Egg and butter company Vital Farms (NASDAQ: VITL) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 37.2% year on year to $198.9 million. The company expects the full year’s revenue to be around $775 million, close to analysts’ estimates. Its GAAP profit of $0.36 per share was 20.9% above analysts’ consensus estimates.

Is now the time to buy Vital Farms? Find out by accessing our full research report, it’s free for active Edge members.

Vital Farms (VITL) Q3 CY2025 Highlights:

- Revenue: $198.9 million vs analyst estimates of $191.9 million (37.2% year-on-year growth, 3.7% beat)

- EPS (GAAP): $0.36 vs analyst estimates of $0.30 (20.9% beat)

- Adjusted EBITDA: $27.39 million vs analyst estimates of $24.16 million (13.8% margin, 13.3% beat)

- The company slightly lifted its revenue guidance for the full year to $775 million at the midpoint from $770 million

- EBITDA guidance for the full year is $115 million at the midpoint, above analyst estimates of $112 million

- Operating Margin: 10.8%, up from 6.4% in the same quarter last year

- Free Cash Flow was -$10.61 million, down from $6.39 million in the same quarter last year

- Market Capitalization: $1.44 billion

"Our third quarter results demonstrate the power of disciplined execution across our business,” said Russell Diez-Canseco, Vital Farms’ President and Chief Executive Officer.

Company Overview

With an emphasis on ethically produced products, Vital Farms (NASDAQ: VITL) specializes in pasture-raised eggs and butter.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $711.9 million in revenue over the past 12 months, Vital Farms is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

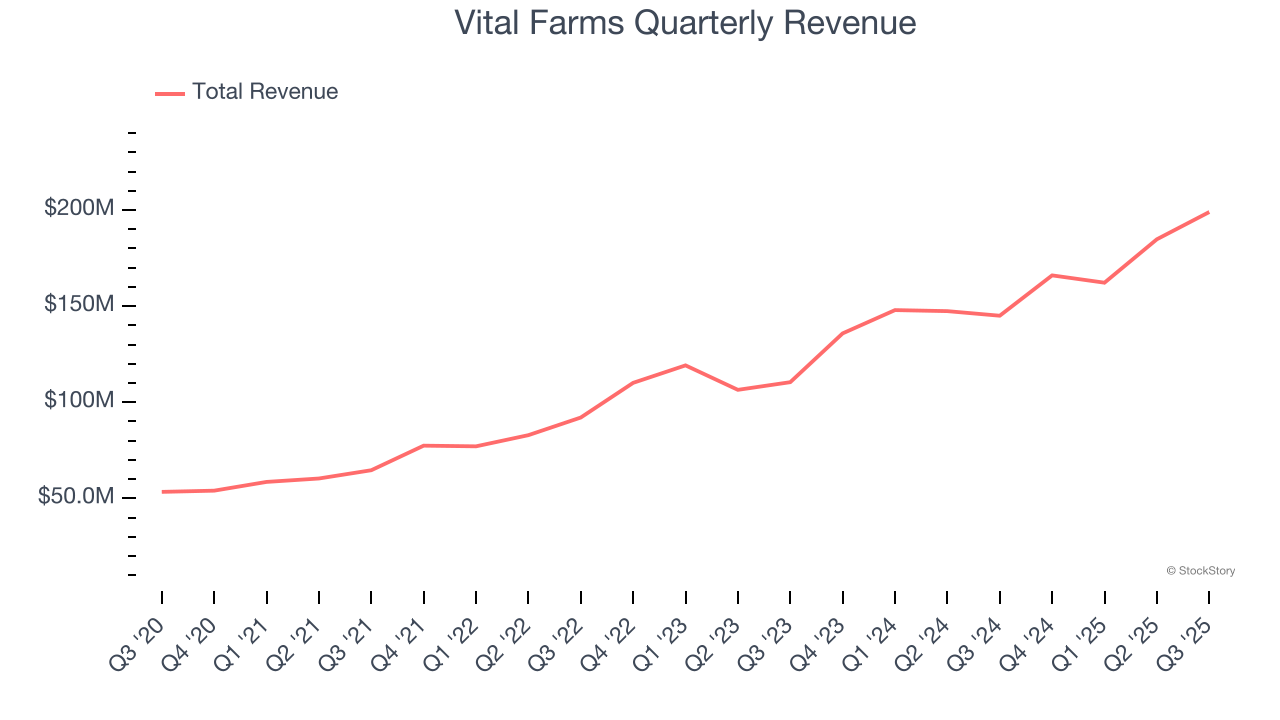

As you can see below, Vital Farms’s sales grew at an exceptional 29.3% compounded annual growth rate over the last three years as consumers bought more of its products.

