Synovus Financial trades at $53.21 per share and has stayed right on track with the overall market, gaining 11.2% over the last six months. At the same time, the S&P 500 has returned 14.4%.

Is there a buying opportunity in Synovus Financial, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Is Synovus Financial Not Exciting?

We're swiping left on Synovus Financial for now. Here are three reasons there are better opportunities than SNV and a stock we'd rather own.

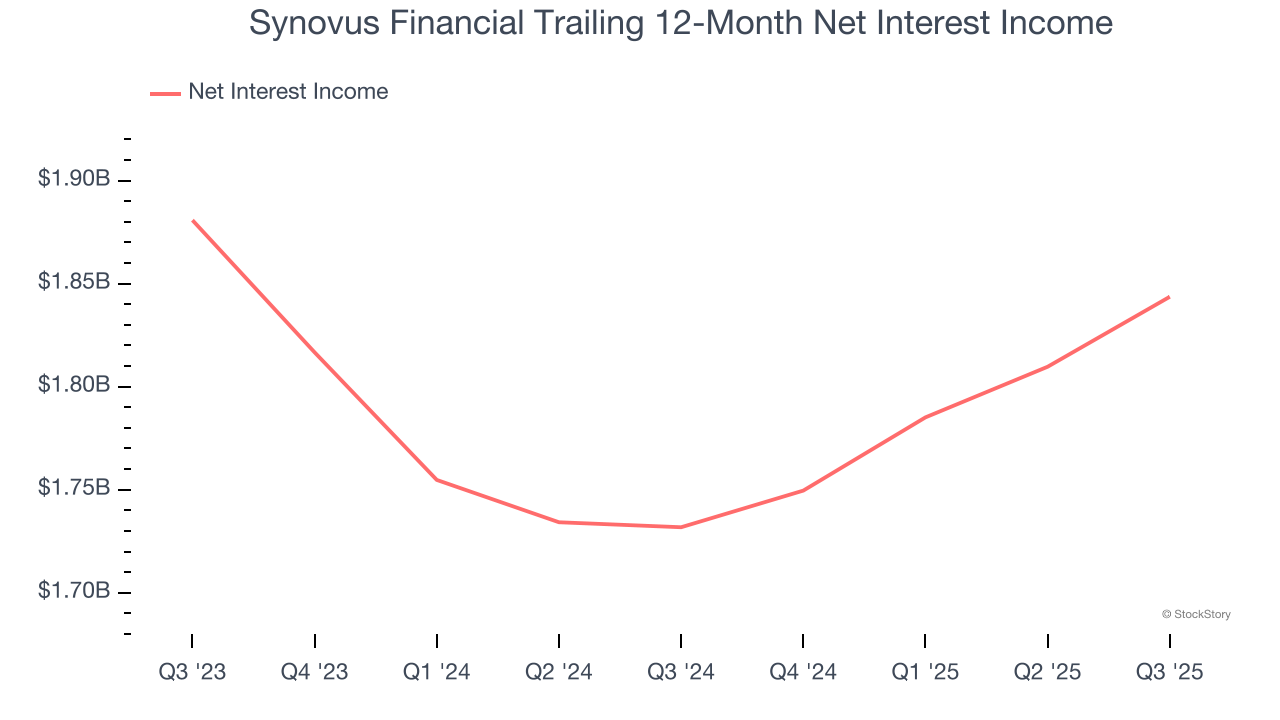

1. Net Interest Income Points to Soft Demand

While bank generate revenue from multiple sources, investors view net interest income as a cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of one-time fees.

Synovus Financial’s net interest income has grown at a 3.9% annualized rate over the last five years, much worse than the broader banking industry and in line with its total revenue.

2. Projected Net Interest Income Growth Is Slim

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Synovus Financial’s net interest income to rise by 4.5%.

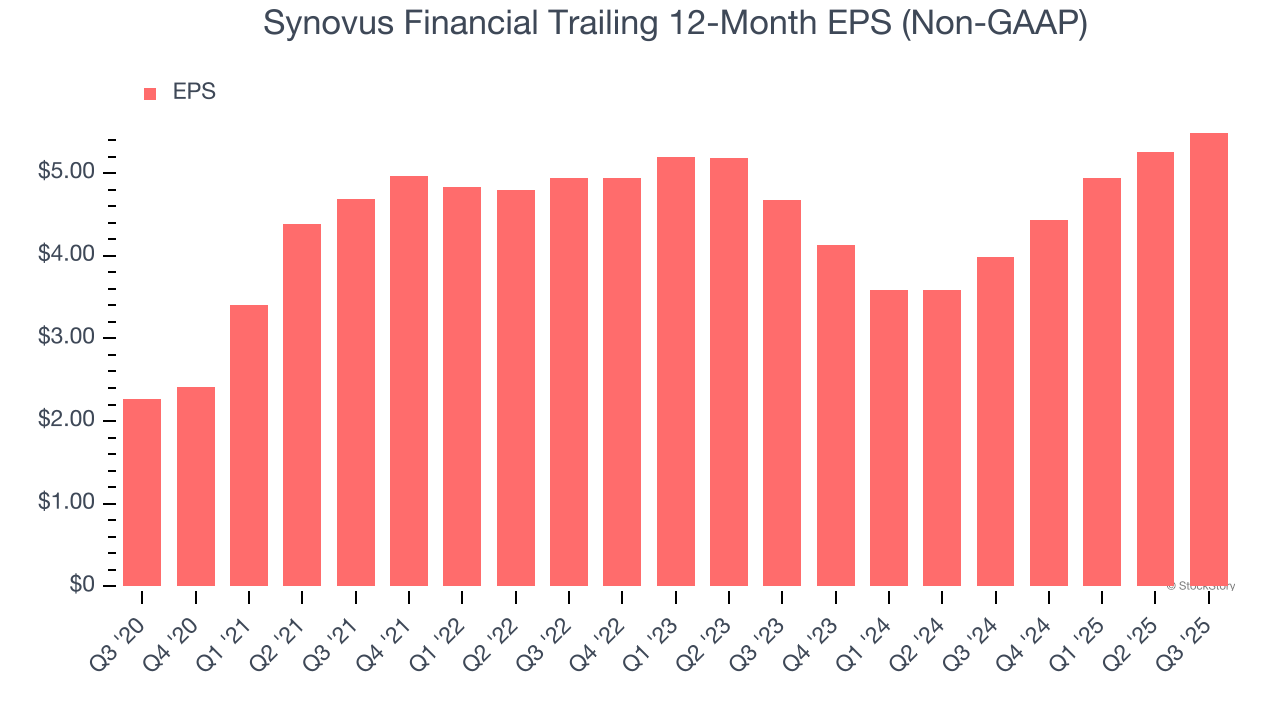

3. Recent EPS Growth Below Our Standards

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Synovus Financial’s EPS grew at an unimpressive 8.3% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its flat revenue and tells us management responded to softer demand by adapting its cost structure.

Final Judgment

Synovus Financial isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 1.4× forward P/B (or $53.21 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now. Let us point you toward the most entrenched endpoint security platform on the market.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.