What a time it’s been for Stride. In the past six months alone, the company’s stock price has increased by a massive 112%, reaching $136.99 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is it too late to buy LRN? Find out in our full research report, it’s free.

Why Are We Positive On Stride?

Formerly known as K12, Stride (NYSE: LRN) is an education technology company providing education solutions through digital platforms.

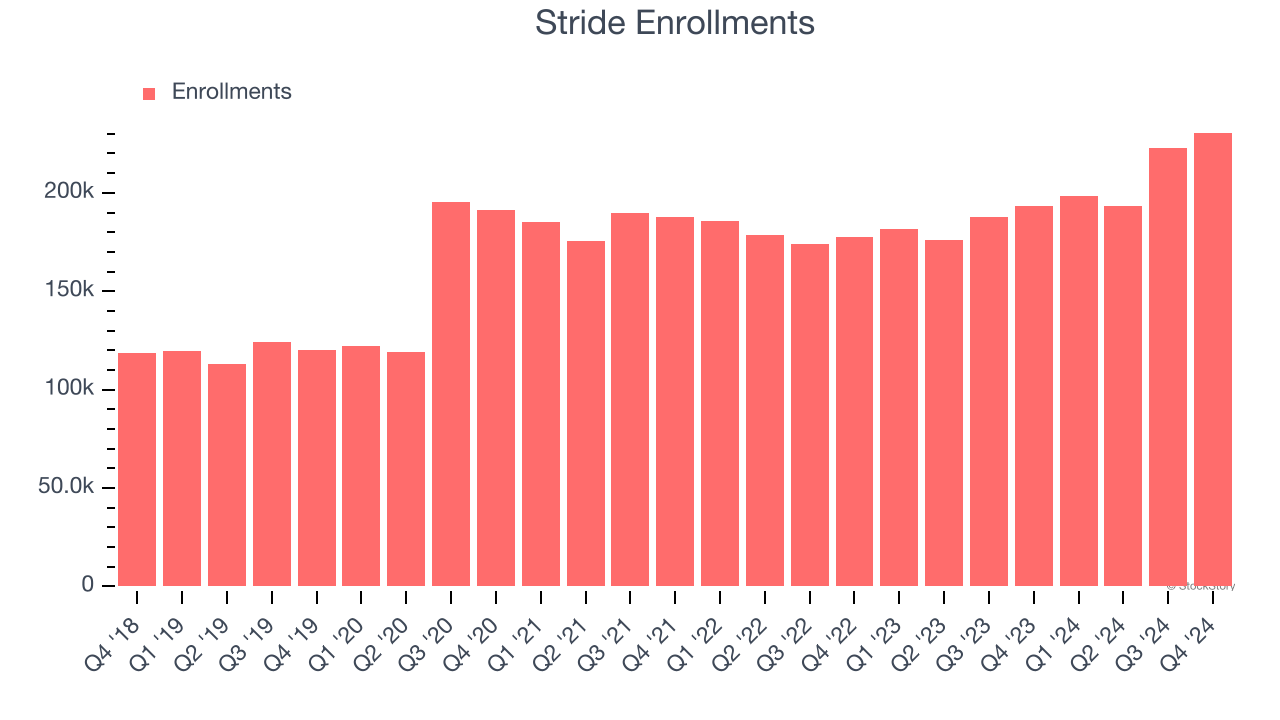

1. Growth in Enrollments Suggests Increasing Demand

Revenue growth can be broken down into changes in price and volume (for companies like Stride, our preferred volume metric is enrollments). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Stride’s enrollments punched in at 230,600 in the latest quarter, and over the last two years, averaged 8.8% year-on-year growth. This performance was solid and shows there is something unique about its services.

