Since August 2024, SmartRent has been in a holding pattern, posting a small return of 4.9% while floating around $1.51. The stock also fell short of the S&P 500’s 12.2% gain during that period.

Is now the time to buy SMRT? Find out in our full research report, it’s free.

Why Is SmartRent a Good Business?

Founded by an employee at a real estate rental company, SmartRent (NYSE: SMRT) provides smart home devices and software for multifamily residential properties, single-family rental homes, and student housing communities.

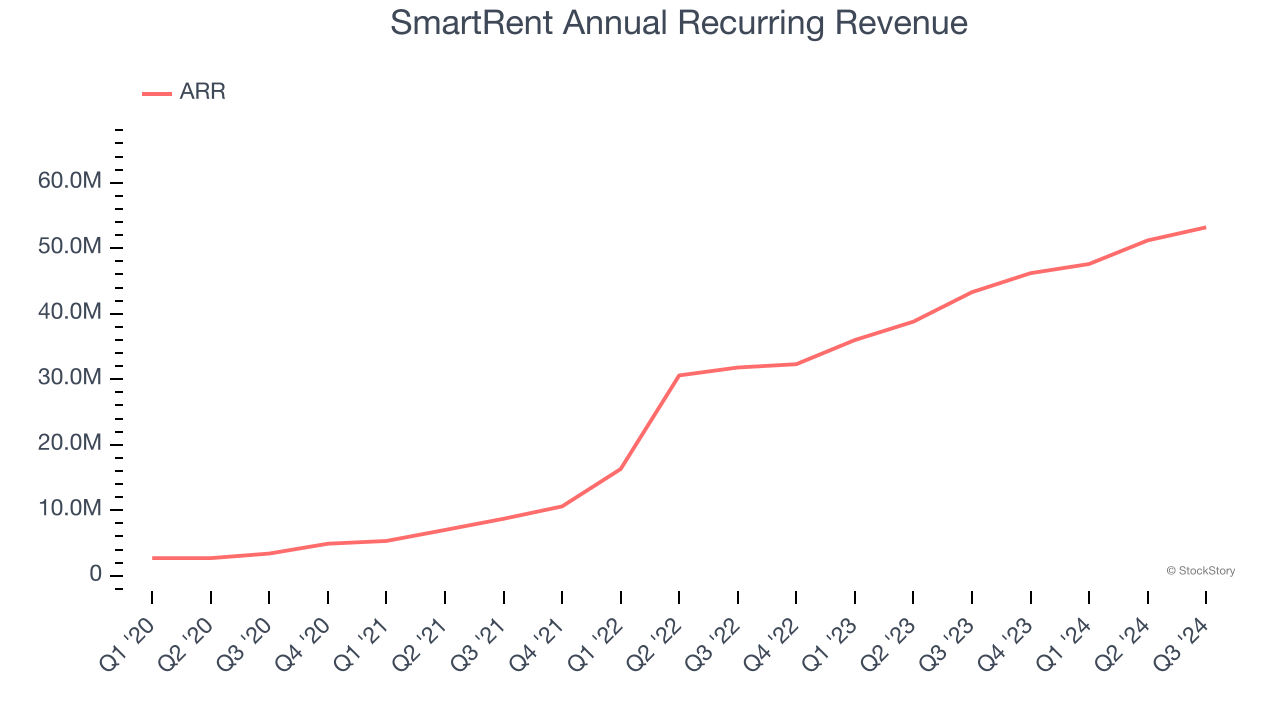

1. ARR Surges as Recurring Revenue Flows In

Investors interested in Internet of Things companies should track ARR (annual recurring revenue) in addition to reported revenue. This metric shows how much SmartRent expects to collect from its existing customer base in the next 12 months, giving visibility into its future revenue streams.

SmartRent’s ARR punched in at $53.2 million in the latest quarter, and over the last two years, its year-on-year growth averaged 64.8%. This performance was fantastic and shows that customers are willing to take multi-year bets on the company’s product offerings. Its growth also makes SmartRent a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

