Old Second Bancorp has been treading water for the past six months, recording a small return of 4.1% while holding steady at $19.74. The stock also fell short of the S&P 500’s 11.1% gain during that period.

Does this present a buying opportunity for OSBC? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free.

Why Does OSBC Stock Spark Debate?

Dating back to 1871 as one of the Chicago area's longest-standing financial institutions, Old Second Bancorp (NASDAQ: OSBC) is an Illinois-based community bank offering deposit services, commercial and consumer loans, wealth management, and mortgage products through its 53 branch locations.

Two Things to Like:

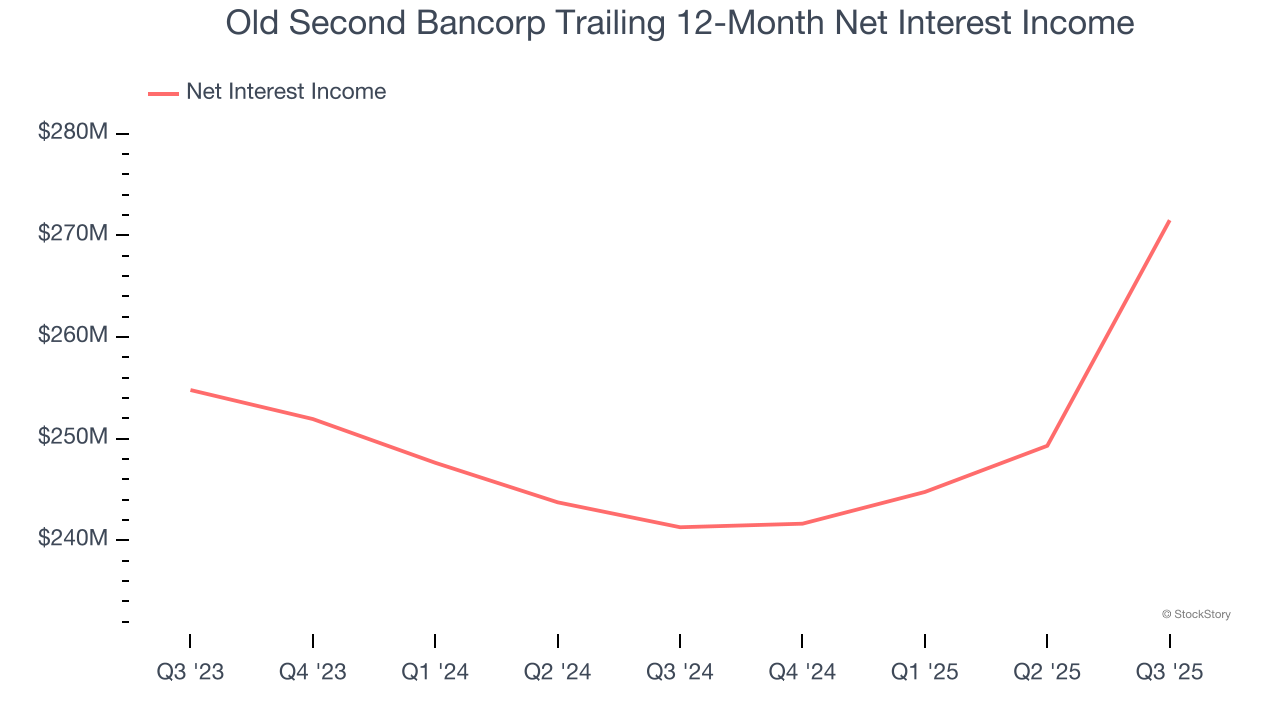

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

Our experience and research show the market cares primarily about a bank’s net interest income growth as one-time fees are considered a lower-quality and non-recurring revenue source.

Old Second Bancorp’s net interest income has grown at a 24.4% annualized rate over the last five years, much better than the broader banking industry and faster than its total revenue. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

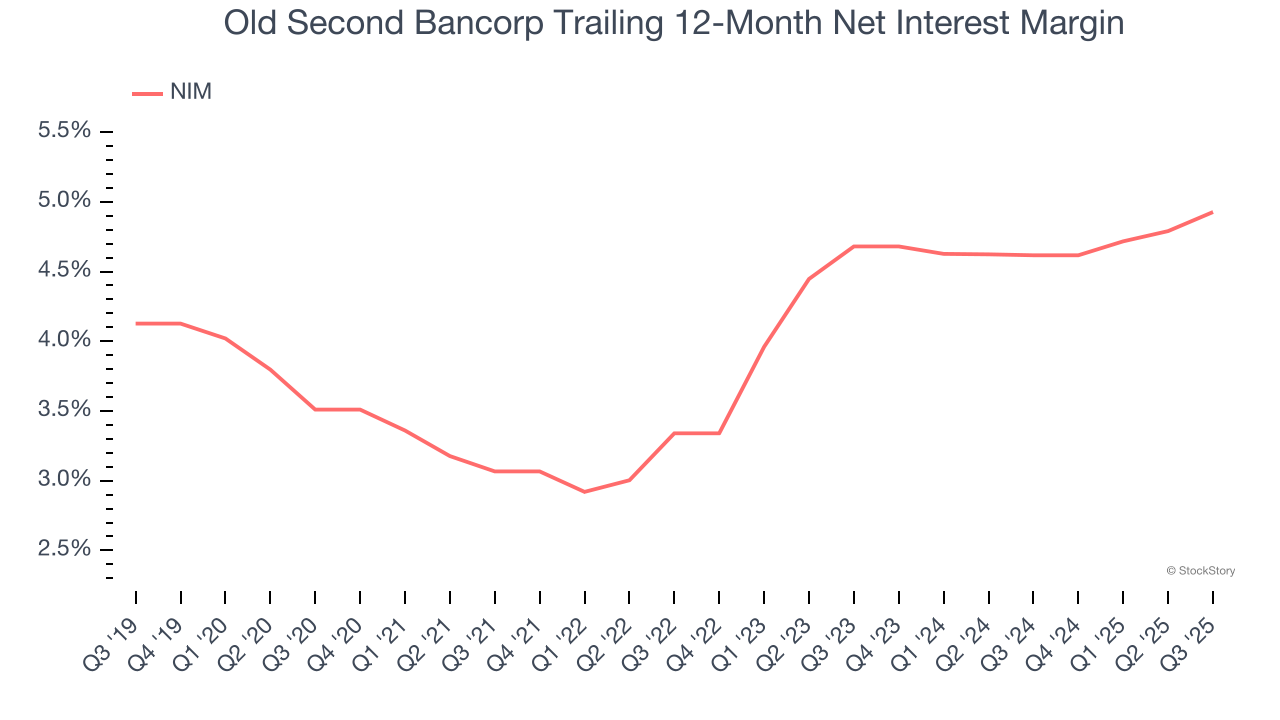

2. Elite Net Interest Margin Powers Best-In-Class Loan Book

Net interest margin (NIM) serves as a critical gauge of a bank's fundamental profitability by showing the spread between interest income and interest expenses. It's essential for understanding whether a firm can sustainably generate returns from its lending operations.

Over the past two years, we can see that Old Second Bancorp’s net interest margin averaged an elite 4.8%, indicating the company has a high-yielding loan book and a low cost of funds.

One Reason to be Careful:

Lackluster Revenue Growth

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. Old Second Bancorp’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 4.7% over the last two years was well below its five-year trend.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Final Judgment

Old Second Bancorp’s merits more than compensate for its flaws. With its shares trailing the market in recent months, the stock trades at 1.2× forward P/B (or $19.74 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.