Live events and entertainment company Live Nation (NYSE: LYV) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, but sales fell by 2.7% year on year to $5.68 billion.

Is now the time to buy Live Nation? Find out by accessing our full research report, it’s free.

Live Nation (LYV) Q4 CY2024 Highlights:

- Revenue: $5.68 billion vs analyst estimates of $5.6 billion (2.7% year-on-year decline, 1.4% beat)

- Adjusted Operating Income: $157.3 million (2.8% margin)

- Operating Margin: -4.2%, down from -2% in the same quarter last year

- Free Cash Flow was -$39.6 million, down from $27.28 million in the same quarter last year

- Market Capitalization: $35.44 billion

Company Overview

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE: LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Sales Growth

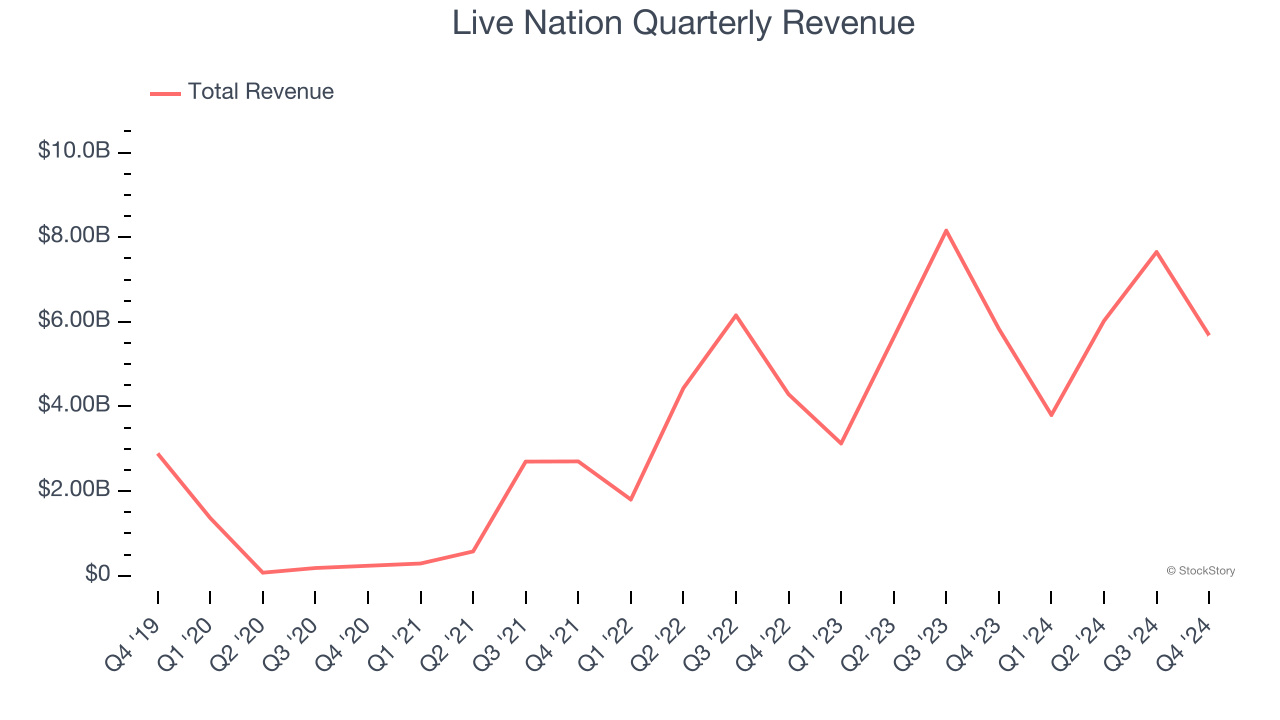

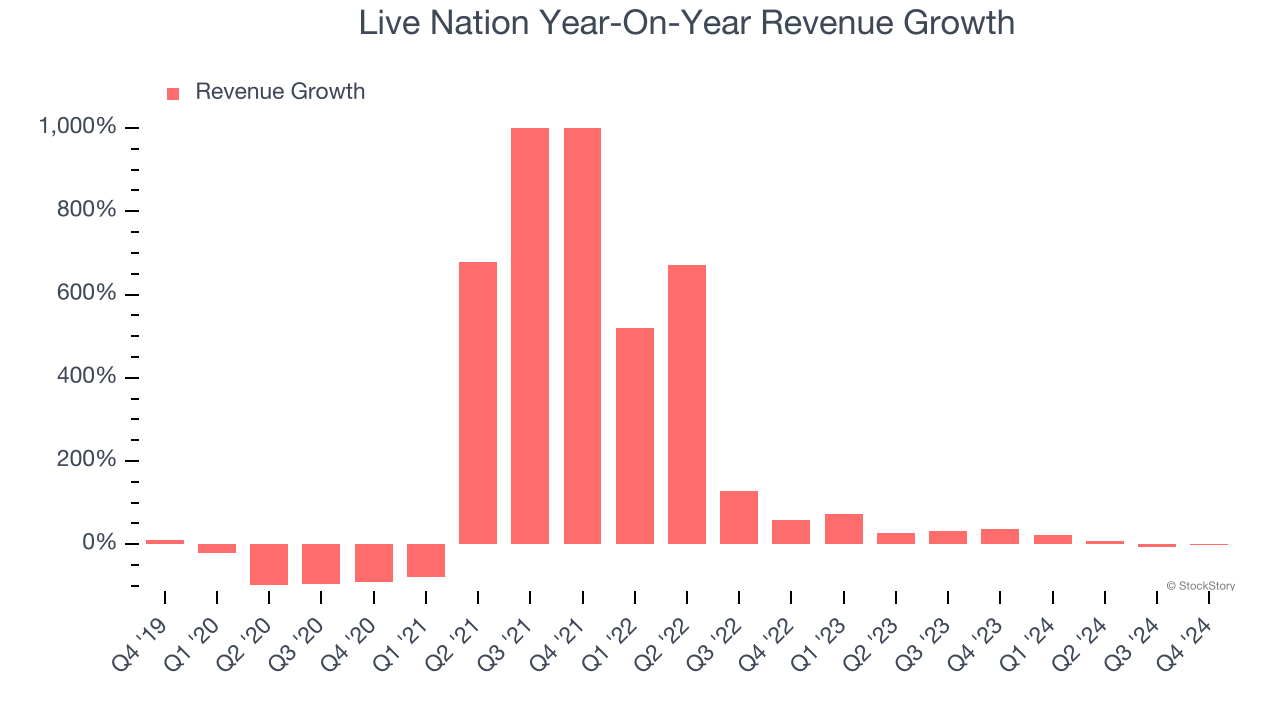

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Live Nation grew its sales at a 14.9% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our benchmark for the consumer discretionary sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Live Nation’s annualized revenue growth of 17.8% over the last two years is above its five-year trend, suggesting some bright spots. Note that COVID hurt Live Nation’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

