Toy and entertainment company Hasbro (NASDAQ: HAS) announced better-than-expected revenue in Q1 CY2025, with sales up 17.1% year on year to $887.1 million. Its non-GAAP profit of $1.04 per share was 54.3% above analysts’ consensus estimates.

Is now the time to buy Hasbro? Find out by accessing our full research report, it’s free.

Hasbro (HAS) Q1 CY2025 Highlights:

- Revenue: $887.1 million vs analyst estimates of $773 million (17.1% year-on-year growth, 14.8% beat)

- Adjusted EPS: $1.04 vs analyst estimates of $0.67 (54.3% beat)

- Adjusted EBITDA: $274.3 million vs analyst estimates of $201.1 million (30.9% margin, 36.4% beat)

- Operating Margin: 19.2%, up from 15.3% in the same quarter last year

- Free Cash Flow Margin: 10.7%, down from 17.4% in the same quarter last year

- Market Capitalization: $7.38 billion

“Hasbro’s Playing to Win strategy is delivering in a challenging environment. We’re outperforming today and building for tomorrow through disciplined execution, standout partnerships like our extended Disney agreement, and future-focused bets that are already paying off,” said Chris Cocks, Hasbro Chief Executive Officer.

Company Overview

Credited with the creation of toys such as Mr. Potato Head and the Rubik’s Cube, Hasbro (NASDAQ: HAS) is a global entertainment company offering a diverse range of toys, games, and multimedia experiences for children and families.

