Wrapping up Q2 earnings, we look at the numbers and key takeaways for the specialty retail stocks, including Best Buy (NYSE: BBY) and its peers.

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

The 9 specialty retail stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 3% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 5.2% on average since the latest earnings results.

Best Buy (NYSE: BBY)

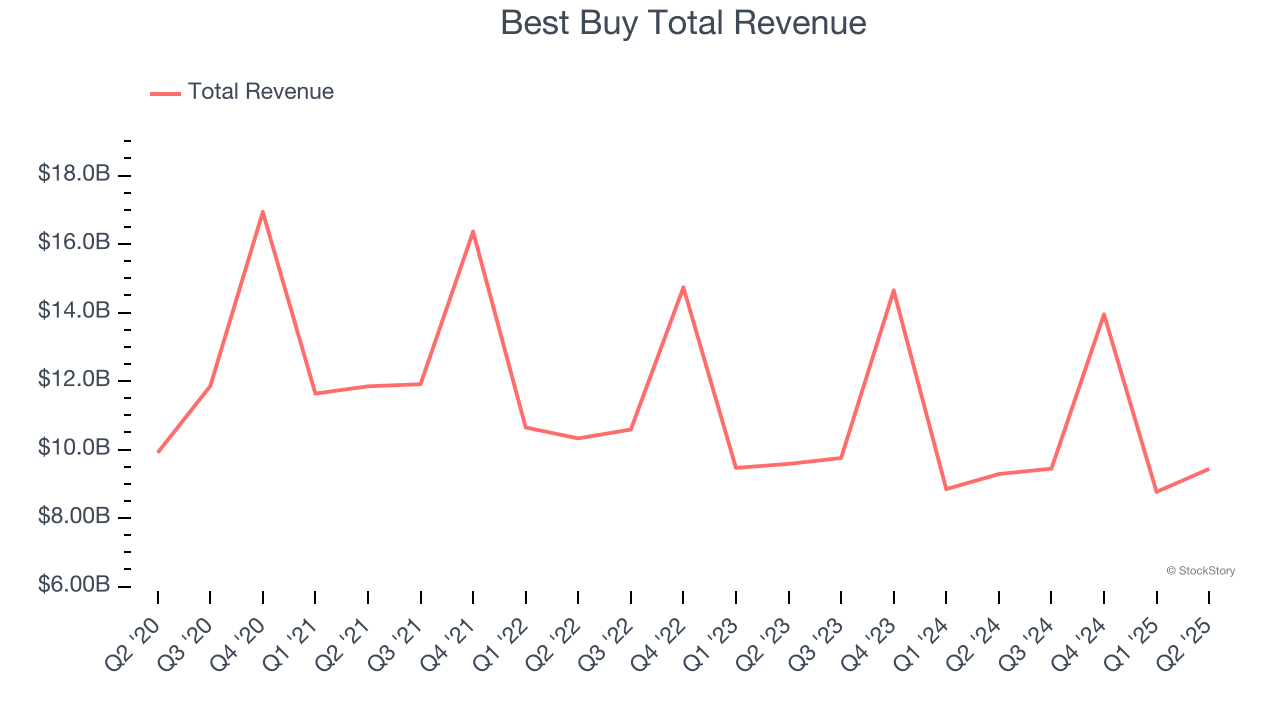

With humble beginnings as a stereo equipment seller, Best Buy (NYSE: BBY) now sells a broad selection of consumer electronics, appliances, and home office products.

Best Buy reported revenues of $9.44 billion, up 1.6% year on year. This print exceeded analysts’ expectations by 2.3%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA and EPS estimates.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $74.84.

Is now the time to buy Best Buy? Access our full analysis of the earnings results here, it’s free.

Best Q2: GameStop (NYSE: GME)

