BERLIN, MD / ACCESSWIRE / May 3, 2018 / Calvin B. Taylor Bankshares, Inc. (the "Company") (OTCQX: TYCB), parent company of Calvin B. Taylor Bank, today reported unaudited financial results for the quarter ended March 31, 2018. Selected highlights of the company's financial performance are included below.

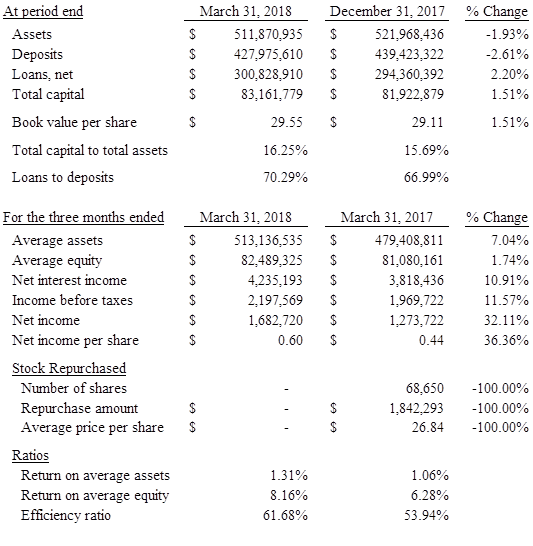

Total assets were $511.9 million at March 31, 2018, which is a decrease of $10.1 million or 1.9% since December 31, 2017. The decrease in total assets during the first quarter is the result of seasonal outflows of deposits that decreased total deposits to $428.0 million as of March 31, 2018, a decrease of $11.4 million or 2.6% since December 31, 2017. Seasonal deposit outflows were primarily funded by reductions in cash and cash equivalents, which decreased $9.9 million or 13.3% since December 31, 2017 and totaled $64.2 million at March 31, 2018. Furthermore, the Company continued to experience growth in net loans, which increased $6.5 million or 2.2% since December 31, 2017 and totaled $300.8 million at March 31, 2018.

Income before taxes for the quarter ended March 31, 2018 was $2.2 million, an increase of $228 thousand or 11.6% compared to the same quarter last year. The primary contributor to the increase in income before taxes was a $417 thousand or 10.9% increase in net interest income resulting from a combination of organic loan growth, higher investment yields and increases in the Federal Funds interest rate. In addition, non-interest income for the quarter ended March 31, 2018 increased $393 thousand or 76.8% primarily as a result of a $389 thousand gain recognized upon the sale of an investment security. Partially offsetting these increases was a $607 thousand or 26.0% increase in non-interest expense, primarily as the result of a $411 thousand loss recorded from an unauthorized wire transfer by a bank employee on February 27, 2018. The unauthorized wire transfer was previously disclosed as a subsequent event in the Company's 2017 financial statements. Subsequent to the issuance of the 2017 financial statements and prior to March 31, 2018 it was determined by Company management that the customer did not authorize the wire transfer, the wired funds could not be recovered from the recipient bank, and the loss will not be covered by any of the Company's insurance policies. As a result of this determination, the unauthorized wire loss, as well as related legal fees of approximately $20 thousand, were recorded in the quarter ended March 31, 2018. At this time, management believes that the financial impact of the unauthorized wire transfer has been fully recorded. The increase in non-interest expense associated with the unauthorized wire loss also resulted in an increase in the Company's efficiency ratio to 61.7% as compared to 53.9% the same quarter last year.

Net income for the quarter ended March 31, 2018 was $1.7 million, an increase of $409 thousand or 32.1% compared to the same quarter last year. The increase in net income was a result of the $228 thousand increase in income before taxes as noted above and a $181 thousand reduction in income tax expense. In December 2017, the Tax Cut and Jobs Act was enacted, which decreased the Company's federal income tax rate from 34% to 21% beginning January 1, 2018. As a result, the Company's effective income tax rate has dropped from 34.4% in 2017 to an estimated 23.8% for 2018.

Net income growth outpaced growth in average assets and average equity, which resulted in an increase in Return on Average Assets from 1.06% to 1.31% and an increase in Return on Equity from 6.28% to 8.16%. Earnings per share increased 36.4% to $0.60 per share for the quarter ended March 31, 2018, compared to $0.44 per share for the quarter ended March 31, 2017.

About Calvin B. Taylor Banking Company

Calvin B. Taylor Banking Company, the bank subsidiary of Calvin B. Taylor Bankshares, Inc., founded in 1890, offers a wide range of loan, deposit, and ancillary banking services through both physical and digital delivery channels. The Company has 11 banking locations within the eastern coastal area of the Delmarva Peninsula including Worcester County, Maryland, Sussex County, Delaware and Accomack County, Virginia. The Company also has a loan production office located in Onley, Virginia.

Contact

M. Dean Lewis, Vice President and Chief Financial Officer

410-641-1700

SOURCE: Calvin B. Taylor Bankshares, Inc.