Let’s dig into the relative performance of Belden (NYSE: BDC) and its peers as we unravel the now-completed Q2 electronic components earnings season.

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

The 10 electronic components stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 4.8% while next quarter’s revenue guidance was in line.

Luckily, electronic components stocks have performed well with share prices up 15.7% on average since the latest earnings results.

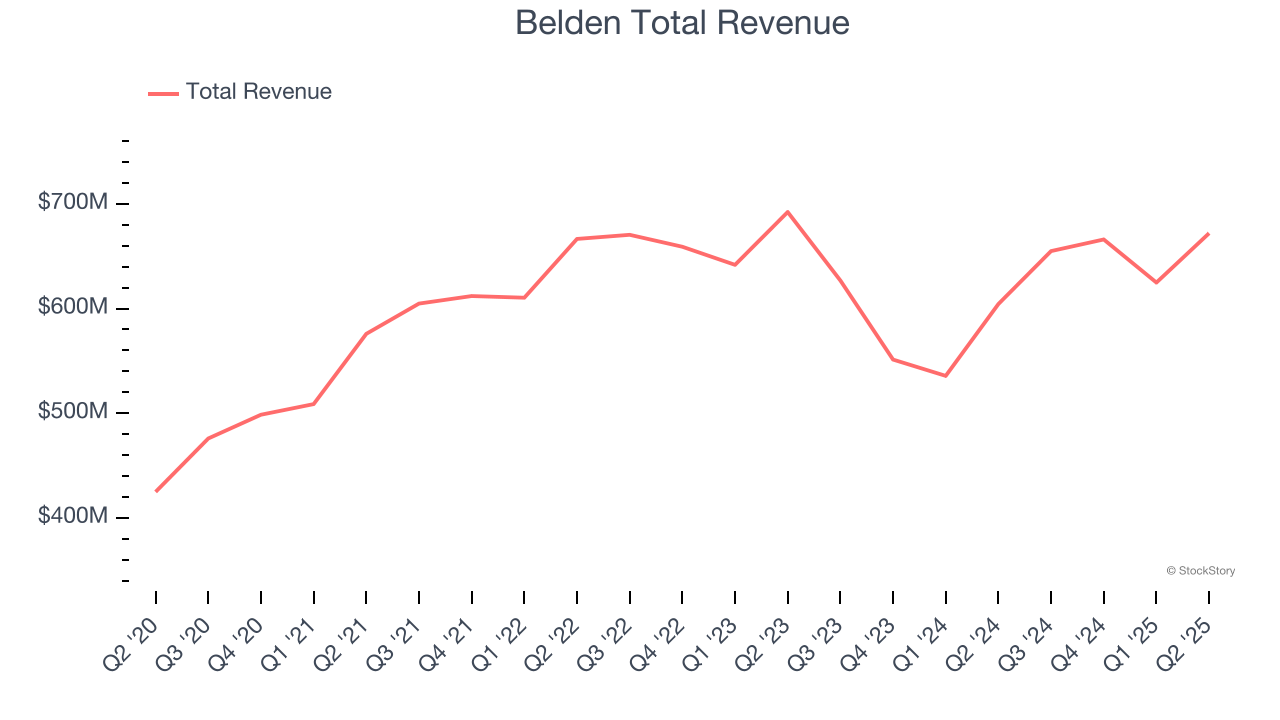

Belden (NYSE: BDC)

With its enamel-coated copper wire used in WWI for the Allied forces, Belden (NYSE: BDC) designs, manufactures, and sells electronic components to various industries.

Belden reported revenues of $672 million, up 11.2% year on year. This print exceeded analysts’ expectations by 2.1%. Overall, it was a strong quarter for the company with and a solid beat of analysts’ adjusted operating income estimates.

The stock is down 5.7% since reporting and currently trades at $120.60.

Is now the time to buy Belden? Access our full analysis of the earnings results here, it’s free.

