Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Wabash (NYSE: WNC) and the best and worst performers in the heavy transportation equipment industry.

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

The 13 heavy transportation equipment stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.6%.

Thankfully, share prices of the companies have been resilient as they are up 6.6% on average since the latest earnings results.

Wabash (NYSE: WNC)

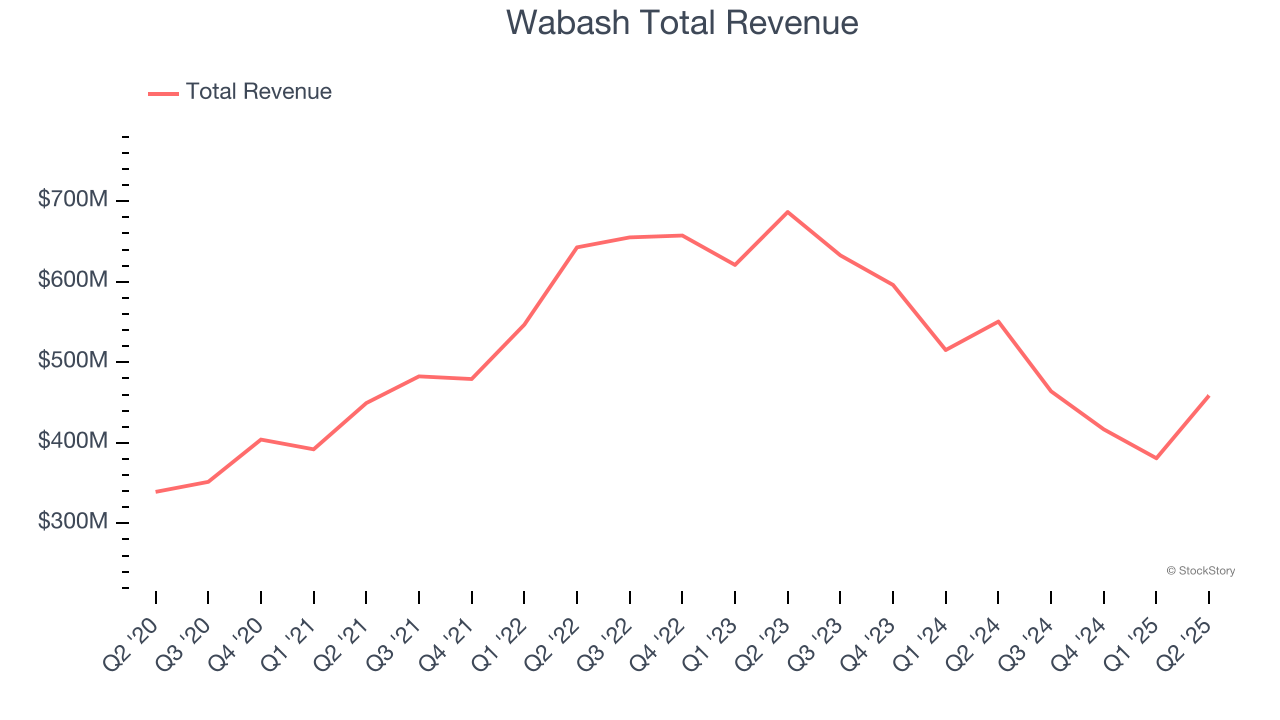

With its first trailer reportedly built on two sawhorses, Wabash (NYSE: WNC) offers semi trailers, liquid transportation containers, truck bodies, and equipment for moving goods.

Wabash reported revenues of $458.8 million, down 16.7% year on year. This print exceeded analysts’ expectations by 5.8%. Overall, it was a strong quarter for the company with a beat of analysts’ EPS and EBITDA estimates.

Wabash delivered the weakest full-year guidance update of the whole group. The stock is down 4.3% since reporting and currently trades at $10.23.

Is now the time to buy Wabash? Access our full analysis of the earnings results here, it’s free.

