agilon health has gotten torched over the last six months - since July 2025, its stock price has dropped 56.3% to $1.00 per share. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Given the weaker price action, is now an opportune time to buy AGL? Find out in our full research report, it’s free.

Why Does AGL Stock Spark Debate?

Transforming how doctors care for seniors by shifting financial incentives from volume to outcomes, agilon health (NYSE: AGL) provides a platform that helps primary care physicians transition to value-based care models for Medicare patients through long-term partnerships and global capitation arrangements.

Two Things to Like:

1. Customer Base Skyrockets, Fueling Growth Opportunities

Revenue growth can be broken down into the number of customers and the average spend per customer. Both are important because an increasing customer base leads to more upselling opportunities while the revenue per customer shows how successful a company was in executing its upselling strategy.

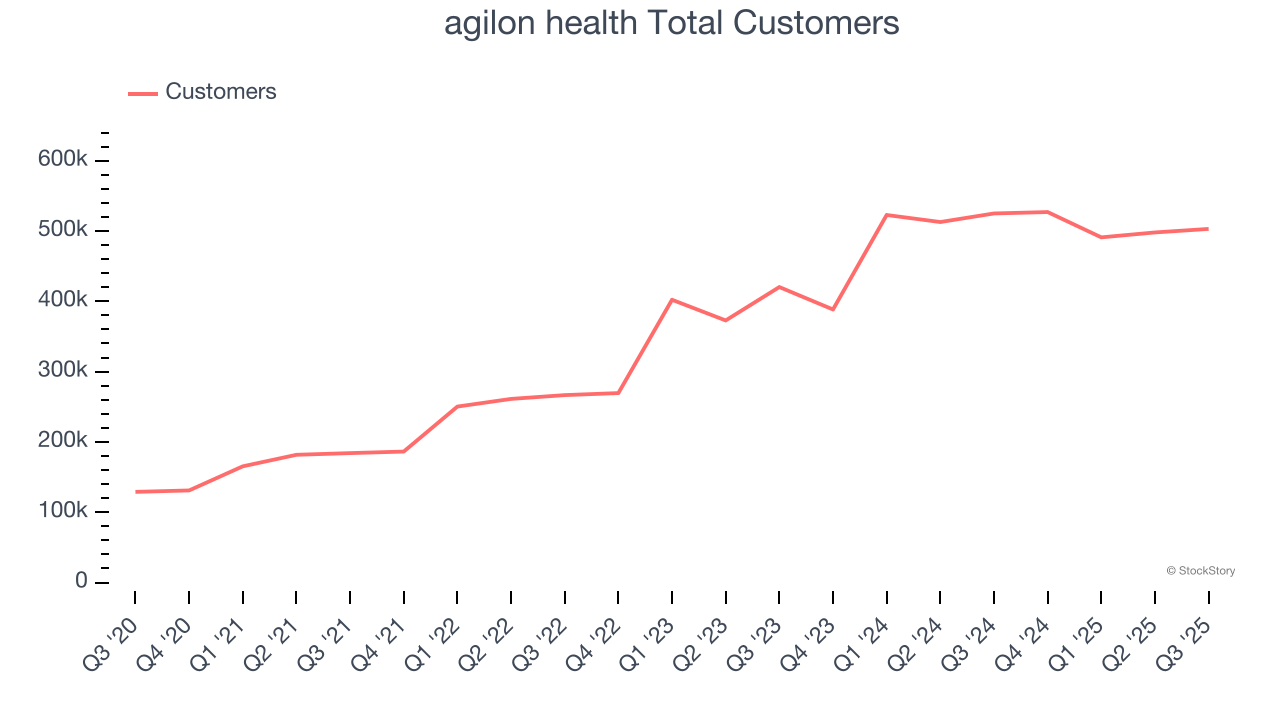

agilon health’s total customers punched in at 503,000 in the latest quarter, and over the last two years, their count averaged 19.9% year-on-year growth. This performance was fantastic, reflecting its ability to "land" new contracts and potentially "expand" them later - a powerful one-two punch for sales.

2. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

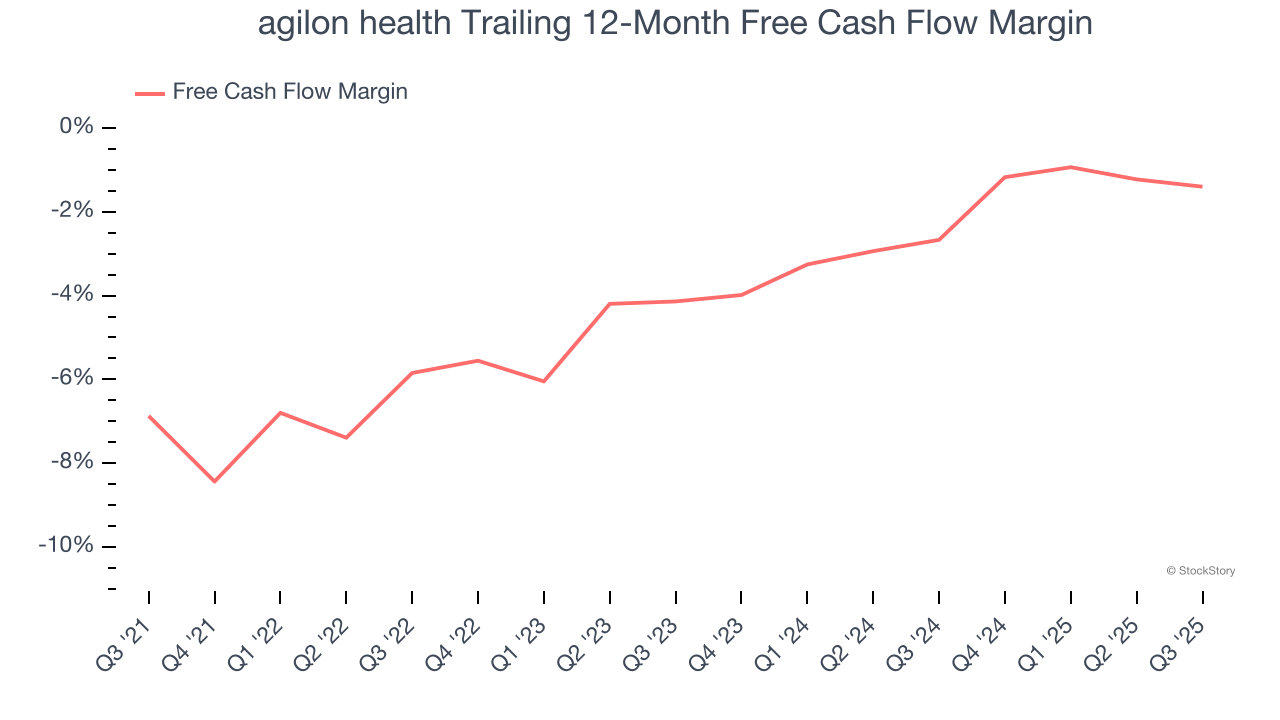

As you can see below, agilon health’s margin expanded by 5.5 percentage points over the last five years. agilon health’s free cash flow margin for the trailing 12 months was negative 1.4%, and continued increases could help it achieve long-term cash profitability.

One Reason to be Careful:

Shrinking Adjusted Operating Margin

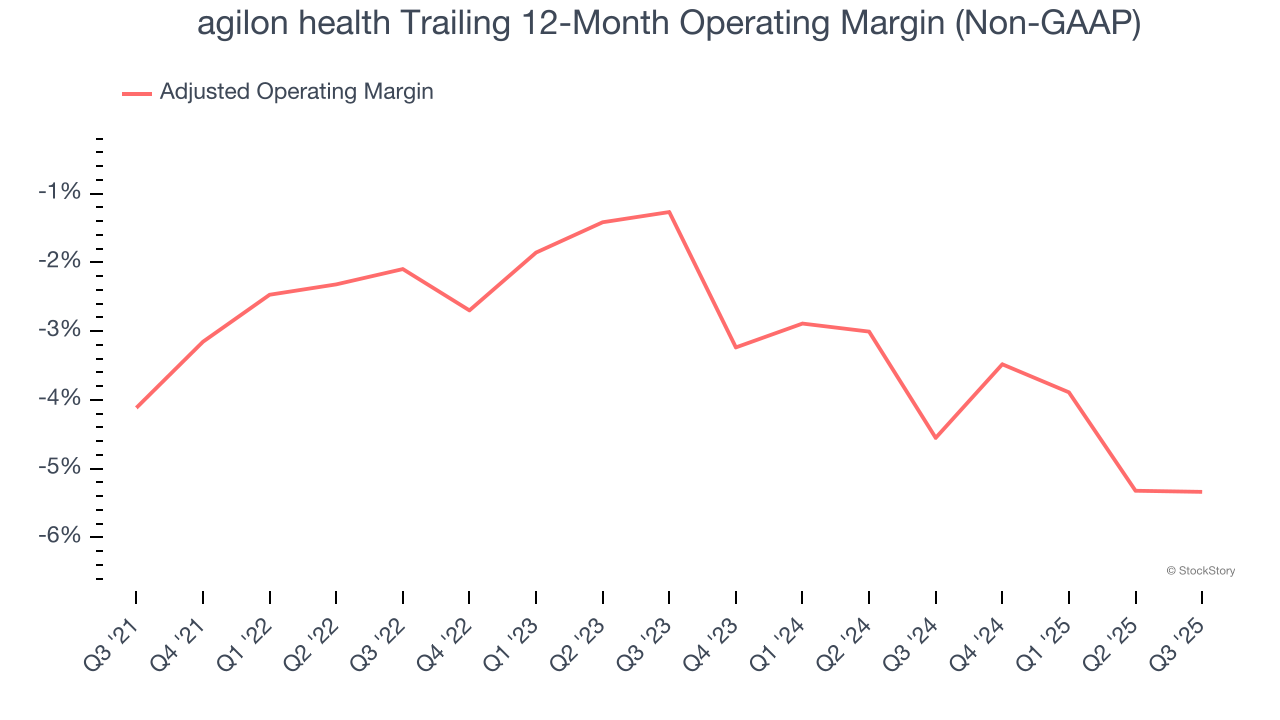

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

Looking at the trend in its profitability, agilon health’s adjusted operating margin decreased by 4.1 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. agilon health’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its adjusted operating margin for the trailing 12 months was negative 5.3%.

Final Judgment

agilon health’s merits more than compensate for its flaws. With the recent decline, the stock trades at $1.00 per share (or a forward price-to-sales ratio of 0.1×). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than agilon health

Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.