Since July 2025, Academy Sports has been in a holding pattern, floating around $56.96. The stock also fell short of the S&P 500’s 8.1% gain during that period.

Is now the time to buy Academy Sports, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Academy Sports Not Exciting?

We're cautious about Academy Sports. Here are three reasons there are better opportunities than ASO and a stock we'd rather own.

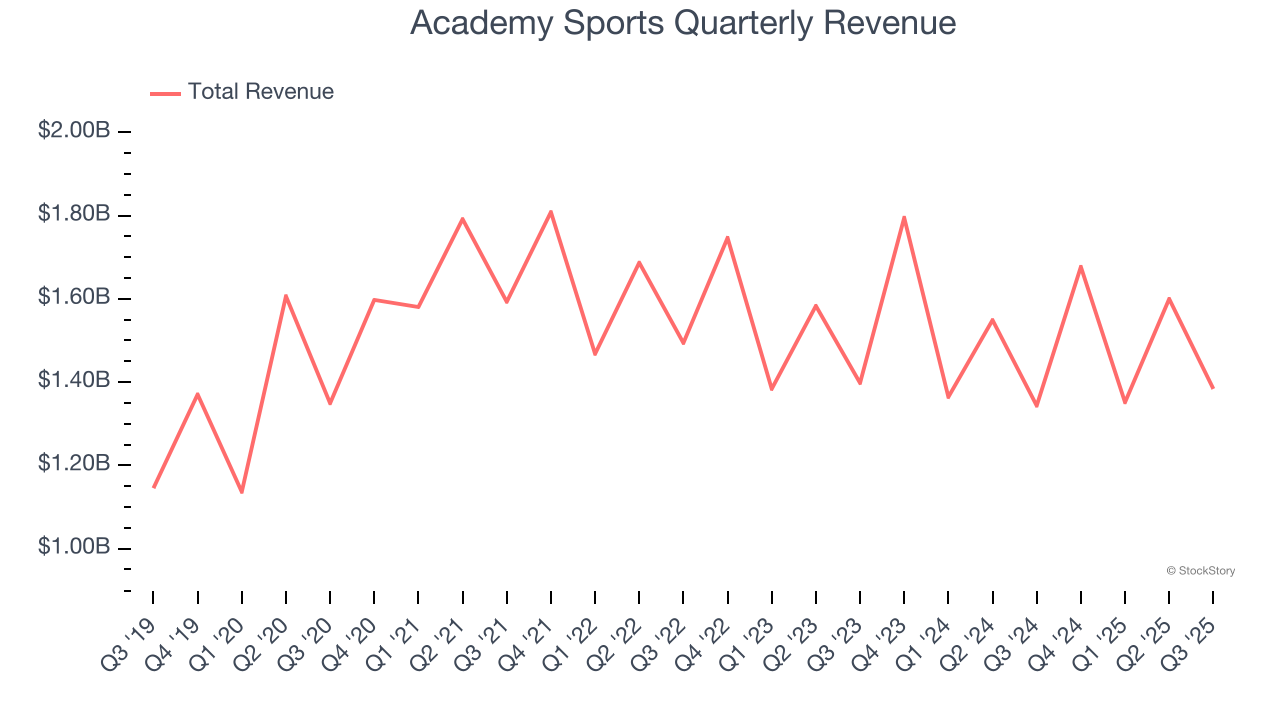

1. Revenue Spiraling Downwards

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Academy Sports’s demand was weak and its revenue declined by 2.4% per year. This was below our standards and is a sign of lacking business quality.