Toys and Electronics

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

Sales Growth

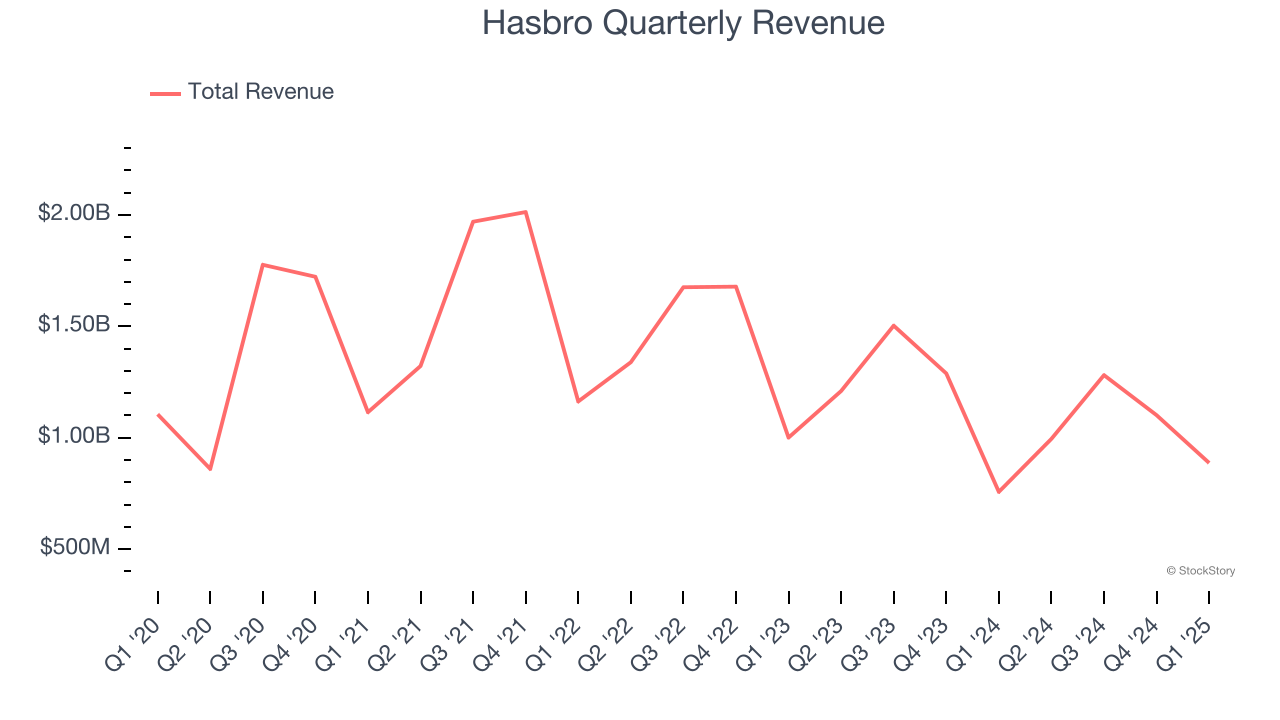

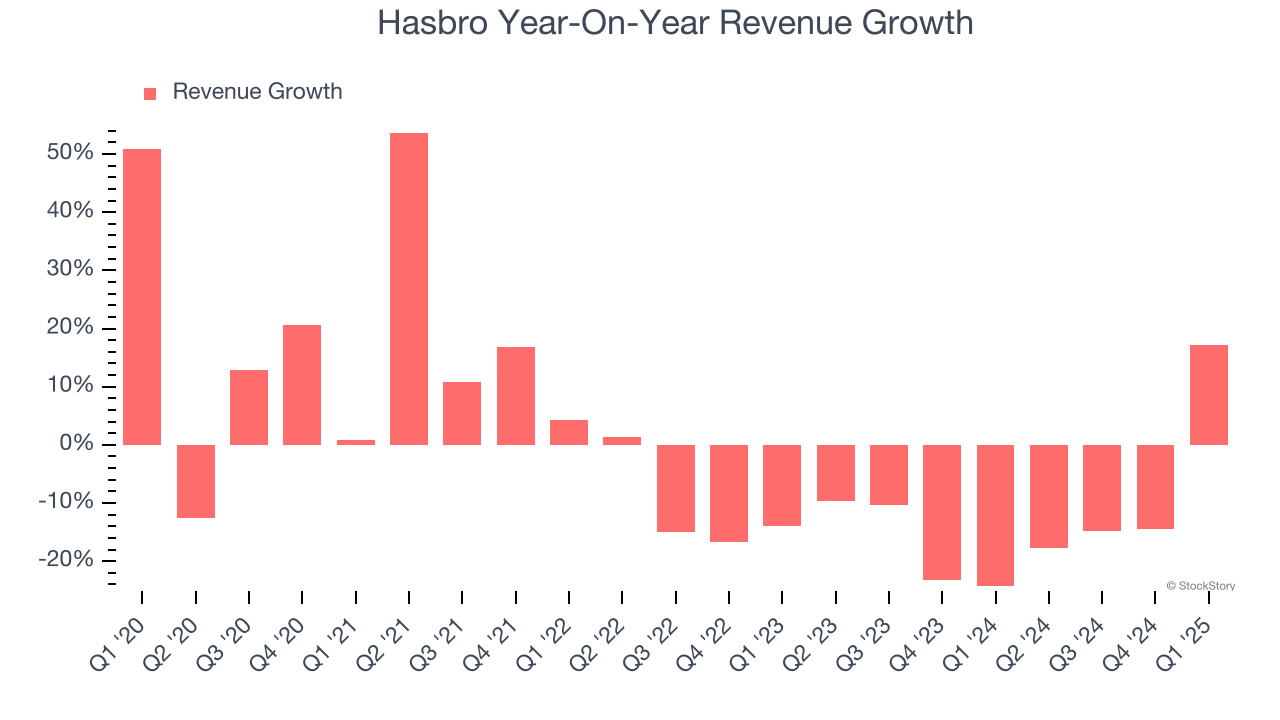

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Hasbro’s demand was weak and its revenue declined by 3.5% per year. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Hasbro’s recent performance shows its demand remained suppressed as its revenue has declined by 13.5% annually over the last two years.

Hasbro also breaks out the revenue for its three most important segments: Consumer Products, Entertainment, and Wizards & Digital Gaming, which are 52.1%, 44.9%, and 3% of revenue. Over the last two years, Hasbro’s Entertainment revenue (content) averaged 110% year-on-year growth while its Consumer Products (toys, games, apparel) and Wizards & Digital Gaming (Wizards of the Coast) revenues averaged 11.6% and 4.9% declines.

This quarter, Hasbro reported year-on-year revenue growth of 17.1%, and its $887.1 million of revenue exceeded Wall Street’s estimates by 14.8%.

Looking ahead, sell-side analysts expect revenue to decline by 2.2% over the next 12 months. While this projection is better than its two-year trend, it's hard to get excited about a company that is struggling with demand.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