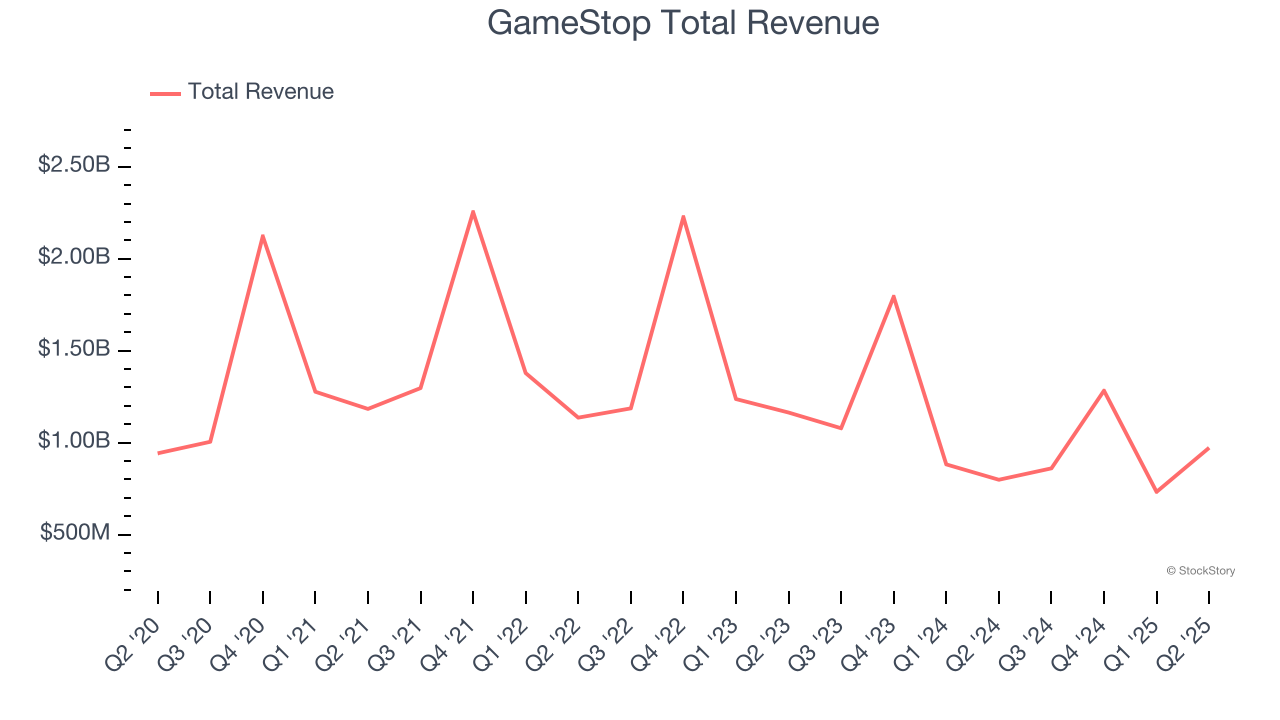

Drawing gaming fans with demo units set up with the latest releases, GameStop (NYSE: GME) sells new and used video games, consoles, and accessories, as well as pop culture merchandise.

GameStop reported revenues of $972.2 million, up 21.8% year on year, outperforming analysts’ expectations by 18.1%. The business had a stunning quarter with a beat of analysts’ EPS estimates.

GameStop scored the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 7.4% since reporting. It currently trades at $25.34.

Is now the time to buy GameStop? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Bath and Body Works (NYSE: BBWI)

Spun off from L Brands in 2020, Bath & Body Works (NYSE: BBWI) is a personal care and home fragrance retailer where consumers can find specialty shower gels, scented candles for the home, and lotions.

Bath and Body Works reported revenues of $1.55 billion, up 1.5% year on year, in line with analysts’ expectations. It was a softer quarter as it posted EPS guidance for next quarter missing analysts’ expectations.

As expected, the stock is down 17.5% since the results and currently trades at $26.

Read our full analysis of Bath and Body Works’s results here.

Ulta (NASDAQ: ULTA)

Offering high-end prestige brands as well as lower-priced, mass-market ones, Ulta Beauty (NASDAQ: ULTA) is an American retailer that sells makeup, skincare, haircare, and fragrance products.

Ulta reported revenues of $2.79 billion, up 9.3% year on year. This print topped analysts’ expectations by 4.2%. Overall, it was an exceptional quarter as it also produced an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ gross margin estimates.

Ulta scored the highest full-year guidance raise among its peers. The stock is up 1.6% since reporting and currently trades at $539.

Read our full, actionable report on Ulta here, it’s free.

Sally Beauty (NYSE: SBH)

Catering to both everyday consumers as well as salon professionals, Sally Beauty (NYSE: SBH) is a retailer that sells salon-quality beauty products such as makeup and haircare products.

Sally Beauty reported revenues of $933.3 million, flat year on year. This result met analysts’ expectations. It was a very strong quarter as it also logged a solid beat of analysts’ EBITDA and EPS estimates.

Sally Beauty had the slowest revenue growth among its peers. The stock is up 55.6% since reporting and currently trades at $15.51.

Read our full, actionable report on Sally Beauty here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.