Digital payments platform PayPal (NASDAQ: PYPL) fell short of the markets revenue expectations in Q4 CY2025 as sales rose 3.7% year on year to $8.68 billion. Its non-GAAP profit of $1.23 per share was 4.5% below analysts’ consensus estimates.

Is now the time to buy PayPal? Find out by accessing our full research report, it’s free.

PayPal (PYPL) Q4 CY2025 Highlights:

- Revenue: $8.68 billion vs analyst estimates of $8.78 billion (3.7% year-on-year growth, 1.2% miss)

- Pre-tax Profit: $1.63 billion (18.8% margin)

- Adjusted EPS: $1.23 vs analyst expectations of $1.29 (4.5% miss)

- Market Capitalization: $48.96 billion

Company Overview

Originally spun off from eBay in 2015 after being acquired by the auction giant in 2002, PayPal (NASDAQ: PYPL) operates a global digital payments platform that enables consumers and merchants to send, receive, and process payments online and in person.

Revenue Growth

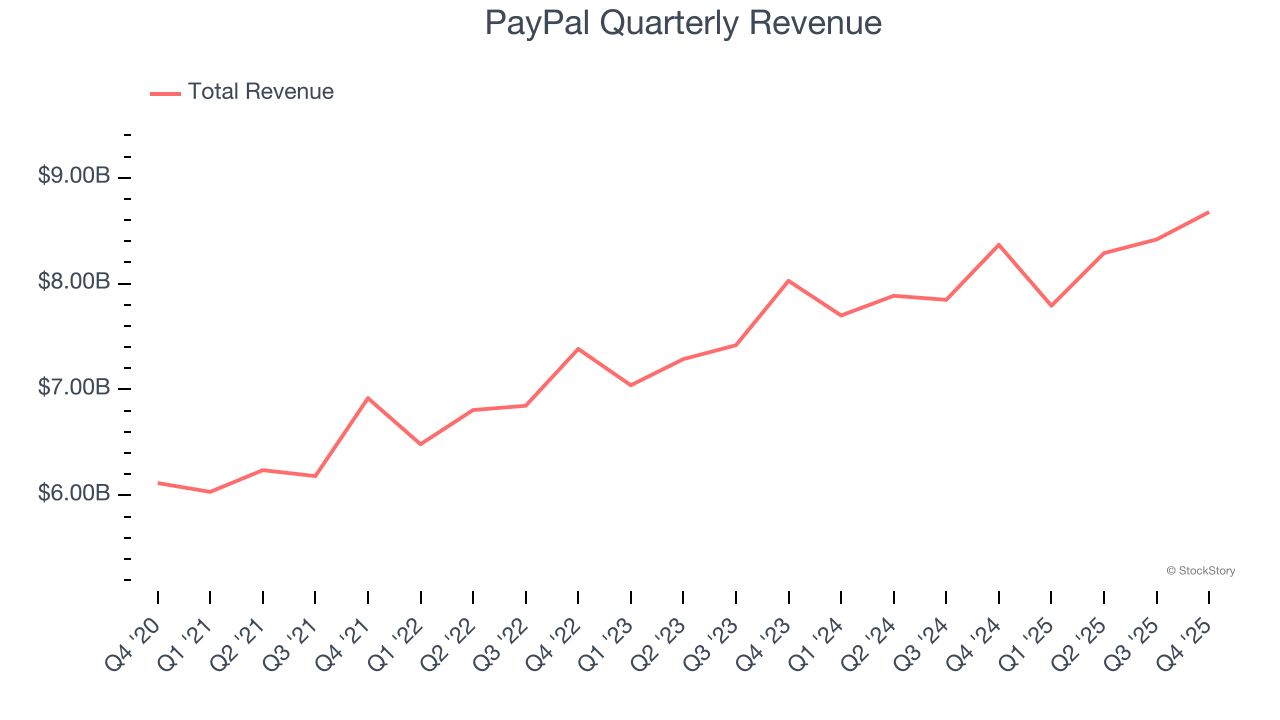

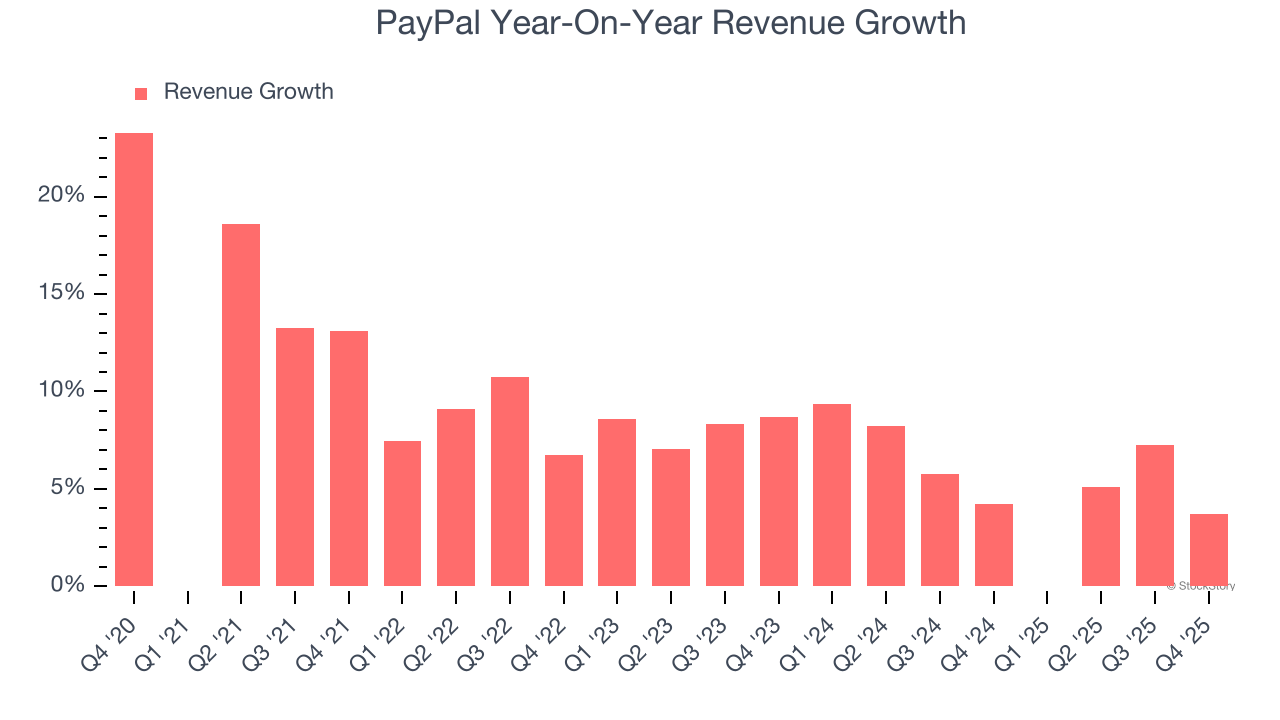

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, PayPal grew its revenue at a decent 9.1% compounded annual growth rate. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. PayPal’s recent performance shows its demand has slowed as its annualized revenue growth of 5.6% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, PayPal’s revenue grew by 3.7% year on year to $8.68 billion, falling short of Wall Street’s estimates.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Key Takeaways from PayPal’s Q4 Results

We struggled to find many positives in these results. Its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 14.6% to $44.86 immediately following the results.

The latest quarter from PayPal’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).