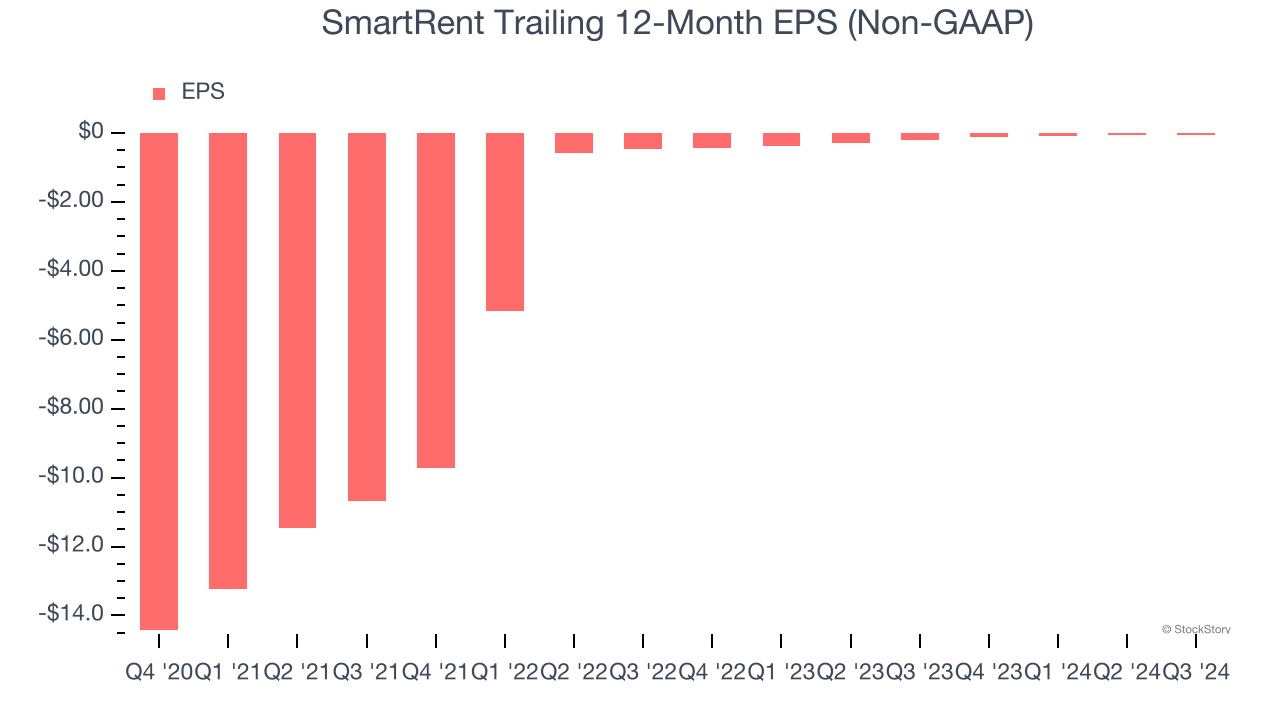

2. EPS Improving Significantly

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Although SmartRent’s full-year earnings are still negative, it reduced its losses and improved its EPS by 74.7% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability. An inflection point could be coming soon.

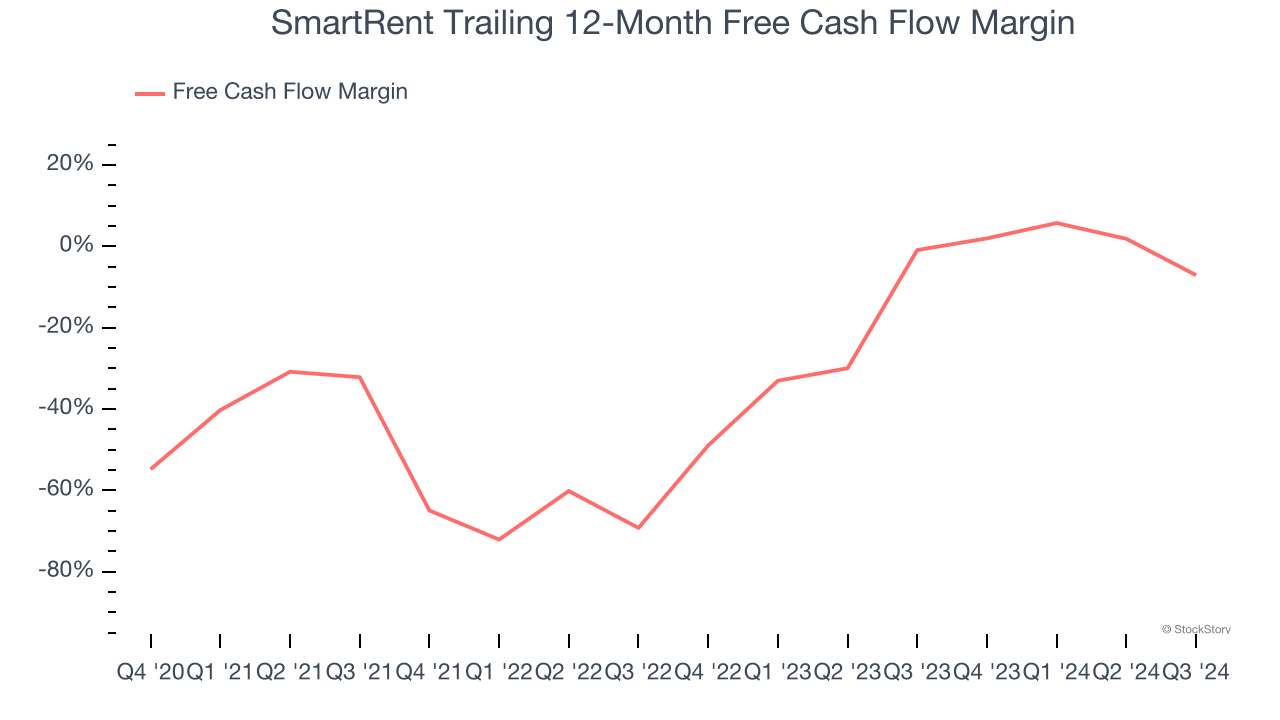

3. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, SmartRent’s margin expanded by 94 percentage points over the last five years. SmartRent’s free cash flow margin for the trailing 12 months was negative 7.1%, and continued increases could help it achieve long-term cash profitability.

Final Judgment

These are just a few reasons SmartRent is a rock-solid business worth owning. With its shares underperforming the market lately, the stock trades at $1.51 per share (or 1.7× forward price-to-sales). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than SmartRent

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.