Shareholders of agilon health would probably like to forget the past six months even happened. The stock dropped 75.4% and now trades at $1.11. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy agilon health, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is agilon health Not Exciting?

Despite the more favorable entry price, we don't have much confidence in agilon health. Here are three reasons you should be careful with AGL and a stock we'd rather own.

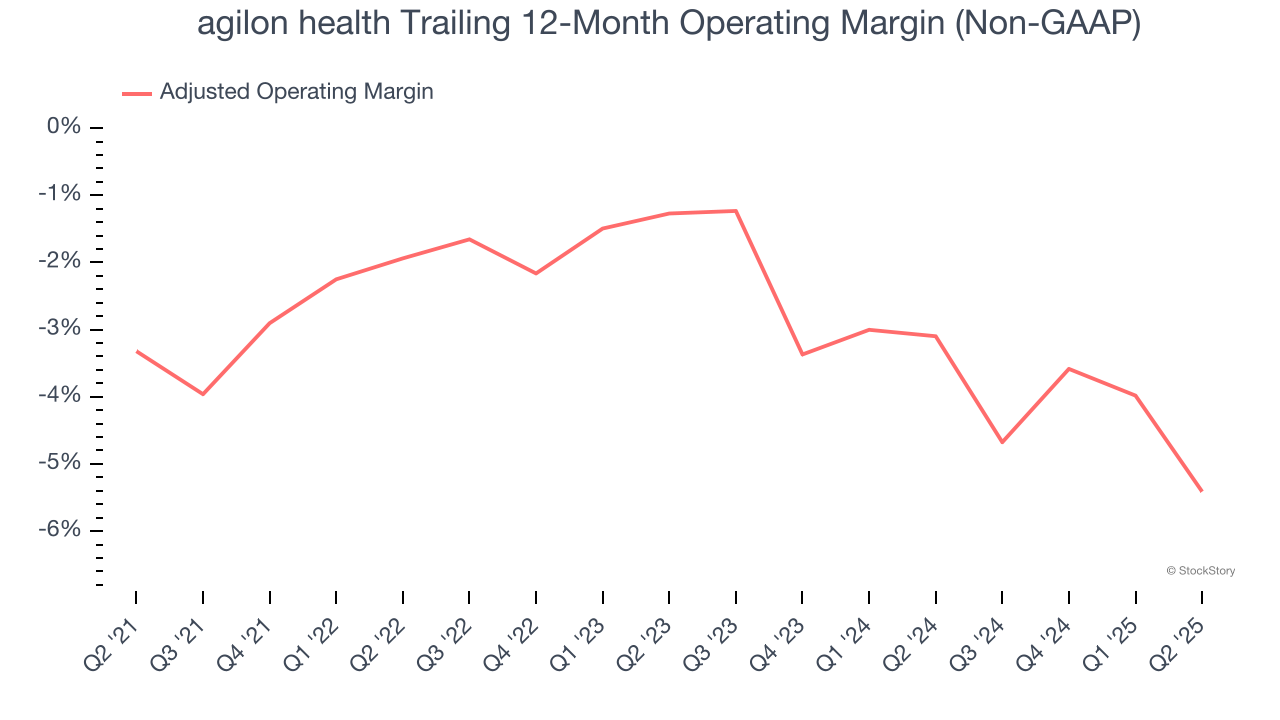

1. Shrinking Adjusted Operating Margin

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

Looking at the trend in its profitability, agilon health’s adjusted operating margin decreased by 4.1 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. agilon health’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its adjusted operating margin for the trailing 12 months was negative 5.4%.

