Over the past six months, Viatris’s stock price fell to $10.77. Shareholders have lost 9% of their capital, which is disappointing considering the S&P 500 has climbed by 9.3%. This might have investors contemplating their next move.

Is there a buying opportunity in Viatris, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Despite the more favorable entry price, we're cautious about Viatris. Here are three reasons why there are better opportunities than VTRS and a stock we'd rather own.

Why Do We Think Viatris Will Underperform?

Formed in 2020 through the merger of Mylan and Upjohn, Viatris (NASDAQ: VTRS) provides a portfolio of branded, generic, and over-the-counter medications as well as biosimilars aimed at addressing a wide range of therapeutic areas.

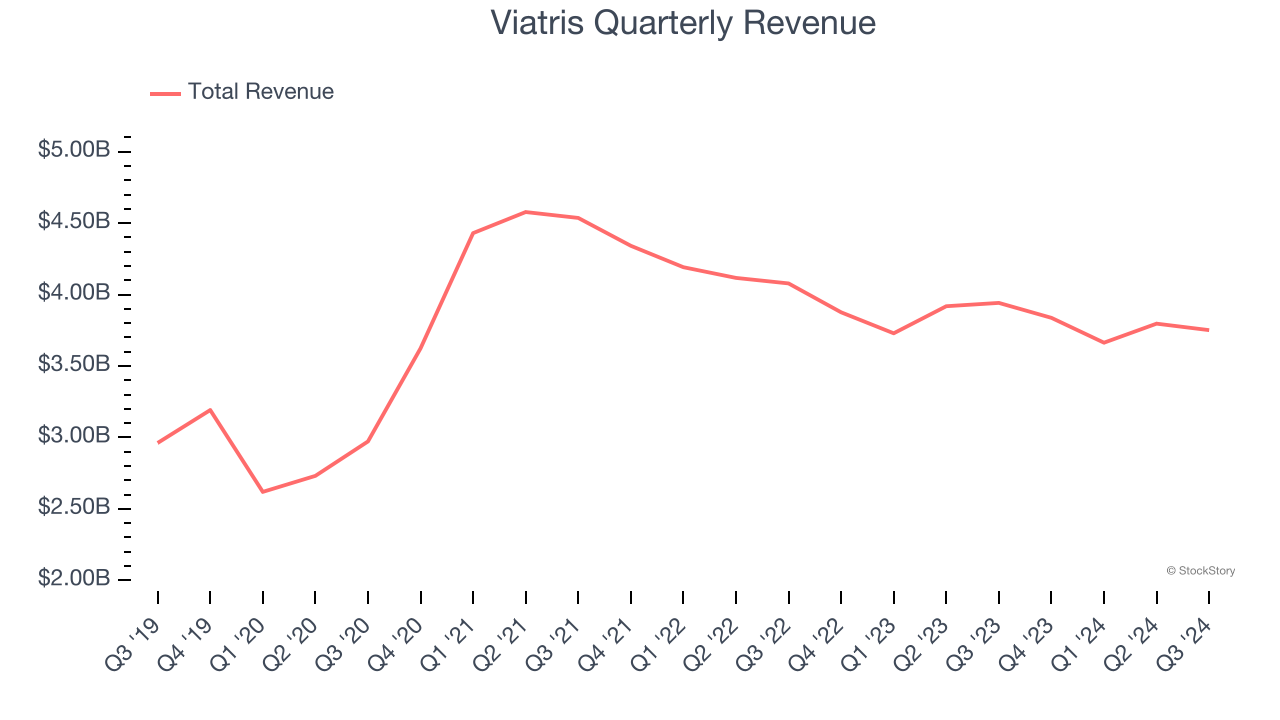

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Viatris’s 5.7% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the healthcare sector.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Viatris’s revenue to drop by 5.6%, close to its 5.2% annualized declines for the past two years. This projection is underwhelming and indicates its newer products and services will not accelerate its top-line performance yet.

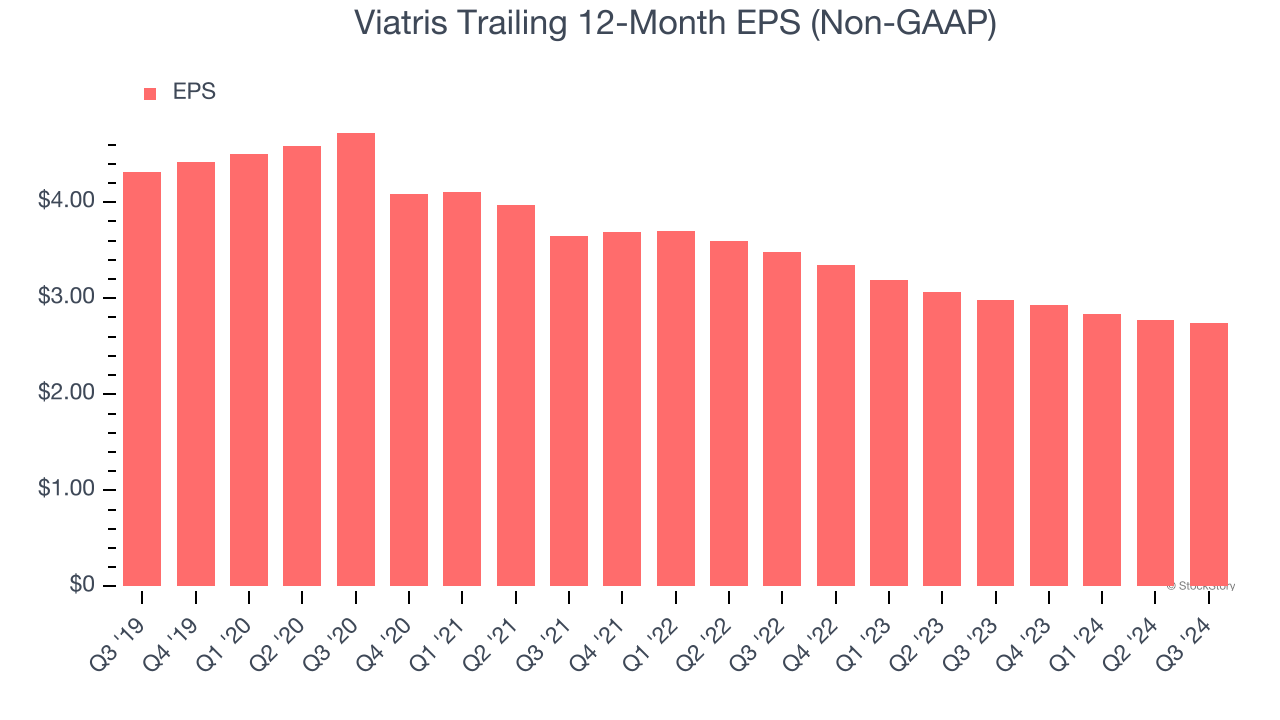

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Viatris, its EPS declined by 8.7% annually over the last five years while its revenue grew by 5.7%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Viatris doesn’t pass our quality test. After the recent drawdown, the stock trades at 4.3× forward price-to-earnings (or $10.77 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Viatris

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.