This quarter, Vital Farms reported wonderful year-on-year revenue growth of 37.2%, and its $198.9 million of revenue exceeded Wall Street’s estimates by 3.7%.

Looking ahead, sell-side analysts expect revenue to grow 26.1% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is admirable and implies the market is forecasting success for its products.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

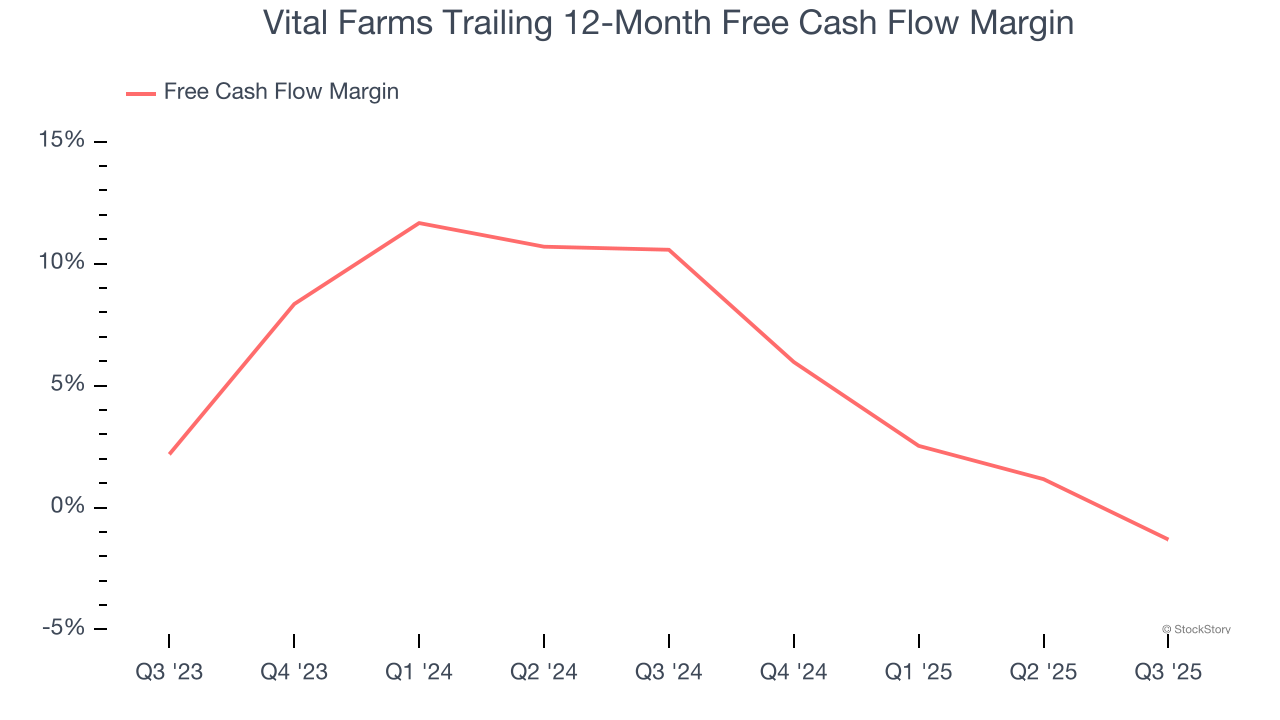

Vital Farms has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4%, subpar for a consumer staples business.

Taking a step back, we can see that Vital Farms’s margin dropped by 11.9 percentage points over the last year. If the trend continues, it could signal it’s in the middle of a big investment cycle.

Vital Farms burned through $10.61 million of cash in Q3, equivalent to a negative 5.3% margin. The company’s cash flow turned negative after being positive in the same quarter last year, which isn’t ideal considering its longer-term trend.

Key Takeaways from Vital Farms’s Q3 Results

We were impressed by how significantly Vital Farms blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Looking ahead, full-year EBITDA guidance also came in ahead. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 6.1% to $34.08 immediately following the results.

Vital Farms put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.