Best Q2: Cummins (NYSE: CMI)

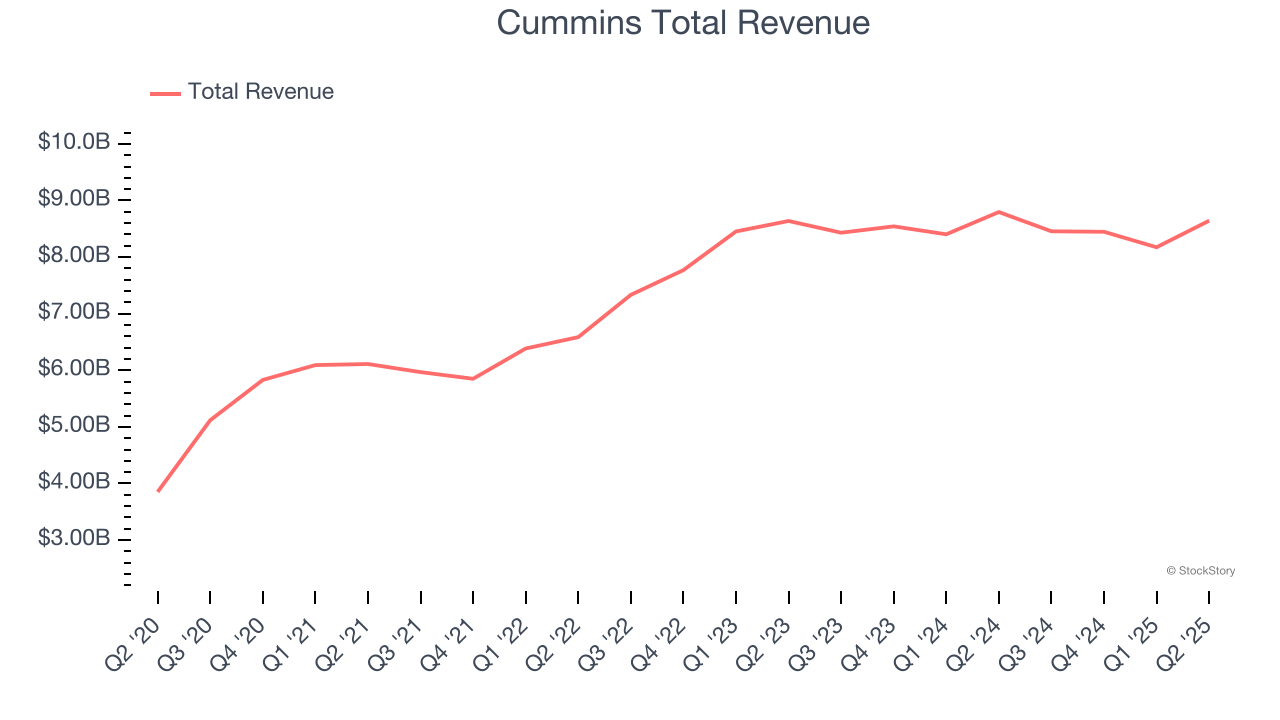

With more than half of the heavy-duty truck market using its engines at one point, Cummins (NYSE: CMI) offers engines and power systems.

Cummins reported revenues of $8.64 billion, down 1.7% year on year, outperforming analysts’ expectations by 3.4%. The business had an incredible quarter with an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 15.5% since reporting. It currently trades at $418.00.

Is now the time to buy Cummins? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Trinity (NYSE: TRN)

Operating under the trade name TrinityRail, Trinity (NYSE: TRN) is a provider of railcar products and services in North America.

Trinity reported revenues of $506.2 million, down 39.8% year on year, falling short of analysts’ expectations by 13.3%. It was a slower quarter as it posted a significant miss of analysts’ EPS and EBITDA estimates.

Trinity delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 12.2% since the results and currently trades at $28.04.

Read our full analysis of Trinity’s results here.

Greenbrier (NYSE: GBX)

Having designed the industry’s first double-decker railcar in the 1980s, Greenbrier (NYSE: GBX) supplies the freight rail transportation industry with railcars and related services.

Greenbrier reported revenues of $842.7 million, up 2.7% year on year. This result topped analysts’ expectations by 7.3%. Overall, it was a stunning quarter as it also put up an impressive beat of analysts’ sales volume and EPS estimates.

Greenbrier achieved the biggest analyst estimates beat among its peers. The stock is down 1.7% since reporting and currently trades at $46.22.

Read our full, actionable report on Greenbrier here, it’s free.

Allison Transmission (NYSE: ALSN)

Helping build race cars at one point, Allison Transmission (NYSE: ALSN) offers transmissions to original equipment manufacturers and fleet operators.

Allison Transmission reported revenues of $814 million, flat year on year. This number surpassed analysts’ expectations by 1.7%. It was a strong quarter as it also produced a solid beat of analysts’ adjusted operating income estimates.

The stock is down 1.4% since reporting and currently trades at $86.79.

Read our full, actionable report on Allison Transmission here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.