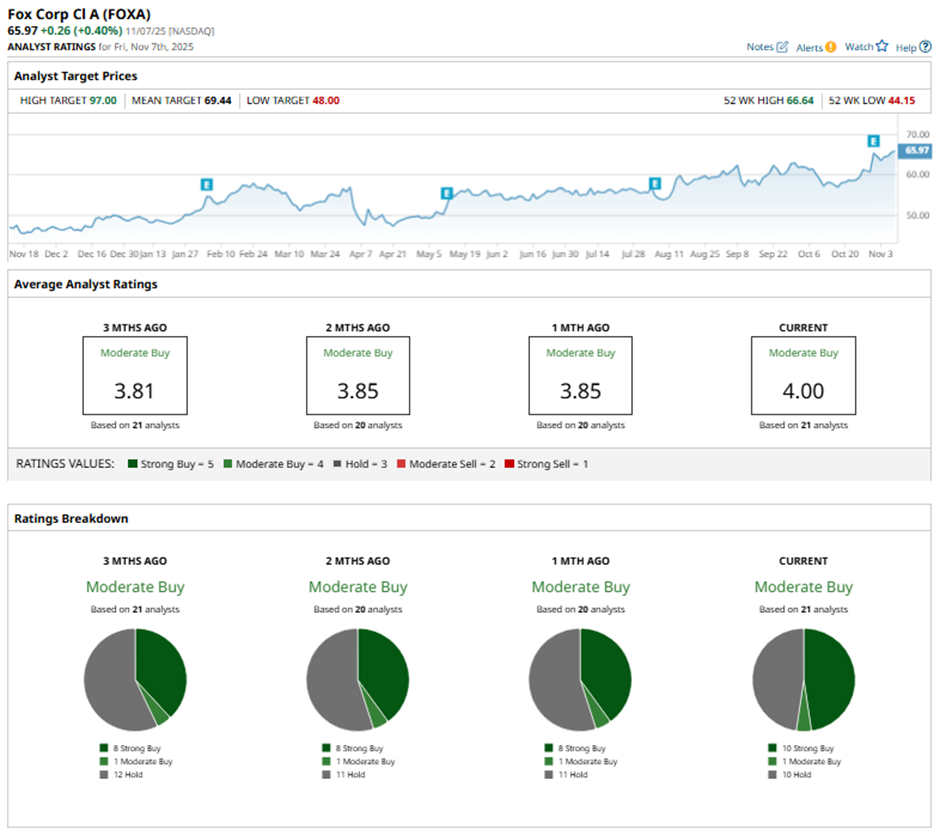

Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, one “Moderate Buy,” and 10 “Holds.”

This configuration is more bullish than three months ago, with eight “Strong Buy” ratings on the stock.

On Oct. 31, Wells Fargo analyst Steven Cahall raised Fox Corp.’s price target to $80 and maintained an “Overweight” rating.

The mean price target of $69.44 represents a premium of 5.3% to FOXA's current price. The Street-high price target of $97 suggests a 47% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- How to Generate Consistent Passive Income Through Dividend Stocks (Without Falling Into Yield Traps)

- SoundHound Stock Just Got a New Street-High Price Target. Should You Buy SOUN Here?

- Option Volatility and Earnings Report for November 10 - 14

- Stocks Set to Open Sharply Higher as End to U.S. Government Shutdown Nears