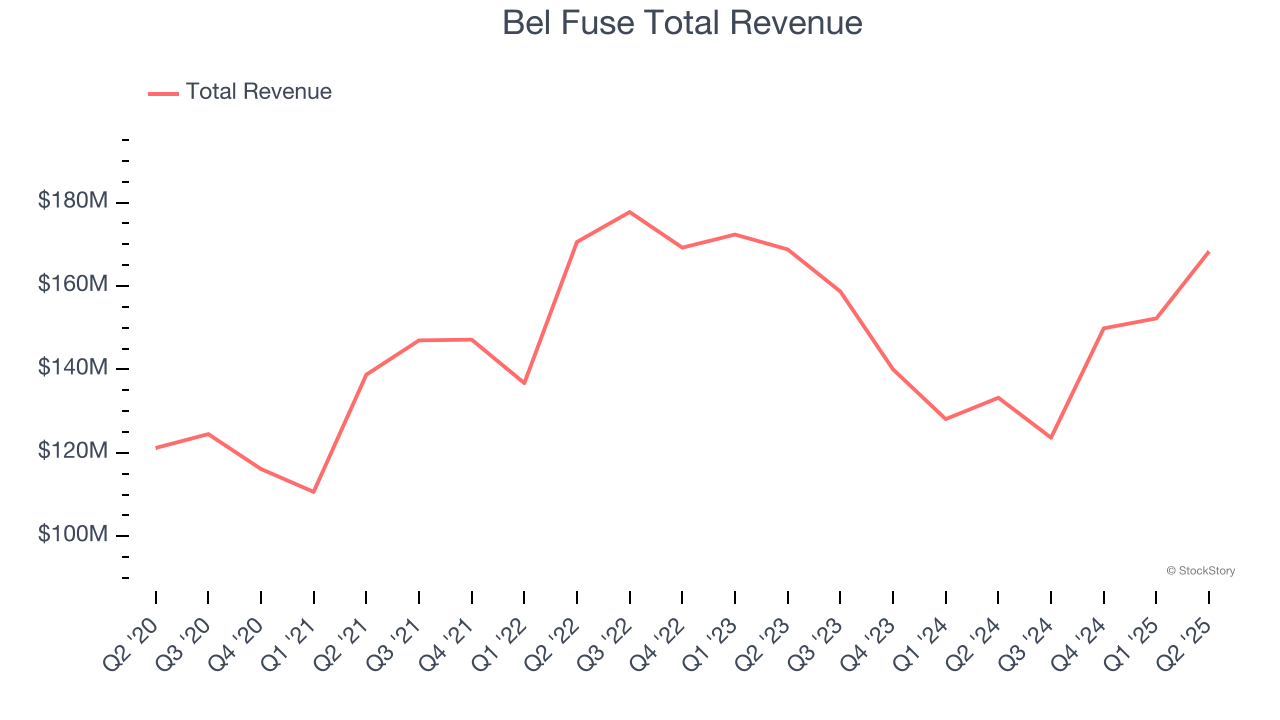

Best Q2: Bel Fuse (NASDAQ: BELFA)

Founded by 26-year-old Elliot Bernstein during the electronics boom after WW2, Bel Fuse (NASDAQ: BELF.A) provides electronic systems and devices to the telecommunications, networking, transportation, and industrial sectors.

Bel Fuse reported revenues of $168.3 million, up 26.3% year on year, outperforming analysts’ expectations by 10.1%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

Bel Fuse scored the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 25.5% since reporting. It currently trades at $116.08.

Is now the time to buy Bel Fuse? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Novanta (NASDAQ: NOVT)

Originally a pioneer in the laser scanning industry during the late 1960s, Novanta (NASDAQ: NOVT) offers medicine and manufacturing technology to the medical, life sciences, and manufacturing industries.

Novanta reported revenues of $241 million, up 2.2% year on year, exceeding analysts’ expectations by 1.3%. Still, it was a slower quarter as it posted EBITDA guidance for next quarter missing analysts’ expectations.

As expected, the stock is down 20.3% since the results and currently trades at $98.99.

Read our full analysis of Novanta’s results here.

Vishay Precision (NYSE: VPG)

Emerging from Vishay Intertechnology in 2010, Vishay Precision (NYSE: VPG) operates as a global provider of precision measurement and sensing technologies.

Vishay Precision reported revenues of $75.16 million, down 2.8% year on year. This result surpassed analysts’ expectations by 3.1%. It was an exceptional quarter as it also produced a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Vishay Precision had the slowest revenue growth among its peers. The stock is up 21.7% since reporting and currently trades at $31.73.

Read our full, actionable report on Vishay Precision here, it’s free.

Allient (NASDAQ: ALNT)

Founded in 1962, Allient (NASDAQ: ALNT) develops and manufactures precision and specialty-controlled motion components and systems.

Allient reported revenues of $139.6 million, up 2.6% year on year. This number topped analysts’ expectations by 5%. Overall, it was a stunning quarter as it also logged a solid beat of analysts’ EBITDA and EPS estimates.

The stock is up 9.8% since reporting and currently trades at $44.15.

Read our full, actionable report on Allient here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.