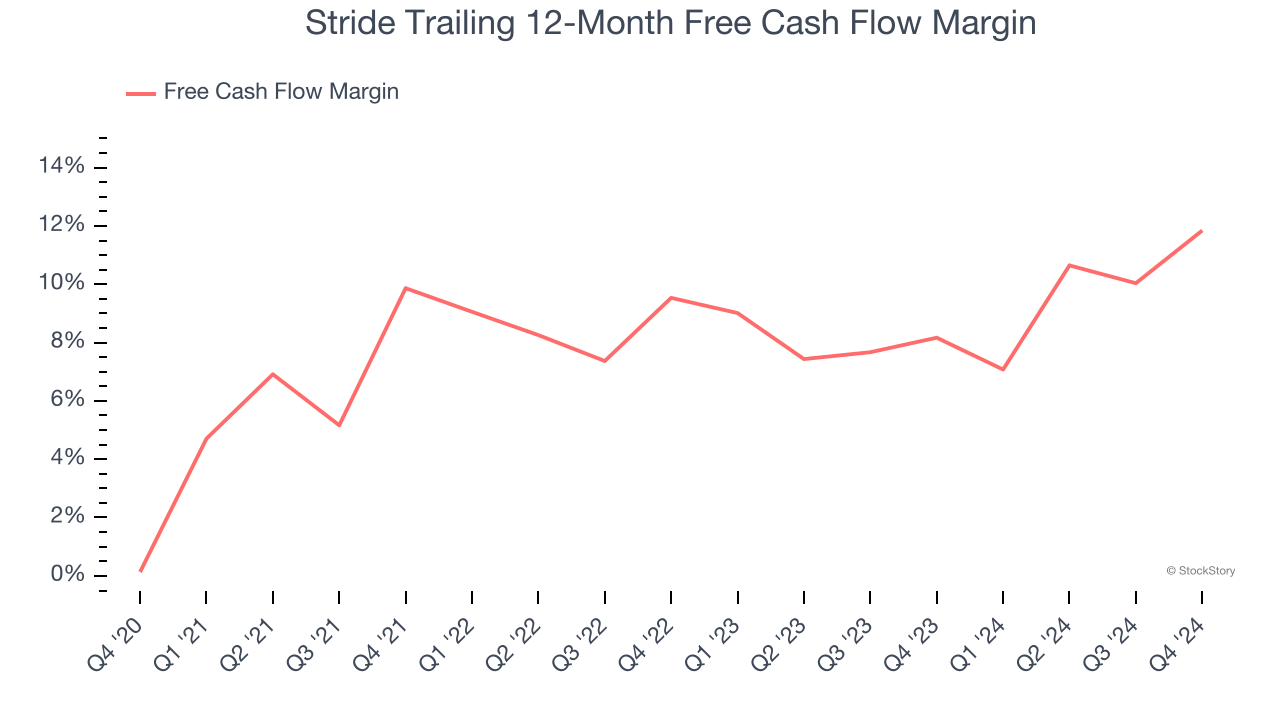

2. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Stride’s margin expanded by 11.7 percentage points over the last five years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Stride’s free cash flow margin for the trailing 12 months was 11.8%.

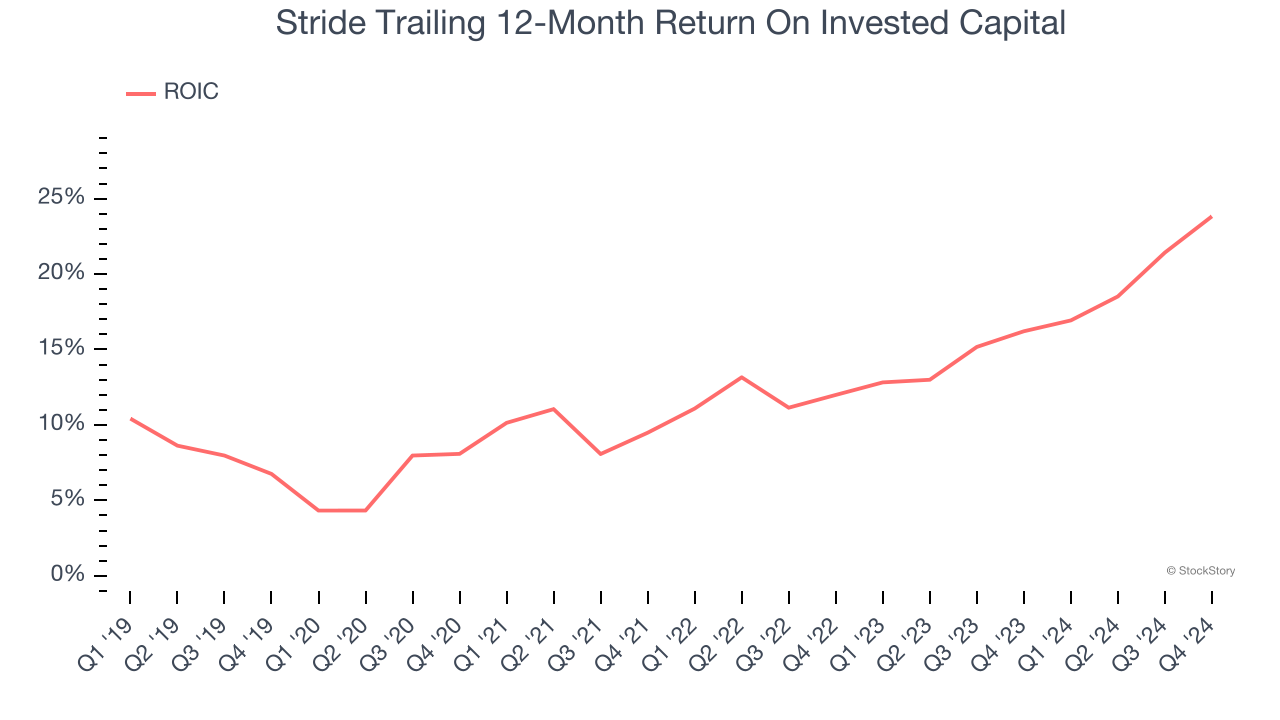

3. New Investments Bear Fruit as ROIC Jumps

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Stride’s ROIC has increased significantly. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

Final Judgment

These are just a few reasons why we're bullish on Stride, and with the recent surge, the stock trades at 19.2× forward price-to-earnings (or $136.99 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Stride

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.