This quarter, Live Nation’s revenue fell by 2.7% year on year to $5.68 billion but beat Wall Street’s estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to grow 14.5% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is satisfactory given its scale and indicates the market is baking in success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

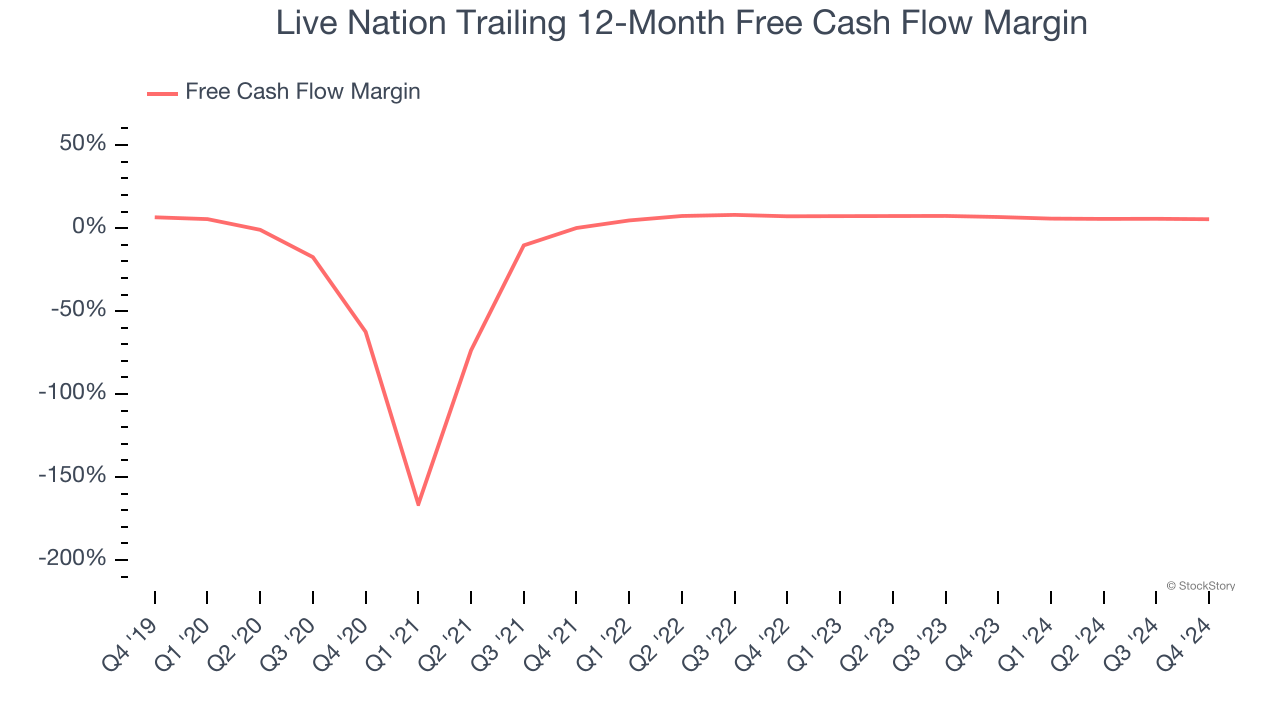

Live Nation has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.1%, subpar for a consumer discretionary business.

Live Nation broke even from a free cash flow perspective in Q4. The company’s cash profitability regressed as it was 1.2 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts’ consensus estimates show they’re expecting Live Nation’s free cash flow margin of 5.4% for the last 12 months to remain the same.

Key Takeaways from Live Nation’s Q4 Results

It was good to see Live Nation's revenue narrowly outperformed Wall Street’s estimates. We were also glad it burned less cash than expected. Zooming out, we think this was a decent quarter. The stock remained flat at $152.94 immediately following the results.

Live Nation had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.