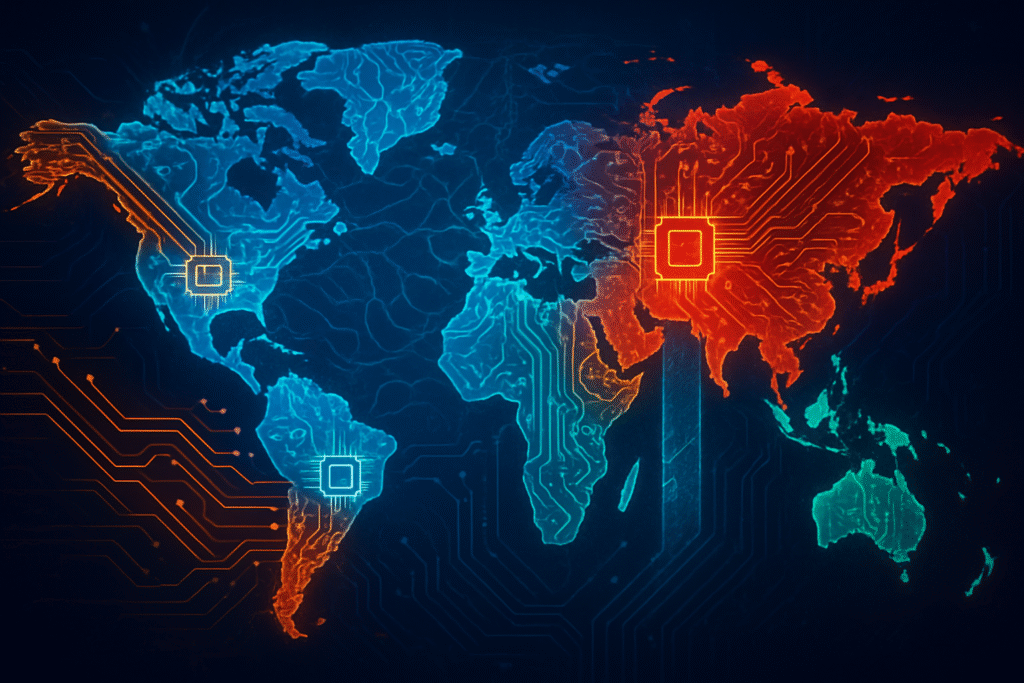

The global semiconductor industry, the bedrock of modern technology and artificial intelligence, is currently (October 2025) undergoing a profound and unprecedented transformation. Driven by escalating geopolitical tensions, strategic trade policies, and recent disruptive events, the era of a globally optimized, efficiency-first semiconductor supply chain is rapidly giving way to fragmented, regional manufacturing ecosystems. This seismic shift signifies a fundamental re-evaluation of national security, economic power, and technological leadership, placing semiconductors at the heart of 21st-century global power struggles and fundamentally altering the landscape for AI development and deployment worldwide.

The Great Decoupling: A New Era of Techno-Nationalism

The current geopolitical landscape is characterized by a "great decoupling," with a "Silicon Curtain" descending that divides technological ecosystems. This fragmentation is primarily fueled by the intense tech rivalry between the United States and China, compelling nations to prioritize "techno-nationalism" and aggressively invest in domestic chip manufacturing. The historical concentration of advanced chip manufacturing in East Asia, particularly Taiwan, has exposed a critical vulnerability that major economic blocs like the U.S. and the European Union are actively seeking to mitigate. This strategic competition has led to a barrage of new trade policies and international maneuvering, fundamentally altering how semiconductors are designed, produced, and distributed.

