Second paragraph, first sentence in Primary Mortgage Origination Rankings section of release should read: The 2019 U.S. Primary Mortgage Origination Satisfaction Study measures overall customer satisfaction based on performance in four factors (in alphabetical order): application/approval process; communication; loan closing; and loan offerings (Instead of The 2019 U.S. Primary Mortgage Origination Satisfaction Study measures customer satisfaction with the mortgage origination experience in six factors (listed alphabetically): application/approval process; interaction; loan closing; loan offerings; onboarding; and problem resolution).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20191114005016/en/

(Graphic: Business Wire)

Also, please replace the photo with the accompanying corrected photo.

The corrected release reads:

MORTGAGE CUSTOMER SATISFACTION IMPROVES BUT LOAN BOOM REVEALS FOUNDATION CRACKS, J.D. POWER FINDS

Quicken Loans Ranks Highest in Customer Satisfaction for 10th Consecutive Year

Overall customer satisfaction with primary mortgage originators has improved throughout most of 2019 but dropped off significantly in Q2 as loan origination volume surged. According to the J.D. Power 2019 U.S. Primary Mortgage Origination Satisfaction Study,SM released today, the industry’s inability to maintain consistently high levels of customer satisfaction throughout swings in the credit cycle is the key to understanding the current challenges mortgage lenders face.

“Mortgage originators have been consistently transforming their businesses by adding self-service technology tools and reducing customer-facing staff, but when put to the test by an unexpected surge in refinancing volume, this approach fell short of customer expectations,” said John Cabell, Director of Wealth and Lending Intelligence at J.D. Power. “It is critical that originators get the balance right between tech and staffing to be able to deal with the swings in loan volume that can dramatically change from month to month.”

Following are some key findings of the 2019 study:

- Customer satisfaction inversely correlated to origination volume: While overall customer satisfaction with mortgage originators is up 14 points (on a 1,000-point scale) from 2018, those satisfaction levels declined sharply in Q2 2019 as the total mortgage origination growth rate climbed 54% from the previous quarter. Overall satisfaction fell to 853 in Q2 from 869 in Q1 2019, with a particularly higher decline among customers buying a home than among those refinancing.

- Much of loan origination process managed manually via email and phone: Despite the industry’s push toward digital self-service tools and mobile apps, the lion’s share of customer interaction is occurring via email (70% utilization rate) and phone (63% utilization rate). Just 15% of customers indicate using their mortgage originator’s mobile app.

- Real-time status updates are key to effective digital communication: Overall satisfaction scores are 140 points higher, on average, when mortgage customers are provided—and use—real-time access to the status of their loan via an online portal than when no such access is provided.

- Intermediaries negatively influence the experience: Overall satisfaction with their lender and trust are significantly lower among customers who worked with their lender through a broker or real estate agent/builder. The involvement of these third-party intermediaries drops satisfaction by as much as 40 points and trust by as much as 50 points. These differences underscore the ongoing challenges that lenders have in controlling the loan experience.

- Many refinance customers open to alternative financing options: Nearly two-thirds (63%) of all mortgage customers chose to refinance their loan for more favorable terms. Among the remaining 37%—those looking to consolidate debt or cash out equity—approximately half considered other product options such as home equity loans and personal lines of credit.

Primary Mortgage Origination Rankings

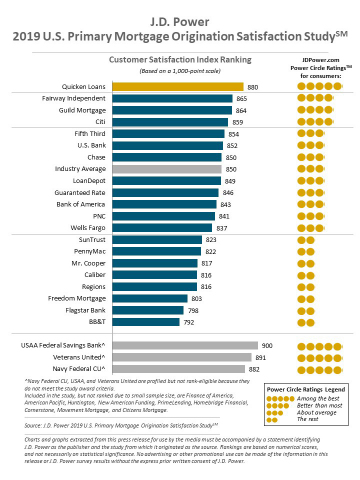

Quicken Loans ranks highest in mortgage origination satisfaction for a 10th consecutive year, achieving a score of 880. Fairway Independent (865) ranks second and Guild Mortgage Company (864) ranks third.

The 2019 U.S. Primary Mortgage Origination Satisfaction Study measures overall customer satisfaction based on performance in four factors (in alphabetical order): application/approval process; communication; loan closing; and loan offerings. The study was fielded in July-August 2019 and is based on responses from 4,602 customers who originated a new mortgage or refinanced within the past 12 months.

For more information about the U.S. Primary Mortgage Origination Satisfaction Study, visit https://www.jdpower.com/resource/us-primary-mortgage-origination-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2019220.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, South America, Asia Pacific and Europe.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20191114005016/en/

Contacts:

John Roderick; St. James, N.Y.; 631-584-2200; john@jroderick.com