Over the past six months, RXO’s shares (currently trading at $15.75) have posted a disappointing 7.5% loss, well below the S&P 500’s 8.1% gain. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy RXO, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is RXO Not Exciting?

Even with the cheaper entry price, we're swiping left on RXO for now. Here are three reasons why RXO doesn't excite us and a stock we'd rather own.

1. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect RXO’s revenue to drop by 2.4%, a decrease from its 13.6% annualized growth for the past five years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

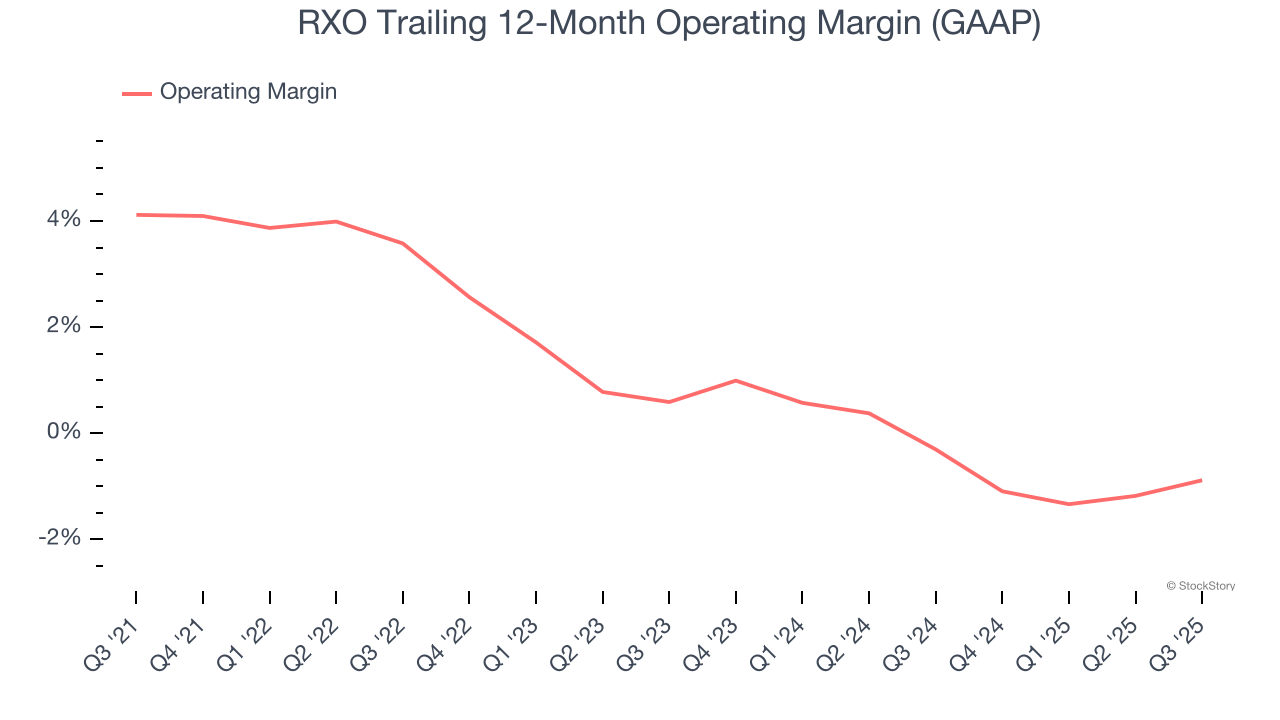

2. Shrinking Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Looking at the trend in its profitability, RXO’s operating margin decreased by 5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. We’ve noticed many Ground Transportation companies also saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction, but RXO’s performance was poor no matter how you look at it. It shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was breakeven.

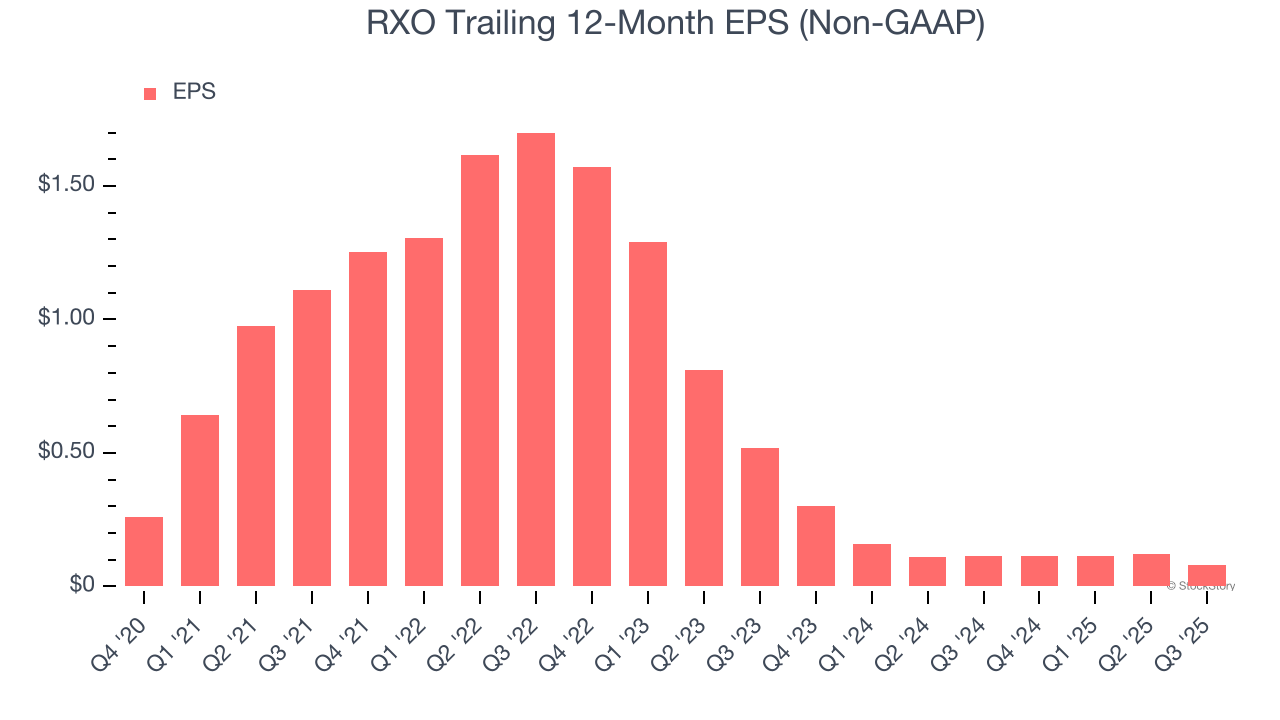

3. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for RXO, its EPS declined by 60.8% annually over the last two years while its revenue grew by 20.8%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

RXO isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 31.5× forward EV-to-EBITDA (or $15.75 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. We’d suggest looking at an all-weather company that owns household favorite Taco Bell.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.