Wrapping up Q3 earnings, we look at the numbers and key takeaways for the business services & supplies stocks, including OPENLANE (NYSE: KAR) and its peers.

This is a sector that encompasses many types of business, and so it follows that a number of trends will impact the space. For industrial and environmental services companies, for example, trends around environmental compliance and increasing corporate ESG commitments matter while for safety and security services companies, the intersection of physical security, cybersecurity, and workplace safety regulations are the topics du jour. Broadly, AI and automation could be tailwinds for companies in the space that invest wisely. On the other hand, shifting regulatory frameworks could force continual changes in go-to-market and costly investments.

The 19 business services & supplies stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 2.5% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Best Q3: OPENLANE (NYSE: KAR)

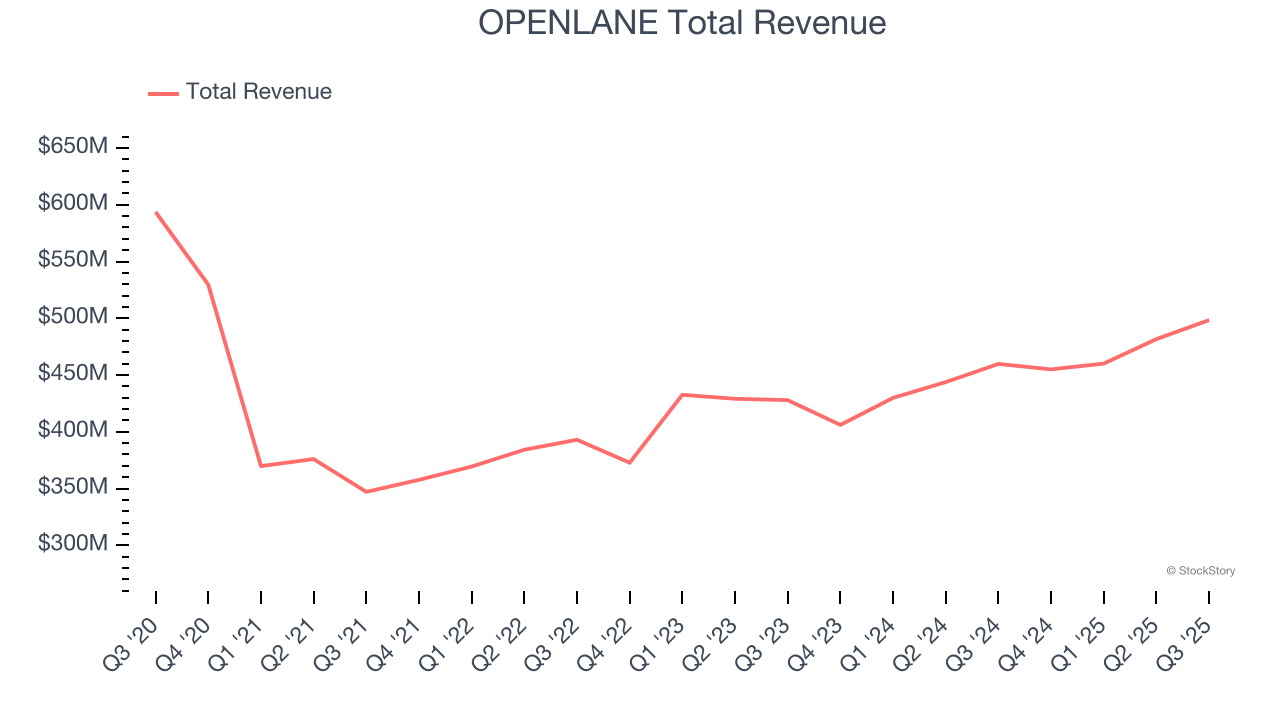

Facilitating the sale of approximately 1.3 million used vehicles in 2023, OPENLANE (NYSE: KAR) operates digital marketplaces that connect sellers and buyers of used vehicles across North America and Europe, facilitating wholesale transactions.

OPENLANE reported revenues of $498.4 million, up 8.4% year on year. This print exceeded analysts’ expectations by 5.9%. Overall, it was an incredible quarter for the company with a beat of analysts’ EPS and revenue estimates.

"OPENLANE's strategy — and the investments we've made to accelerate it — produced another strong quarter of organic growth and profitability, including 8% consolidated revenue growth and $87 million in Adjusted EBITDA," said Peter Kelly, CEO of OPENLANE.

Unsurprisingly, the stock is down 1.6% since reporting and currently trades at $26.14.

Is now the time to buy OPENLANE? Access our full analysis of the earnings results here, it’s free for active Edge members.