The United States has progressively tightened export controls on advanced semiconductors and related manufacturing equipment to China, with significant expansions occurring in October 2023, December 2024, and March 2025. These measures specifically target China's access to high-end AI chips, supercomputing capabilities, and advanced chip manufacturing tools, utilizing the Foreign Direct Product Rule and expanded Entity Lists. In a controversial recent development, the Trump administration is reportedly allowing certain NVIDIA (NASDAQ: NVDA) H20 chips to be sold to China, but with a condition: NVIDIA (NASDAQ: NVDA) and AMD (NASDAQ: AMD) must pay the U.S. government 15% of their revenues from these sales, signaling a shift towards using export controls as a revenue source and a bargaining chip. Concurrently, the CHIPS and Science Act, enacted in August 2022, commits over $52 billion to boost domestic chip production and R&D, aiming to triple U.S. manufacturing capacity by 2032. This legislation has spurred over $500 billion in private-sector investments, with major beneficiaries including Intel (NASDAQ: INTC), which has committed over $100 billion, TSMC (NYSE: TSM), expanding with three leading-edge fabs in Arizona with over $65 billion in investment and $6.6 billion in CHIPS Act subsidies, and Samsung (KRX: 005930), investing $37 billion in a new Texas factory. Further escalating tensions, the Trump administration announced 100% tariffs on all Chinese goods starting November 1, 2025.

China has responded by weaponizing its dominance in rare earth elements, critical for semiconductor manufacturing. Sweeping export controls on rare earths and associated technologies were significantly expanded in April and October 2025. On October 9, 2025, Beijing implemented new regulations requiring government export licenses for rare earths used in semiconductor manufacturing or testing equipment, specifically targeting sub-14-nanometer chips and high-spec memory. Exports to U.S. defense industries have been effectively banned since December 1, 2025. Additionally, China added 28 U.S. companies to its "unreliable entities list" in early January 2025 and, more recently, on October 9, 2025, imposed export restrictions on components manufactured by Nexperia's China facilities, prohibiting them from leaving the country, following the Dutch government's seizure of Nexperia. The European Union, through its European Chips Act (September 2023), mobilizes over €43 billion to double its global market share to 20% by 2030, though it faces challenges, with Intel (NASDAQ: INTC) abandoning plans for a large-scale facility in Germany in July 2025. All 27 EU Member States have called for a stronger "Chips Act 2.0" to reinforce Europe's position.

Reshaping the Corporate Landscape: Winners, Losers, and Strategic Shifts

These geopolitical machinations are profoundly affecting AI companies, tech giants, and startups, creating a volatile environment of both opportunity and significant risk. Companies with diversified manufacturing footprints or those aligned with national strategic goals stand to benefit from the wave of government subsidies and incentives.

Intel (NASDAQ: INTC) is a primary beneficiary of the U.S. CHIPS Act, receiving substantial funding to bolster its domestic manufacturing capabilities, aiming to regain its leadership in process technology. Similarly, TSMC (NYSE: TSM) and Samsung (KRX: 005930) are making significant investments in the U.S. and Europe, leveraging government support to de-risk their supply chains and gain access to new markets, albeit at potentially higher operational costs. This strategic diversification is critical for TSMC (NYSE: TSM), given Taiwan's pivotal role in advanced chipmaking (over 90% of 3nm and below chips) and rising cross-strait tensions. However, companies heavily reliant on a single manufacturing region or those caught in the crossfire of export controls face significant headwinds. SK Hynix (KRX: 000660) and Samsung (KRX: 005930) had their authorizations revoked by the U.S. Department of Commerce in August 2025, barring them from procuring U.S. semiconductor manufacturing equipment for their chip production units in China, severely impacting their operational flexibility and expansion plans in the region.

The Dutch government's seizure of Nexperia on October 12, 2025, citing "serious governance shortcomings" and economic security risks, followed by China's retaliatory export restrictions on Nexperia's China-manufactured components, highlights the unpredictable nature of this geopolitical environment. Such actions create significant uncertainty, disrupt established supply chains, and can lead to immediate operational challenges and increased costs. The fragmentation of the supply chain is already leading to increased costs, with advanced GPU prices potentially seeing hikes of up to 20% due to disruptions. This directly impacts AI startups and research labs that rely on these high-performance components, potentially slowing innovation or increasing the cost of AI development. Companies are shifting from "just-in-time" to "just-in-case" supply chain strategies, prioritizing resilience over economic efficiency. This involves multi-sourcing, geographic diversification of manufacturing (e.g., "semiconductor corridors"), enhanced supply chain visibility with AI-powered analytics, and strategic buffer management, all of which require substantial investment and strategic foresight.