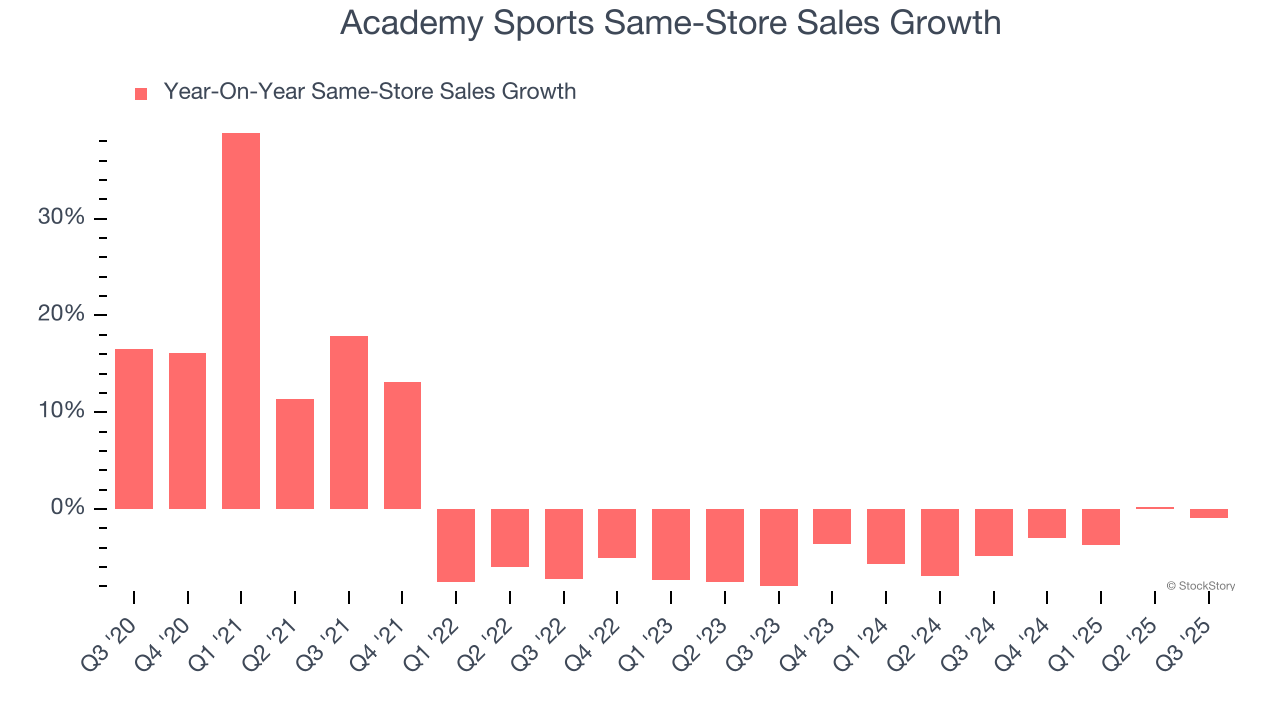

2. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Academy Sports’s demand has been shrinking over the last two years as its same-store sales have averaged 3.6% annual declines.

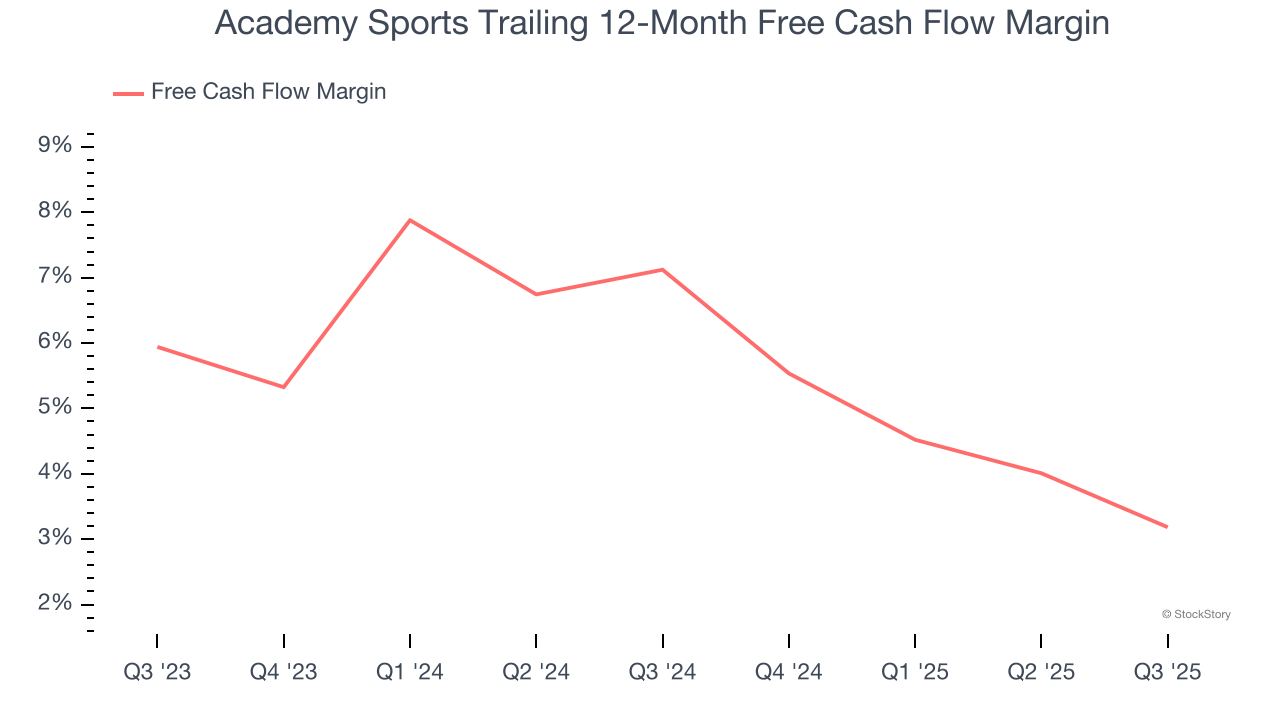

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Academy Sports’s margin dropped by 3.9 percentage points over the last year. This decrease came from the higher costs associated with opening more stores.

Final Judgment

Academy Sports’s business quality ultimately falls short of our standards. With its shares trailing the market in recent months, the stock trades at 9.1× forward P/E (or $56.96 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better investments elsewhere. We’d suggest looking at one of our top software and edge computing picks.

Stocks We Like More Than Academy Sports

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.