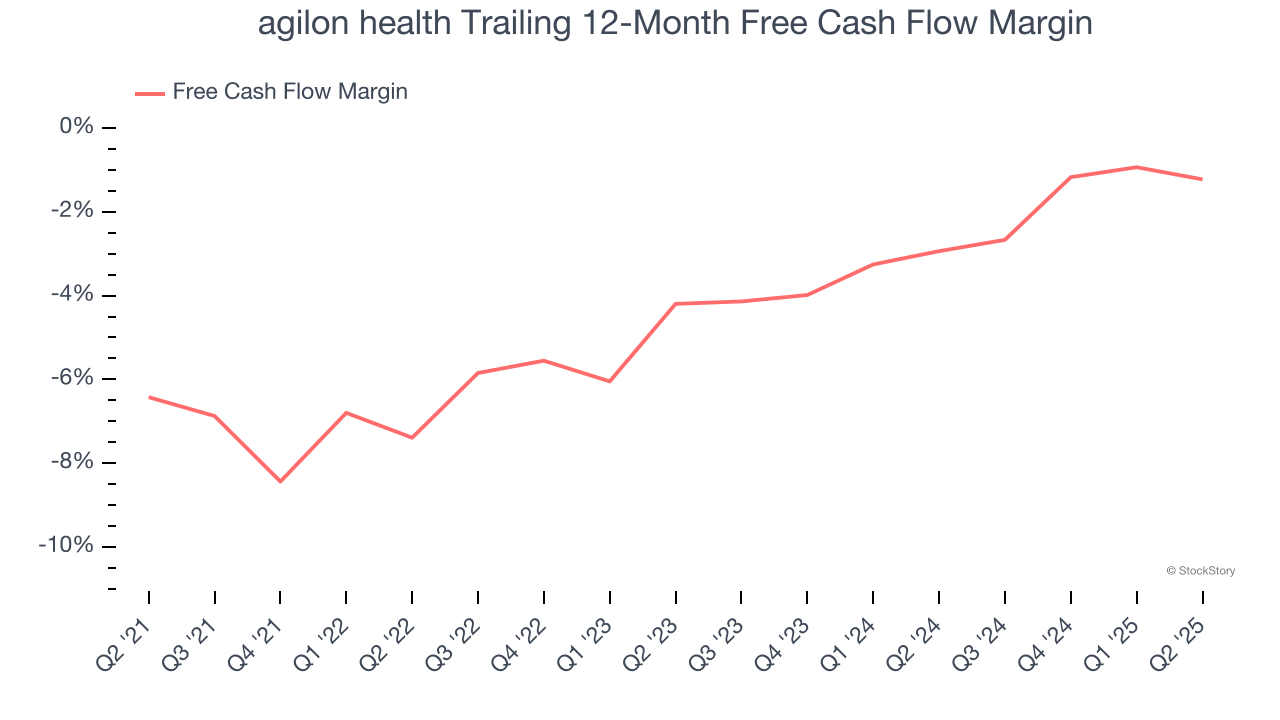

2. Cash Burn Ignites Concerns

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

agilon health’s demanding reinvestments have consumed many resources over the last five years, contributing to an average free cash flow margin of negative 3.5%. This means it lit $3.46 of cash on fire for every $100 in revenue.

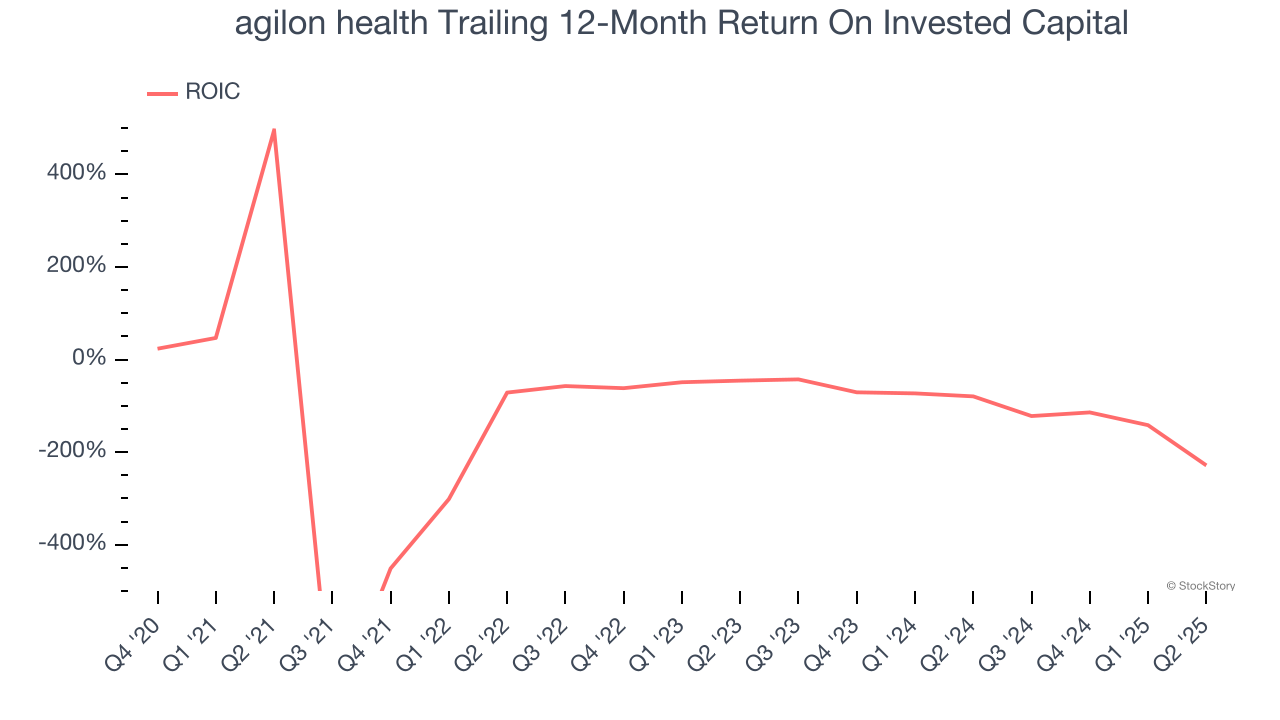

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

agilon health’s five-year average ROIC was negative 65.5%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

Final Judgment

agilon health isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at $1.11 per share (or a forward price-to-sales ratio of 0.1×). The market typically values companies like agilon health based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.