Broader Implications: A Shift in Global Power Dynamics

The geopolitical reshaping of the semiconductor supply chain extends far beyond corporate balance sheets, touching upon national security, economic stability, and the future trajectory of AI development. This "great decoupling" reflects a fundamental shift in global power dynamics, where technological sovereignty is increasingly equated with national security. The U.S.-China tech rivalry is the dominant force, pushing for technological decoupling and forcing nations to choose sides or build independent capabilities.

The implications for the broader AI landscape are profound. Access to leading-edge chips is crucial for training and deploying advanced large language models and other AI systems. Restrictions on chip exports to certain regions could create a bifurcated AI development environment, where some nations have access to superior hardware, leading to a technological divide. Potential concerns include the weaponization of supply chains, where critical components become leverage in international disputes, as seen with China's rare earth controls. This could lead to price volatility and permanent shifts in global trade patterns, impacting the affordability and accessibility of AI technologies. The current scenario contrasts sharply with the pre-2020 globalized model, where efficiency and cost-effectiveness drove supply chain decisions. Now, resilience and national security are paramount, even if it means higher costs and slower innovation cycles in some areas. The formation of alliances, such as the emerging India-Japan-South Korea trilateral, driven by mutual ideals and a desire for a self-sufficient semiconductor ecosystem, underscores the urgency of building alternative, trusted supply chains, partly in response to growing resentment against U.S. tariffs.

The Road Ahead: Fragmented Futures and Emerging Opportunities

Looking ahead, the semiconductor industry is poised for continued fragmentation and strategic realignment, with significant near-term and long-term developments on the horizon. The aggressive pursuit of domestic manufacturing capabilities will continue, leading to the construction of more regional fabs, particularly in the U.S., Europe, and India. This will likely result in a more distributed, albeit potentially less efficient, global production network.

Expected near-term developments include further tightening of export controls and retaliatory measures, as nations continue to jockey for technological advantage. We may see more instances of government intervention in private companies, similar to the Nexperia seizure, as states prioritize national security over market principles. Long-term, the industry is likely to settle into distinct regional ecosystems, each with its own supply chain, potentially leading to different technological standards and product offerings in various parts of the world. India is emerging as a significant player, implementing the Production Linked Incentive (PLI) scheme and approving multiple projects to boost its chip production capabilities by the end of 2025, signaling a potential new hub for manufacturing and design. Challenges that need to be addressed include the immense capital expenditure required for new fabs, the scarcity of skilled labor, and the environmental impact of increased manufacturing. While the EU's Chips Act aims to double its market share, it has struggled to gain meaningful traction, highlighting the difficulties in achieving ambitious chip independence. Experts predict that the focus on resilience will drive innovation in areas like advanced packaging, heterogeneous integration, and new materials, as companies seek to optimize performance within fragmented supply chains. Furthermore, the push for domestic production could foster new applications in areas like secure computing, defense AI, and localized industrial automation.

Navigating the New Semiconductor Order

In summary, the global semiconductor supply chain is undergoing a monumental transformation, driven by an intense geopolitical rivalry between the U.S. and China. This has ushered in an era of "techno-nationalism," characterized by aggressive trade policies, export controls, and massive government subsidies aimed at fostering domestic production and securing national technological sovereignty. Key takeaways include the rapid fragmentation of the supply chain into regional ecosystems, the shift from efficiency to resilience in supply chain strategies, and the increasing politicization of technology.

This development holds immense significance in AI history, as the availability and accessibility of advanced chips are fundamental to the future of AI innovation. The emerging "Silicon Curtain" could lead to disparate AI development trajectories across the globe, with potential implications for global collaboration, ethical AI governance, and the pace of technological progress. What to watch for in the coming weeks and months includes further developments in U.S. export control policies and China's retaliatory measures, the progress of new fab constructions in the U.S. and Europe, and how emerging alliances like the India-Japan-South Korea trilateral evolve. The long-term impact will be a more resilient, but likely more expensive and fragmented, semiconductor industry, where geopolitical considerations will continue to heavily influence technological advancements and their global reach.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.