RB Global (NYSE: RBA)

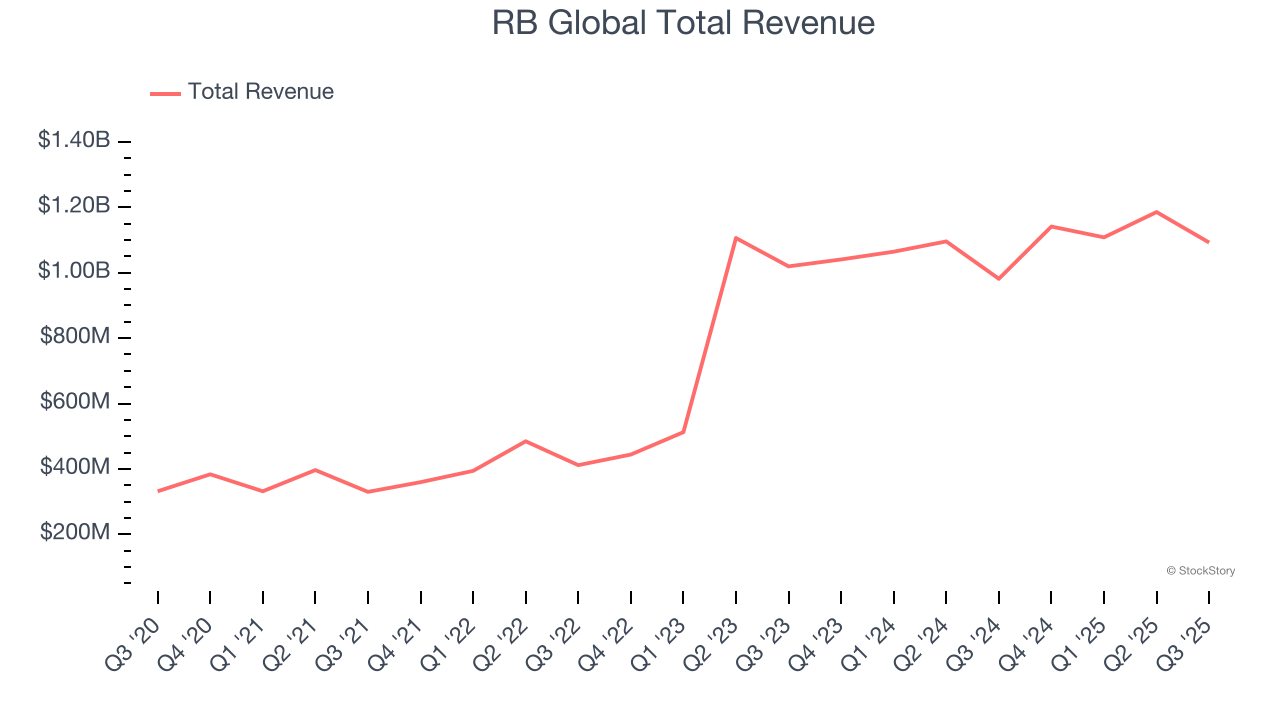

Born from the 1958 founding of Ritchie Bros. Auctioneers and rebranded in 2023, RB Global (NYSE: RBA) operates global marketplaces that connect buyers and sellers of commercial assets, vehicles, and equipment across multiple industries.

RB Global reported revenues of $1.09 billion, up 11.3% year on year, outperforming analysts’ expectations by 3.4%. The business had a stunning quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ revenue estimates.

The market seems content with the results as the stock is up 2.6% since reporting. It currently trades at $98.67.

Is now the time to buy RB Global? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: CoreCivic (NYSE: CXW)

Originally founded in 1983 as the first private prison company in the United States, CoreCivic (NYSE: CXW) operates correctional facilities, detention centers, and residential reentry programs for government agencies across the United States.

CoreCivic reported revenues of $580.4 million, up 18.1% year on year, exceeding analysts’ expectations by 7.3%. Still, it was a softer quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates and a significant miss of analysts’ EPS estimates.

The stock is flat since the results and currently trades at $18.68.

Read our full analysis of CoreCivic’s results here.

CECO Environmental (NASDAQ: CECO)

With roots dating back to 1869 and a focus on creating cleaner industrial operations, CECO Environmental (NASDAQ: CECO) provides technology and expertise that helps industrial companies reduce emissions, treat water, and improve energy efficiency across various sectors.

CECO Environmental reported revenues of $197.6 million, up 45.8% year on year. This print surpassed analysts’ expectations by 3.6%. More broadly, it was a satisfactory quarter as it also logged a solid beat of analysts’ revenue estimates but full-year revenue guidance slightly missing analysts’ expectations.

CECO Environmental delivered the fastest revenue growth among its peers. The stock is up 2.9% since reporting and currently trades at $54.94.

Read our full, actionable report on CECO Environmental here, it’s free for active Edge members.

MillerKnoll (NASDAQ: MLKN)

Created through the 2021 merger of industry icons Herman Miller and Knoll, MillerKnoll (NASDAQ: MLKN) designs, manufactures, and distributes interior furnishings for offices, healthcare facilities, educational settings, and homes worldwide.

MillerKnoll reported revenues of $955.7 million, up 10.9% year on year. This number beat analysts’ expectations by 4.9%. It was a strong quarter as it also logged a beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

The stock is down 17.2% since reporting and currently trades at $15.75.

Read our full, actionable report on MillerKnoll here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.