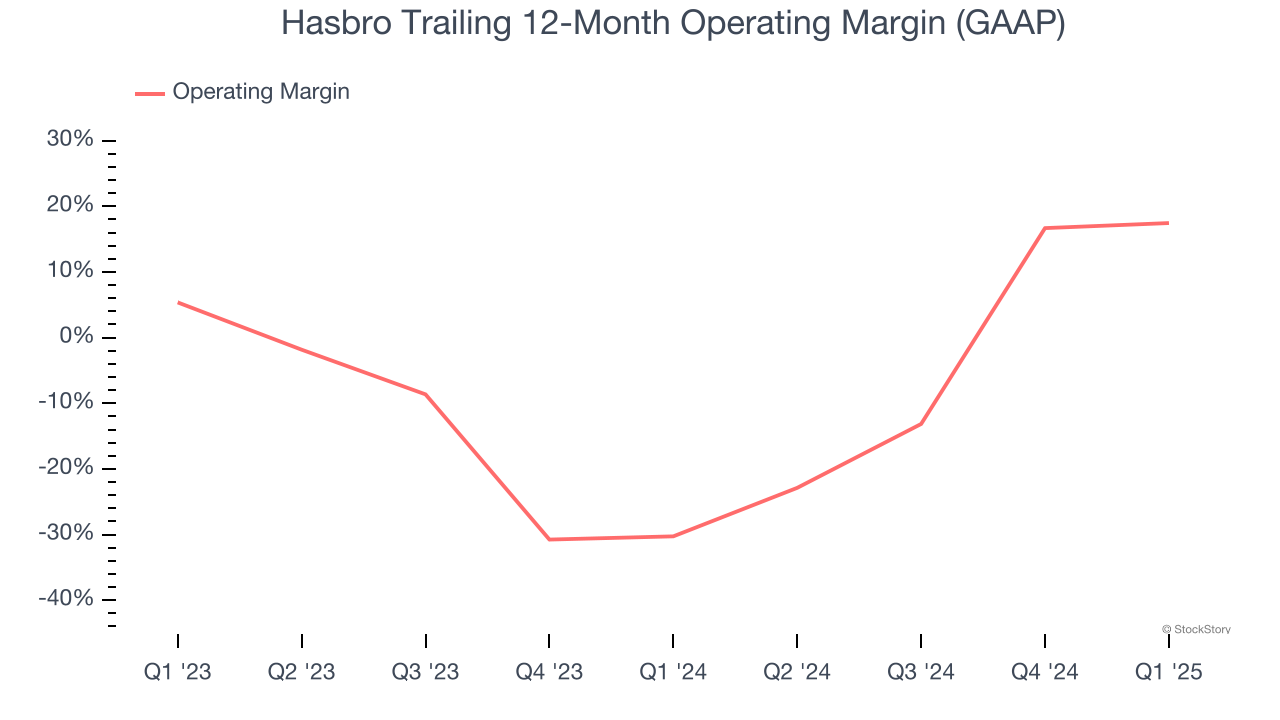

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Hasbro’s operating margin has been trending up over the last 12 months, but it still averaged negative 7.7% over the last two years. This is due to its large expense base and inefficient cost structure.

This quarter, Hasbro generated an operating profit margin of 19.2%, up 3.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

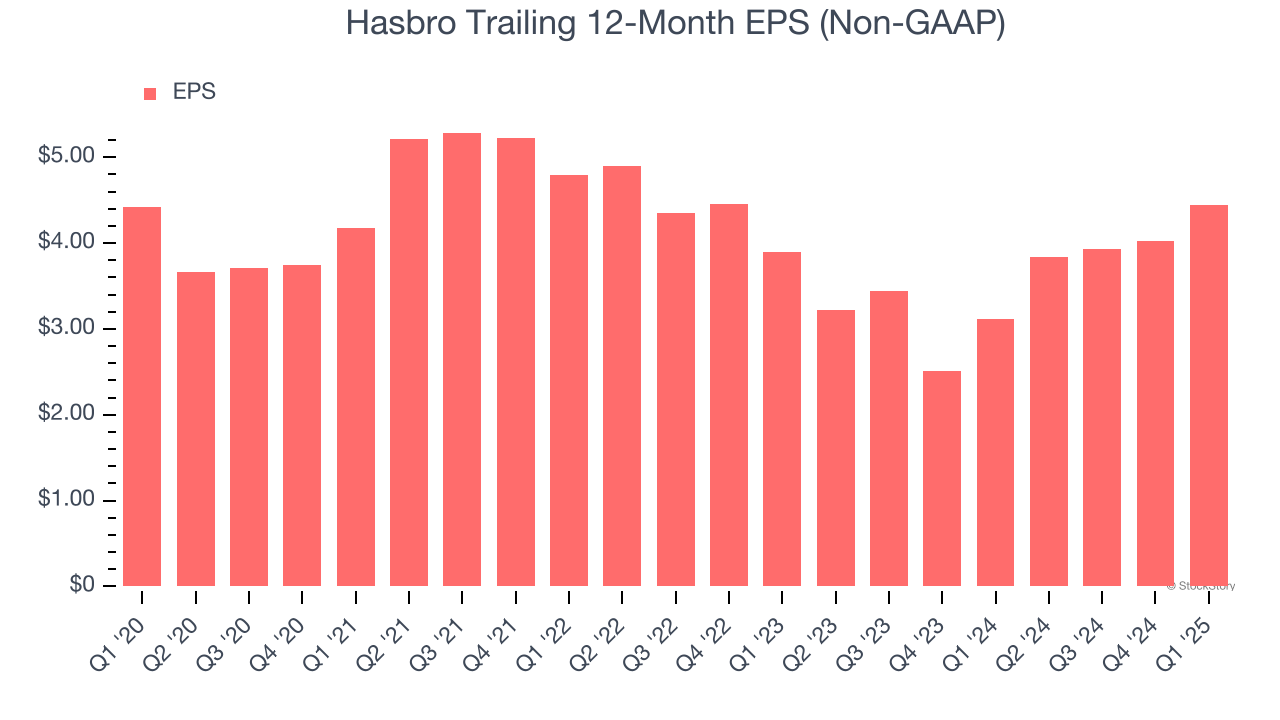

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Hasbro’s flat EPS over the last five years was weak but better than its 3.5% annualized revenue declines. This tells us management adapted its cost structure.

In Q1, Hasbro reported EPS at $1.04, up from $0.61 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Hasbro’s full-year EPS of $4.45 to shrink by 5.9%.

Key Takeaways from Hasbro’s Q1 Results

We were impressed by how significantly Hasbro blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. Zooming out, we think this quarter featured some important positives. The stock traded up 6.7% to $56.16 immediately following the results.

Hasbro had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.